Lymphoma Therapeutics Market Research, 2032

The lymphoma therapeutics market size was valued at $15,691.45 million in 2022 and is projected to reach $35,207.45 million by 2032, registering a CAGR of 8.4% from 2023 to 2032. Lymphoma therapeutics refers to various medical treatments and interventions aimed at treating lymphoma, a type of cancer that affects the lymphatic system, which is a part of the body's immune system. The major goal of lymphoma therapeutics is to eliminate cancerous cells, prevent the spread of the disease, and improve a patient's quality of life. There are several treatment options available for lymphoma, including chemotherapy, radiation therapy, targeted therapy, immunotherapy, and stem cell transplantation. The choice of treatment depends on the type and stage of lymphoma as well as other factors such as a patient's overall health and medical history. The aim of lymphoma therapeutics is to achieve long-term remission and increase the chances of survival for patients with lymphoma.

Market dynamics

The key factor that drives the growth of the lymphoma treatment market is a significant rise in the prevalence rate of lymphoma and an increase in R&D activities on several potential drug molecules that target cancerous lymphatic cells. For instance, according to the report published by the American Society of Clinical Oncology (ASCO), an estimated 8,830 people (4,850 men and 3,980 women) in the U.S. will be diagnosed with Hodgkin lymphoma in 2023. In addition, globally, an estimated 83,087 people were diagnosed with Hodgkin lymphoma in 2020. It is estimated that 900 deaths (540 men and 360 women) from this disease will occur in the U.S. in 2023. In 2020, an estimated 23,376 people globally died from Hodgkin lymphoma. Hodgkin lymphoma affects both children and adults.

A rise in the number of clinical trials for the treatment of lymphoma is expected to drive the lymphoma treatment market. For instance, according to the GlobalData report in March 2023, Larotrectinib sulfate by Bayer AG is under clinical development and is currently in phase II for non-Hodgkin lymphoma. The Phase II drugs for non-Hodgkin lymphoma have a 40% phase transition success rate (PTSR) indication benchmark for progressing into Phase III.

Furthermore, an increase in R&D activities among key players for the development of lymphoma therapeutics with fewer side effects is the major factor that is anticipated to foster the growth of the lymphoma treatment market. However, stringent regulatory compliance for the approval of lymphoma therapeutics and potential side effects of lymphoma therapeutics such as fatigue, nausea, and hair loss hamper the growth of the lymphoma treatment market size. Conversely, the rise in the geriatric population and increase in awareness about lymphoma and its treatment options among the public in emerging economies such as India, China, Mexico, and Brazil are anticipated to create new opportunities during the forecast period.

Segmental Overview

The lymphoma therapeutics market share is segmented into disease type, treatment type, route of administration, distribution channel, and region. By disease type, the market is bifurcated into Hodgkin lymphoma and non-Hodgkin lymphoma. On the basis of treatment type, it is divided into immune therapy, chemotherapy, targeted therapy, and radiation therapy. Depending on the route of administration, it is categorized into the oral route and injectables. By distribution channel, it is classified into hospital pharmacies, retail pharmacies, and online pharmacies. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

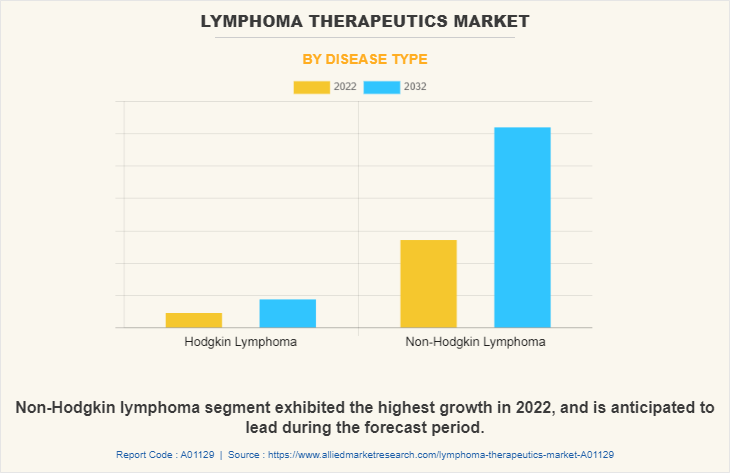

By disease type

The lymphoma treatment market share is segmented into Hodgkin lymphoma and non-Hodgkin lymphoma. In 2022, the non-Hodgkin lymphoma segment accounted for the largest share of the market and is projected to exhibit the fastest market growth during the forecast period, owing to the rise in prevalence of non-Hodgkin lymphoma and surge in the development of new and more effective drugs by key market players to treat non-Hodgkin lymphoma.

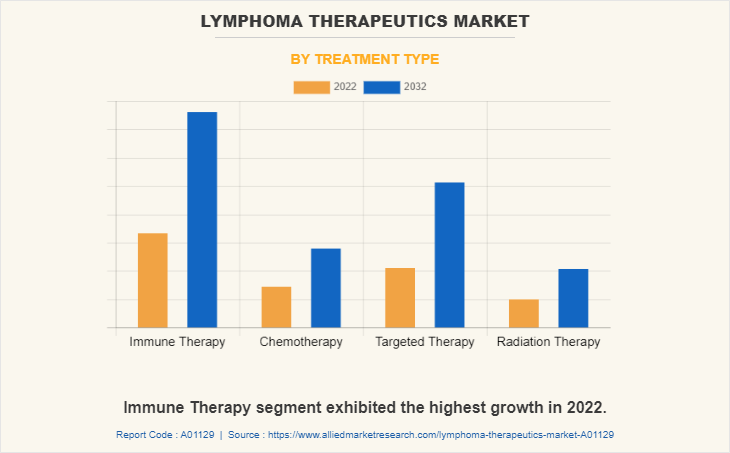

By treatment type

The lymphoma therapeutics market growth is categorized into immune therapy, chemotherapy, targeted therapy, and radiation therapy. The immune therapy segment was the major shareholder in 2022 and is anticipated to continue the same trend in the coming future, owing to advancements in immunology, an increase in the availability of immune therapies, and a rise in the number of product approvals across the world

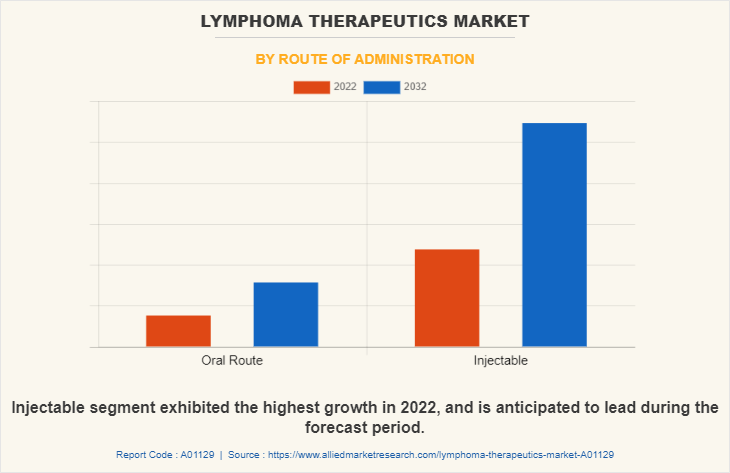

By route of administration

The lymphoma therapeutics market is bifurcated into oral routes and injectables. In 2022, the injectable segment garnered the maximum share of the market and is projected to dominate during the forecast period, owing to a rise in investment in R&D activities by pharmaceutical companies for the development of technologically advanced injectable dosage forms for lymphoma.

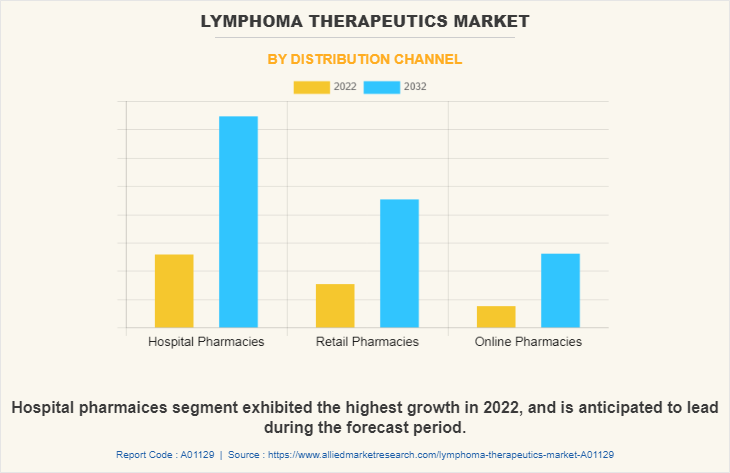

By distribution channel

The lymphoma therapeutics market is segregated into hospital pharmacies, retail pharmacies, and online pharmacies, the hospital pharmacies segment exhibited the highest growth in 2022 and is anticipated to lead during the forecast period, owing to the fact that lymphoma therapeutics are mostly dispensed in hospital pharmacies for hospitalized patients. In addition, the rise in the consumption of lymphoma therapeutics in hospitals acts as the key driver of the segment.

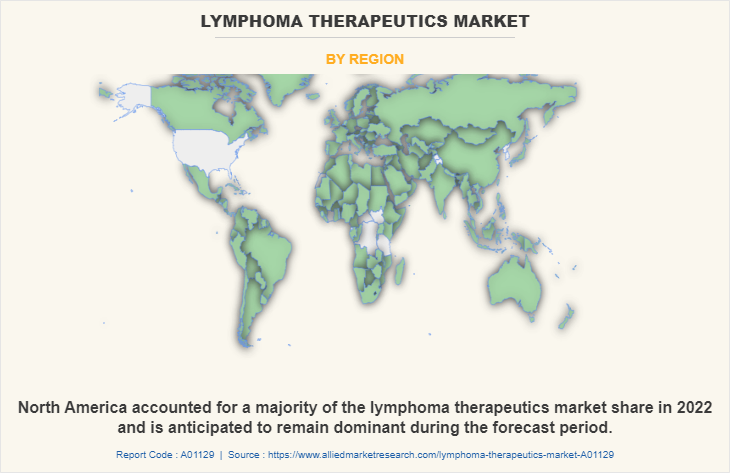

By region

The lymphoma therapeutics market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the majority of the share in 2022 and is anticipated to remain dominant during the forecast period owing to rise in the prevalence of lymphoma, development in lymphoma therapeutics, including targeted therapies and immunotherapies and a surge in a number of new product launches by key market players in this region. For instance, in January 2023, the U.S. FDA approved Jaypirca (pirtobrutinib), the first and only non-covalent (reversible) Bruton's tyrosine kinase (BTK) BTK inhibitor, for adult patients with relapsed or refractory mantle cell lymphoma after at least two lines of systemic therapy, including a (BTK) inhibitor.

Asia-Pacific is expected to witness growth at the highest rate during the lymphoma therapeutics market forecast. Owing to rise in prevalence of lymphoma and increase in initiatives in R&D activities for the development of advanced therapies for the treatment of lymphomas. Furthermore, rise in awareness of available treatment options for lymphoma and surge in the geriatric population in developing countries such as India, China, Japan, and South Korea contribute to the growth of the market.

Competition Analysis

The report provides competitive analysis and profiles of the major players in the lymphoma therapeutics industry, such as AstraZeneca Plc., Bayer AG, Bristol Myers Squibb Co., Eli Lily and Company, F Hoffman La Roche Ltd., Johnson & Johnson, Gilead Sciences, Inc., Seagen Inc., Teva Pharmaceutical Industries Ltd., and Pfizer Inc.

Recent product approval in lymphoma treatment industry

- In March 2023, National Medical Products Administration (NMPA) approved AstraZeneca’s Calquence in China for the treatment of adult patients with mantle cell lymphoma (MCL).

- In January 2023, the U.S. Food and Drug Administration (FDA) approved Eli Lilly's Jaypirca a covalent Bruton Tyrosine Kinase (BTK) inhibitor for the treatment of patients with refractory mantle cell lymphoma (MCL).

- In December 2022, the U.S. FDA approved Roche's Lunsumio. Lunsumio is used for the treatment of adult patients with relapsed follicular lymphoma.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the lymphoma therapeutics market analysis from 2022 to 2032 to identify the prevailing lymphoma therapeutics market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the lymphoma therapeutics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global lymphoma therapeutics market trends, key players, market segments, application areas, and market growth strategies.

Lymphoma Therapeutics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 35.2 billion |

| Growth Rate | CAGR of 8.4% |

| Forecast period | 2022 - 2032 |

| Report Pages | 481 |

| By Disease Type |

|

| By Treatment Type |

|

| By Route of Administration |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Bayer AG, AstraZeneca, Johnson & Johnson, F. Hoffmann-La Roche Ltd., Pfizer Inc., Gilead Sciences, Inc., Teva Pharmaceutical Industries Ltd., Seagen Inc., Bristol-Myers Squibb Company, Eli Lilly and Company |

Analyst Review

According to the insights of CXOs, the lymphoma therapeutics market is expected to witness significant growth in the future, owing to increase in prevalence of all forms of cancers, surge in demand for advanced products for the treatment of lymphoma, and increase in R&D activities by key market players.

The lymphoma therapeutics market is expected to witness steady growth in the future due to increase in prevalence of lymphoma and technological advancements for the development of lymphoma therapeutics. In addition, surge in investments in R&D activities by pharmaceutical companies and increase in healthcare expenditure in the developed countries such as the U.S. and Canada boost the growth of the market. However, stringent regulatory compliance for the approval of lymphoma therapeutics; high cost of available treatments; and potential side effects of lymphoma therapeutics such as fatigue, nausea, and hair loss hamper the growth of the market.

North America is expected to dominate the lymphoma therapeutics market during the forecast period, followed by Europe. In addition, emerging economies such as India, China, Mexico, and Brazil are expected to offer lucrative opportunities owing to surge in geriatric population and rise in prevalence of lymphoma.

Lymphoma therapeutics refers to various medical treatments and interventions aimed at treating lymphoma, a type of cancer that affects the lymphatic system, which is a part of the body's immune system. The goal of lymphoma therapeutics is to eliminate cancerous cells, prevent the spread of the disease, and improve a patient's quality of life.

The total market value of the lymphoma therapeutics market is $15691.45 million in 2022.

The forecast period for lymphoma therapeutics market is 2023 to 2032

Increase in the prevalence of lymphoma, increase in number of clinical trials and surge in number of drugs in pipeline.

The factors that restrain the growth of the market is high cost of available treatment.

Non-Hodgkin Lymphoma segment dominated the global market in 2022, and expected to continue this trend throughout the forecast period. The dominance of this segment can be attributed to rise in prevalence of non-Hodgkin lymphoma and surge in development of new and more effective drugs by key market players to treat non-Hodgkin lymphoma (NHL).

Top companies such as AstraZeneca Plc, Bayer AG, Bristol Myers Squibb Co., Eli Lily and Company, F Hoffman La Roche Ltd, Johnson & Johnson held a high market position in 2021.

Yes, the competitive landscape is included in the lymphoma therapeutics market report.

Loading Table Of Content...

Loading Research Methodology...