Lithotripsy Devices Market Research, 2033

The global lithotripsy devices market size was valued at $1.3 billion in 2023, and is projected to reach $2.2 billion by 2033, growing at a CAGR of 5.4% from 2024 to 2033. The growth of the lithotripsy devices market is driven by rising prevalence of kidney stones, an increasing geriatric population, and advancements in technology that enhance treatment efficacy. Additionally, the trend towards minimally invasive procedures is gaining traction, as patients prefer options that offer quicker recovery times. Increased healthcare expenditure and growing awareness of kidney stone management further contribute to the lithotripsy devices market growth.

Market Introduction and Definition

Lithotripsy devices are medical instruments used to treat renal calculi by breaking them into smaller fragments, facilitating easier passage through the urinary tract. The most common type, extracorporeal shock wave lithotripsy (ESWL) , employs shock waves generated outside the body to target and disintegrate stones. These devices consist of a shockwave generator, focusing system, coupling mechanism, and imaging unit for stone localization. Advancements in technology have led to improved efficacy and reduced complications, making lithotripsy a preferred treatment option for patients with renal calculi.

Key Takeaways

- The lithotripsy devices market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major lithotripsy devices industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

According to lithotripsy devices market forecast analysis the key factors driving the growth of the market are rising prevalence of kidney stones and urinary tract disorders, growing adoption of minimally invasive procedures, and technological advancement in the lithotripsy devices. The rising prevalence of kidney stones is a crucial driver for the lithotripsy devices market. According to 2023 article by National Library of Medicine, kidney stones (KS) are a common urological disease entailing the formation and occasional passage of crystal agglomerates in the urinary tract. Factors such as changing dietary patterns, characterized by high sodium, sugar, and oxalate consumption, contribute significantly to the formation of kidney stones. Additionally, the increasing rates of obesity and sedentary lifestyles further heighten the risk, as these conditions are often linked to metabolic changes that promote stone development. Furthermore, the growing prevalence of chronic conditions like diabetes and hypertension, which can lead to an increased likelihood of kidney stones, adds to the urgency for effective medical interventions. Thus, the growing prevalence of kidney stones is expected to drive the lithotripsy devices market growth.

According to lithotripsy devices market opportunity analysis growing adoption of minimally invasive procedures is a significant driver for the lithotripsy devices market, as both patients and healthcare providers increasingly favor these techniques over traditional surgical options. Minimally invasive approaches, such as lithotripsy, offer numerous advantages, including reduced pain, shorter recovery times, and lower complication rates, which appeal to patients seeking effective yet less traumatic treatments for kidney stones. As healthcare technology advances, lithotripsy devices have become more sophisticated, enabling precise targeting and effective fragmentation of stones while minimizing damage to surrounding tissues.

Technological advancements in lithotripsy devices are a major driver of growth in the lithotripsy devices market size, significantly enhancing treatment efficacy and patient outcomes. Innovations such as improved shock wave generation, enhanced imaging techniques, and more precise targeting mechanisms have revolutionized the way kidney stones are treated.

In March 2022, Shockwave Medical, Inc. globally launched its new peripheral intravascular lithotripsy (IVL) catheter, Shockwave M5+ peripheral IVL catheter after receiving both CE Mark and USFDA clearance. The device is specifically designed to reduce the time of IVL treatment, offer alternative access options, and expand access for the IVL therapy to patients with larger vessel sizes. As manufacturers continue to innovate and refine their technologies, the lithotripsy devices market is poised for sustained growth.

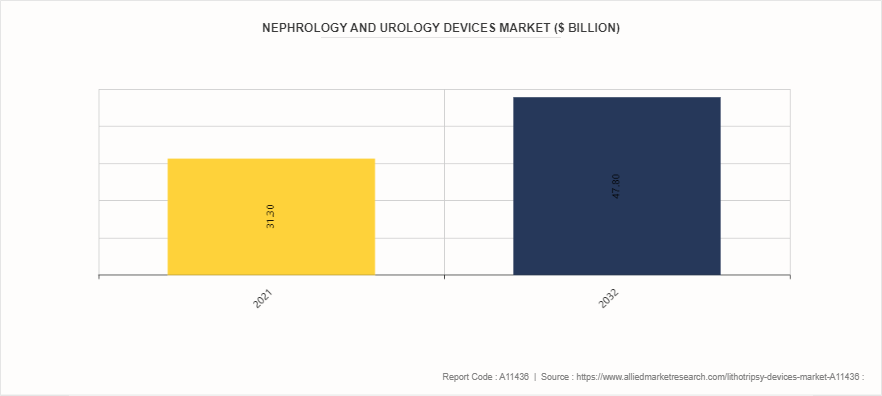

Parent Market Overview: Nephrology & Urology Devices Market

The nephrology and urology devices market encompasses a wide range of devices used in the diagnosis, treatment, and management of kidney and urinary tract disorders. This market is driven by factors such as the increasing prevalence of chronic kidney diseases, rising demand for minimally invasive procedures, technological advancements, and growing healthcare expenditure globally. Key segments within the nephrology and urology devices market include dialysis equipment, lithotripsy devices, urinary catheters, and endoscopy devices. These devices play critical roles in addressing various urological and nephrological conditions, ranging from kidney stones and urinary incontinence to renal failure and urinary tract infections.

Market Segmentation

The lithotripsy devices industry is segmented on the basis of type, application, end user, and region. By type, the market is classified into extracorporeal shock wave lithotripsy devices and intracorporeal lithotripsy devices. By application, the market is classified into kidney stones, ureteral stones, pancreatic stones, and bile duct stones. By end user, the market is divided into hospitals, ambulatory surgical centers, and other. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the lithotripsy devices market share in 2023. This is attributed to well-established healthcare facilities, growing prevalence of kidney stone, and high healthcare spending in North America. However, Asia-Pacific region is expected to register highest CAGR. The region is experiencing a rising incidence of kidney disorders due to lifestyle changes, urbanization, and an aging population. This trend is leading to a greater demand for minimally invasive procedures, thereby driving the need for lithotripsy devices. Countries, like India and Thailand, are becoming popular destinations for medical tourism. The influx of international patients seeking advanced medical care is boosting the demand for lithotripsy devices in Asia-Pacific.

- According to the data published by the Centers for Disease Control and Prevention, in July 2022, in the U.S. around 37 million people, or 15% of the adult population, were estimated to have chronic kidney diseases.

- According to Government of India, medical tourism in India has increased by 65.79%.

- According to European Commission, as of January 1, 2023, around 21.3% of the European population was aged 65 years and over

Industry Trends

- According to 2024 report by American Kidney Fund, over 1 in 10 men and about 1 in 14 women in the United States will have kidney stones at least once in their lives.

- In November 2022, Adventist Health Hanford invested over USD 250, 000 into the new laser technology for the treatment of kidney stones. Under the investment, the hospital purchased Lumenis Pulse 120H Holmium Laser System with MOSES Technology which is capable to offer faster procedures by saving 20% of the time, less use of anesthesia, faster recovery times, and ease of treating outpatients without a hospital stay.

- According to 2023 article by National Library of Medicine, the success rate of extracorporeal shockwave lithotripsy was 81.5%.

- According to 2023 article by National Library of Medicine, extracorporeal shockwave lithotripsy is effective in treating patients with urinary calculi with a simple, safe, and quick operation and a low incidence of adverse events, as it effectively reduces the incidence of complications, accelerates the recovery of patients and improves their quality of life.

- According to a 2023 article by National Library of Medicine, in the general population, the overall prevalence of gallstones is estimated to be between 10% and 15%.

- In July 2022, Calyxo, Inc., a medical device company focused on improving care for patients with kidney stones by delivering next generation treatment solutions, announced the closing of a $32.7 million Series C financing round led by Questa Capital and CRG.

Competitive Landscape

Lithotripsy devices market report summarizes top key players overview as EDAP TMS, DirexGroup, Becton, Dickinson, and Company, Olympus Corporation, Cook Medical LLC, Dornier MedTech, Storz Medical AG, Boston Scientific Corporation, Novamedtek, and Elmed Medical Systems. Other players in the lithotripsy devices market are Karl Storz SE & Co. KG, and Siemens Healthineers AG.

Recent Key Strategies and Developments

- In March 2022, Shockwave Medical, Inc. globally launched its new peripheral intravascular lithotripsy (IVL) catheter, Shockwave M5+ peripheral IVL catheter after receiving both CE Mark and USFDA clearance. The device is specifically designed to reduce the time of IVL treatment, offer alternative access options, and expand access for the IVL therapy to patients with larger vessel sizes.

- In November 2021, Shockwave Medical Inc. provided the safety and effectiveness of coronary Intravascular Lithotripsy (IVL) for the treatment of Intravascular Lithotripsy (IVL) .

- In September 2022, Advanced MedTech Holdings, acquired the WIKKON, Chinese company of urology and shock wave therapy devices. The acquisition would strengthen the extracorporeal shock wave lithotripsy portfolio of Advanced MedTech Holdings with the WIKKON advanced portfolio of urological solutions.

- In June 2021, STORZ MEDICAL received the FDA 510 (k) clearance for its MODULITH SLX-F2 extracorporeal shock wave lithotripter for the new indications. With the FDA 510 (k) clearance the extracorporeal shock wave lithotripter would be able to offer non-invasive treatment of kidney stone

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lithotripsy devices market analysis from 2024 to 2033 to identify the prevailing lithotripsy devices market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lithotripsy devices market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lithotripsy devices market trends, key players, market segments, application areas, and market growth strategies.

Lithotripsy Devices Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.2 Billion |

| Growth Rate | CAGR of 5.4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Type |

|

| By Application |

|

| By End Users |

|

| By Region |

|

| Key Market Players | Cook Medical LLC, Dornier MedTech, Boston Scientific Corporation, DirexGroup, Storz Medical AG, Olympus Corporation, Becton, Dickinson, and Company, Elmed Medical Systems, EDAP TMS, Novamedtek |

The total market value of Lithotripsy Devices market is $1.3 billion in 2023

The forecast period for Lithotripsy Devices market is 2024-2033.

The market value of Lithotripsy Devices market in 2033 is projected to reach $2.2 billion by 2033

The Lithotripsy Devices market growth is driven by rising prevalence of kidney stones and urinary tract disorders, growing adoption of minimally invasive procedures, and technological advancement in the lithotripsy devices

The base year is 2023 in Lithotripsy Devices market

Loading Table Of Content...