Lighting Control System Market Research, 2032

The global lighting control system market was valued at $17.4 billion in 2022 and is projected to reach $34.8 billion by 2032, growing at a CAGR of 7.2% from 2023 to 2032.

Lighting control systems are a range of lighting software that regulate the levels, quality, and characteristics of light in a defined space. These devices aid in reducing electricity wastage while simultaneously encouraging energy efficiency. In addition, intelligent lighting control systems can be defined as a network-based lighting control solution that uses various components, such as occupancy sensors, transmitters & receivers, and microcontrollers for controlling lighting.

The smart lighting control systems offer various advantages such as maximizing energy savings while adhering to building codes and complying with green building and energy conservation programs. These systems have been widely used in lighting applications of smart buildings & smart home establishments, industries, and automotive areas. Reduced energy consumption is one of the major advantages of using lighting control systems.

Several factors are driving the lighting control system market, with one of them being the increasing capability and functionalities of lighting control systems. They can be used to turn ON and OFF the individual lights and luminaires remotely. It is possible to adjust the color and hues of the lights. Furthermore, different types of ambiance can be created by adjusting the dimness of the lights. Many functionalities have been added to the lighting control systems, making them a more attractive option for customers.

Another driving factor is that many governments across the world have introduced policies to support energy-saving products. The growth of the lighting control systems market is fostered by such supportive government initiatives as these systems ensure efficient usage of electricity in lighting with minimal wastage. For instance, the European Union and the U.S. are offering grants, easier access to loans, tax rebates, and subsidies to lighting projects, which reduce CO2 emissions.

On the other hand, system reliability is a concern when lighting control systems are installed in large environments. Many lighting control systems operate on proprietary systems. This means that the systems have been developed by that manufacturer and can only operate with the equipment of that manufacturer. This, combined with the fact that lighting control systems themselves are still a relatively new phenomenon, means that these proprietary systems are rarely tested outside of the manufacturer’s laboratories.

Separately, the rapid development of smart city projects in Asia-Pacific is one of the most important lighting control system market trends during the forecast period. Governments have played a major role in the development of smart cities through regulations and initiatives focused on the deployment of smart services as a major part of the infrastructure. Lighting control systems can be used to provide huge momentum in the process of building smart cities, specifically as they successfully address sustainable development challenges.

The outbreak of COVID-19 has significantly impacted the global lighting control system market growth in 2022, owing to a significant impact on prime players operating in the supply chain. However, recent technological advancements have resulted in the development of standardized lighting control systems, which is expected to impact market growth favorably over the forecast period during the COVID-19 pandemic. The market was principally hit by several obstacles amid the COVID-19 pandemic, such as a lack of skilled workforce availability and delay or cancelation of projects, owing to partial or complete lockdowns globally.

Segment Overview

The lighting control system market is segmented based on components, technology, application, and region.

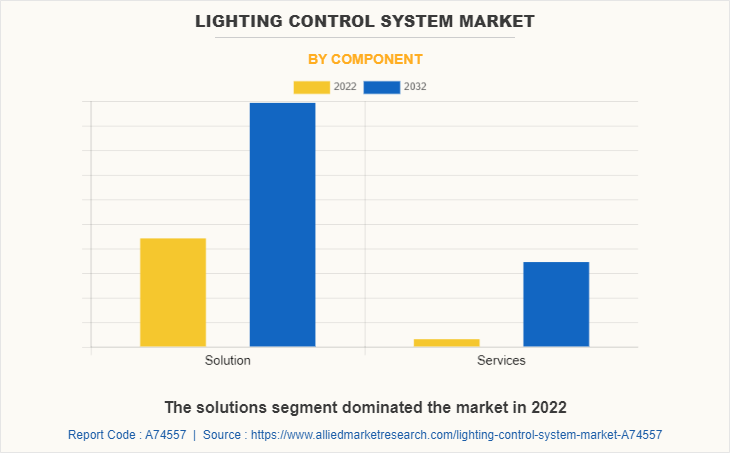

By Component

In terms of market segmentation by component, the market was dominated by the solutions segment in 2022, whereas the services segment is expected to witness a higher growth rate during the forecast period. Solutions primarily consist of the software required to run the lighting control systems, and associated components required to make the software work, such as chips and sensors. The software is connected to all parts of the hardware and is the means through which the hardware is operated.

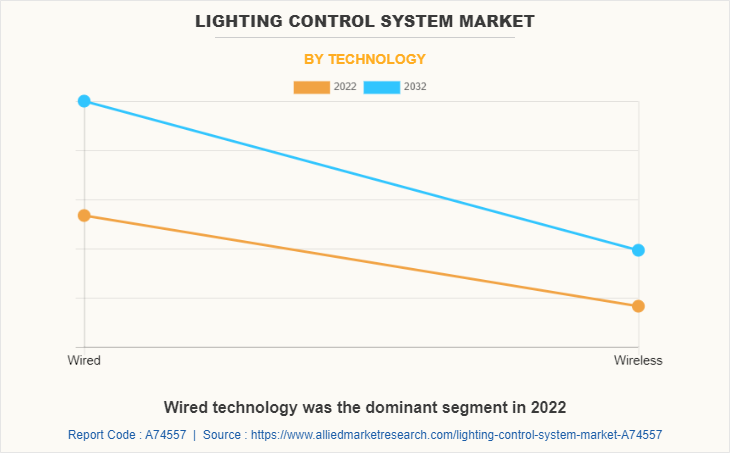

By Technology

In terms of lighting control system industry segmentation by technology, the market was dominated by the wired technology segment in 2022, whereas the wireless segment is expected to witness a higher growth rate during the forecast period. The software in the lighting control system passes the required commands and information to the hardware through wires. Wired connections are especially preferred in small settings where they are not only an affordable option, however, also more convenient.

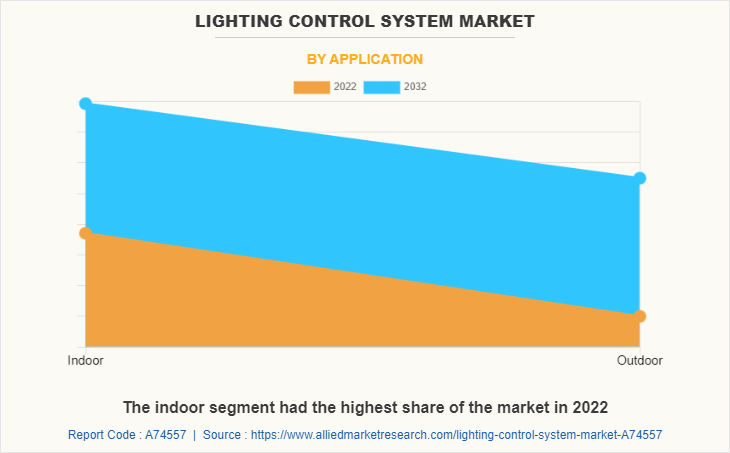

By Application

In terms of segmentation of lighting control system market size by application, the market was dominated by the indoor segment in 2022, whereas the outdoor segment is expected to witness a higher growth rate during the forecast period. The indoor lighting control system includes such systems used within homes, offices, industrial units, and other smart light systems within the premise boundaries. The smart lighting control systems help in reducing energy bills, while simultaneously reducing carbon emissions.

By Region

In terms of region, the lighting control system market share was dominated by North America in 2022, while Asia-Pacific is anticipated to expand at a faster rate during the forecast period. This region is towards its maturity stage for adoption of lighting control systems. The wireless connectivity type of lighting control system market has witnessed a prominent adoption in this region. The North American region has witnessed a huge demand for lighting control systems, through new, as well as, retrofit installations. Different societies and regulatory bodies have given mandates to reduce energy consumption and hence, to reduce the overall CO2 emissions in the North American region.

Competitive Analysis

Competitive analysis and profiles of the major lighting control system market players that have been provided in the report include Acuity Brands, Inc. (Georgia), Cree LED (U.S.), Eaton Corporation (U.S.), General Electric (U.S.), OSRAM AG (Germany), Signify Holding (The Netherlands), Dialight (UK), Legrand S.A. (France), Lutron Electronics Co., Inc (U.S.), and Hubbell Incorporated (U.S.). These key players have adopted several strategies such as new product launches and development, acquisition, partnership, collaboration, and business expansion to increase their market share in the global lighting control system market during the forecast period.

Top Impacting Factors

The global lighting control system market outlook is driven by the increasing capability and functionality of lighting control systems. Many functionalities have been added to the lighting control systems, making them a more attractive option for customers. Another driving factor is that many governments across the world have introduced policies to support energy-saving products. For instance, the European Union and the U.S. are offering grants, easier access to loans, tax rebates, and subsidies to lighting projects, which reduce CO2 emissions.

However, system reliability is a concern when lighting control systems are installed in large environments. Given the fact that lighting control systems are relatively and most of them are proprietary systems, means that these proprietary systems are rarely tested outside of the manufacturer’s laboratories. This restraint affects the lighting control system market forecast. On the other hand, the rapid development of smart city projects in Asia-Pacific presents a lighting control system market opportunity during the forecast period. Lighting control systems can be used to provide huge momentum in the process of building smart cities, specifically as they successfully address sustainable development challenges.

Key Developments/Strategies

- In January 2022, Acuity Brands, Inc. announced that it is expanding its collaboration with Microsoft to bring new capabilities to Acuity Brands' smart lighting, lighting controls, and building automation solutions. Acuity Brands has a bold goal to avoid 100m metric tons of carbon emissions as a result of projected 2020-2030 sales of LED luminaires, lighting controls, and building management systems replacing older technologies in existing buildings. By combining the power of Microsoft's Cloud for Sustainability and Microsoft Azure IoT with Acuity Brands customer solutions, Acuity Brands and Microsoft will jointly enable end customers, operating many types of facilities and buildings, to forecast and calculate the environmental and financial impacts that these new lighting and building management technologies deliver

- In January 2022, GE Current, a Daintree company announced that DaintreeR. Networked wireless lighting controls are now a DesignLights ConsortiumR. (DLCR.) Qualified Networked Lighting Controls Product, giving lighting designers and building owners a tested and certified full-featured lighting control option for commercial and industrial environments.

- In November 2022, Signify announced that it is certifying all of its WiZ products as Matter-compatible. WiZ will be among the first loT brands to support the Matter standard. Pioneering Matter is another major step in delivering on the WiZ mission to make smart lighting accessible for everyone and more meaningful in daily life. The Connectivity Standards Alliance (CSA), formerly the Zigbee Alliance, created the Matter standard as a means of bringing to market interoperable products that work across brands and platforms with greater privacy, security, and simplicity.

- In November 2021, Legrand announced the launch of a new generation of wireless and batteryless switches. This technological innovation was developed in collaboration with CEA, a major player in research, development, and innovation. Protected by three patents, this new “wireless and batteryless” technology is very easy to install and enables electrical devices such as lights or shutters to be controlled via the international radio communication standard, ZigBee.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lighting control system market analysis from 2022 to 2032 to identify the prevailing lighting control system market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lighting control system market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global lighting control system market trends, key players, market segments, application areas, and market growth strategies.

Lighting Control System Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 34.8 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 571 |

| By Component |

|

| By Technology |

|

| By Application |

|

| By Region |

|

| Key Market Players | Signify Holding, Cree, Inc., Eaton Corporation, Lutron Electronics Co., Inc,, General Electric, Dialight plc., OSRAM GmbH, Legrand S.A., ACUITY BRANDS, INC., Hubbell Incorporated |

Analyst Review

The lighting control system market holds high potential in the smart building and smart home segment. The current business scenario experiences rapid development in smart infrastructure and lighting leading to a readiness to adopt this connectivity type, particularly in the developed and developing regions such as North America, Asia-Pacific, and Europe. Companies in this industry have adopted various innovative techniques to provide customers with advanced and innovative features.

Asia-Pacific has witnessed a wide-scale adoption of lighting control systems in recent years owing to rise in demand across various smart building & smart home sectors such as retail, hospitals, automotive, and manufacturing. Companies operating in the lighting controls market have a robust supply chain network owing to the high penetration of local players in this market.

The key players of the market focus on introducing technologically advanced products to remain competitive in the market. Product launch, agreement, collaboration, and partnership are expected to be the prominent strategies adopted by the market players.

The lighting control system market size was valued at $17,376 million in 2022, and is projected to reach $34,760 million in 2032, registering a CAGR of 7.2%.

Wired technology segment was the leading technology of lighting control system market in 2022.

Indoor segment was the leading application of lighting control system market in 2022.

North America was the leading region of lighting control system market in 2022.

Acuity Brands, Inc. (Georgia), Cree LED (U.S.), Eaton Corporation (U.S.), General Electric (U.S.), OSRAM AG (Germany), Signify Holding (The Netherlands), Dialight (UK), Legrand S.A. (France), Lutron Electronics Co., Inc (U.S.), and Hubbell Incorporated (U.S.) are the top companies in the global lighting control system market.

Loading Table Of Content...

Loading Research Methodology...