Metal Packaging Market Outlook - 2030

The global metal packaging market was valued at $108.8 billion in 2020, and is projected to reach $147.4 billion by 2030, growing at a CAGR of 3.1% from 2021 to 2030. Increase in consumer preference for recyclable and environment-friendly packaging is expected to drive the growth of the metal packaging market. Metal packaging, particularly aluminum and steel, is highly recyclable and can be reused multiple times without degrading its quality. This characteristic aligns well with the values of eco-conscious consumers who seek products that contribute to a circular economy.

Introduction

Metal packing refers to packaging constructed primarily of metals, such as metal, aluminum, and steel. Impact resistance, ability to endure extreme temperature, convenience for long-distance shipment, and others are just few key advantages of using metal packing. The growing popularity of using the product for canned food serves to enhance consumption because there is a large demand for canned food, especially in busy urban areas. The product is also widely used in the fragrance sector because of its capacity to handle high pressure and durability. Furthermore, the expanding popularity of luxury products in metal packaging, such as cookies, coffee, tea, and other items, results in increase in the use of metal-based packaging.

One of the most prominent applications of metal packaging is in the food and beverage sector. Cans and tins are widely used to package a range of products, including soft drinks, beer, fruits, vegetables, soups, and sauces. The ability of metal containers to maintain the integrity and flavor of the contents, coupled with their long shelf life, makes them a preferred choice for manufacturers. Additionally, metal packaging is often associated with convenience, as many containers are designed for easy opening and serving.

In the pharmaceutical sector, metal packaging is utilized for its ability to safeguard medicines from contamination and degradation. Aluminum blisters, for instance, are commonly used for packaging tablets and capsules, providing a hermetic seal that protects the contents from moisture and light. This not only enhances the shelf life of pharmaceuticals but also ensures the safety and efficacy of medications, making metal packaging an essential component of drug delivery systems.

Metal packaging is also prevalent in the personal care and cosmetics industry. Products such as aerosol sprays, lotions, and creams are often packaged in aluminum or tin containers. The use of metal not only ensures product integrity but also allows for sophisticated design options, which can enhance brand visibility on retail shelves. The durability of metal packaging also contributes to the safe storage of personal care products, protecting them from external factors that can affect their quality.

Key Takeaways

The metal packaging market study covers 20 countries. The research includes a segment analysis of each country in terms of both value ($million) and volume (kilotons) for the projected period 2020-2030.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global metal packaging markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the metal packaging market.

The metal packaging market is highly fragmented, with several players including Amcor plc., Ardagh Group S.A, Ball Corporation, CPMC Holdings Ltd., Crown Holdings Inc., Greif Incorporated, Metal Packaging Europe, Silgan Holdings Inc., Tata Steel, and Ton Yi Industrial. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the wax market.

Market Dynamics

Increase in demand for the beverage industry is expected to drive the growth of the metal packaging market during the forecast period. The growth of the beverage industry has significantly influenced the demand for metal packaging solutions, particularly in canned drinks. As consumer preferences shift towards convenient and portable beverage options, the popularity of canned products has surged. Metal packaging, especially aluminum cans, offers several advantages that align well with these evolving consumer habits. Cans are lightweight, easily transportable, and provide a secure seal that preserves the freshness and flavor of the beverage, making them an ideal choice for manufacturers.

Additionally, the increasing emphasis on sustainability has further propelled the demand for canned drinks. Consumers are more inclined to choose beverages packaged in metal, as aluminum cans are highly recyclable and contribute to a circular economy. This sustainability aspect resonates particularly well with environmentally conscious consumers, driving brands to adopt metal packaging as part of their eco-friendly initiatives. Many beverage companies actively promote the recyclability of their cans, appealing to a market that values sustainability alongside convenience. In October 2023, Budweiser Brewing Company APAC Limited introduced a "Can-to-Can" recycling initiative in China, aimed at boosting the use of recycled aluminum cans. This program supports the company’s objective of reducing carbon emissions by 35% by 2025. Committed to advancing China's carbon reduction efforts, Budweiser also aims for net-zero emissions across its value chain by 2040. The company's initiatives align with China's national targets to peak carbon dioxide emissions before 2030 and achieve carbon neutrality by 2060, which are expected to enhance the growth of metal packaging solutions in the region.

However, competition from other alternative packaging is expected to hamper the growth of the metal packaging market during the forecast period. As manufacturers continuously seek ways to reduce costs and improve efficiency, many are turning to alternatives like plastic and composite materials. These alternatives often provide advantages such as lower production costs, reduced weight, and enhanced versatility, making them attractive options for brands looking to optimize their packaging solutions. As a result, the metal packaging industry faces increased competition, particularly in sectors where weight and flexibility are crucial considerations. Moreover, the consumer trend toward convenience and portability further fuels the adoption of lightweight packaging. Flexible pouches, for example, are increasingly favored for their easy handling, resealability, and space-saving characteristics. This trend poses a challenge for metal packaging, which, while offering durability and protection, is often heavier and less adaptable than its flexible counterparts. As brands prioritize packaging that aligns with modern consumer lifestyles, the appeal of lightweight materials may limit the market share of traditional metal packaging.

Segments Overview

The metal packaging market is segmented into type, material, application, and region. Depending on type, the market is categorized into cans, caps & closure, barrels & drums, and others. Depending on material, it is fragmented into steel, aluminum, and others. By application, it is classified into food, beverage, healthcare, personal care, and others. Region-wise, it is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

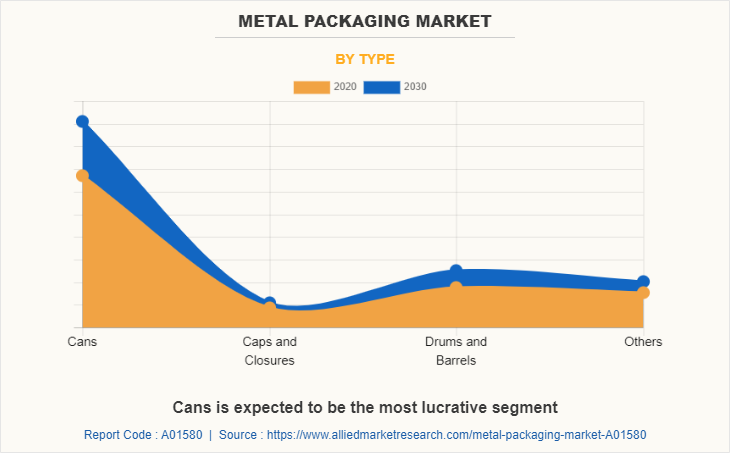

Metal Packaging Market By Type

On the basis of type, the cans segment held the largest share of the global metal packaging market in 2020. Metal packaging, particularly in the form of cans, is widely used across various industries due to its durability, lightweight nature, and recyclability. Cans are predominantly found in the food and beverage sector, where they serve as containers for products such as soft drinks, beer, and canned food. This application not only preserves the freshness and taste of the contents but also provides a barrier against light, moisture, and oxygen, which can degrade the quality of the products. In the food industry, metal cans are utilized for packaging vegetables, fruits, soups, and meats, allowing for extended shelf life without the need for preservatives. The ability to withstand high temperatures during the canning process ensures that the food remains safe for consumption over long periods.

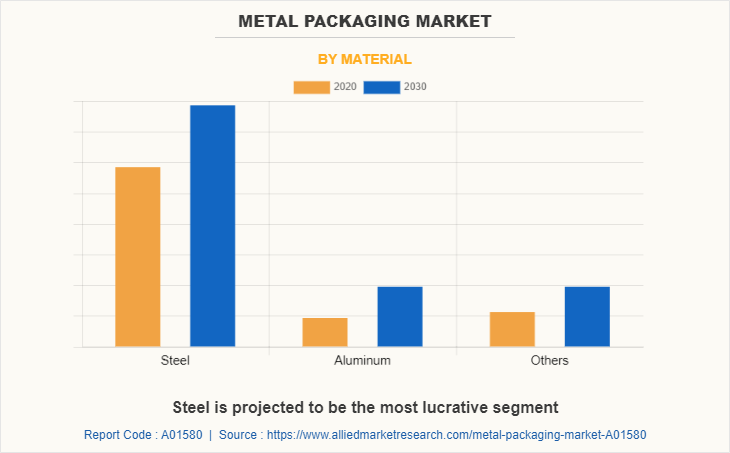

Metal Packaging Market By Material

On the basis of material, the steel segment dominated the metal packaging market accounting for more than half of the market share in 2020. Metal packaging, particularly in the form of steel cans, is widely utilized across various industries due to its durability, recyclability, and ability to preserve products. Steel cans find applications in non-food industries, such as chemicals, personal care, and pharmaceuticals. For instance, they are used to package aerosol products, paints, and household cleaners, ensuring safety and ease of use. The versatility of steel cans also allows for various designs and sizes, catering to different market needs and consumer preferences.

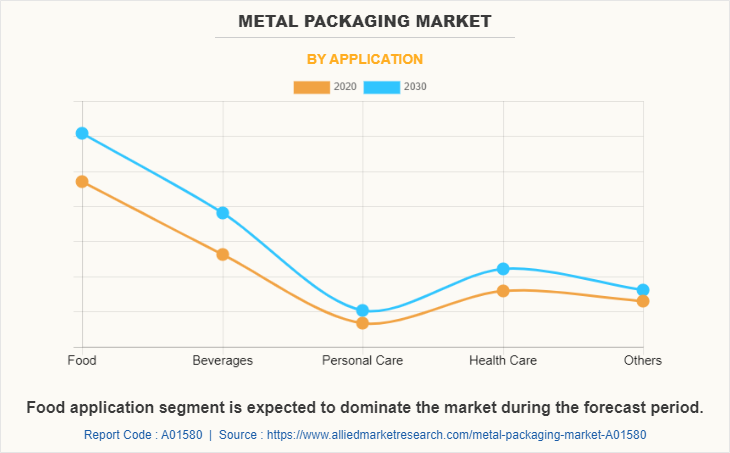

Metal Packaging Market By Application

On the basis of application, the food segment dominated the metal packaging market in 2020. In the beverage industry, metal packaging is predominantly represented by aluminum and steel cans, which are favored for soft drinks, beers, and energy drinks. Aluminum cans are lightweight, recyclable, and provide an excellent barrier against external elements, ensuring the freshness of the beverage inside. The ease of stacking and transportation, combined with the ability to print vibrant graphics directly on the metal surface, allows brands to create eye-catching designs that attract consumers. Moreover, the sustainability aspect of metal packaging has gained significant traction, as both aluminum and steel can be recycled indefinitely without losing quality. This characteristic aligns with the growing consumer demand for environment-friendly packaging solutions.

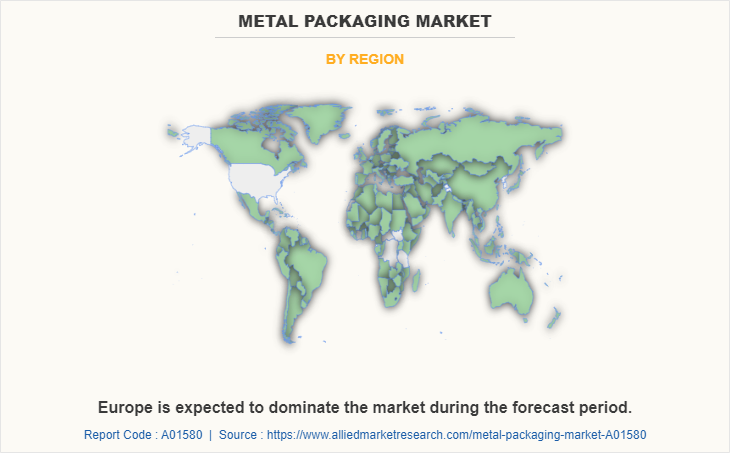

Metal Packaging Market By Region

Region-wise, Europe dominated the metal packaging market in 2020. Metal packaging is a significant sector in Europe, driven by its application across various industries due to its durability, sustainability, and protective qualities. The primary industries utilizing metal packaging in Europe are food and beverages, pharmaceuticals, cosmetics, and personal care. In the food and beverage sector, metal cans are widely used for preserving perishable goods such as vegetables, fruits, meat, and ready-to-eat meals. The beverage industry, particularly for carbonated drinks, beer, and energy drinks, depends heavily on aluminum cans due to their lightweight and recyclable properties. Germany is the largest market for metal packaging in Europe, driven primarily by the food and beverage industry. The country's strong beer and soft drink culture make aluminum cans a preferred choice due to their light weight, recyclability, and excellent preservation properties.

Competitive Analysis

The global metal packaging market analysis covers in-depth information about the major industry participants. The key players operating and profiled in the report include, Amcor plc., Ardagh Group S.A, Ball Corporation, CPMC Holdings Ltd., Crown Holdings Inc., Greif Incorporated, Metal Packaging Europe, Silgan Holdings Inc., Tata Steel, and Ton Yi Industrial.

Industry Trends of Metal Packaging Market

In February 2024, Ardagh Metal Packaging partnered with Britvic Soft Drinks to introduce an innovative, high-end design for the new Tango Mango cans. The striking visual design aims to enhance the brand's consumer experience by creating a more captivating and premium aesthetic.

In June 2024, Sonoco Products Company, a global leader in sustainable packaging, announced its agreement to acquire Eviosys, a European supplier of food cans, ends, and closures, from KPS Capital Partners for $3.9 billion. Sonoco highlighted that this acquisition aligns with its strategy to focus on core business growth while pursuing high-return opportunities through both internal expansion and strategic external acquisitions.

In October 2023, Colep Packaging entered a joint venture with Envases Group to establish an aerosol packaging plant in Mexico. This strategic collaboration aims to leverage both companies' expertise to better serve customers across North and Central America while enhancing competitiveness by increasing production capacity and expanding their product offerings.

In November 2023, Mauser Packaging Solutions announced its agreement to acquire Taenza SA de CV, a Mexico-based manufacturer specializing in tin-steel aerosol cans and steel pails. This acquisition aims to enhance Mauser's service capabilities by leveraging Taenza’s industry expertise and strong local presence to better meet customer needs.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the metal packaging market analysis from 2020 to 2030 to identify the prevailing metal packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the metal packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global metal packaging market trends, key players, market segments, application areas, and market growth strategies.

Metal Packaging Market Report Highlights

| Aspects | Details |

| By Material |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Metal Packaging Europe, Ton Yi Industrial, cpmc holdings ltd, Greif Incorporated, Ball Corporation, Amcor plc, Silgan Holdings Inc, Ardagh Group S.A, Crown Holdings Inc, Tata Steel |

Analyst Review

Metal packaging is an integral part of the packaging and preservation process. Metal packaging has seen a significant increase in popularity over the last few years as customers have become more health concerned. Metal packaging is utilized in a variety of ways globally. Cans are one of the most extensively used types of metal packaging, and in recent years, have become a significant element of the human diet in both, industrialized and developing countries. It is more valuable in places where there is no or limited refrigeration for preserving food. It's a way to keep foods, pharmaceuticals, chemicals, and other items safe from microbial degradation. Metal packaging has a lucrative business opportunity, since it has excellent printability, is cost effective for high speed filling & packaging, and has glossy & high aesthetic value over other packaging materials.

Food & beverage industries is projected to increase the demand for metal packaging market

Type, material and application segment are covered in metal packaging market report

Growth in industrialization is expected to trigger the demand for bulk packaging such as drums and barrels are some of the key factors driving the growth of the market.

Food packaging are the major applications which are expected to drive the adoption of metal packaging

Import and export activities were significantly impacted, which, in turn, adversely affected the industries using metal packaging, thereby affecting the metal packaging market.

Amcor plc., Ardagh Group S.A, Ball Corporation, CPMC Holdings Ltd., Crown Holdings Inc., Greif Incorporated, Metal Packaging Europe are the top players in metal packaging market.

The global metal packaging market was valued at $147.4 Billion in 2030

Rapid growth in industrialization, changes in lifestyle, and rise in demand for processed canned food are anticipated to fuel the growth of metal packaging in industrial and commercial sectors.

Loading Table Of Content...