Large Excavators Market Research: 2032

The Global Large Excavators Market size was valued at $22 billion in 2022, and is projected to reach $29.3 billion by 2032, growing at a CAGR of 3% from 2023 to 2032. An excavator is a heavy industrial machinery used in construction, mining, and other industries for digging and earthmoving applications. Excavators with operating weights of 45 tons and more are considered large excavators. The framework of an excavator comprises essential components, including a boom, dipper, and bucket. These elements are linked to a cab positioned on a revolving house. Many excavator cabs have the capability to rotate a complete 360 degrees, enhancing overall visibility.

Market Dynamics

Growth in the mining industry is a major driver for the large excavators market. These excavators are used for digging the surface to extract valuable ores, and minerals. In addition, these are also used for earthmoving tasks such as loading earth and other materials in a truck. In the past few years, there has been a significant rise in the demand for minerals and metals due to the growing need for batteries, and other industrial and non-industrial products. Countries such as India, China, Australia, the U.S., Canada, and Brazil are experiencing heightened investments and increased production in their respective mining sectors. As a result, these countries experience a heightened demand for large excavators, crucial for loading debris and mined materials onto trucks, thereby positively impacting the large excavators market.

In addition, population growth rate is a major driver of the construction sector across the globe. For the last few decades, the population growth rate has been high, which fosters the demand for urban infrastructure, such as roads, bridges, and buildings. For example, urbanization has also risen significantly across the globe. For instance, according to the world bank, there were 794,432 Built Up Areas (BUAs) globally in 2016, which it had estimated to reach 849,407 by 2022. Such developments are eventually driving the demand for construction equipment including large excavators. Moreover, India's ambitious National Infrastructure Pipeline project, with an anticipated expenditure of $759.76 billion spread over five years (2020-2025), significantly contributing to the increasing demand for large excavators.

Similarly, the significant $1 trillion bipartisan infrastructure law in the U.S. is poised to further strengthen the market. Moreover, owing to population growth, public and private entities have invested significantly in the construction of buildings as well as public infrastructure. For example, owing to overcrowding in the capital city Jakarta, Indonesia, government officials have planned to shift its capital to Nusantra, where numerous new buildings are projected to be constructed. Similarly, in March 2023, the government of India considered a proposal to build eight new cities across the country, which may cost more than $360 million. Thus, the rising construction activities, globally, have driven the need for large excavators.

However, varying carbon emission regulations across the globe is a major restraining factor for the large excavators market growth. Diesel, which is a highly polluting source of energy, is primarily used to power a large excavator. The increase in the level of carbon emissions exhibits a challenge to the market; thus, governments across the world have imposed strict regulations for construction equipment machines to reduce carbon emissions. For example, every few years, Europe introduces new regulations for IC engine vehicles to reduce carbon emissions. One such regulation is Stage V. The implementation of Stage V necessitates the incorporation of a Diesel Particulate Filter (DPF) in the after-treatment system. Meeting the stringent requirements, including a reduction in PM mass limit and the introduction of a particulate number count for diesel engines ranging from 19 to 560 kW, poses a considerable challenge without the use of a filter. Therefore, manufacturers spend significant capital on the research and development of new and innovative equipment.

Moreover, technological advancements, including the integration of IoT and AI, have helped in making automated large excavators that can finish a task in less time while exhibiting higher fuel efficiency. In addition, the probability of any human error is also reduced to a greater degree. Thus, intergation of advanced technology is considerd a large excavators market opportunity.

The large excavators market has witnessed various obstructions in its regular operations due to the COVID-19 pandemic and inflation. Earlier, the global lockdowns resulted in reduced industrial activities, eventually leading to reduced demand for large excavators from the construction and industrial sectors. However, COVID-19 has subsided, and the major manufacturers in 2023 have been performing well. Contrarily, the rise in global inflation is a new major obstructing factor for the entire industry. The inflation, which is a direct result of the Ukraine-Russia war and few long-term impacts of the coronavirus pandemic, has introduced volatility in the prices of raw materials used for construction which is a major end-user sector of leaders and other such as construction equipment. In addition, inflation is expected to worsen in the coming years, as the possibility of the ending of the war between Ukraine and Russia is less. However, a peace agreement between Ukraine and Russia can be devised, with the continued talks between different countries, which is expected to end the war between them and reduce global inflation.

Segmental Overview

The large excavators market is segmented on the basis of large excavators operating weight, business type, end user, and region. On the basis of operating weight, the market is divided into 45 to 65 tons, 65 to 100 tons, and above 100 tons. On the basis of business type, the market is categorized into new sales and aftersales. On the basis of end user, the market is classified into construction & infrastructure, mining & quarrying, and others. On the basis of region the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, Italy, the UK, and rest of Europe), Asia-Pacific (China, India, Japan, South Korea, and the rest of Asia-Pacific), and LAMEA (Latin America, Middle East, and Africa).

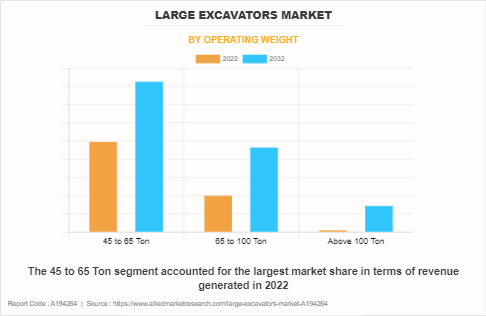

By Operating Weight:

The large excavators market is divided into 45 to 65 tons, 65 to 100 tons, and above 100 tons. In 2020, the 45 to 65 tons segment dominated the large excavators market share, in terms of revenue, and the 65 to 100 tons segment is expected to grow with a higher CAGR during the forecast period. The excavators included in the 45 to 65 tons segment are primarily used for applications such as construction, hydel power projects, and port applications. The growth in these sectors is a primary factor in driving the market growth of this segment. On the other hand, the high CAGR of 65 to 100 tons segment is particularly due to the rise in smaller mining projects.

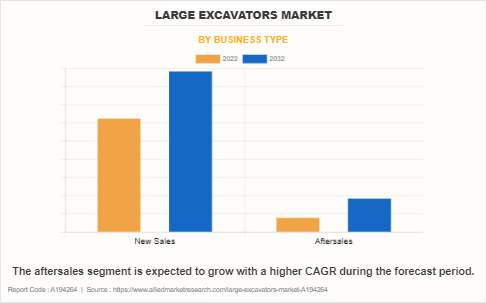

By Business Type:

The large excavators market is bifurcated into new sales and aftersales. In 2020, the new sales segment dominated the large excavators market, in terms of revenue, and the aftersales segment is expected to dominate the large excavators market forecast by growing at a higher CAGR. Large excavators are essential equipment for mining and construction industry, and these industries make frequent use of these machines for digging, and earthmoving applications. Moreover, large excavators are frequently used for long term in these sectors, thus buying instead of leasing the equipment is typically more economical, especially for large mining companies. There are various manufacturers of large excavators, including Komatsu, Liebherr-International AG, XCMG, and various others. These companies are better prepared to produce products that perform as per the customer requirements and customize their products for them. This often leads to sturdier, and longer-lasting parts.

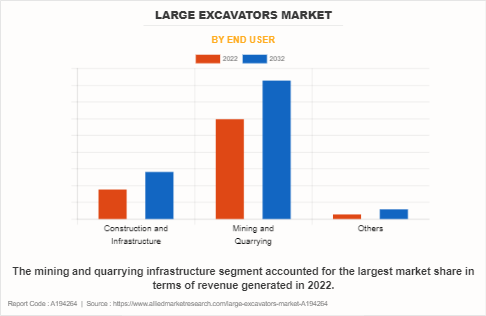

By End User:

The large excavators market is divided into construction and infrastructure, mining and quarrying, and others. The mining and quarrying segment accounted for the highest market share in 2020, owing to the growing mining sector driven by rising demand for metals and minerals for industrial and consumer products. Additionally, rising demand for batteries is also driving the demand for the mining sector. However, the construction segment is anticipated to register a higher growth rate during the forecast period, owing to the rise in urbanization in developing regions. For example, the Bharatmala project of the Indian government to develop its infrastructure is driving the segment growth.

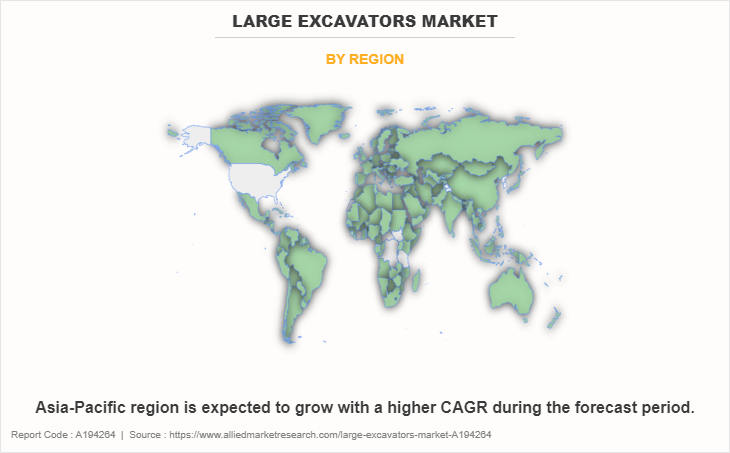

By region: Asia-Pacific accounted for the highest market share in 2020 and the same region is expected to grow with the highest CAGR during the forecast period. The population growth rate of the Asia-Pacific region is a major factor for the growth of the market in Asia-Pacific. Moreover, the existing and upcoming mining and quarrying sites in the region are also the major driver for the market.

Competition Analysis

Competitive analysis and profiles of the major players in the large excavators market are provided in the report. Major companies in the report include AB Volvo, LIEBHERR-INTERNATIONAL AG, KOMATSU Ltd, Hitachi Ltd., XCMG Construction Machinery Co., Ltd., Deere & Company, CNH Industrial N.V., Sanny Global, HD Hyundai Infracore Co., Ltd., and Caterpillar Inc.

Key players in the industry adopt competitive development strategies, including product launches, business expansion, acquisitions, partnerships, mergers, and technological integrations. In May 2023, Komatsu unveiled a prototype for a medium-sized hydraulic excavator featuring a hydrogen fuel cell and key components, aiming to achieve carbon neutrality in construction equipment. Additionally, in June 2023, LIEBHERR-INTERNATIONAL AG introduced the R 9300, a 250-tonne mining excavator that consumes 15% less fuel and improves fuel efficiency by 25% compared to its predecessor.

Technological advancements are a prominent strategy, as seen in Komatsu's introduction of the intelligent Machine Control 2.0 (iMC 2.0) on the PC490LCi-11 excavator in October 2022, providing contractors with advanced automation features for enhanced productivity on a larger scale. Furthermore, major companies are enhancing their partnership providing new and innovative solutions to their existing customers. For example, in October 2023, Volvo CE provided 21 large excavators in the category of 47,300 - 53,100 kg to state-owned mining company of PT Bukit Asam (PTBA) in Indonesia.

Key Benefits for Stakeholders

- The report provides an extensive analysis of the current and emerging large excavators market trends.

- In-depth large excavators market analysis is conducted by constructing market estimations for key market segments between 2020 and 2032.

- Extensive analysis of the large excavators market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The large excavators market revenue and volume forecast analysis from 2023 to 2032 are included in the report.

- The key players within the large excavators market are profiled in this report and their strategies are analyzed thoroughly, which helps to understand the competitive outlook of the large excavators industry.

Large Excavators Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 29.3 billion |

| Growth Rate | CAGR of 3% |

| Forecast period | 2022 - 2032 |

| Report Pages | 193 |

| By Operating Weight |

|

| By Business Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | HD Hyundai Infracore Co., Ltd., KOMATSU Ltd, Deere & Company, CNH Industrial N.V., XCMG Construction Machinery Co., Ltd., Sanny Global, Hitachi, Ltd, Caterpillar Inc., LIEBHERR-INTERNATIONAL AG, AB Volvo |

Analyst Review

The large excavators market has experienced substantial growth in recent years, driven by the increase in construction and infrastructure development activities as well as mining activities.

The demand for large excavators that are capable of versatile applications from construction sites to mining sites is high. In addition, the rising concerns over the deteriorating condition of the earth’s environment due to extensive greenhouse gas emissions by large excavators is driving the need for environment-friendly excavators. For example, Komatsu is developing an excavator that would run on the fuel cell. However, this technology is yet to debut in a medium-sized excavator, it is anticipated that this technology will also be introduced in large excavators. Furthermore, electric excavators for the mining sector are also being introduced by key players.

The growth of the market is certain; however, various political factors such as imposition of heavy tariffs on imports and trade bans with a particular nation limit the market growth.

A rise in the mining and quarrying industry, growth in the construction and infrastructure sector, and an increase in focus on public-private partnerships (PPP) products drive the growth of the global large excavators market.

The latest version of the global large excavators market report can be obtained on demand from the website.

The global large excavators market size was valued at $21.9 billion in 2022.

The global large excavators market size is estimated to reach $29.2 billion by 2032, exhibiting a CAGR of 3.0% from 2023 to 2032.

The forecast period considered for the global large excavators market is 2023 to 2032, wherein, 2022 is the base year, 2023 to 2032 is the forecast duration.

Asia-Pacific is the largest regional market for large excavators market.

Key companies profiled in the large excavators market report include AB Volvo, LIEBHERR-INTERNATIONAL AG, KOMATSU Ltd, Hitachi Ltd., XCMG Construction Machinery Co., Ltd., Deere & Company, CNH Industrial N.V., Sanny Global, HD Hyundai Infracore Co., Ltd., and Caterpillar Inc.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Loading Table Of Content...

Loading Research Methodology...