Layer Pads Market Research, 2033

The global layer pads market was valued at $1.3 billion in 2023, and is projected to reach $2.2 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033.

Market Introduction and Definition

Layer pad is a flat, rigid sheet made from materials such as corrugated cardboard, plastic, or foam board, that are strategically placed between layers of stacked products during packaging and storage. These pads serve the purpose of providing structural support, distributing weight evenly, and preventing damage or deformation to the products within a stack. Layer pads are crucial in material handling and logistics, particularly in industries where the protection of fragile or sensitive goods is essential. These pads are widely used in various end-use industries where fragile or sensitive goods are involved, such food & beverage, chemicals, transportation, construction, automotive, electronics, and pharmaceuticals.

Key Takeaways

- The layer pads market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major layer pads industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrates high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The global expansion of manufacturing and exports drives the growth of the layer pads market, meeting the need for efficient packaging in various sectors such as automotive, electronics, food, and pharmaceuticals. In export, layer pads are placed between layers of goods in containers or pallets to prevent damage from shifting, impacts, or compression during transit. In manufacturing, layer pads are used to separate and stack products efficiently, ensuring easy handling and preventing product damage on assembly lines or during storage in warehouses. Layer pads offer versatile packaging solutions, enhancing logistics efficiency by easing goods handling in warehouses and during transportation.

Layer pads are experiencing surge in demand due to increasing emphasis on sustainable packaging practices. The materials used in layer pads production are often sourced from renewable or recycled sources, reducing reliance on virgin resources and minimizing environmental impact. In addition, manufacturers prioritize energy-efficient production processes to reduce carbon emissions. Moreover, layer pads are designed to be reusable, recyclable, or biodegradable, ensuring minimal waste generation and promoting circular economy principles. These sustainable practices contribute to meeting the increasing emphasis on environmentally friendly packaging solutions, driving the demand for layer pads.

However, cost sensitivity and intense price competition hinder the growth of the layer pads market. Cost sensitivity emerges as a significant challenge, particularly in industries where profit margins are closely scrutinized. The materials used in layer pads, such as plastics or cardboard, are susceptible to price variations influenced by factors such as global supply chain disruptions, changes in demand, and fluctuations in raw material prices. These uncertainties can impact the overall production costs, affecting the pricing strategies of manufacturers.

Contrarily, technological advancements revolutionize layer pad production, driving efficiency and sustainability. Innovations in materials, design, and manufacturing techniques enhance precision and reduce costs. Automation and smart technologies optimize processes, increasing production capacity. Industries embrace efficient packaging solutions, reshaping the landscape of layer pad manufacturing.

Market Segmentation

The global layer pads market is segmented into material type, shape type, end-use industry, and region. By material type, the market is divided into plastic, paperboard, and others. As per end-use industry, it is segregated into food & beverages, electronics, chemical, pharmaceutical, and others. Depending on shape type, it is bifurcated into die cut shape and flat shape. Region wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

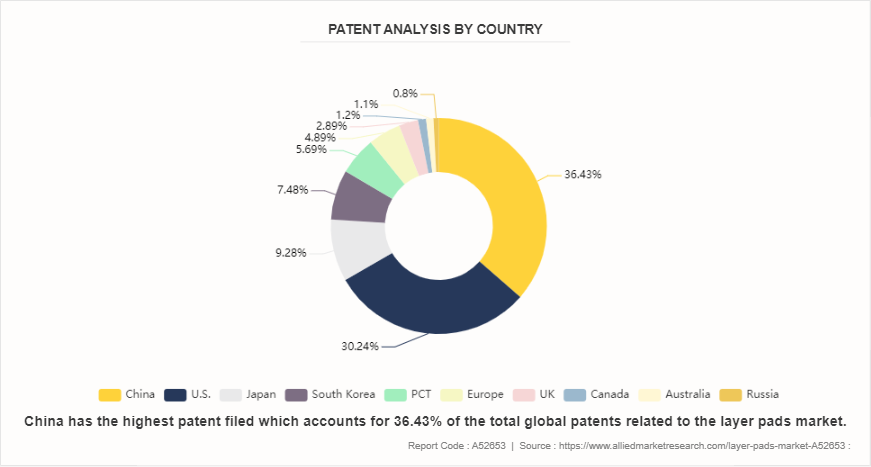

Patent Analysis of Global Layer pads Market

U.S., Canada, and China collectively possess a significant portion of layer pad patents, demonstrating substantial innovation and investment in this sector. This underscores intense competition and considerable research and development focus on layer pad technology in these countries. With the U.S. leading with the highest patent filings, accounting for a substantial share of global layer pad patents, it highlights the nation's leadership in this market. Although Japan, India, and South Korea individually hold smaller percentages of layer pad patents, their combined contribution underscores Asia's dominance in layer pad innovation, reflecting the region's robust presence in materials engineering and packaging R&D. Recent patent filings cover advanced layer pad compositions, production methods, and innovative applications, indicating ongoing advancements in layer pad technology.

Competitive Landscape

The key market players operating in the layer pads market include Smurfit Kappa, DS Smith, Corex, GWP Group, Karton S.p.A., Shish Industries Limited, WestRock Company, ER&GE (UK) Limited, Qingdao Tianfule Plastic CO., LTD. and Northrich. Other players in the layer pads market include Alvaboard, Romiley Board Mill, Crown Paper Converting, and Samuel Grant Group Ltd.

Regional Industry Outlook

In Asia-Pacific, the countries such as India and China are set to take the lead in the market due to their growing population and expanding middle classes, which, in turn, create demand for a wide range of goods, thereby driving manufacturing and trade. Furthermore, industrial expansion and infrastructure development in the region increase consumption, creating a need for effective packaging solutions, establishing it as a dominant market force. In addition, food processing and export industries rely heavily on efficient packaging solutions such as layer pads to ensure product safety during transportation. Layer pads offer support, protection, and organization to various goods facilitating smooth handling and preserving quality. As these industries grow, the demand for layer pads also increases, driving the market growth.

- As per the India Brand Equity Foundation, manufacturing exports have registered highest ever annual exports of $447.46 billion with 6.03% growth during FY23 surpassing the previous year (FY22) record exports of $422 billion. India has the capacity to export goods worth $1 trillion by 2030 and is expected to become a major global manufacturing hub. Thus, the surge in manufacturing and exports activities drives the growth of layer pads market.

- The growth in agricultural food exports in India boosts the growth of the layer pads market. According to Invest India, the share of processed food exports in agri-exports has increased substantially from 13.7% in 2014-15 to 25.6% in 2022-23. The total FDI received in the food processing sector from April 2000 till Dec 2023 was $12.46 billion which is 1.87% of the total FDI Equity inflow.

Industry Trends

- The penetration of e-commerce platforms has significantly increased with the rapid growth of online shopping, making e-commerce a dominant force in the retail industry. This shift is boosting the demand for layer pads, essential for protecting products during shipping and storage. As more consumers shop online, the need for secure packaging solutions like layer pads rises, ensuring products reach customers undamaged, thereby driving the market growth.

- Adopting sustainable practices is a growing trend across industries, significantly boosting the demand for layer pads. Companies are increasingly prioritizing eco-friendly packaging solutions to reduce their environmental impact. According to a report published by the Invest India, the global packaging industry is projected to reach $1.05 trillion by 2024. This growth is driven by the rising emphasis on sustainability. Their reusability and recyclability make them an attractive choice for businesses aiming to adopt more sustainable packaging practices.

Key Sources Referred

- India Brand Equity Foundation

- Invest India

- Packaging Industry Association of India (PIAI)

- Flexible Packaging Association

- World Packaging Organization

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the layer pads market analysis to identify the prevailing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the layer pads market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global layer pads market trends, key players, market segments, application areas, and market growth strategies.

Layer Pads Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.2 Billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 230 |

| By Material Type |

|

| By Shape Type |

|

| By End-Use Industry |

|

| By Region |

|

| Key Market Players | Northrich, GWP Group, Corex, WestRock Company, Qingdao Tianfule Plastic CO.,LTD., Smurfit Kappa, ER&GE (UK) Limited, Shish Industries Limited, Karton S.p.A., DS Smith |

Loading Table Of Content...