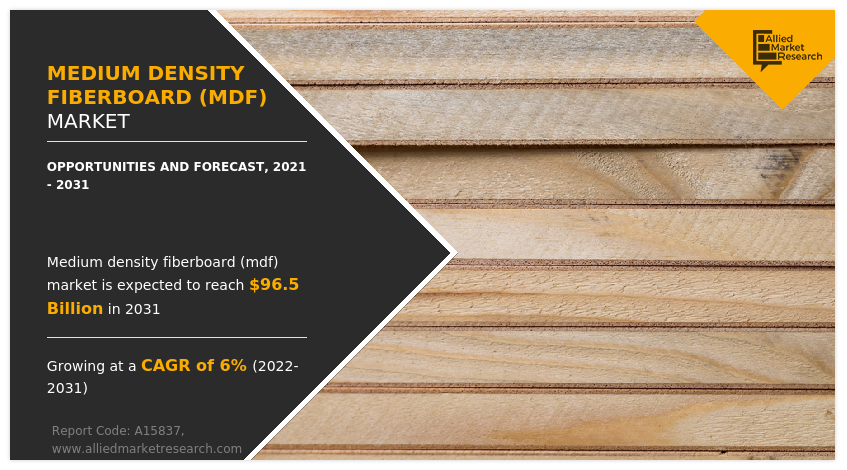

Medium Density Fiberboard (MDF) Market Research, 2031

The global medium density fiberboard (MDF) market size was valued at $53.9 billion in 2021, and is projected to reach $96.5 billion by 2031, growing at a CAGR of 6% from 2022 to 2031. Medium density fiberboard (MDF) market overview includes an engineered wood made by compressing together the uniformly sized wood particulates at high temperature along with resin and wax to bind these particulates. It is widely used in all applications that is applicable for plywood, such as flooring, furniture, cabinets, speaker boxes, wooden temporary construction, and others.

Rise in global population, increasing urbanization, and rising tourism across the globe have significantly increased the demand for residential and non-residential buildings. This has fueled the use of medium density fiberboard (MDF), as it is majorly used for flooring, door and windows, and in interior designing of the house or buildings. Furthermore, the furniture industry is witnessing a significant surge in demand, largely as a result of rising number of dwellings, and other residential and non-residential buildings. Since a substantial number of furniture is made using medium density fiberboard (MDF) panels, increasing demand for furniture is driving the medium density fiberboard (MDF) market growth. Furthermore, medium density fiberboard (MDF), is also used for manufacturing various other products such as speaker boxes, temporary wooden construction, and shipping boxes. This also plays a substantial role in driving the growth of the medium density fiberboard (MDF) market.

Medium density fiberboard (MDF) offers many advantageous features as compared to plywood. It is more moisture proof, does not bend or crack, has structural stability, and requires little maintenance. In addition, since MDF is an engineered wood, it has a homogenous structure, unlike the wood, which has various surface irregularities, presence of knots, and other issues. Moreover, availability of a wide range of medium density fiberboard (MDF) having varied thickness, durability, and prices, is also driving its demand.

Major medium density fiberboard (MDF) manufacturers such as, Century Plyboards (India) Limited (Century Prowud), Dare Panel Group Co., Ltd., Egger Holzwerkstoffe GmbH, and others offer a wide variety of medium density fiberboard (MDF) to consumers. Moreover, various development strategies are adopted by the medium density fiberboard (MDF) manufacturers to sustain harsh competition in the market. For instance, in September 2020, EGGER Group, expanded its presence in the Lexington, N.C., U.S., for raw particleboard manufacturing and particleboard lamination. This expansion helped the company to enhance its presence in North Carolina, U.S.

By Product Type

Fire-Resistant MDF segment is projected to grow at a highest CAGR

On the basis of product type, the standard MDF segment generated highest revenue in 2021, owing to its wide applications and easy availability. Standard MDF is vastly available in the market, as it is used in many kinds of application such as furniture, cabinets, doors and windows, and others, except the applications and places with possibility of moisture and fire.

The novel coronavirus rapidly spread across various countries and regions, causing an enormous impact on the lives of people and the overall community. It began as a human health condition and later became a significant threat to global trade, economy, and finance. The COVID-19 pandemic halted the production of medium density fiberboard (MDF) due to lockdown. The economic slowdown initially resulted in reduced spending on various applications of medium density fiberboard (MDF) by residential and commercial users. However, owing to the introduction of various vaccines, the severity of the COVID-19 pandemic has significantly reduced. As of mid-2022, the number of COVID-19 cases has diminished significantly. This has led to the reopening of medium density fiberboard (MDF) manufacturing companies at their full-scale capacities. Furthermore, it has been more than two years since the outbreak of this pandemic, and many companies have already shown notable signs of recovery.

Furthermore, rising standards of living and increasing spendings on home remodeling projects, especially in high income countries are also anticipated to positively influence the medium density fiberboard (MDF) market during the forecast period.

By End-user

Residential segment holds dominant position in 2021

on the basis of end user, the residential segment was the largest segment in 2021, owing to rise in number of buildings, fueled by rising population and urbanization. Gradual increase in population and rise in disposable income of majority population in various developing countries, including India and Brazil, boost the demand for MDF panels for applications in furniture, flooring, and home interior.

The medium density fiberboard (MDF) market is segmented into Product type, Application and End-User. On the basis of product type, the market is categorized into standard MDF, moisture-resistant MDF, and fire-resistant MDF. On the basis of application, the market is segmented into cabinet flooring, furniture, molding, door, and millwork, packaging system, and others. On the basis of end user, it is categorized into residential, commercial, and institutional.

By Region

Asia-Pacific holds a dominant position in 2021 and is expected to grow at a significant rate during the forecast period.

On the basis of region, the medium density fiberboard (MDF) market share is analyzed across North America, Europe, Asia-Pacific, and LAMEA. Asia-Pacific dominated the market in 2021, followed by Europe and LAMEA. Moreover, Asia-Pacific is also anticipated to maintain this trend during the forecast period. This is attributed to increase in building construction activities and increasing demand for furniture.

Competition Analysis

Key companies profiled in the medium density fiberboard (MDF) market report include Arauco and Constitution Pulp Inc., Century Plyboards (India) Limited (Century Prowud), Dare Panel Group Co., Ltd., Egger Holzwerkstoffe GmbH, Greenpanel Industries Limited, Kastamonu Entegre, Korosten MDF manufacture, Kronospan Limited, Uniboard Canada Inc., and West Fraser Timber Co. Ltd.

Key Benefits For Stakeholders

- The report provides an extensive analysis of the current and emerging medium density fiberboard (MDF) market trends and dynamics.

- In-depth medium density fiberboard (MDF) market analysis is conducted by constructing market estimations for key market segments between 2021 and 2031.

- Extensive analysis of the medium density fiberboard (MDF) market is conducted by following key product positioning and monitoring of top competitors within the market framework.

- A comprehensive analysis of all the regions is provided to determine the prevailing opportunities.

- The global medium density fiberboard (MDF) market forecast analysis from 2022 to 2031 is included in the report.

- The key players within medium density fiberboard (MDF) market are profiled in this report and their strategies are analyzed thoroughly, which help understand the competitive outlook of the medium density fiberboard (MDF) industry.

Medium Density Fiberboard (MDF) Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 96.5 billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 283 |

| By Product type |

|

| By Application |

|

| By End-User |

|

| By Region |

|

| Key Market Players | Korosten MDF manufacture, Kastamonu Entegre, Egger Holzwerkstoffe GmbH, Dare Panel Group Co., Ltd., Century Plyboards (India) Limited (Century Prowud), Kronospan Limited, Greenpanel Industries Limited, Uniboard Canada Inc., Arauco and Constitution Pulp Inc., West Fraser Timber Co., Ltd. |

Analyst Review

The medium density fiberboard (MDF) market has witnessed significant growth in past few years, owing to surge in construction and renovation activities of residential, commercial, and institutional buildings, along with surge in the furniture industry. Medium density fiberboard (MDF) is made up of wood particulates, which is mixed with resin and wax, and compressed at high pressure and temperature. Owing to this, MDF has a homogenous and very dense structure, leading to high strength, durability, and resistance towards bending and cracking. Moreover, MDF can also be made water and fire resistant/retardant; thereby, making it widely usable in many applications including water and fire. Furthermore, MDF is made with recycled wood that reduces its carbon footprint, and also significantly reduces its price.

Furthermore, rise in demand for luxurious interiors of homes, especially in high income countries such as the U.S, France, UK, and Germany fuels the demand for medium density fiberboard (MDF). In addition, increased building construction activities in countries, such as China and India have increased the demand for medium density fiberboard (MDF) from residential and non-residential sectors. Medium density fiberboard (MDF) are extensively used in making temporary construction, such as exhibition booths, movie shooting sets, and others, aiding in increased demand for MDFs. In addition, rising demand for furniture across the globe is also anticipated to drive significant growth of the medium density fiberboard (MDF) market.

Moreover, rising trend of home renovation activities in high- and mid-income countries is expected to provide lucrative opportunities for the growth of the medium density fiberboard (MDF) market.

Growth of furniture industry and rise in building construction are the upcoming trends of Medium Density Fiberboard (MDF) Market in the world

Furniture is the leading application of Medium Density Fiberboard (MDF) Market

Asia-Pacific region is the largest regional market for Medium Density Fiberboard (MDF)

The estimated industry size of Medium Density Fiberboard (MDF) in 2031 is $96,457.2 million

Arauco and Constitution Pulp Inc., Century Plyboards (India) Limited (Century Prowud), Dare Panel Group Co., Ltd., Egger Holzwerkstoffe GmbH, Greenpanel Industries Limited, Kastamonu Entegre, Korosten MDF manufacture, Kronospan Limited, Uniboard Canada Inc., and West Fraser Timber Co. Ltd

The product launch is key growth strategy of Medium Density Fiberboard (MDF)industry players.

The company profile has been selected on factors such as geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Its end-users include the residential, commercial, and industrial sectors.

Loading Table Of Content...

Loading Research Methodology...