Medical Terminology Software Market Research, 2032

The medical terminology software market size was valued at $0.9 billion in 2022 and is projected to reach $2.6 billion by 2032, growing at a CAGR of 10.9% from 2023 to 2032. Medical terminology software is a type of computer program that is specifically designed to help healthcare professionals better understand and use medical language. This software provides a comprehensive database of medical terms, definitions, and abbreviations that are commonly used in the healthcare industry. It is primarily used by medical students, healthcare professionals, and medical researchers, and it offers a variety of features to make their work easier and more efficient. One of the most important features of medical terminology software is its comprehensive database. This database contains a vast array of medical terms, definitions, and abbreviations, which can be searched and browsed with ease. This is particularly useful for healthcare professionals who need to quickly and accurately understand and use medical terminology in their day-to-day work.

Market dynamics

One of the major factors driving the growth of the medical terminology software market size is the rise in the adoption of electronic health records (EHRs). Electronic health records enable healthcare providers to access patient information quickly and easily, without having to sift through paper records. This saves time and improves efficiency, allowing providers to focus on providing better care to patients.

For instance, according to the 2021 report by The Office of the National Coordinator for Health Information Technology (ONC), 96% of general acute care hospitals had adopted electronic health records. In addition, surge in the prevalence of noncommunicable diseases (NCDs) has significantly contributed in the growth of the medical terminology software industry.

NCDs are chronic diseases that require long-term management and treatment, which involves a lot of documentation and record-keeping. Medical terminology software can help healthcare professionals efficiently document and manage patient information, reducing errors and streamlining the process of data entry. This has become increasingly important as the number of patients with NCDs has grown, creating a greater need for accurate and efficient record-keeping. Thus the rising prevalence of NCDs is also expected to drive the medical terminology software market growth.

For instance, according to the 2022 factsheet of WHO, each year, 17 million people die from a NCD before age 70; 86% of these premature deaths occur in low- and middle-income countries. However, the data privacy issue is the main hurdle that limits the growth of the medical terminology software market. Medical terminology software is designed to help healthcare providers manage and analyze vast amounts of patient data.

However, the use of patient data in medical terminology software raises concerns about data privacy and security. Medical terminology software collects, stores, and processes sensitive patient information, including medical histories, diagnoses, and treatments. The software must comply with strict data privacy laws and regulations to protect patient confidentiality. Failure to do so can result in legal penalties, reputational damage, and loss of patient trust. The concerns related to patient data can negetively impact the medical terminology software market share.

For instance, according to a 2022 report by HIPAA Journal, in 2022, an average of 1.94 healthcare data breaches of 500 or more records were reported each day. On the other hand, the integration of artificial intelligence (AI) into medical terminology software is a potential growth opportunity in the medical terminology software industry.

Medical terminology software that incorporates AI can greatly improve accuracy in medical coding, clinical documentation, and other areas of healthcare. AI algorithms can analyze vast amounts of medical data, identify patterns, and make predictions with a high level of accuracy.

Furthermore, in the medical terminology software market opportunity, AI can also aid in automating routine tasks and decreasing manual labor. For instance, AI can assist in extracting pertinent medical codes and terms from clinical notes, thereby freeing up valuable time for healthcare professionals to dedicate to other essential responsibilities.

The COVID-19 pandemic has had a positive impact on the medical terminology software market, owing to the rise in the adoption of medical terminology software in hospitals, as hospitals are receiving a lot of patient-related data to provide treatment and care to a patient by using patient-related data information. Governments are making efforts to adopt cutting-edge healthcare software solutions in order to reduce the number of deaths by gathering and managing the data in a uniform way and using it to reduce medical errors during treatments.

Furthermore, the pandemic has resulted in increased demand for healthcare data analytics. As healthcare providers have struggled to keep up with the sheer volume of COVID-19 patients, there has been a need for software solutions that can help analyze patient data and identify patterns and trends. Medical terminology software can play an important role in this process, as it can help ensure that patient data is accurately categorized and analyzed.

However, the COVID-19 pandemic has also had some negative impacts on the medical terminology software market share. Many healthcare providers have faced significant financial challenges due to the pandemic, which has led to budget cuts and a reduced investment in new technologies. Additionally, some healthcare providers may be hesitant to adopt new software solutions during a time of crisis, as they may be focused on more immediate concerns.

Overall, the impact of COVID-19 remains significant on the medical terminology software market. However, it is clear that medical terminology software will continue to be an important tool for healthcare providers, especially as the industry continues to evolve and adapt to new challenges.

Segmental Overview

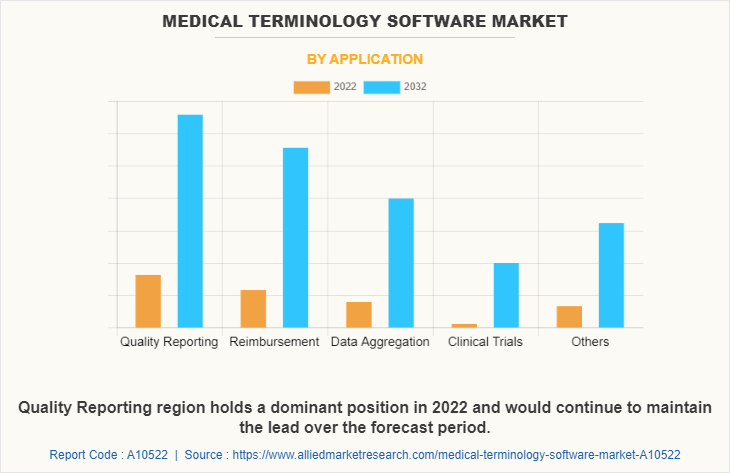

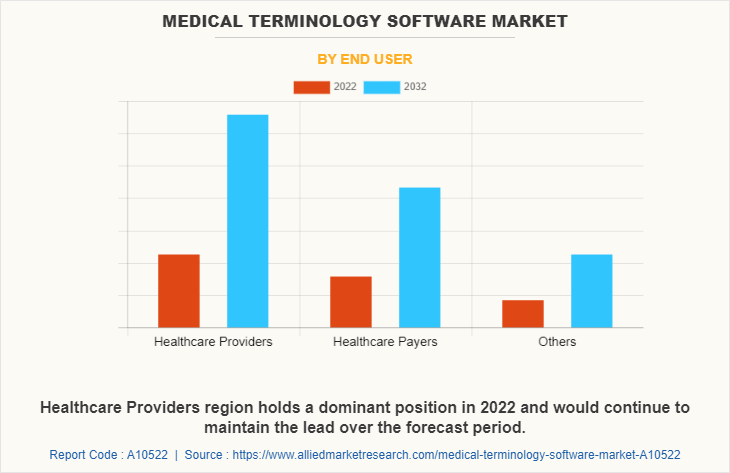

The medical terminology software market is segmented into application, end user, and region. By application, the market is categorized into clinical trials, data aggregation, reimbursement, quality reporting, and others. On the basis of end user, it is categorized into healthcare providers, healthcare payers, and others.

Region-wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (Japan, China, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

Depending on applications, the market is categorized into quality reporting, reimbursement, data aggregation, clinical trials, and others. The quality reporting segment accounted for the largest share in 2022 and is also expected to remain dominant during the forecast period. The growth is attributable to the government's increased efforts to enhance healthcare quality outcomes and set quality assessment standards.

On the basis of end user, the market is categorized into healthcare providers, healthcare payers, and others. Healthcare providers occupied highest share in 2022, owing to the demand for medical terminology software among hospitals, pharmacies, and other healthcare related forms to manage the increase in amount of patient information in hospitals.

By region: The medical terminology software market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the medical terminology software market in 2022, and is expected to maintain its dominance during the forecast period, owing to strong presence of several major players, such as Wolters Kluwer N.V, Intelligent Medical Objects Inc., and adoption in EHRs.

In addition, rise in number of clinical trials in this region also contribute toward the growth of market. Moreover, high purchasing power and rise in awareness about various advantages of EHRs and clinical decision support systems (CDSS) are expected to drive the market growth.

In addition, Asia-Pacific is expected to grow at the fastest rate during the forecast period. This is attributed to rise in medical tourism, surge in use of EHR by the healthcare institutes, and favorable government initiatives which drive the growth of the market. For instance, Lifetime Health Record (LHR) is an initiative by the Government of Malaysia to promote the adoption of digital healthcare technology in the country.

COMPETITION ANALYSIS

Competitive analysis and profiles of the major players in the medical terminology software market, such as Wolters Kluwer N.V., Intelligent Medical Objects Inc., Clinical Architecture, LLC., Rhapsody, SNOMED International, Hiveworx LLC, 3M, West Coast Informatics Inc., TermSolutions GmbH, and BT Clinical Computing are provided in this report.

Major players have adopted collaboration as key developmental strategy to improve the product portfolio of the medical terminology software market. An example of collaboration in the market In January 2021, Wolters Kluwer Health collaborated with Henry Schein MicroMD for developing Health Language Clinical Interface Terminology (CIT) to quickly map over a million medical abbreviations, typos, incomplete terms, and acronyms to standardized terminology.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the medical terminology software market analysis from 2022 to 2032 to identify the prevailing medical terminology software market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the medical terminology software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global medical terminology software market trends, key players, market segments, application areas, and market growth strategies.

Medical Terminology Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 2.6 billion |

| Growth Rate | CAGR of 10.9% |

| Forecast period | 2022 - 2032 |

| Report Pages | 243 |

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | SNOMED International, Hiveworx, West Coast Informatics inc, Wolters Kluwer N.V, BT Clinical Computing, Clinical Architecture, LLC., Rhapsody, TermSolution Gmbh, Intelligent Medical Objects Inc., 3M Company |

Analyst Review

This section provides various opinions of top-level CXOs in the medical terminology software market. In accordance with several interviews conducted, the medical terminology software market is expected to witness a significant growth in the future, owing to rise in the adoption of electronic health records (EHRs).

According to the perspectives of CXOs, the global medical terminology software market is expected to witness a steady growth in the future. The growing focus on quality reporting and regulatory compliance among healthcare providers across the world drives the growth of the medical terminology software market. For instance, in order to comply with regulatory requirements and to improve quality reporting, healthcare providers are increasingly adopting standardized terminologies, such as SNOMED CT, LOINC, and ICD-10. However, data privacy issues might restrain the growth of the medical terminology software market. Moreover, the integration of artificial intelligence (AI) into medical terminology software presents various new growth opportunities.

Further, North America is expected to witness highest growth, in terms of revenue, owing to increase in adoption of EHRs by healthcare institutes, high number of clinical trials, and surge in healthcare infrastructure which drive the growth of the medical terminology software market. Upsurge in healthcare expenditure in the emerging economies is anticipated to offer lucrative opportunities for the market expansion. However, Asia-Pacific is anticipated to witness notable growth, owing to increase in investments for development of medical terminology software and rise in number of key players developing medical terminology software, which is expected to drive the growth of the market during the forecast period.

The Upcoming trends are the rise in the adoption of electronic health records (EHRs).

$0.9 billion is the market size of Medical Terminology Software Market in 2022

North America is the largest regional market in medical terminology software

$2.6 billion is the estimated industry size of Medical Terminology Software in 2032

Wolters Kluwer N.V, 3M, and Intelligent Medical Objects Inc. are the top companies to hold the market share in Medical Terminology Software

2023-2032 forecast period is considered in the market report

No, there is value chain analysis provided in the report

10 Company are profiled in the medical terminology software market

Loading Table Of Content...

Loading Research Methodology...