Limb Prosthetics Market Research, 2033

The global limb prosthetics market size was valued at $1.7 billion in 2023, and is projected to reach $2.9 billion by 2033, growing at a CAGR of 5.6% from 2024 to 2033. The major factors driving the growth of the limb prosthetics market are advancements in technology and increasing awareness of prosthetic solutions. Innovations such as 3D printing, smart prosthetics, and lightweight materials are enhancing functionality and comfort for users. The market is further propelled by the rising prevalence of limb loss due to accidents, diabetes, and vascular diseases, alongside growing demand for personalized and advanced prosthetic solutions. Additionally, increasing investments in research and development by key players and government support for rehabilitation programs are expected to drive market growth

Market Introduction and Definition

Limb prosthetics are artificial devices designed to replace missing limbs, restoring functionality and improving quality of life for individuals who have experienced amputation or congenital limb deficiencies. Modern prosthetics have evolved significantly with advancements in technology, offering more than just basic functionality. They include sophisticated materials and designs that enhance comfort, durability, and aesthetic appeal. Prosthetics are categorized into several types based on their function and complexity, including passive, body-powered, and myoelectric prosthetics. Passive prosthetics are primarily cosmetic and provide little to no functional movement, while body-powered prosthetics use cables and harnesses controlled by the user's remaining muscles to move the prosthetic. Myoelectric prosthetics, on the other hand, utilize electrical signals from the user’s muscles to control the movement of the prosthetic limb, offering more advanced and precise functionality.

Key Takeaways

- The limb prosthetics market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major limb prosthetics industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- In April 2022, Indian Institutes of Technology (IIT) Madras researchers launched polycentric prosthetic knee in India.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objective.

Key Market Dynamics

According to limb prosthetics market forecast analysis key factors driving the growth of the limb prosthetics market are rising incidences of limb loss, growing awareness and acceptance of prosthetic limbs, rise in prevalence of diabetes and rising disposable income. According to 2024 report by National Library of Medicine, approximately 150, 000 patients per year undergo a lower extremity amputation in the U.S. Rise in amputation is driven by several factors, including an increase in the prevalence of conditions such as diabetes, vascular diseases, and traumatic injuries. Diabetes, in particular, can lead to severe complications like diabetic foot ulcers and infections, which may necessitate limb amputation. Additionally, advancements in medical care and trauma management have improved survival rates for severe injuries, often resulting in limb loss. Thus, the rise in the incidence of amputation is expected to drive the limb prosthetics market growth.

In addition, according to limb prosthetics market opportunity analysis the growing awareness and acceptance of prosthetic limbs have emerged as significant drivers in the limb prosthetics market. As educational initiatives and advancements in medical technology continue to spread, more individuals are becoming informed about the benefits and possibilities offered by modern prosthetics. This increasing awareness is coupled with a greater societal acceptance of prosthetic devices, which has reduced the stigma traditionally associated with their use. Media coverage, success stories of prominent figures, and the dissemination of information through various channels have played crucial roles in shifting public perception and fostering a more inclusive attitude towards prosthetics. Additionally, improvements in prosthetic technology have made these devices more functional, comfortable, and aesthetically pleasing, further encouraging their adoption. Thus, the rise in adoption of the prosthetic limbs is expected to drive the limb prosthetics market size.

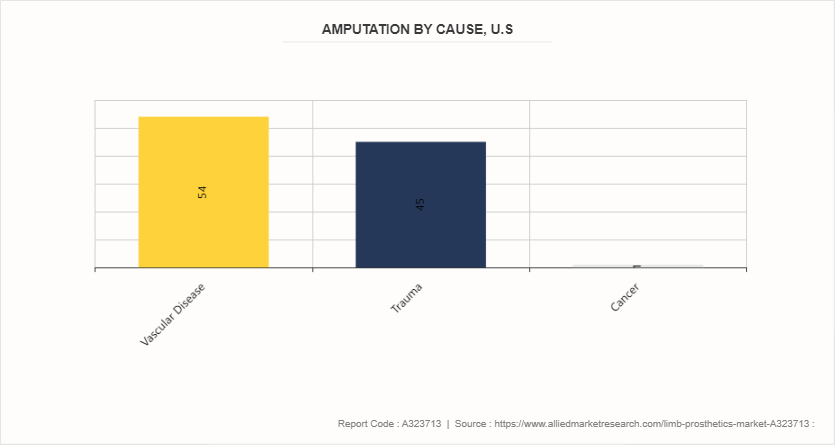

Cause of Amputation

Amputation of a limb has significant impact on the quality of life of an individual. Prosthetic plays a major role in everyday activity of the individual improving overall quality of the life. Among individuals living with limb loss, vascular diseases, which include diabetes and peripheral arterial disease, account for 54% of amputations. These conditions often lead to severe complications that necessitate the removal of a limb to save the patient's life. Traumatic injuries are the second leading cause, responsible for 45% of amputations. Traumatic events, such as accidents or injuries, frequently result in limb loss, requiring prompt medical intervention. In addition, cancer accounts for around 1% of the amputations. The rising case of amputation is expected to drive the demand of prosthetics including limb prosthetics, which plays major role in facilitating mobility of individuals with leg amputation.

Market Segmentation

The limb prosthetics industry is segmented into type, technology, component, end user, and region. By type, the market is bifurcated into upper limb prosthetics and lower limb prosthetics. As per technology, the market is classified into conventional prosthetic devices, electric prosthetic devices, and hybrid prosthetic devices. By component, the market is divided into socket, appendage, joint, connecting module, and others. Depending on end user, the market is hospitals, clinics and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the limb prosthetics market share in 2023 owing to increasing prevalence of chronic diseases, such as diabetes and vascular conditions which often result in limb loss, strong presence of major key players, and high disposable income. In the Asia-Pacific region, the market is experiencing rapid growth. This expansion is fueled by increasing healthcare expenditures, rising awareness of prosthetics, a growing prevalence of diabetes and vascular diseases, and surge in incidence of traumatic injuries leading to amputations. However, in the Asia-Pacific region the market faces challenges related to the affordability and accessibility of advanced prosthetic solutions.

- In an article published by the National Library of Medicine in 2023, an epidemiological study conducted in Kolkata, India, found that lower limb amputations account for 94.8% of all amputations among amputees. As the lower limb amputation accounts for the majority of the amputation, there is a growing demand for prosthetic feet.

- According to 2022 article by National Library of Medicine, approximately 150, 000 patients per year undergo a lower extremity amputation in the U.S. The high number of amputations signifies the growing demand for limb prosthetics.

- In 2023, UK Government has announced funding for microprocessor controlled Prosthetic knees. The policy facilitates hundreds of amputees living in UK with above knee limb loss to have access to life changing microprocessor controlled prosthetic knee (MPK) via the National Health Service. The funding program significantly contributes to the growth of the market as it provides access to prosthetic feet to those who can't afford prosthetic feet.

Industry Trends

- In May 2024, South Dakota State University mechanical engineering students designed and developed cheap and affordable prosthetic. Around 40 million people live with amputated limbs and only 2 million of them have access to prosthetics. Cost effective prosthetic is expected to increase the adoption among the people with limited financial resources to spend on healthcare.

- In a 2024 article published by National Library of Medicine, it was reported that biomimetic prosthetics offer promising advancements in functionality, comfort, and integration with the human body. The technological advancement in the limb prosthetics led to the development of new advanced biomaterial which have greater biocompatibility. Thus, the technological advancement in biomaterials is expected to significantly contribute in the adoption of limb prosthetics.

- In 2024 China International Import Expo, Ossur, a prosthetics developer based in Iceland, showcased its latest prosthetic knee designed to serve a broader spectrum of above-knee amputees and enhance their mobility with sophisticated controls.

- According to 2024 article Amputee Coalition, more than 2.3 million people are living with limb loss in the U.S

Competitive Landscape

The major players operating in the limb prosthetics market include Fillauer LLC Companies, Inc., Hanger, Inc, Ossur, Blatchford Limited, Spinal Technology Inc, Ottobock, WillowWood Global LLC, Steeper Inc, Uniprox, and Ortho Europe. Other players in limb prosthetics market include Roadrunnerfoot, Howard Orthopedics, Inc. and Protunix.

Recent Key Strategies and Developments

- In September 2022, Siemens Caring Hands, a global charitable organization, provided $250, 000 to Unlimited Tomorrow for Global Initiative to secure prostheses for victims in Ukraine.

- In July 2022, Unlimited Tomorrow partnered with Singularity Group to bring functional prosthetic limbs to those in need. This organization launched a $1.0 million GoFundMe initiative to create and provide functional prosthetic limbs to 100 amputee victims of the Russian invasion of Ukraine.

- In February 2022, Ossur launched a new product, POWER KNEE. It is the world’s first actively powered microprocessor prosthetic knee for people with above-knee amputation or limb differences.

- In December 2021, Ortho Europe launched straight and pre-flexed suspension gel sleeves. It provides a secure sealing solution to lower limb amputees.

Key Sources Referred

- World Health Organization

- Government of UK

- Center of Disease Control and Prevention.

- National Library of Medicine

- The Amputee Coalition of America

- Amputation Foundation

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the limb prosthetics market analysis from 2024 to 2033 to identify the prevailing limb prosthetics market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the limb prosthetics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global limb prosthetics market trends, key players, market segments, application areas, and market growth strategies.

Limb Prosthetics Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.9 Billion |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By Technology |

|

| By Component |

|

| By End User |

|

| By Region |

|

| Key Market Players | Blatchford Limited, Ortho Europe, Steeper Inc, Fillauer LLC Companies, Inc, Össur, Spinal Technology Inc, WillowWood Global LLC, Hanger, Inc, ottobock, Uniprox |

The global limb prosthetics market size was valued at $1.7 billion in 2023

The market value of Limb Prosthetics Market is projected to reach $2.9 billion by 2033.

The forecast period for Limb Prosthetics Market is 2024-2033.

The base year is 2023 in Limb Prosthetics Market

Major key players that operate in the Limb Prosthetics Market are Fillauer LLC Companies, Inc., Hanger, Inc, Ossur, and Blatchford Limited

Loading Table Of Content...