Laser Cutting Machine Market Research, 2032

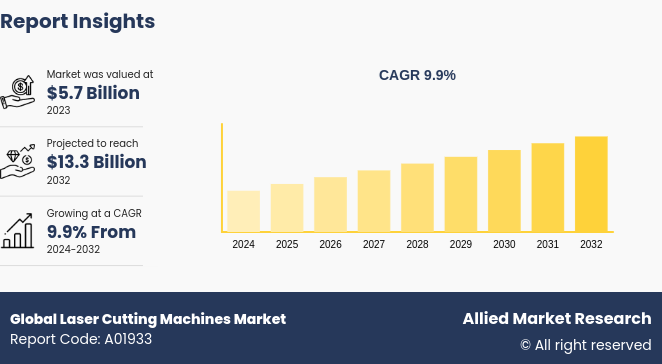

The Global Laser Cutting Machines Market was valued at $5.7 billion in 2023 and is estimated to reach $13.3 billion by 2032, exhibiting a CAGR of 9.9% from 2024 to 2032.

Market Introduction and Definition

A laser cutting machine is a precision tool that uses a high-powered laser beam to laser engraver and cutter materials with outstanding accuracy and rapidity. Such tools are often equipped with advanced fiber or CO2 lasers that focus concentrated light energy on the material, leading to its melting, burning, or vaporizing the required portions. Hence it is possible to make sharp neat cuts in metal, plastic, wood, and textiles. These laser metal cutting machine find great utility in industries such as automobiles, airplanes, electronics, and manufacturing due to their ability to make complex geometrical structures that minimize waste materials while increasing output efficiency. In addition, laser cutting machines are majorly used across various industries such as automotive, defense, and manufacturing sectors showcasing significant growth opportunities for the laser cutting machines market across these sectors.

Key Takeaways

By technology, the solid-state lasers segment dominated the laser cutting machines market analysis in terms of revenue in 2023 and is anticipated to grow at a fastest CAGR during the forecast period.

By process, the fusion cutting segment dominated the laser cutting machines market forecast in terms of revenue in 2023, However, the sublimation cutting segment is anticipated to grow at the fastest CAGR during the forecast period.

By end user, the laser cutting machines industry is majorly dominated by the automotive segment accounted for a major share during the base year 2023. Further, the medical devices segment is expected to grow at a high CAGR during the forecast period.

Region-wise, Asia-Pacific generated the largest revenue in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

Industry Trends:

In December 2023: In a move to protect domestic manufacturers, the Indian government imposed anti-dumping duties on industrial laser cutting machines imported from China. The decision followed an investigation by the Directorate General of Trade Remedies (DGTR) , which found that Chinese manufacturers were dumping these machines in the Indian market at below-market prices, causing material injury to domestic producers. The anti-dumping duties are expected to level the playing field for Indian manufacturers and encourage the growth of the domestic laser-cutting machine industry.

In May 2023: The European Union (EU) introduced new safety regulations for industrial laser systems, aimed at protecting workers from potential hazards associated with laser radiation. The regulations set stricter standards for laser safety features, labeling, and user training. Manufacturers and operators of laser cutting machines in the EU are required to comply with these regulations to ensure the safety of their employees and prevent accidents.

In November 2022: The U.S. Department of Energy announced a new funding initiative to support research and development of advanced laser cutting technologies for industrial applications. The program aims to accelerate the development of next-generation laser cutting systems that offer improved efficiency, precision, and versatility. The funding will be awarded to universities, research institutions, and private companies working on innovative laser cutting technologies.

In June 2022: The Chinese government launched a program to encourage the adoption of laser cutting machines in various manufacturing sectors. The program aims to modernize the manufacturing industry by promoting the use of advanced technologies like laser cutting, which offers higher precision, flexibility, and efficiency compared to traditional cutting methods. The government is providing subsidies and tax incentives to manufacturers who invest in laser cutting machines, as well as supporting training programs for workers to operate these machines.

In March 2023: The Japanese government introduced tax incentives for companies investing in laser cutting technology. The aim is to promote the adoption of laser cutting in various industries, including automotive, electronics, and metal fabrication. By offering tax breaks for investments in laser cutting machines, the government hopes to encourage companies to upgrade their manufacturing processes and improve their competitiveness in the global market.

Key Market Dynamics

This dynamic growth of the laser cutting machines industry has witnessed significant growth in recent years, owing to a surge in demand from the automotive and aerospace industries as precision laser cutting increasingly becomes an integral part of manufacturing components in these sectors. Second, machine efficiency and capabilities have been improved with advancements in laser technology like fiber lasers leading to higher cutting speeds, lower operational costs, and expanded material compatibility. In addition, as automation is increasingly adopted in manufacturing processes so too is the need for laser engraver and cutter machines which increase productivity through automated systems resulting in fewer mistakes on top of reducing labor costs for manufacturers. Nevertheless, the high initial costs associated with purchasing and setting up a laser cutting machine remain some of the challenges faced by this industry thus making it difficult for small and medium-sized enterprises (SMEs) to adopt them fully.

However, the market offers many growth opportunities, particularly in expanding into emerging markets which demand laser cutting machines due to rapid industrialization and investments in manufacturing infrastructure. As these regions continue to develop, the demand for advanced manufacturing technologies like laser cutting machines is expected to rise steadily. Laser cutting machines manufacturer that strategically position themselves in these burgeoning markets can exploit the increasing market potential and establish a strong foothold, gaining a competitive edge in the global market landscape.

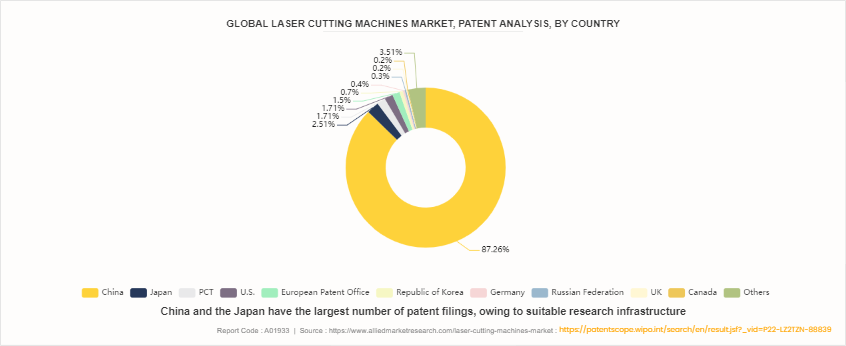

Patent Analysis of Global Laser Cutting Machines Market

The global laser cutting machines market data is segmented according to the patents filed in China, Japan, PCT, the U.S., the European Patent Office, the Republic of Korea, Germany, the Russian Federation, the UK, and Canada. China and the Japan have the largest number of patent filings, owing to suitable research infrastructure. Approvals from these authorities are followed/accepted by registration authorities in many of the developing regions/countries. Therefore, these two regions have a maximum number of patent filings. Further, the laser cutting machines for US market is expected to register major share in the coming years.

Market Segmentation

The laser cutting machines market insights is segmented into technology, process, end-user industry, and region. By technology, the market is divided into solid-state lasers, gas lasers, and semiconductor lasers. By process, the market is classified into fusion cutting, flame cutting, and sublimation cutting. By end-user industry, the market is categorized into automotive, consumer electronics, defense & aerospace, industrial, and others. Region-wise, the laser cutting machines industry report is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Market Segment Outlook

By technology, solid-state lasers dominate the laser cutting machines market due to their high efficiency, reliability, and versatility. These lasers use a solid gain medium, such as crystals or glass, doped with rare-earth elements, which allows them to deliver high power output with excellent beam quality. Solid-state lasers are particularly favored in industrial applications that require precise and high-speed cutting of materials such as metals, ceramics, and composites. Their ability to operate at various wavelengths and pulse durations makes them suitable for a wide range of cutting tasks, from microfabrication to heavy-duty metal cutting. Furthermore, the robust construction and lower maintenance requirements of solid-state lasers contribute to their widespread adoption. The ongoing advancements in solid-state laser technology, such as increased power output and improved energy efficiency, continue to drive their market share, making them a preferred choice in the laser cutting machine industry.

Based on process, the fusion cutting's dominance is due to its versatility and efficiency in processing a variety of materials, including metals and non-metals. It offers high cutting speeds and precision, which are essential for industrial applications such as automotive and aerospace manufacturing. Fusion cutting minimizes thermal distortion and provides clean cuts with minimal post-processing, making it a preferred choice for manufacturers. On the other hand, the sublimation cutting segment is expected to grow rapidly due to its advantages in cutting heat-sensitive and delicate materials. Sublimation cutting uses laser energy to directly vaporize the material, resulting in high-quality cuts with minimal heat-affected zones. This process is increasingly being adopted in industries such as electronics, textiles, and packaging, where precision and minimal thermal impact are crucial.

Based on the end-user industry, the automotive segment dominated the market, owing to the surge in laser cutting technology across the automotive sector to manufacture a wide range of parts, from body panels and frames to delicate engine components, thereby making the vehicle segment dominate. Laser cutters provide the precision, speed, and flexibility required to satisfy high production rates and tight quality standards imposed by auto manufacturers. As automobile manufacturers continue to innovate more complicated and lighter-weight products, demand for innovative laser-cutting technologies remains robust.

Regional/Country Market Outlook

Asia-Pacific's dominance in the laser cutting machines sector analysis is attributed to the region's rapid industrialization, robust manufacturing sector, and significant investments in infrastructure development. Asia-Pacific laser cutting machines market size by country is dominated by China in the year 2023. Countries like China, Japan, South Korea, and India are leading contributors, with strong demand from the automotive, electronics, and aerospace industries. The presence of numerous manufacturing hubs and favorable government policies supporting industrial growth further bolster the market. Additionally, the increasing adoption of automation and advanced manufacturing technologies in this region drives the demand for laser-cutting machines. The anticipated high growth rate is also supported by the region's expanding economic activities, rising disposable incomes, and continuous advancements in laser technology. As Asia-Pacific continues to industrialize and modernize, the demand for efficient and precise laser-cutting solutions is expected to grow, maintaining the region's leading position in the market

Competitive Landscape

The laser cutting machines company list market are Trumpf, Bystronic, Amada, Coherent, IPG Photonics, Mazak Optonics Corp., LVD Strippit, Prima Power, Salvagnini, Hans Laser. The other laser cutting machines company list include Epilog Laser, Universal Laser Systems, Trotec Laser, Kern Lasersysteme, and so on. Further, the laser cutting machines market share by companies os domianted by Trumpf, Bystronic, Amada, Coherent, IPG Photonics, Mazak Optonics Corp., and other top players in 2023.

Recent Key Strategies and Developments

In March 2024: Trumpf launched a new laser cutting machine, the TruLaser Center 7030, designed for fully automated production. It features an innovative nozzle changer for faster and more efficient processing, along with intelligent monitoring systems for optimal performance and quality.

In December 2023: Bystronic announced a strategic partnership with Kurago, a software provider, to integrate Kurago's cloud-based software with Bystronic's laser cutting machines. This collaboration aims to enhance production efficiency, optimize material utilization, and streamline workflows for Bystronic's customers.

In October 2023: Amada unveiled the ENSIS series of fiber laser cutting machines, featuring a high-speed cutting head and advanced automation capabilities for improved productivity and precision in sheet metal processing.

In June 2023: Coherent expanded its portfolio of laser cutting solutions by acquiring O.R. Lasertechnologie, a German manufacturer of high-precision laser cutting machines for industrial applications. The acquisition aims to strengthen Coherent's presence in the European market and expand its product offerings.

In February 2023: IPG Photonics a leading laser cutting machines manufacturer introduced the YLR-U series of high-power fiber lasers for cutting and welding applications. These lasers offer improved efficiency, reliability, and beam quality, meeting the demands of various industrial sectors.

In December 2022: Mazak Optonics partnered with Mitsubishi Electric to develop an integrated laser cutting and automation solution. The collaboration combines Mazak Optonics' laser cutting technology with Mitsubishi Electric's automation expertise, providing customers with a comprehensive and efficient solution for sheet metal processing.

Key Sources Referred

Semiconductor Industry Association (SIA)

SEMI.org

IEEE Electron Devices Society (EDS)

U.S. Department of Energy

Global Semiconductor Alliance (GSA)

World Economic Forum

European Semiconductor Industry Association (ESIA)

Key Benefits For Stakeholders

This report provides a quantitative analysis, laser cutting machines sector analysis of the market segments, current trends, estimations, and dynamics of the laser cutting machines market analysis from 2024 to 2032 to identify the prevailing laser cutting machines market data, and laser cutting machines market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the laser cutting machines market segmentation assists to determine the prevailing robot vision system market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the manufacturers market players.

The report includes the analysis of the regional as well as global laser cutting machines market trends, laser cutting machines market insights, laser cutting machines for US market, laser cutting machines market size by country, laser cutting machines company list, key players, market segments, application areas, and market growth strategies.

Global Laser Cutting Machines Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.3 Billion |

| Growth Rate | CAGR of 9.9% |

| Forecast period | 2024 - 2032 |

| Report Pages | 240 |

| By Technology |

|

| By Process |

|

| By End User Industry |

|

| By Region |

|

| Key Market Players | TRUMPF, IPG Photonics, Prima Power, Hans Laser, BYSTRONIC AG, LVD Strippit, Salvagnini Group, Coherent, Inc, Amada, Mazak Optonics Corporation |

Analyst Review

Increase in technological improvement in the machining technology forces the market to evolve. The difference in features of the laser cutting machines and its substitute affects the market growth. The number of players in the market is limited but the competition is high for the market share. Product launches with improving technologies and the geographical expansion are expected to increase the market competition.

To increase the efficiency and to make the process more user-friendly, the machine features undergo continuous improvements. These new features will be upgraded with time to compete in the market. The changes in requirements by the manufacturers further motivate the developers to bring out changes in the Laser Cutting Machines.

The increase in need for automation to keep up with the high requirements of the manufacturing industry affects the market. There is an estimated increase in the automation requirements with production of more sophisticated and precise components in the future. To remove the possibility of human error, human intervention in the manufacturing process needs to be reduced.

The global laser cutting machines market is expected to witness significant growth during the forecast period, with North America being the major market, followed by Asia-Pacific.

The laser cutting machine market is trending towards the adoption of automation and AI for enhanced precision and efficiency, and increasing use of fiber lasers for superior performance.

The leading application of laser cutting machines is in the automotive and aerospace industries for precision cutting and fabrication of metal components..

Asia-Pacific is the largest regional market for laser cutting machines, fueled by rapid industrialization and manufacturing growth in countries like China and India.

In 2023, $5.7 billion was the estimated market size for the market

Major companies holding significant market share include TRUMPF, Bystronic, Amada, Mitsubishi Electric, and Mazak.

Loading Table Of Content...