Lithium Metal Market Research, 2032

The global lithium metal market size was valued at $4.3 billion in 2022, and is projected to reach $13.5 billion by 2032, growing at a CAGR of 12.1% from 2023 to 2032. Rise in demand for electric vehicles (EVs) is a key driver for the lithium metal market, as lithium-ion batteries are essential for EVs' energy storage. Similarly, growth in energy storage systems (ESS), used to store renewable energy, further fuels the demand for lithium metal. These sectors rely on lithium for their high energy density and efficient performance, driving market expansion.

Introduction

Lithium metal is a soft, silver-white alkali metal and is one of the chemical elements on the periodic table with the symbol "Li" and atomic number 3. It is the lightest metal and the least dense solid element at room temperature. Lithium has several unique properties, including its high reactivity with water and air, making it highly flammable and requiring careful handling and storage.

Lithium metal is known for its high electrochemical potential, making it a valuable component in lithium-ion batteries, one of its most significant and widespread applications. It is widely used in various industries, including electronics, electric vehicles, energy storage, aerospace, pharmaceuticals, and metallurgy.

Report Key Highlighters:

The report provides competitive dynamics by evaluating business segments, product portfolios, target market revenue, geographical presence and key strategic developments by prominent manufacturers.

The lithium metal market is consolidated in nature among prominent companies such as Albemarle Corporation., Allkem Limited, Ganfeng Lithium Co., Ltd., Mineral Resources Limited, Piedmont Lithium, SQM S.A., and Tianqui Lithium Industries Inc.

- The study contains qualitative information such as the market dynamics (drivers, restraints, challenges, and opportunities), key regulation analysis, pricing analysis, and Porter’s Five Force Analysis across North America, Europe, Asia-Pacific, LAMEA regions.

- Latest trends in global lithium metal market such as mining activities, undergoing R&D, public policies, and government initiatives for mining and utilization of lithium metal are analyzed across 16 countries in 4 different regions.

- More than 3,300 lithium metal-related product literatures, industry releases, annual reports, and other such documents of key industry participants along with authentic industry journals and government websites have been reviewed for generating high-value industry insights for global lithium metal market.

Market Dynamics

One of the most significant drivers of the lithium metal market is the rapid growth of the electric vehicle industry. Lithium-ion batteries, which rely on lithium metal-based compounds, are the preferred choice for powering electric cars due to their high energy density and lightweight properties. The demand for EVs is increasing, subsequently boosting the demand for lithium metal as governments and consumers worldwide prioritize sustainable transportation.

Moreover, the proliferation of smartphones, laptops, tablets, and other portable electronic devices is another key driver for the lithium metal market. Lithium-ion batteries are widely used in these devices due to their ability to offer long-lasting power in a compact form factor. This is projected to act as one of the key drivers responsible for the growth of the market in the growing portable electronics sector.

However, the demand for lithium metal has been growing rapidly, primarily driven by the electric vehicle (EV) industry and the energy storage sector. However, there have been concerns about potential supply constraints due to the limited number of lithium metal producers and the time it takes to bring new lithium metal mining operations online. This supply-demand imbalance can lead to price volatility and affect the availability of lithium for various industries. This factor may restrain the growth of the lithium metal market during the forecast period.

On the contrary, with increase in environmental awareness, there are opportunities for sustainable mining practices and efficient recycling of lithium metal. Companies that adopt environmentally responsible approaches to lithium metal extraction and recycling are likely to gain a competitive advantage and meet the demand for ethically sourced lithium metal. This factor is anticipated to offer remunerative opportunities for the lithium metal market during the forecast period.

Segment Overview:

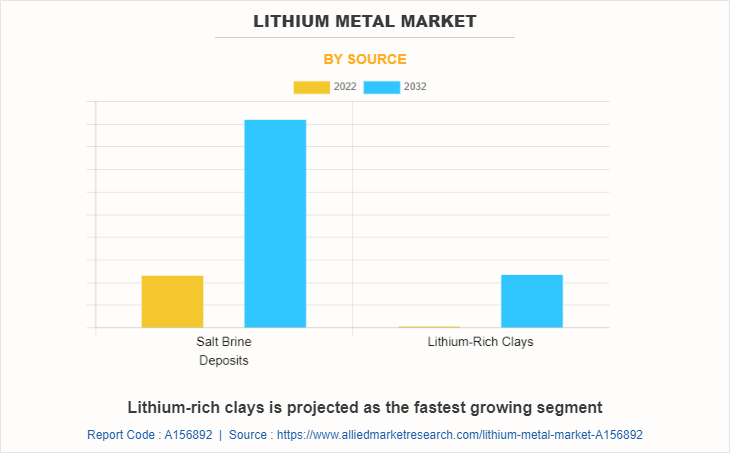

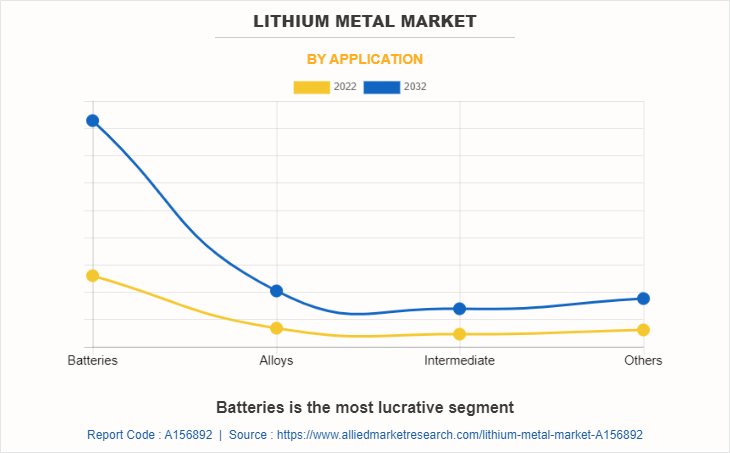

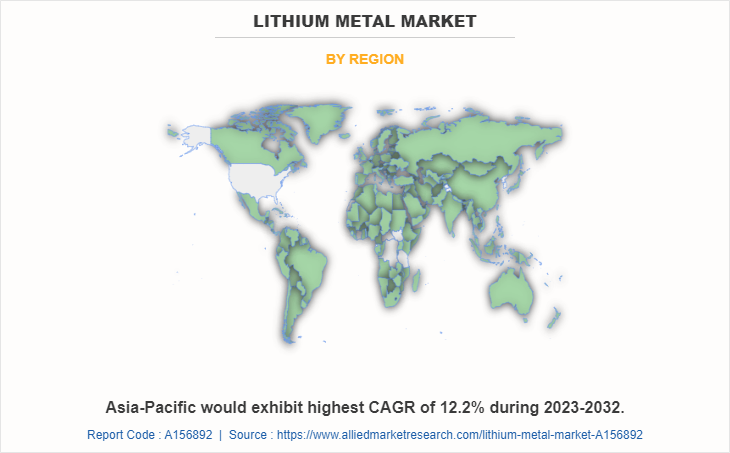

The lithium metal market is segmented on the basis of source, application, and region. On the basis of source, the market is categorized into salt brine deposits and lithium-rich clays. On the basis of application, it is divided into batteries, alloys, intermediate, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Lithium Metal Market By Source

In 2022, the salt brine deposits segment was the largest revenue generator, and is anticipated to grow at a CAGR of 12.0% during the forecast period. The lithium industry is focusing on research to explore new technologies and applications for lithium. While lithium metal from salt brine deposits may not be commonly used now-a-days, advancements in battery technology or other specialized applications are projected to create new opportunities for its utilization in the future.

Lithium Metal Market By Application

By application, the batteries segment dominated the global market in 2022, and is anticipated to grow at a CAGR of 12.4% during forecast period. The global shift toward electric vehicles is one of the primary drivers of the increase in demand for lithium metal used for producing lithium-ion batteries. There is a growing focus on transitioning from fossil-fuel-powered vehicles to electric cars as countries and regions aim to reduce carbon emissions and combat climate change. Lithium-ion batteries are the preferred choice for EVs due to their high energy density, longer driving ranges, and faster charging times. This may act as one of the key drivers responsible for the growth of the lithium metal market for batteries application.

Furthermore, the widespread use of smartphones, laptops, tablets, and other portable electronic devices has contributed significantly to the demand for lithium metal for producing lithium-ion batteries. These devices require compact, lightweight, and rechargeable batteries, and lithium-ion batteries meet these criteria effectively. This may further aid the growth of the lithium metal market for batteries application. .

Lithium Metal Market, By Geography

The Asia-Pacific market size is projected to grow at the highest CAGR of 12.2% during the forecast period and accounted for 69.4% of lithium metal market share in 2021. The rapid pace of urbanization and industrial development in countries like China and India has led to increased demand for consumer electronics and portable devices. This surge in demand for smartphones, laptops, and other electronic gadgets has driven the need for lithium-ion batteries, which utilize lithium metal. Moreover, the Asia-Pacific region is also home to significant lithium metal resources, particularly in Australia. Developing these local resources contributes to securing a stable supply of lithium metal for the region's growing industries.

In addition, several countries in the Asia-Pacific region, including Australia and Japan, have been actively investing in renewable energy and energy storage projects. The integration of solar and wind energy into the power grid has increased the demand for lithium metal for producing lithium-ion batteries used for energy storage applications. These factors are projected to boost the growth of the lithium metal market during the forecast period.

Furthermore, the primary driver of the lithium metal market in India is the government's push for electric vehicle (EV) adoption and renewable energy storage solutions. Under the National Electric Mobility Mission Plan (NEMMP) and the Faster Adoption and Manufacturing of Electric Vehicles (FAME II) scheme, the Indian government aims to achieve 30% EV penetration by 2030. To support this, India is investing heavily in building a robust domestic supply chain for lithium-ion batteries, which heavily rely on lithium metal. The Ministry of Heavy Industries reported a 200% increase in EV sales in 2023, highlighting the growing demand for lithium ion battery manufacturing.

Additionally, India’s focus on renewable energy, with a target of achieving 500 GW of renewable capacity by 2030 under its *National Solar Mission*, is increasing the need for efficient energy storage systems, further driving the demand for lithium metal. In 2023, India signed agreements with Australia and Argentina to secure lithium supplies, as part of efforts to reduce reliance on imports and boost domestic production capabilities. These initiatives are expected to accelerate lithium metal demand in the coming years, positioning India as a key player in the global lithium market.

Competitive Analysis

The global lithium metal market profiles leading players that include A123 Systems LLC, Albemarle Corporation., Allkem Limited, Ganfeng Lithium Co., Ltd., Livent, Mineral Resources Limited, Piedmont Lithium, Shenzhen Chengxin Lithium Group Co., Ltd., SQM S.A., and Tianqui Lithium Industries Inc.

Moreover, the other key players of market that are not profiled in the report include Lithium One, Ardiden Ltd., Argosy Minerals Ltd., Aurora Energy Metals Limited, Morella Corporation, Anson Resources Ltd., Arrow Minerals Ltd., AVZ Minerals, BMG Resources Ltd., Benz Mining Corporation, and others. The global lithium metal market report provides in-depth competitive analysis as well as profiles of these major players.

Historical Trends in Lithium Metal Market

Early Development (1980s - 1990s): Lithium metal began to gain attention due to its lightweight and high-energy-density properties, making it ideal for batteries, especially in early portable electronics like cameras and watches. However, its use was limited due to cost and supply constraints.

Battery Boom (2000s): Development of lithium-ion batteries revolutionized the electronics market. By the early 2000s, lithium metal and its compounds were increasingly utilized in mobile phones, laptops, and other consumer electronics. The demand for lithium significantly increased as these devices became global.

Electric Vehicle (EV) Growth (2010s): Lithium’s role in energy storage accelerated with rise in electric vehicles. Companies like Tesla pushed for more efficient, high-capacity lithium-ion batteries, leading to surge in lithium demand. As EV adoption grew, the need for lithium metal increased, with a focus on improving battery performance and reducing costs.

Supply and Demand Imbalance (Mid-2010s - 2020s): As the demand for lithium surged, there were concerns about the supply chain, given that most lithium resources were concentrated in countries such as Australia, Chile, and China. This imbalance led to efforts to scale up mining operations and develop more sustainable extraction technologies.

Sustainability Focus (2020s): With growing environmental concerns, there has been an emphasis on sourcing lithium more sustainably. Companies have been exploring innovative extraction methods like direct lithium extraction (DLE) and recycling to reduce the environmental impact of mining.

Industry Trend

- The lithium metal market is witnessing rapid growth due to surge in demand for lithium-ion batteries, particularly for electric vehicles (EVs) and renewable energy storage. Governments worldwide are promoting EV adoption to reduce carbon emissions. In the U.S., the Inflation Reduction Act (2022) provides substantial incentives for battery manufacturing and EV production, boosting lithium metal demand. The U.S. Geological Survey reported that lithium production increased by 21% in 2023 to meet growing battery needs.

- In China, which leads the world in EV production, the government’s New Energy Vehicle (NEV) Plan aims for 20% of all vehicle sales to be electric by 2025. This has spurred investments in lithium mining and battery production, with the Ministry of Industry and Information Technology reporting a 30% rise in domestic lithium demand in 2023. China also controls much of the global lithium supply chain, thereby enhancing its role in the market.

- Additionally, the European Union’s Green Deal and push for carbon neutrality by 2050 have led to significant investments in renewable energy and battery storage solutions, further driving the demand for lithium metal.

Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lithium metal market analysis from 2022 to 2032 to identify the prevailing lithium metal market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lithium metal market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lithium metal market trends, key players, market segments, application areas, and lithium metal market growth strategies.

Lithium Metal Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 13.5 billion |

| Growth Rate | CAGR of 12.1% |

| Forecast period | 2022 - 2032 |

| Report Pages | 400 |

| By Application |

|

| By Source |

|

| By Region |

|

| Key Market Players | Albemarle Corporation., Ganfeng Lithium Co., Ltd., SQM S.A., Shenzhen Chengxin Lithium Group Co., Ltd., Tianqui Lithium Industries Inc., Piedmont Lithium, Allkem Limited, Mineral Resources Limited, A123 Systems LLC, Livent |

Analyst Review

The global lithium metal market is expected to exhibit high growth potential, owing to its use in the batteries, portable electronics, industrial, aerospace, and others. CXOs may recognize the increasing demand for lithium metal as the world transitions to clean energy and electric mobility. Lithium-ion batteries, which heavily rely on lithium metal, are vital components in electric vehicles, renewable energy storage systems, and various electronic devices.

CXOs may view lithium metal as a strategic resource to support the energy transition as governments and industries shift toward renewable energy sources and reduce carbon emissions. Lithium-ion batteries enable the storage and efficient use of renewable energy, making lithium metal a critical element in the decarbonization of various sectors.

Furthermore, CXOs may closely monitor the stability and resilience of the lithium metal supply chain, given that a significant portion of the world's lithium metal production comes from a few countries like Australia, Chile, and China. Ensuring a diversified and secure supply chain is essential to mitigate potential risks and disruptions.

In addition, the lithium metal industry continually evolves with technological advancements and innovations. CXOs may be interested in staying informed about research and development efforts that could improve lithium metal extraction, battery performance, and explore new applications for lithium metal; thus, boosting the market growth.

Escalating demand from electric vehicle (EV) industry, robust demand from portable electronics sector, and advancements in energy storage solutions are the upcoming trends of the lithium metal market in the world.

Batteries is the leading application of the lithium metal market.

Asia-Pacific is the largest regional market for lithium metal.

The lithium metal market was valued at $4.3 billion in 2022 and is estimated to reach $13.5 billion by 2032, exhibiting a CAGR of 12.1% from 2023 to 2032

A123 Systems LLC, Albemarle Corporation., Allkem Limited, Ganfeng Lithium Co., Ltd., Livent, Mineral Resources Limited, Piedmont Lithium, Shenzhen Chengxin Lithium Group Co., Ltd., SQM S.A., Tianqui Lithium Industries Inc are the top companies to hold the market share in the lithium metal market.

Loading Table Of Content...

Loading Research Methodology...