Lithium Compounds Market Research, 2032

The global lithium compounds market was valued at $7.1 billion in 2022 and is projected to reach $33.5 billion by 2032, growing at a CAGR of 16.9% from 2023 to 2032.

Report Key Highlighters:

- The lithium compounds market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($million) and volume (Kilotons) for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

- Over 3,700 product literature, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the market.

- The lithium compounds market is highly fragmented, with several players including Lithium Americas Corp, Albemarle Corporation, Neometals Ltd., FMC Corporation, Livent, Orocobre Limited, Bacanora Lithium, Sigma Lithium, Ganfeng Lithium Co., Ltd., SQM S.A.

Lithium compounds exhibit high solubility in water and at low concentrations. It does not pose significant harm to the environment. This characteristic makes it relatively safe when present in natural water sources. The industrial applications of lithium are primarily driven by its unique chemical properties. As a highly reactive metal, lithium readily loses one electron, leading to the formation of lithium compounds containing the Li+ cation. One notable example is lithium carbonate, which demonstrates retrograde solubility, meaning its solubility decreases with an increase in temperature. Owing to its reactivity and pyrophoric nature, lithium is typically stored in mineral oil as it is insoluble in cold water. This helps to prevent reactions with moisture and air, reducing the risk of fire or explosion.

Increased demand for batteries

In lithium-ion rechargeable battery technology, lithium compounds are commonly used to conserve and save energy. In devices such as mobile phones, cameras, laptop computers, power apparatus, and vehicles, lithium-ion batteries are utilized. Lithium-ion batteries are an integral component of both internal combustion and electric vehicles. Lithium-ion batteries are preferred in the automotive industry due to their high energy density, low self-discharge rate, long life cycle, inexpensive maintenance, quick charging, and low weight. Ni-Cd batteries are in high demand, as they are presently utilized in some hybrid electric vehicles. In India, Southeast Asia, and South Korea, hybrid vehicle sales and demand have increased substantially over the past few years.

According to the Bureau of Economic Analysis (BEA), the value added by manufacturing electrical appliances, equipment, and components in the U.S. during the third quarter of 2022 was approximately $ 73.8 billion, an increase of approximately 8% compared to the same period the year prior. In the first three quarters, the total value added was close to $ 220 billion.

In addition, the cumulative output of computer and electronic product manufacturing in the U.S. during the first three quarters of 2022 was approximately $1,300 billion. In 2022, the economy grew by 7% compared to the same period in 2021 ($1,200 billion). The International Energy Agency (IEA) reported in its 'September 2022 Electric Vehicles Outlook' that despite supply chain constraints, sales of electric cars attained a record high in 2021. Compared to 2020, sales nearly doubled to 6.6 million, bringing the number of electric vehicles on the road to 16.5 million. The rise in the number of electric vehicles and the surge in the use of electronic equipment in developing nations fuel the demand for rechargeable batteries, which may propel the lithium compounds market.

The electric vehicle (EV) industry has emerged as a significant driver of lithium demand.

Compared to smartphones, EVs require much larger quantities of lithium. A single electric car uses approximately five times more lithium than a smartphone, and a higher-range electric vehicle for example, Hyundai Kona EV can consume the equivalent of ten thousand cell phones. This surge in demand is due to the use of lithium-ion batteries, which are the preferred energy storage technology for EVs. The surge in adoption of electric vehicles globally has contributed to the increase in demand for lithium compounds. As the EV market continues to expand, so does the need for lithium as a key component in lithium-ion batteries.

The increase in production of glass & ceramic and related products is one of the major factors driving the demand for lithium concentrate. Lithium concentrate, a form of lithium compound, is widely used in the production of glass and ceramics, which fosters the growth of the lithium compound market. In 2018, according to Glass Alliance Europe, the European region’s glass production reached 37,2 million tons, an increase of 1.8% from the previous year. According to the Bureau of Economic Analysis of the U.S., the value of the glass and glass product manufacturing industry in the U.S. was $3.83 trillion in 2020, an increase of 0.26 % from the previous year. The increase in glass and ceramic production boosts the demand for lithium concentrate, a lithium compound, which in turn drives the market for lithium compounds.

The extraction of lithium has a substantial social and environmental impact, particularly in the form of water depletion and pollution. In addition, toxic substances are required to process this metal. The release of such toxic substances via air emission, leaching, or leaks can be detrimental to the ecosystem, food production, and communities. The extraction of metals inevitably causes soil degradation and air pollution. Locals in Argentina asserted that the extraction of lithium had contaminated streams used by humans and livestock. In addition, concerns exist regarding product recycling. Low collection rates, price volatility, and high recycling costs have all contributed to the lack of lithium recycling. As the material is extremely reactive, flammable, and toxic, the product's potential for recycling is complicated. Thus, environmental concerns and recycling are expected to hinder market growth.

In the near future, the increase in the use of lithium in aircraft manufacturing is anticipated to generate lucrative market growth opportunities. Lithium, for example, is regarded as a lightweight metal and is widely preferred in the production of aircraft body materials. Components that reduce an aircraft's weight improve its fuel efficiency, and the lithium market offers bountiful opportunities in aircraft manufacturing. Lithium is frequently combined with aluminum and copper in the production of airplanes and jet aircraft. A single Airbus A350 requires approximately 400 kilograms of lithium for production.

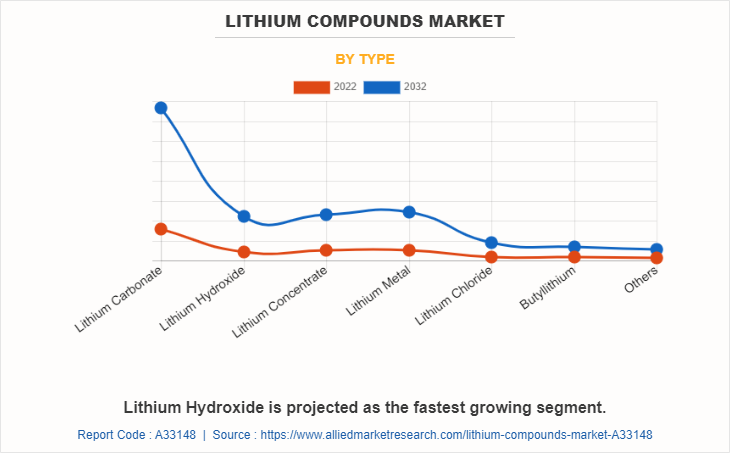

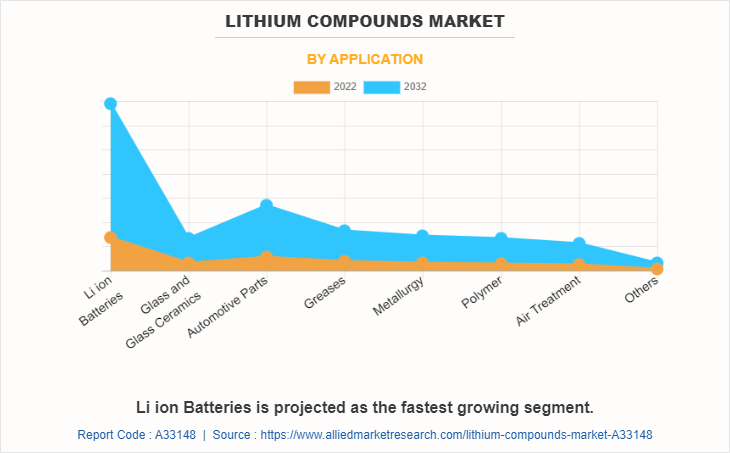

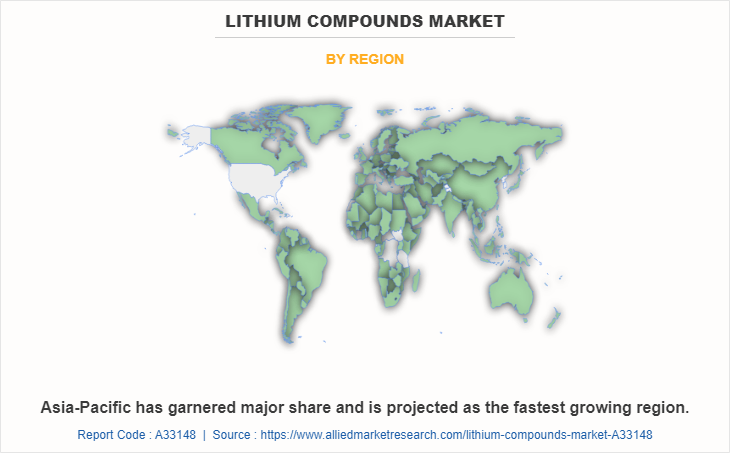

The lithium compounds market is segmented into type, application, and region. Depending on the type, the market is divided into lithium carbonate, lithium hydroxide, lithium concentrate, lithium metal, lithium chloride, butyllithium, and others. On the basis of application, it is categorized into Li-ion batteries, glass & glass ceramics, automotive parts, greases, metallurgy, polymer, air treatment, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major players operating in the global lithium compounds market are Lithium Americas Corp, Albemarle Corporation, Neometals Ltd., FMC Corporation, Livent, Orocobre Limited, Bacanora Lithium, Sigma Lithium, Ganfeng Lithium Co., Ltd., SQM S.A., Jiangxi Ganfeng Lithium Co., Ltd., Sichuan Tianqi Lithium Industries, Inc.

Other players include Galaxy Resources Limited, Pilbara Minerals Limited, Altura Mining Limited, Sayona Mining Limited, Critical Elements Lithium Corporation, Piedmont Lithium Limited, Bacanora Lithium Plc, Sigma Lithium Resources Corporation.

The lithium carbonate segment held the highest market share in 2022, accounting for nearly half of the global lithium compounds market revenue, Lithium carbonate is mainly used as a mood stabilizer for treating bipolar sickness and controlling manic episodes. It helps adjust neurotransmitters in the brain, lowering temper swings. Additionally, lithium carbonate can be prescribed for particular intellectual fitness conditions and as an off-label remedy for cluster headaches and certain behavioral disorders.

Lithium hydroxide is expected to register the highest CAGR of 17.4%. Lithium hydroxide is a critical driver in modern-day rechargeable lithium-ion batteries, broadly used in digital devices, electric vehicles, and renewable power storage systems. Its excessive reactivity and strong alkaline houses enable environment-friendly electrochemical processes, facilitating electricity storage and release, as a consequence powering our transportable and sustainable technologies.

the Li-ion batteries segment held the highest market share in 2022, accounting for around two-fifths of the global lithium compounds market revenue, and is expected to register the highest CAGR of 17.5%. Li-ion batteries include transportable electronic devices, electric-powered vehicles, renewable electricity storage, and power tools. The excessive power density, speedy charging, and longer lifespan make Li-ion batteries popular. Additionally, environmental issues and developments in technology fuel research and development to improve their performance and safety.

Asia-Pacific held the highest market share in terms of revenue in 2022, accounting for more than two-fifths of the global Lithium compounds market revenue. The Asia-Pacific lithium compounds market is driven by increasing demand for lithium-ion batteries used in electronics and electric powered vehicles, an increase in renewable electricity storage solutions, and the region's robust industrial and manufacturing sectors. Additionally, authority's initiatives for merchandising easy energy and sustainability contribute to the market's expansion.

Key development strategies undertaken by key players

On January 2, 2019, The Australian government approved the establishment of Albemarle Corporation's Kemerton Plant, which would produce 60,000 metric tons of lithium hydroxide. If necessary, this capacity may be increased to 100,000 metric tons. The plant's commissioning is scheduled to begin in 2021.

On June 11, 2021, Ganfeng Lithium announced to increase in its Li2CO3 product by 600,000 tons original time as demand for the commodity used in electric-vehicle batteries increases. The company will vend around USD 630 million in new shares to boost capacity and fund implicit investments.

On April 27, 2022, SQM increased lithium carbonate production capacity to 180,000 metric tons per year, while working towards 210,000 tons by early 2023.

On December 5, 2022, Sigma Lithium stated that it has obtained a USD 100 million finance from Synergy Capital to construct the first phase of a USD 155 million expansion at its Grota do Cirilo lithium mine in Minas Gerais, Brazil. This mine has the capacity to produce up to 270,000 tons of high-purity battery-grade lithium concentrates per year, which equates to around 36,700 tons of Lithium Carbonate Equivalent (LCE).

On June 13, 2022, Albemarle Corporation inaugurated a third chemical conversion plant La Negra III/IV, in Antofagasta. This institution is one of the most modern in Latin America. This plant will more than quadruple lithium output while reducing water use by 30% per metric ton and committing to a sustainable manufacturing line.

On May 2, 2022, Livent Corporation announced that it has agreed to double its ownership interest to 50% in Nemaska Lithium Inc. ("Nemaska"), a fully integrated lithium hydroxide development project located in Québec, Canada. Livent will issue 17,500,000 shares of its common stock to The Pallinghurst Group ("Pallinghurst") and its investors to acquire their half of Québec Lithium Partners ("QLP"). Livent already owns the other half of QLP. Following the closing of the transaction, QLP will become a wholly owned subsidiary of Livent, and Livent will in turn own 50% of Nemaska through QLP. Investissement Québec ("IQ") will remain the owner of the remaining 50% interest in Nemaska.

On 23 January 2023, Ganfeng Lithium Co., Ltd. announced an investment of USD 2.14 billion in two new battery manufactories to increase its product capacities by 34 GWh. This installation will add to manufacturing, which is anticipated to grow to around 100 GWh annually.

Market trends

One of the major drivers fueling the market's expansion is the surge in use of lithium carbonate compound, which helps to reduce firing temperatures and thermal expansion. In addition, the rise in demand for lithium compounds in the construction industry due to an increase in infrastructure activities and renovation projects offers a positive outlook for the market.

In addition, the increase in the use of lithium compounds in the healthcare industry for the treatment of bipolar disorder (BD) fosters the market's expansion.

Furthermore, an upsurge in the use of lithium compounds in the automotive industry due to the surge in the popularity of electric vehicles (EVs) among consumers augments the market's expansion.

The increase in the use of lithium compounds in the electronics industry to power a variety of electronic devices, such as calculators, cameras, mobile phones, and tablets across the globe, provides investors with lucrative growth opportunities.

In addition, the surge in demand for lithium compounds, which aid in reducing carbon footprint and eliminating greenhouse gas (GHG) emissions, contributes to the market's expansion. In addition, the rise in the use of lithium-ion batteries, which are lightweight, cost-effective, and have a high energy density, aids in the expansion of the market.

Impact Of Russia Ukraine War On the Lithium Compounds Market

The conflict between Russia and Ukraine has several implications for the lithium compounds market.

Ukraine was a major producer of lithium compounds, particularly lithium carbonate. The conflict disrupted the supply chain, leading to a reduction in the availability of lithium compounds in the market. This resulted in higher prices and limited availability, affecting industries relying on lithium for various applications, such as electric vehicles (EVs) and energy storage.

The conflict between Russia and Ukraine had broader geopolitical implications, creating uncertainty in global markets. Investors and businesses became cautious and hesitant to make long-term investments or commitments, slowing down the growth of the lithium market. This uncertainty impacted lithium mining projects, as geopolitical tensions affected the stability of mining operations in the region.

The growth of the electric vehicle market and energy storage systems heavily relied on lithium-ion batteries. Any disruption in the supply of lithium compounds from Ukraine, or even concerns about such disruptions, affected the production and availability of lithium-ion batteries. This, in turn, slowed down the deployment of EVs and the expansion of energy storage projects, impacting the overall demand for lithium compounds.

To mitigate potential risks associated with geopolitical conflicts, businesses considered diversifying their supply chains and reducing dependence on regions affected by conflicts. As a result, there was a shift in the sources of lithium compounds, with companies seeking alternative suppliers from other regions such as South America (e.g., Chile and Argentina) or Australia, which are major lithium producers. This shift impacted the market dynamics and trade patterns of lithium compounds.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lithium compounds market analysis from 2022 to 2032 to identify the prevailing lithium compounds market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lithium compounds market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lithium compounds market trends, key players, market segments, application areas, and market growth strategies.

Lithium Compounds Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 33.5 billion |

| Growth Rate | CAGR of 16.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 350 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Livent, FMC Corporation., Bacanora Lithium, SQM S.A, Ganfeng Lithium Group Co., Ltd, Sigma Lithium, Albemarle Corporation., Lithium Americas Corp., Neometals Ltd, Orocobre Limited Pty Ltd |

Analyst Review

According to the insights of the CXOs of leading companies, the growth of the global lithium compound market is driven by building renovations, new housing construction, and infrastructure investments. Lithium compound is utilized in the production of ceramics, enamels, glass, and lubricants for high-temperature applications; these products aid the construction industry, thereby driving the product's market expansion. Segments such as rechargeable batteries, armor plating, cooling systems for nuclear reactors, bicycle frames, aircraft, and specialty eyewear contribute to the market's expansion. The increase in use of lithium-ion batteries in portable electronic devices, such as smartphones, cameras, watches, electric vehicles, and pacemakers, fosters the market’s expansion.

The Lithium compounds market attained $7.0 billion in 2022 and is projected to reach $33.5 billion by 2032, growing at a CAGR of 16.9% from 2023 to 2032.

The lithium Compounds Market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Asia-Pacific is the largest regional market for Lithium Compounds.

Lithium Americas Corp, Albemarle Corporation, Neometals Ltd., FMC Corporation, Livent, Orocobre Limited are the top companies to hold the market share in Lithium Compounds.

Li ion batteries is the leading application of Lithium Compounds Market.

Increased demand for batteries and surge in demand from the medical industry are the driving factor of Lithium Compounds Market.

Increasing adoption of lithium in smart grid electricity is the upcoming trend of Lithium Compounds Market in the world.

Loading Table Of Content...

Loading Research Methodology...