Metal Cutting Gas Market Research, 2031

The global metal cutting gas market was valued at $2.7 billion in 2021, and is projected to reach $4.0 billion by 2031, growing at a CAGR of 4.2% from 2022 to 2031.

Report Key Highlighters

- The global metal cutting gas market has been analyzed in terms of value ($billion) and volume (Kilotons). The analysis in the report is provided on the basis of type, insulation type, end-use industry, 4 major regions, and more than 15 countries.

- The metal cutting gas market is fragmented in nature with few players such as esab, TotalEnergies SE, Hornet Cutting Systems, Ador Welding Limited, Bharat Petroleum Corporation Limited, LEVSTAL, NISSAN TANAKA CORPORATION, Indian Oil Corporation Ltd, HACO, Brothers Gas., which hold significant share of the market.

- The report facilitates strategy planning and industry dynamics to enhance decision making for existing market players and new entrants entering the aluminum wire industry.

- Countries such as China, U.S., India, Germany, and Brazil hold a significant share in the global metal cutting gas market.

Metal cutting gas is a flame of fuel gas such as acetylene, propane, propylene, natural gases, and others. Steam of oxygen is injected around the flame which burns the steel and ejects the oxide as dross. Metal cutting gases possess temperature variation during welding and cutting process of metal. Metal cutting torch is handheld or it is mounted on a mechanized carriage While cutting the metals. Metal cutting gases have a wide range of applications in various end use industries such as automotive, aerospace, building and construction, metal fabrication, and others.

Well established industrial sectors across the globe is projected to drive the market

Metal cutting gas is widely employed in high-temperature applications due to which it is the most preferred gas in the metal casting industry. Furthermore, rise in demand for high-quality metal in electronics, automotive, and other end-use sectors is expected to drive the market growth during the forecast period.

The surge in population coupled with rapid urbanization has surged the growth of the construction sector in both developed and developing economies, where metal-cutting gases are popularly used in the construction industry for cutting, welding, and designing various steel materials. This is expected to boost the demand for metal-cutting gas in the growing building & construction sector. Ease of accessibility and incorporation of multiple torches can enhance the functionality of metals. This is expected to garner high adoption rates during the forecast period.

Furthermore, surge in demand for processing carbon and low alloy from aerospace, automotive, metal fabrication, and industrial sector is expected to accelerate the market growth. In addition, strong economic growth has surged the establishment of industries where metal-cutting gas is used in the metal casting industry. This is projected to propel the growth of the metal-cutting gas market.

According to an article published by Weldster company, propylene metal-cutting gas offers an excellent benefit such as, it offers cost-effective solutions, reduces labor costs, increases the productivity and effectiveness of metals, and is considered a safer metal-cutting gas due to its stability than other metal cutting gases. This is expected to fuel the makret growth during the forecast period.

However, lack of technical expertise and adoption of high-range advanced metal cutting machinery are expected to restrain the market growth. Furthermore, high technological costs and complicated manufacturing processes are projected to hinder the growth of the metal cutting gas market. In addition, the launch of robotics and automated metal cutting machinery is likely to restrain the market growth. Furthermore, the lack of requirement of ventilation spaces and the advent of 3D technology is expected to hamper the growth prospects of the metal cutting gas market.

On the contrary, increase in usage of metal cutting gases in diversified industry such as scrapers, metalworking, metal fabrication, and welding and cutting industry is projected to create new opportunities for the market. In addition, to curb the growing pollution, the government of both developed and developing economies have increased the production capacities for natural gases. For instance, according to an article published by U.S. Energy Information Administration In 2022, the U.S. dry natural gas production in 2021 was about 34.5 trillion cubic feet (Tcf), an average of about 94.6 billion cubic feet per day and the highest annual amount recorded. This factor has positively impacted the growth of the market; thus, offering the most lucrative opportunities for the market.

Key Market Trends:

The advent of 3D printing reduces complicated metal fabrication to a single step. In addition, Miller Weld’s AugmentedArc technology helps in efficient welding and cutting of metal processes duw to which it has boosted the metal cutting gas market duirng the forecast period.

Investment in new technology, adoption of artificial intelligence, and robotics system can boost the metal cutting gas market in the coming years.

The metal cutting gas market is segmented based on gas type, end-use, and region. Based on type, the market is categorized into acetylene, propylene, natural gas, propane, and others. Based on end-use industry, it is divided into automotive, aerospace, building and construction, metal and metal fabrication, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The global metal cutting gas market profiles leading players that include Ador Welding Limited, Bharat Petroleum Corporation Limited, Brothers Gas, ESAB, HACO, Hornet Cutting Systems, Indian Oil Corporation Ltd, LEVSTAL, NISSAN TANAKA CORPORATION, and TotalEnergies. The global metal cutting gas market report provides in-depth competitive analysis as well as profiles of these major players.

The Asia-Pacific metal cutting gas market size is projected to grow at the highest CAGR of 4.6% during the forecast period and accounted for 48% of metal cutting gas market share in 2021. This is attributed to the proliferating demand for iron & steel from various end-use sectors such as industrial, construction infrastructure, automotive, and others have led the iron & steel manufacturers to increase their production capacities where metal cutting gas are widely used for welding and cutting purposes.

For instance, according to a report published by India Brands Equity Foundation, India’s finished steel consumption is anticipated to increase to 230 metric ton (MT) by 2030-31 from 93.43 metric ton (MT) in 2020-21. In addition, China's consumer electronics sector is experiencing rapid growth, which in turn has enhanced the performance of the metal cutting gas market in the region. Furthermore, metal cutting gases are used in cutting, welding, designing, and assembling of various industrial equipment, aircraft components, sports equipment, pressure vessels, and blades of wind turbines. They are extensively used in industrial applications due to high heat, strength, and fuel efficiency.

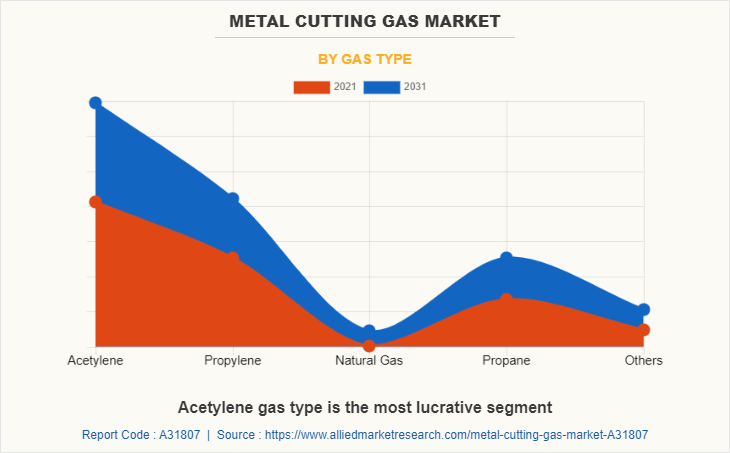

In 2021, the acetylene segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.5% during the forecast period. Acetylene can produce the hottest flame owing to which it is widely used in industrial applications. Acetylene is also known as oxyfuel cutting or metal cutting gas. This method is used to cut or weld materials that require temperatures as high as 3,500 °C (6,330 °F). Acetylene is an important industrial raw material extensively used to produce solvents and alkenes, which serve as monomers in plastic production. Furthermore, Acetylene is the primary fuel for oxy-fuel welding, and it is best suited for repair work and general cutting and welding applications. These factors are anticipated to increase the sales of silicon carbide-based metal cutting gas; thus, creating remunerative opportunities for the market.

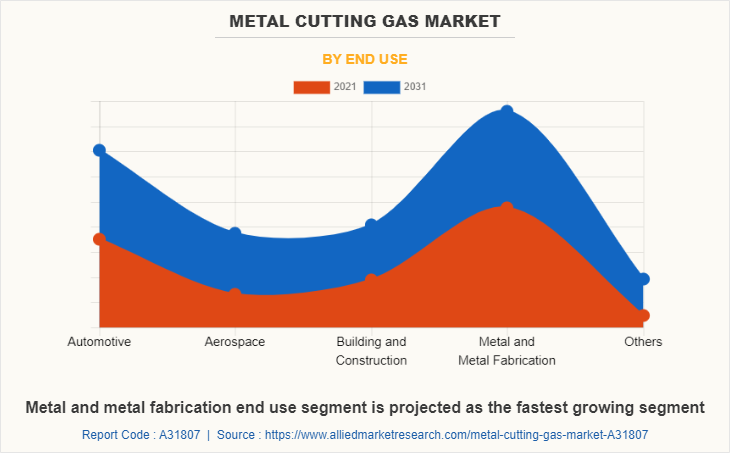

In 2021, the metal and metal fabrication end use segment was the largest revenue generator, and is anticipated to grow at a CAGR of 4.1% during the forecast period. The metal and metal fabrication end use segment is driven by rapid industrialization and infrastructure development is expected to boost the metal fabrication industry where metal cutting gases have a huge scope in welding, cutting, and assembling the metal parts. This factor is likely to boost the market during the forecast period. Furthermore, ongoing infrastructure activities and increase in the usage of prefabricated structures in the construction industry is accelerating the market growth. This factor is projected to foster the market during the forecast period.

COVID 19 Impact Analysis :

- The metal cutting gas market had a negative impact due to the wake of the COVID-19 pandemic. Fluctuation in the prices of metal cutting gas products has hit the market globally.

- In addition, decreases in the potential sales of automotive and metal cutting industry have affected the market negatively. For instance, according to an article published by, The Economics Times in January 2021, India's crude steel output falls 10.6 per cent to 99.6 million tons in 2020.

- However, the rise in demand for construction, automotive, manufacturing units, and increasing focus on an escalating economic recovery across the globe has supported the metal cutting gas market in 2021.

- In addition, increase in the potential sales of automotive industry in2021 has driven the market post COVID-19. For instance, according to data revealed by the StatCan, Canada’s automotive sector increased by around 6.5% in 2021 as compared to 2020, owing to increase in imports and exports activities.

Key Benefits For Stakeholders:

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the metal cutting gas market analysis from 2021 to 2031 to identify the prevailing metal cutting gas market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the metal cutting gas market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global metal cutting gas market trends, key players, market segments, application areas, and market growth strategies.

Metal Cutting Gas Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4 billion |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 456 |

| By Gas Type |

|

| By End Use |

|

| By Region |

|

| Key Market Players | LEVSTAL, brothers gas, esab, Bharat Petroleum Corporation Limited, TotalEnergies SE, NISSAN TANAKA CORPORATION, Hornet Cutting Systems, haco, Ador Welding Limited, Indian Oil Corporation Ltd |

Analyst Review

According to CXOs of leading companies, the global metal cutting gas market is expected to exhibit high growth potential. Growing demand for high quality metal from automotive and aerospace industry has spurred the metal cutting gas market. It also finds a wide range of applications in various end use industries including building & construction, electronics, metal casting, metal fabrication, industrial, and others. Industrial equipment requires high strength, corrosion protection, and abrasion resistant properties and it can be accomplished with the use of advanced metals where metal cutting gases are required in large quantities. In addition, metal cutting gas possesses excellent significant properties such as high flame, safety measures, high speed measures that makes it best suited for welding and cutting applications. Furthermore, advent of 3D technology and launch of automated robotics metal cutting gas is expected to create lucrative opportunities for the market in the coming years. CXOs further added that sustained economic growth and development of the automotive and construction sector have increased the popularity of metal cutting gas.?

Metal cutting gas is a flame of fuel gas such as acetylene, propane, propylene, natural gases, and others. Steam of oxygen is injected around the flame which burns the steel and ejects the oxide as dross. Metal cutting gases possess temperature variation during welding and cutting process of metal.? Metal cutting torch is handheld or it is mounted on a mechanized carriage While cutting the metals. Metal cutting gases have a wide range of applications in various end use industries such as automotive, aerospace, building and construction, metal fabrication, and others.???

The surge in population coupled with rapid urbanization has surged the growth of the construction sector in both developed and developing economies, where metal-cutting gases are popularly used in the construction industry for cutting, welding, and designing various steel materials. This is expected to boost the demand for metal-cutting gas in the growing building & construction sector.? Ease of accessibility and incorporation of multiple torches can enhance the functionality of metals. This is expected to garner high adoption rates during the forecast period.

esab, TotalEnergies SE, Hornet Cutting Systems, Ador Welding Limited, Bharat Petroleum Corporation Limited, LEVSTAL, NISSAN TANAKA CORPORATION, Indian Oil Corporation Ltd, HACO, Brothers Gas.

Asia-pacific is the largest regional market for metal cutting gas market.

The global metal cutting gas market was valued at $2.7 billion in 2021, and is projected to reach $4.0 billion by 2031, growing at a CAGR of 4.2% from 2022 to 2031.

Metal and metal fabrication is the leading application segment in the metal cutting gas market.

Adoption of 3D technology and robotics systems in metal cutting gases is the major upcoming trend.

Loading Table Of Content...