Malt Ingredient Market Research, 2031

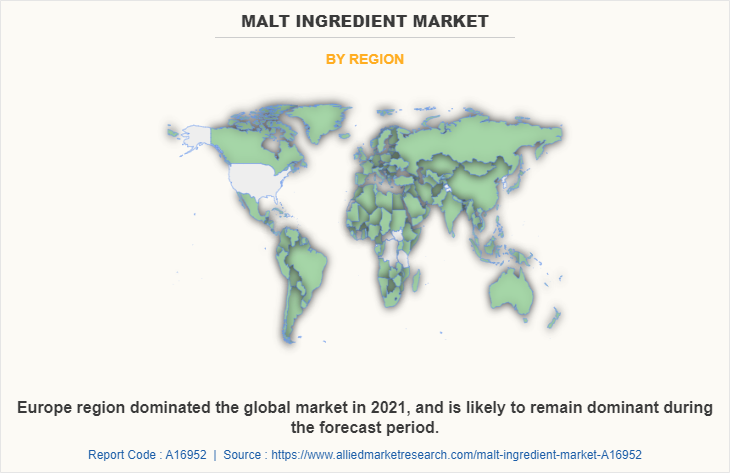

The global malt ingredient market was valued at $20.4 billion in 2021, and is projected to reach $29.4 billion by 2031, growing at a CAGR of 3.9% from 2022 to 2031. Europe was the highest revenue contributor, accounting for $8,604.7 million in 2021, and is estimated to reach $11,087.0 million by 2031, with a CAGR of 2.7%. Malt is a broad category of processed cereals that comes in a variety of market-specific varieties, including malt for brewers and beers (which includes both standard and specialty malts), malt for distilling, and malt for culinary uses. Wheat, rye, sorghum, and barley cereals work particularly well for this method. The latter is currently the grain that gets malted the most frequently. 90% of the 22 million tonnes of malt produced in 2015 came from barley. 108 million tonnes of the 144 million tonnes of barley produced worldwide in 2017 were used for malting. Barley is a short-season crop, which means one can have a few harvests per year, and it is very adaptable to soil and climate, which are the key factors in its appeal among maltsters.

Malting is about the controlled germination of barley grains. It is a natural, biological process that is undertaken using controlled conditions (temperature, humidity, and air). The aim of malting is to begin the conversion of starch into glucose, which can then be fermented into alcohol in the brewing process.

Malt is made from malting grade cereals, usually, barley or wheat, although occasionally other cereals such as rye or oats may be used. The grain is steeped in water and then allowed to germinate under carefully controlled conditions. When the changes inside the grain are sufficient for the maltsters' requirements, heat is applied in the final stage of the malting process, using a specially designed kiln. The result, malt, has a moisture content of below 6.5%. The production of 1 tonne of malt requires, on average, 1.27t of barley, 1.18 Mwh of energy, and 5 cubic meters of water.

Despite the numerous advantages, it is crucial to remember that malt is still regarded as an added sugar, which can be dangerous if ingested in large quantities. In addition, little is known about how it might affect blood sugar levels. But the primary sugar in malt syrup, maltose, is converted to glucose in the body, and some studies indicate that malt may have a similar impact on blood sugar levels to ordinary sugar.

Malt may be a useful substitute for ordinary table sugar in some recipes since it contains various essential nutrients, such as vitamins, minerals, and amino acids. However, people who have diabetes might want, to think about substituting stevia or other all-natural sweeteners into their favorite meals and sweets to help with blood sugar control.

Beer is the most popular alcoholic beverage consumed globally, and consumption climbs by more than 1% per year. Malt barley is one of the primary ingredients of the carbonated beverage, along with hops. The majority of malt products are used to make beer; in fact, American brewers consumed 40% of local malt production last year.

Malted drinks are positioned as nutritious beverages in the market. They are often marketed as containing various nutrients, such as carbohydrates, proteins, fats, vitamins A, B, C, and E, calcium, iron, phosphorus, and potassium. Nonetheless, there is a lack of published literature on malted drink consumption. A study from Singapore indicated that more than 50 % of children aged 7 to 10 years consumed malted drinks during weekdays and weekends. A recent study from Malaysia demonstrated that combined circuit training with chocolate malt drink supplementation had a significant effect on reducing a bone resorption marker, which imposed a positive effect on bone health.

However, malt has numerous side effects as well. Malt may uncommonly induce symptoms of food allergy in sensitized individuals, including Baker's asthma, urticaria, facial itching, Quincke edema, systemic symptoms, and anaphylaxis. Symptoms usually occurred after the consumption of Malt-containing chocolate drinks and Malt-containing snack products.

After consuming beer and a snack made of maize, a 21-year-old atopic lady experienced wheezy dyspnea, urticaria, and facial edoema. Skin-specific IgE was found, and beer, barley, malt, wheat, maize, rye, rice, and oat flour all produced positive specific IgE results. This patient experienced type I hypersensitivity to corn and barley/malt. She also exhibited IgE reactivity to wheat and other grains, but neither of these foods produced any symptoms when she ate them, suggesting that she may have latent sensitization to them. Three customers also reported experiencing urticaria as a result of drinking beer.

As per the sources, global sales of clean-label food products are expected to be valued at US$177 billion by 2021. Clean-label trend has been gaining importance in some of the main sectors of the food and beverages industry. The clean label refers to food or beverage products being free from artificial flavors, colors, and preservatives. But now the category has evolved. Consumers seek to know the origin of the ingredients in the food and beverage products that they consume on daily basis. Hence food manufacturers and brewers strategize on replacing artificial or synthetic ingredients with natural or organic ingredients. Naturally derived specialty malt as an ingredient plays a key role in the processing of various food products including alcoholic beverages. Thus, the rising trend of clean-label paves way for the global Malt Ingredient Market to grow significantly in terms of value sales over the Malt Ingredient Market Forecast period.

Over the past few years, the majority of the young population is engaging in self-employment and is moving out of their houses to work. With their own earned money, the young population is leaning towards spending the income on food & beverages. Moreover, as millennials tend to try new drinks always and explore various countries, their demand for local beers from small countries is also increasing. In addition, with a number of millennials involved in tourism and showing interest in traveling, demand for beers in the travel retail segment is also increasing. Such factors are expected to boost the market for beers during the forecast time period and is likely to foster the Malt Ingredient Market Demand in the process.

Lager is one of the most common types of beer in the world. The bottom-fermented techniques used to brew it result in a crisp, refreshing beer. Lager beer manufacturers include some of U.S's famous beers, including Budweiser, Busch Lite, Coors, Miller Genuine Draft, and PBR, the brand line also include the great Bavarian pilsners, as well as bocks, dunkels, and Oktoberfest. With lager beers available globally and in a variety of types, its demand is high in the market. Although with new beer types the attraction of other beer types is more, Lager beer constitutes a larger market share in the beer market and is expected to remain its dominance during the forecast time period.

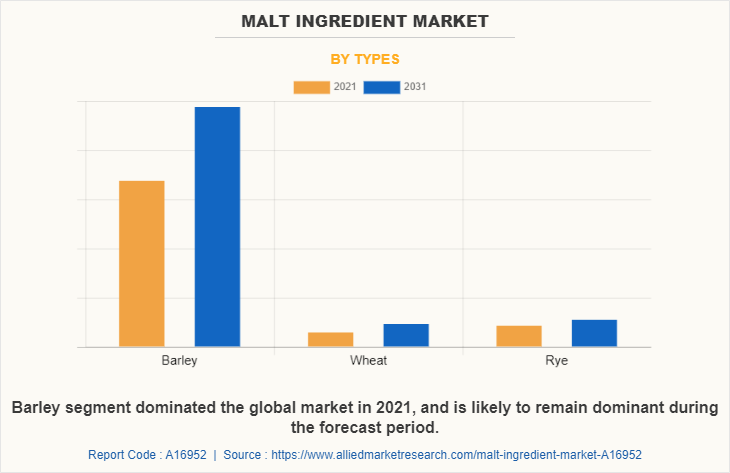

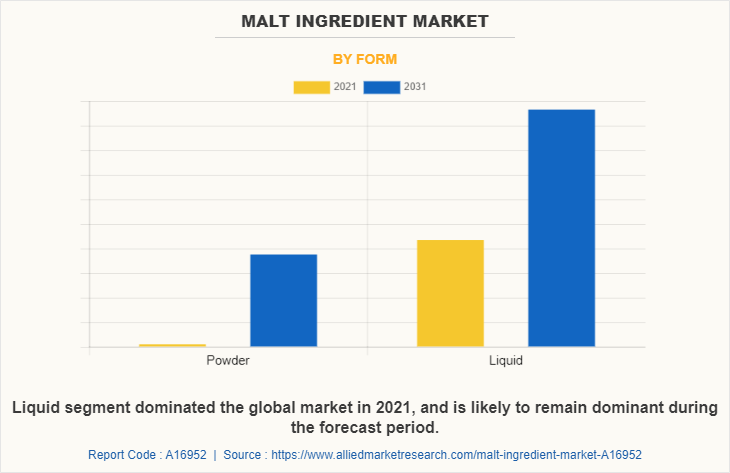

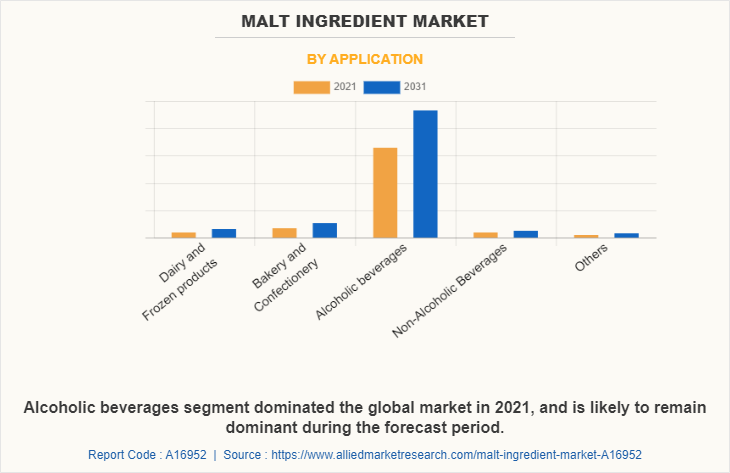

The global malt ingredients market is segmented on the basis of form, type, application and region. On the basis of form, the Malt Ingredient Industry is bifurcated into powder and liquid. On the basis of type the market is classified into barley, wheat and rye. On the basis of application, the market is categorized into dairy and frozen products, bakery and confectionery, alcoholic beverages, non-alcoholic beverages and others. On the basis of region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of type, the barley segment dominated the global Malt Ingredient Industry in 2021. Barley is the most preferred source being used for specialty malt processing. As of 2017, the global barley production accounted to 142.37 million metric tons. Out of which 108 million tons of barley was being used for malt processing. Malting barley is varietal and tastes different depending upon its strain and where it is grown. Barley oriented specialty malt has been gaining higher traction in the craft brewery industry due to its characteristic flavor. Thus, due to some of the key characteristic features possessed by barley coupled with stronghold distribution channel, barley source accounts to higher value share in the global malt ingredients market.

On the basis of form, the liquid segment dominated the global market in 2021. Liquid malt form also known as malt syrup is formed from malted barley after cooking it for a certain period. It is an essential ingredient used in making ales and lagers as it gives those beverages taste, color, and body. Liquid malt is available in a variety of colors ranging from light amber to dark amber. Liquid malt comes packed in containers and is intended to be fully utilized once the containers are open. The liquid malt segment is driven by increase in consumption of beer worldwide, which is supplemented by rise in cross cultural interaction among people and increase in disposable income of people worldwide.

On the basis of application, the alcoholic beverages segment had the dominating Malt Ingredient Market Size in 2021. Beer and flavored malt beverages are the most popular malt based alcoholic beverage. Flavored malt beverage is made by stripping all the malt characteristics of the malt base. Malt base is often considered the most cost-effective base used in making alcohol but has a strong flavor which is difficult to mask. The alcoholic beverages segment in the malt ingredients market is expected to garner substantial growth rate owing to increase in demand for alcoholic beverages across the globe. In addition, benefits such as low cost of malt base further adds to its market attractiveness.

On the basis of region, North America had the dominating Malt Ingredient Market Size in the year 2021. U.S. was the most prominent Malt Ingredient Market in the region with the maximum Malt Ingredient Market Share and a notable CAGR of 4.1%. North America is a mature Malt Ingredient Market with high adoption of malt-based products. According to Beer Institute annual report The U.S. beer industry sells more than $119.3 billion in beer and malt-based beverages to U.S. consumers each year. Based on beer shipment data and U.S. Census population statistics, U.S. consumers 21 years and older consumed 26.5 gallons of beer and cider per person during 2018 The market for malt ingredient is driven by rising demand for flavored drinks and alcohol as well as growing adoption of malt-based food and beverages.

The players operating in the global Malt Ingredient Market have adopted various developmental strategies to increase their market share, gain profitability, and remain competitive in the Malt Ingredient Market. The key players operating in the isolate whey protein market include – Axereal, Barmalt, Briess Malt & Ingredients, Cargill, Inc., CereX BV, Crisp Malting, GrainCorp Limited, Groupe Soufflet, Holland Malt, Imperial Malt Limited, Malteurop, Maltexco S.A., Maltproducts, Muntons plc, Puremalt, Rahr Corporation and Simpsons Malt Limited.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the malt ingredient market analysis from 2021 to 2031 to identify the prevailing Malt Ingredient Market Opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the malt ingredient market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global malt ingredient market trends, key players, market segments, application areas, and Malt Ingredient Market Growth strategies.

Malt Ingredient Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 29.4 billion |

| Growth Rate | CAGR of 3.9% |

| Forecast period | 2021 - 2031 |

| Report Pages | 214 |

| By Types |

|

| By Form |

|

| By Application |

|

| By Region |

|

| Key Market Players | Imperial Malt Limited, puremalt products ltd., Maltexco S.A., muntons plc, crisp malting group, briess malt & ingredients co., simpsons malt limited, Maltproducts, holland malt, GrainCorp Limited, axereal, malteurop, Cargill, Inc., groupe soufflet, barmalt malting (india) pvt. ltd., Rahr Corporation, CereX BV |

Analyst Review

According to the insights of the CXOs of leading companies, some of the key functional properties possessed by specialty malt, is one of the key factors in driving the demand for the product. With the rise in health and wellness trend among the consumers, some of the key food and beverages manufacturers have been strategizing on replacing artificial or synthetic ingredients with natural ingredients for processing. This trend has paved the way for the growth of the global malt ingredients market in terms of value sales.

Over the past couple years, there has been a surge in demand for organic food products specifically in North America and European regions. Therefore, manufacturers have been strategizing on coming with organic formats of their product that caters to target customers’ requirements. For instance, Briess Malt & Ingredients, one of the key players in the malt market, has been availing its products in organic formats such as organic Carapils malt, organic caramel malt, organic roasted barley, and others.

The rise in rate of internet penetration around major parts of the world makes way for manufacturers to initiate several key online marketing programs as online platforms are one of the easiest ways to create awareness about the benefits of using malt among its target customers.

The global malt ingredient market was valued at $20,438.6 million in 2021, and is projected to reach $29,408.6 million by 2031, registering a CAGR of 3.9%.

From 2022-2031 would be forecast period in the market report

$20.4 billion is the market value of malt ingredient market in 2021.

2021 is base year calculated in the malt ingredient market report

Axereal, Barmalt, Briess Malt & Ingredients, Cargill, Inc., CereX BV, Crisp Malting, GrainCorp Limited, Groupe Soufflet, Holland Malt, and Imperial Malt Limited are the top companies hold the market share in malt ingredient market.

Loading Table Of Content...