LED Panel Light Market Research, 2032

The global LED panel light market was valued at $20.1 billion in 2022 and is projected to reach $90.1 billion by 2032, growing at a CAGR of 16.4% from 2023 to 2032.

An LED panel light, also known as an LED enclosure light, provides lighting for industrial enclosures and cabinets. LED panel lights are energy-efficient luminaires designed for widespread use in lighting applications. They are constructed with a sleek and flat profile and are illuminated by LEDs. These fixtures are renowned for delivering even and low-glare lighting across diverse environments, making them popular choices for residential, commercial, and industrial settings. Their soft and diffused light output makes them ideal for a wide range of lighting needs. They are essential for panel builders, contractors, and auto electricians for testing, maintenance, and operation work. It is an energy-efficient lighting fixture that provides even and uniform illumination. These lights are characterized by their flat and thin design, often rectangular or square in shape, and are commonly used in various settings, including residential, commercial, and industrial applications.

Segment Overview:

The LED panel light market is segmented into type, sales channel, voltage, and application.

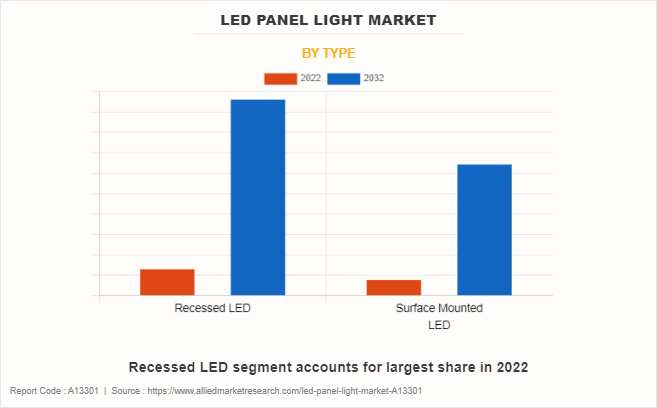

By type, the market is divided into recessed LED and surface-mounted LED. In 2022, the Recessed LED segment dominate the market in terms of revenue and are expected to follow the same trends during the forecast period.

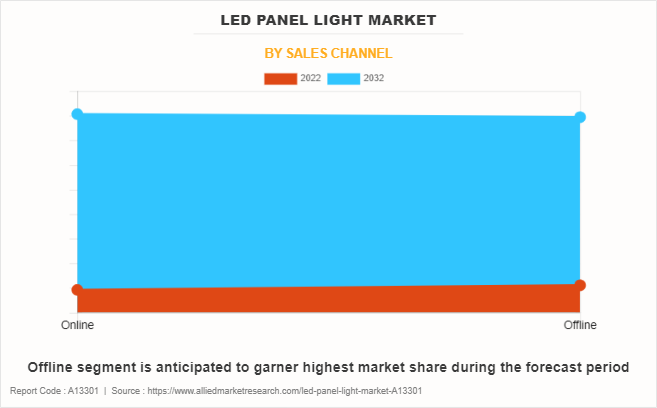

As per the sales channel, the market is bifurcated into online and offline. The Online segment is expected to grow at a high CAGR from 2023 to 2032.

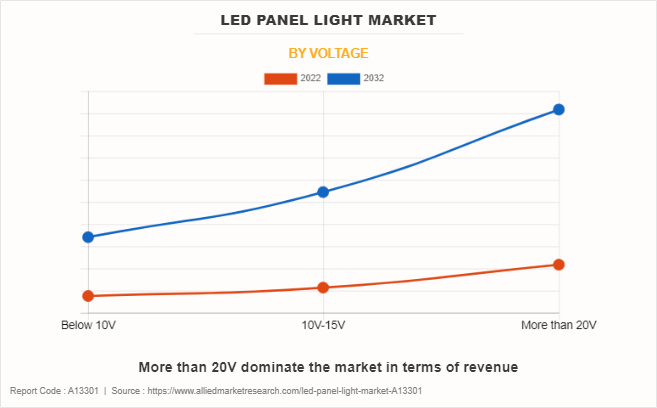

As per voltage, the market is classified into below 10V, 10-20V, and more than 20V. In 2022, the More than 20V segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. Moreover, the 10V-15V segment is expected to grow at a high CAGR from 2023 to 2032.

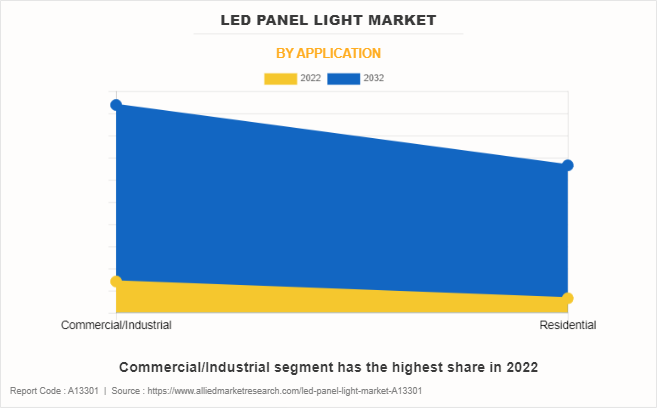

By application, the market is categorized into commercial/industrial and residential. In 2022, the Commercial/Industrial segment dominated the market in terms of revenue and is expected to follow the same trend during the forecast period. Moreover, the Residential segment is expected to grow at a high CAGR from 2023 to 2032.

By region, it is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, Germany, France, Russia, and the rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and the rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa). Asia-Pacific, Specifically China., remains a significant participant in the LED panel light market. Major organizations and government institutions in the Asia-Pacific region have significantly put resources into action to develop enhanced LED panel light which is driving the growth of the LED panel light industry in the Asia-Pacific region.

There are various advantages to having LED panel lights that are highly energy efficient, compared to traditional lighting technologies such as incandescent or fluorescent lights, consuming far less electricity thus reducing energy bills and electricity bills. LED panel lights have a long service life, often thousands of hours. It reduces maintenance and replacement costs, making it a cost-effective lighting solution. Many LED panel lights are dimmable, allowing users to adjust the light output to different lighting zones and save energy consumption. This feature is especially valuable where lighting requirements vary. LED panel lights provide instant light without the warm-up time required by some traditional lighting technologies. They are also glare-resistant, providing a beautiful and consistent lighting effect. The main advantage of LED panel lights is energy efficiency as they use less electricity, reducing energy costs and reducing the carbon footprint.

A significant catalyst for the LED panel light market is the increasing demand for energy-efficient illumination. This trend is propelled by escalating concerns about environmental issues like climate change. The call to diminish carbon emissions has heightened the focus on energy-efficient lighting solutions, including LED and Compact Fluorescent Lamp (CFL) bulbs. These options play a crucial role in curbing energy consumption, maintaining a warmer atmosphere, lowering gas emissions, and lessening the environmental impact of lighting. Despite being initially linked to higher costs, these energy-efficient lighting solutions prove to be financially advantageous in the long run. For example, LED lights, known for their energy efficiency and durability, contribute to reductions in electricity bills and maintenance expenses. Many companies and homeowners are attracted to these cost-saving benefits. Demand for energy-efficient lighting is expected to continue to grow as consumers and businesses place higher priority on sustainability, cost reduction, and improvements in lighting.

Furthermore, ongoing improvements in lighting generation have progressed the overall performance and affordability of electricity-green lighting fixture options. LED lights have seen sizeable advancements, making it a desired option for each residential and industrial program.

On the other hand, complex installation processes hinder the growth of the market. Installing LED panel lights can sometimes be more difficult than traditional light fixtures, due to their unique design and features. Specialized labor and additional materials are often required, which can increase the overall cost of LED panel lighting projects. High installation costs can discourage potential buyers, especially in high-priced markets. Complex installations often take longer to complete, which can be inconvenient for businesses and homeowners. This extended downtime can be a barrier to adoption, as users want lighting solutions that can be installed quickly and without much fuss. Complex installations can be error-prone, such as improper or uneven wiring. These deficiencies can also reduce lighting efficiency, affecting the reputation of LED panel lights. To overcome these challenges and promote the growth of the LED panel lighting market, manufacturers, industry stakeholders, and policymakers are taking several steps such as product innovation, installation training clear guidelines and easy installation, manuals, and videos to help both professionals provide as well as DIY enthusiasts in the installation process.

In addition, rapid urbanization and infrastructure development are opening opportunities for LED panel light manufacturers. The construction of new residential, commercial, and industrial buildings is an important part of urbanization. LED panel lights are preferred for their energy efficiency, lighting, and design. LED panel lighting providers can apply the demand for modern sustainable lighting solutions to new construction projects. The development of public spaces, including parks and transit areas, requires efficient and sustainable lighting solutions. LED panel lights can better illuminate urban areas while reducing energy consumption and maintenance costs. Retrofitting existing lighting with LED panels is also a common practice in cities. Manufacturers, suppliers, and players involved in the LED panel lighting industry can take advantage of these opportunities by developing energy-efficient, sustainable, and technologically advanced lighting solutions elevating the response to the evolving needs of the urban environment.

Competition Analysis

Competitive analysis and profiles of the major LED panel light market players, such as Signify Holding, Seoul Semiconductor Co., Ltd, ACUITY BRANDS, INC., Panasonic Corporation, GE Lighting, LUMIRON INC, Siteco GmbH, Elstar, NICHIA CORPORATION and OsLEDer Lighting Technology Co., Ltd are provided in this report. Product launch and acquisition business strategies were adopted by the major market players in 2022.

Country Analysis

North America-wise, the U.S. acquired a prime share in the LED panel light market in the North American region and is expected to grow at a CAGR of 14.45% during the forecast period of 2023-2032. The U.S. holds a dominant position in the LED panel light market, owing to an increase in the adoption of efficient energy products.

In Europe, the Rest of Europe dominated the Europe LED panel light market share in terms of revenue in 2022 and is expected to follow the same trend during the forecast period. Furthermore, Russia is expected to emerge as one of the fastest-growing countries in Europe's LED panel light industry with a CAGR of 17.87%, owing to the rise in awareness about energy efficiency regulations, the pursuit of sustainable lighting solutions, and a shift away from traditional lighting technologies across the region.

In Asia-Pacific, China holds a dominant market share in the Asia-Pacific region and is expected to follow the same trend during the forecast period, owing to enormous investment in smart cities and infrastructural development inside the country. However, India is expected to emerge as the highest CAGR in LED panel light market Asia-Pacific in this region.

In LAMEA, Latin America is growing the fastest in the LED panel light market growth because of its growing economy, increasing disposable income, and ongoing expansion of smart cities. Moreover, Africa region is expected to grow at a high CAGR of 18.17% from 2023 to 2032, owing to increasing focus on energy efficiency, urbanization, industrialization, and the adoption of LED panel lighting equipment.

Top Impacting Factors

The LED panel light market size is expected to witness notable growth owing to a rise in demand for energy-efficient lighting, cost-effective, and long-lasting lighting solutions, and an increase in demand for smart lighting and control systems. Moreover, rapid urbanization and infrastructure development, integration of IoT, and surge in demand for human-centric light are expected to provide lucrative opportunities for the growth of the market during the forecast period. On the contrary, complex installation limits the growth of the LED panel light market.

Historical Data & Information

The LED Panel light market demand is highly competitive, owing to the strong presence of existing vendors. Vendors of LED panel lights with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands. The competitive environment in this market is expected to increase as technological innovations, product extensions, and different strategies adopted by key vendors increase.

Recent Expansion in the LED Panel Light Market

- In August 2023, Signify opened its LED lighting manufacturing site in Jiujiang, Jiangxi Province, China. The factory of Signify's joint venture company Zhejiang Klite Lighting Holdings Co., Ltd (“Klite”) manufactures high-quality branded LED lighting products, including for the Philips brand, for China and the global market.

Recent Contracts in the LED Panel Light Market

- In April 2023, Nichia completed its contract of implementing Dynasolis and NF2W585AR-P8 lighting at the Tokushima Taisho Bank Sako Branch with the goal of circadian lighting and disinfection lighting, respectively. The disinfection LED, NF2W585AR-P8, is a dual-function LED that provides both white light and high doses of energy geared for the inactivation of various prevalent bacteria. The LED is integrated into Otsuka Corporation's fixtures, which are installed above the ATM booths in the Sako branch.

Recent Product Launch in LED panel light market

- In March 2023, Nichia launched Nichia Light Cluster Type L to the market. Nichia Light Cluster Type L is an LED module for lighting that features an ultra-wide light distribution. This feature enables thin and lightweight fixtures that generate uniform luminescence and realize a comfortable lighting space that envelops the entire space with soft light.

- In January 2023, Nichia launched the Nichia Light Cluster Type V to the market. Nichia Light Cluster Type V is a completely new light source module for LCDs that combines the essential characteristics of a display with high brightness, low power consumption, and high image quality with the functionality of a thin, lightweight, and curved display.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the LED panel light market analysis from 2022 to 2032 to identify the prevailing LED panel light market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the LED panel light market forecast segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global LED panel light market outlook.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global LED panel light market trends, key players, market segments, application areas, and market growth strategies.

LED Panel Light Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 90.1 billion |

| Growth Rate | CAGR of 16.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 314 |

| By Type |

|

| By Sales Channel |

|

| By Voltage |

|

| By Application |

|

| By Region |

|

| Key Market Players | GE Lighting, Seoul Semiconductor Co., Ltd, ACUITY BRANDS, INC., NICHIA CORPORATION, Siteco GmbH, Panasonic Corporation, Elstar, LUMIRON INC, Signify Holding, Osleder Lighting Technology Co., Ltd |

Analyst Review

The global LED panel light market holds high potential for the semiconductor industry. The business scenario witnesses an increase in the demand for LED panel light, in developed economy such as western Europe, Asia-Pacific and North American regions and in developing regions, such as China, India, southeast Asia and others. Companies in this industry have been adopting various innovative techniques to provide customers with customizable, advanced, and innovative product offerings.

The rise in demand for energy-efficient lighting, cost-effectiveness and increase in demand for smart lighting and control systems drive this market. However, complex installation impedes the growth of the market. During the forecast period it is anticipated to witness an increase in demand for electro optical systems in the military sector infrastructure which is expected to create lucrative opportunities for the key players operating in this market.

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Product launch and collaboration are the prominent strategies adopted by the market players. For instance, in August 2023, GE Lighting launched Cync dynamic effects smart hexagon panels. Each panel includes six individual segments with directional control for music and light shows, which can be saved and activated manually via the Cync App.

The integration of smart lighting technologies and human centric lighting are the upcoming trends of LED panel light market.

Commercial/Industrial are the leading application of LED panel Light market

North America is the largest regional market for LED panel light

In 2022, the estimated industry size of LED Panel Light is $ 20,085.82 million.

Signify Holding, Seoul Semiconductor Co., Ltd, ACUITY BRANDS, INC., Panasonic Corporation, GE Lighting are the top companies to hold the market share in LED panel light.

Loading Table Of Content...

Loading Research Methodology...