Medical Biomimetics Market Research, 2031

The global medical biomimetics market size was valued at $35.4 billion in 2021 and is projected to reach $68.9 billion by 2031, growing at a CAGR of 7.2% from 2022 to 2031. Biomimetics is an innovative design concept that draws inspiration from nature and its elements and processes, to solve complex human problems. Medical biomimetics is a type of medical product that is developed from the inspiration of nature and its elements. Medical biomimetics is used to solve problems related to cardiac diseases, ophthalmic diseases, orthopedic diseases, and dental diseases. Medical biomimetics is used in the delivery of drugs, and the regeneration of tissue.

The medical biomimetics market size has witnessed growth owing to a rise in the incidence of heart disease, and dental disease. For instance, according to the National Center for Health Statistics 2022, every 20 seconds, one American suffers a heart attack, thus, more than 1 million Americans have a heart attack each year. In addition, the rise in accidents that further cause wounds increase the demand for wound-healing biomimetics products. For instance, according to the data from World Health Organization (WHO), in June 2022, road traffic injury was the leading cause of death among children and young adults aged 5-29 years. Approximately 1.3 million people die each year and 20 to 50 million are injured or disabled as a result of road traffic crashes.

Furthermore, dental biomimetic is used in dental bone grafts and adds volume and density to the jaw in areas where bone loss has occurred. Dental biomimetic is used to replace a missing tooth, and to rebuild the jaw before getting dentures. Therefore, the rise in the prevalence of dental diseases such as dental caries, and periodontal diseases including gingivitis, and periodontitis propels the demand for medical biomimetics. For instance, the National Institute of Dental and Craniofacial Research in 2020, stated that dental caries (tooth decay) remains the most prevalent chronic disease in both children and adults.

In addition, the rise in the trend of biomimetics products, increase in awareness regarding biomimetics product in developing country, increase in the number of clinical trials of biomimetics product, and a rise in the discovery & development of effective medical biomimetics product drives the growth of the medical biomimetics market. For instance, in July 2020, CorNeat KPro, the first synthetic cornea that bio-integrated with the eye wall, received approval to begin a clinical trial at Beilinson Hospital, Israel. The CorNeat KPro implant is designed to replace deformed, scarred, or opacified corneas and is expected to fully rehabilitate the vision of corneally blind patients immediately following implantation. The device's lens, which provides optical quality equivalent to a perfect cornea, integrates with resident ocular tissue using a unique and patented synthetic non-degradable nano-fabric skirt placed under the conjunctiva.

Market dynamics

The medical biomimetics market share has witnessed growth owing to a rise in the incidence of heart disease, and dental disease. For instance, according to the National Center for Health Statistics 2022, every 20 seconds, one American suffers a heart attack, thus, more than 1 million Americans have a heart attack each year. In addition, the rise in accidents that further cause wounds increase the demand for wound-healing biomimetics products. For instance, according to the data from World Health Organization (WHO), in June 2022, road traffic injury was the leading cause of death among children and young adults aged 5-29 years. Approximately 1.3 million people die each year and 20 to 50 million are injured or disabled as a result of road traffic crashes.

Furthermore, dental biomimetic is used in dental bone grafts and adds volume and density to the jaw in areas where bone loss has occurred. Dental biomimetic is used to replace a missing tooth, and to rebuild the jaw before getting dentures. Therefore, the rise in the prevalence of dental diseases such as dental caries, and periodontal diseases including gingivitis, and periodontitis propels the demand for medical biomimetics. For instance, the National Institute of Dental and Craniofacial Research in 2020, stated that dental caries (tooth decay) remains the most prevalent chronic disease in both children and adults.

In addition, the rise in the trend of biomimetics products, increase in awareness regarding biomimetics product in a developing country, increase in the number of clinical trials of biomimetics product, and rise in the discovery & development of effective medical biomimetics product, drives the growth of the medical biomimetics market. For instance, in July 2020, CorNeat KPro, the first synthetic cornea that bio-integrated with the eye wall, received approval to begin a clinical trial at Beilinson Hospital, Israel. The CorNeat KPro implant is designed to replace deformed, scarred, or opacified corneas and is expected to fully rehabilitate the vision of corneally blind patients immediately following implantation. The device's lens, which provides optical quality equivalent to a perfect cornea, integrates with resident ocular tissue using a unique and patented synthetic non-degradable nano-fabric skirt placed under the conjunctiva.

COVID-19 and the associated restrictions and lockdowns affected overall sales of medical biomimetics products, owing to the cancellation of appointments with doctors, a huge number of medical colleges and hospitals across the globe were reconstructed to increase hospital capacity for patients diagnosed with COVID-19 and the shortage of supply chain. Therefore, the COVID-19 outbreak is anticipated to have a negative impact on the medical biomimetics market. In addition, operations of patients were postponed, and home care setting care was preferred. Nonessential surgical procedures took a potential backlog, owing to rapidly rising COVID-19 cases; only elective emergency surgeries were performed. There was a shortage of doctors and support staff, and this pandemic impacted all the necessary activities for the sales of medical biomimetics products. With the pandemic, researchers identify an alarming shortage of critical orthopedics devices. According to the review article “Effects of COVID-19 pandemic in the field of orthopedics” of National Library Medicine, published in 2020, performing orthopedics surgery has become a significant challenge with the non-availability of hospital staff and operation facilities during COVID-19. It has a significant effect on the manufacturing of orthopedic devices including orthopedic biomimetics prosthetics, tools, orthopedic biomedicine, and routine ongoing research and development. Furthermore, COVID-19 has forced various dentists to terminate their services and staff. For instance, on 25 March 2020, the Chief Dental Officer (CDO) advised that the provision of all non-urgent dental treatment was to be either deferred or stopped entirely. In March 2020, the American Dental Association (ADA) issued public guidance to postpone elective dental procedures.

However, with relaxation in lockdowns, the positive impacts of vaccinations, and a decline in COVID-19 cases, companies have re-started their processes to meet the demand for products. In countries such as Japan, and India, quarantine and the pandemic situation is improving and showing obvious signs of recovery. Various practitioners have started their service by implementing international and local guidance. Furthermore, the medical biomimetics market share witnessed an incline in the sales of medical biomimetics during the forecast period, owing to a rise in technological advancement in the biomimetic product, an increase in initiatives taken by the government to reduce the burden of disease, an increase in regulatory approval. For instance, in December 2021, Osteopore International Pte Ltd, a world-leading regenerative tissue implants company, received regulatory approval from Hong Kong’s Medical Device Control System (MDACS), for offering bone healing specialists a perfect staging ground in Greater China. In addition, the rise in the adoption of medical biomimetics products, and a significant rise in the geriatric population are expected to witness the growth of the medical biomimetics market during the forecast period. Thus, such trends are expected to bring stabilization in the market, and subsequently witness a growth rate during the forecast period.

Segmental Overview

The medical biomimetics market is segmented on the basis of disease type, application, and region. On the basis of disease type, the market is classified into cardiovascular, orthopedic, ophthalmology, dental, and others. On the basis of application, the market is classified into wound healing, tissue engineering, drug delivery, and others. Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and the rest of Europe), Asia-Pacific (China, Japan, Australia, India, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

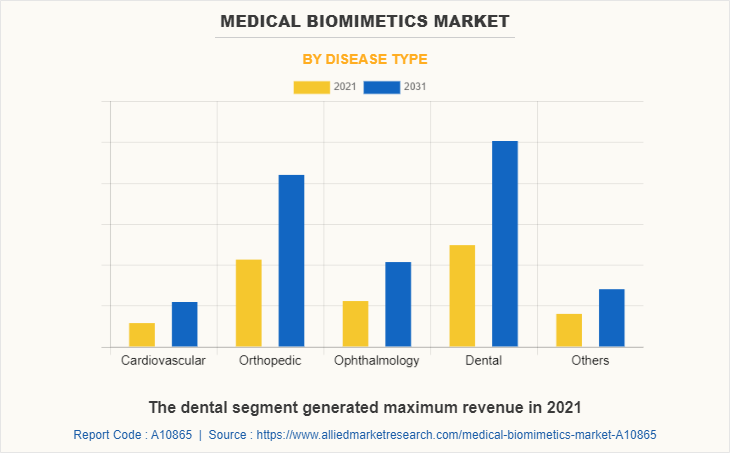

By Disease Type

The medical biomimetics market is segmented into cardiovascular, orthopedic, ophthalmology, dental, and others. The dental segment generated maximum revenue in 2021, owing to the high adoption of dental biomimetics products. The same segment is expected to witness the highest CAGR during the forecast period, owing to an increase in the use of dental biomimetics products, the availability of various biomimetics products for dental diseases, and the rise in prevalence of the dental disease.

By Application

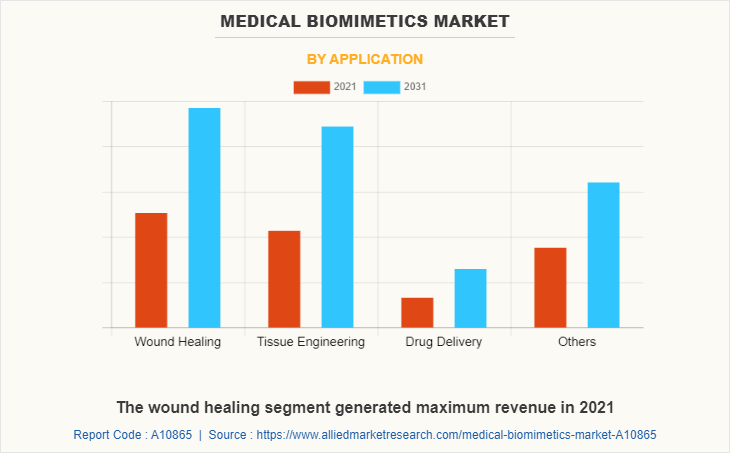

The medical biomimetics market is segregated into wound healing, tissue engineering, drug delivery, and others. The wound healing segment generated maximum revenue in 2021, owing to the high demand for biomimetic products for wound healing, and the increase in a number of availability of biomimetic products for wound healing. The tissue engineering segment is expected to witness the highest CAGR during the forecast period, owing to a rise in research and development activities for use of biomimetics products in tissue engineering, and an increase in focus on creating functional tissue grafts globally.

By Region

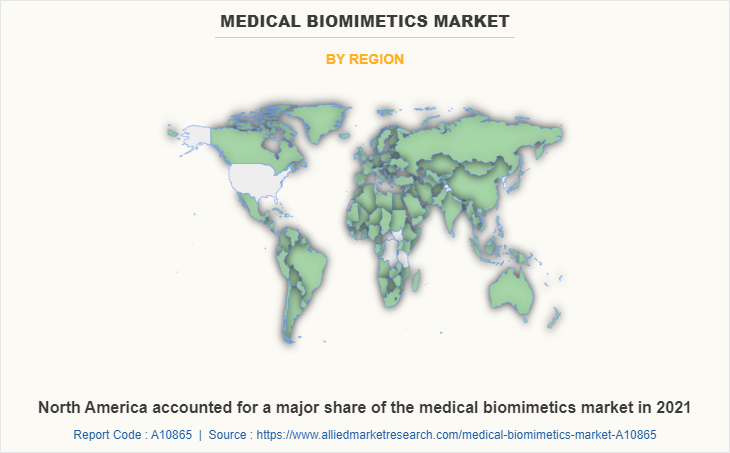

The medical biomimetics market is studied across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the medical biomimetics market in 2021 and is expected to maintain its dominance during the forecast period. The presence of several major players, such as BioHorizons, Curasan, Inc., Keystone Dental Group, and Zimmer Biomet, and the advancement in manufacturing technology of biomimetics products in the region drive the growth of the market. This is majorly attributed to the surge in incidences of dental problems which further require dental biomimetics products, a rise in funding from the government for research regarding biomimetics products, and a significant rise in capital income in developed countries. Furthermore, the existence of a sophisticated reimbursement structure that aims to reduce expenditure levels drives the growth of the market. Hence, such factors propel market growth. In addition, the U.S. is anticipated to contribute to a major share of the regional market and is expected to drive the growth of the medical biomimetics market throughout the forecast period. The presence of well-established healthcare infrastructure, high purchasing power, and a rise in the adoption rate of medical biomimetics products are expected to drive market growth.

Asia-Pacific is expected to grow at the highest rate during the medical biomimetics market forecast period. The medical biomimetics market growth in this region is attributable to the rise in the number of heart and orthopedic diseases in this region as well as the growth in the purchasing power of populated countries, such as China and India. The countries in Asia-Pacific possess a huge population base, with China being the first having 1,397,715 population in 2020 and India being the second most populated country having 1,366,417.75 population in 2020.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the medical biomimetics market, such as AVINENT Science and Technology, BioHorizons, Blatchford Limited, CorNeat Vision, Curasan, Inc., Keystone Dental Group, Osteopore International Pte Ltd, Otsuka Medical Devices group (Veryan Medical Limited), Swedish Biomimetics 3000 ApS, and Zimmer Biomet are provided in the report. There are some important players in the market such as Blatchford Limited, CorNeat Vision, Keystone Dental Group, Osteopore International Pte Ltd, and Otsuka Medical Devices group (Veryan Medical Limited), have adopted acquisition, partnership, product launch, and product approval, as key developmental strategies to improve the product portfolio of the medical biomimetics market.

Some examples of acquisitions in the market

In September 2021, Keystone Dental Inc., the largest independent dental implant company announced the acquisition of Osteon Medical, a Melbourne, Australia-based technology company providing digital solutions for clinicians and dental laboratories leveraging proprietary software and unique hardware developments, significantly improving digital workflows. This will increase Keystone's global visibility in the dental market with innovative solutions and a high-value proposition.

Partnership in the market

In March 2021, CorNeat Vision, a clinical-stage, biomimetic implant and technology company, and LiveU, a company offering high-quality live video streaming and remote production solutions, announced a partnership for a Remote Surgeon Virtual Presence (RSVP) solution. This partnership will enable the initiation of the Canadian clinical site toward the first implantations of the CorNeat KPro artificial cornea which was affected due to COVID-19 travel restrictions.

Product Launch in the market

In September 2020, Veryan Medical announced that it has launched the innovative BioMimics 3D Vascular Stent System in the US. The BioMimics 3D Vascular Stent System is indicated to improve luminal diameter in the treatment of symptomatic de-novo or restenotic lesions in native superficial femoral and proximal popliteal arteries.

In September 2020, Blatchford a leading manufacturer of prosthetic technology, launched EchelonER, the latest hydraulic ankle. Its waterproof design and extended range will provide users with even more ground compliance on steep slopes and uneven terrain.

Product Approval in the market

In December 2021, Osteopore a world-leading regenerative tissue implants company received regulatory approval from Hong Kong’s Medical Device Control System (MDACS), for offering the bone healing specialist the perfect staging ground in Greater China.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical biomimetics market analysis from 2021 to 2031 to identify the prevailing medical biomimetics market opportunity.

- The Medical Biomimetics industry research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the medical biomimetics industry segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes an analysis of the regional as well as global medical biomimetics market trends, key players, market segments, application areas, and market growth strategies.

Medical Biomimetics Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 68.9 billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 221 |

| By Disease Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Swedish Biomimetics 3000 ApS, Keystone Dental Group, Blatchford Limited, Curasan, inc., Biohorizons, Osteopore International Pte Ltd, CorNeat Vision, Otsuka Medical Devices Co., Ltd., Zimmer Biomet Holding Inc., AVINENT Science and Technology |

Analyst Review

The medical biomimetics market has witnessed growth, owing to an increase in the prevalence of chronic heart disease, an increase in orthopedic injuries, and a rise in ophthalmic problems such as deformed, scarred, or opacified corneas across the world and the availability of various medical biomimetics products.

According to the perspectives of CXOs, the global medical biomimetics market is expected to witness steady growth in the future. The rise in a number of dental problems, such as dental caries and periodontal diseases, increase in the prevalence of orthopedic diseases, injuries, and heart diseases have led to an increase in demand for medical biomimetics and boosted the growth of the market. Furthermore, the surge in the geriatric population that is susceptible to orthopedic disorders, dental problems, opacified corneas, and heart attack drives the growth of the medical biomimetics market. In addition, the increase in the preference of healthcare professionals for medical biomimetics, and the rise in acceptance of orthopedic implants, drive the growth of the medical biomimetics market. Medical biomimetics is expected to help improve the patient survival rate and reduce the burden of chronic disease in the world.

North America is expected to witness the highest growth, in terms of revenue, owing to an increase in cases of orthopedic injuries, robust healthcare infrastructure, presence of key players, and rise in healthcare expenditure. However, Asia-Pacific is anticipated to witness notable growth, owing to an increase in awareness related to the use of medical biomimetics to treat dental disease and orthopedic injuries, unmet medical demands, a high population base, and an increase in public–private investments in the healthcare sector.

The utilization of biomimetic products made of novel materials is one of the major trends being observed in the industry.

The wound healing segment generated maximum revenue in 2021, owing to the high demand for biomimetic products for wound healing, and the increase in a number of availability of biomimetic products for wound healing.

North America accounted for a major share of the medical biomimetics market in 2021 and is expected to maintain its dominance during the forecast period.

The increase in awareness regarding biomimetics product in developing country, the increase in the number of clinical trials of biomimetics product, rise in the discovery & development of effective medical biomimetics product, drives the growth of the medical biomimetics market

The high cost of medical implants coupled with the complications/side effects associated with the Medical Biomimetic Market might restrict the growth of the market

Yes, competitive landscape included in the Medical Biomimetic Market

Biohorizons, Blatchford Limited, and Zimmer Biomet Holding Inc. are a few major players operating in the Medical Biomimetic Market.

The medical biomimetics market was valued at $35,374.7 million in 2021 and is estimated to reach $68,856.7 million by 2031, exhibiting a CAGR of 7.2% from 2022 to 2031.

Loading Table Of Content...