Mexico Automotive Composites Market Research, 2033

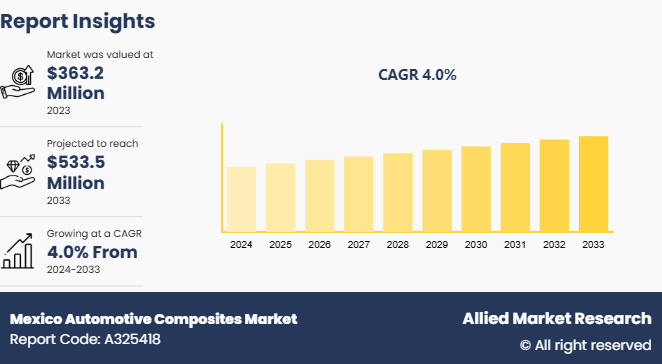

The Mexico automotive composites market was valued at $363.2 million in 2023, and is projected to reach $533.5 million by 2033, growing at a CAGR of 4% from 2024 to 2033.

Market Introduction and Definition

Automotive composites are advanced materials made by combining two or more distinct components. It is typically a reinforcement material of carbon or glass fibers and a matrix material such as resin or thermoplastics. These composites are engineered to enhance the strength, durability, and lightweight properties of automotive parts. Manufacturers produce lighter vehicles by using composites, which leads to improved fuel efficiency, better handling, and reduced emissions. In addition, automotive composites offer excellent corrosion resistance, design flexibility, and the ability to absorb & distribute impact forces that make them ideal for both structural and aesthetic applications in modern vehicles.

Key Takeaways

- The Mexico automotive composites market study includes a segment analysis in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major Mexico automotive composites industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The growth in the automotive manufacturing industry in Mexico drives the demand for automotive composites in the country. Mexico has become a major hub for global automotive production, attracting significant investments from leading automakers, including General Motors, Ford, Volkswagen, Toyota, and BMW, among others. These manufacturers are producing vehicles for the domestic market and using Mexico as a strategic base for exports to North America, Latin America, and beyond, taking advantage of trade agreements such as the USMCA (United States-Mexico-Canada Agreement) . All these factors are expected to drive the growth of the Mexico automotive composites market during the forecast period.

However, the limited supply chain infrastructure in Mexico poses a significant challenge to the growth of the automotive composites market. While Mexico has established itself as a global hub for automotive manufacturing, the country’s supply chain for advanced materials such as automotive composites is still underdeveloped. Automotive composites such as carbon fiber-reinforced plastics (CFRP) and glass fiber-reinforced plastics (GFRP) , require specialized raw materials, advanced manufacturing technologies, and precision logistics elements that are not yet fully integrated into Mexico’s existing automotive supply chain. All these factors hamper the growth of the Mexico automotive composites market.

In Mexico, the increase in focus on electric vehicles (EVs) creates opportunities for sustainable automotive composites. EVs require lightweight materials to offset the weight of batteries and maximize range, however, there is growing pressure to ensure that these materials are environmentally friendly. Sustainable composites such as natural fiber-reinforced plastics made from flax or hemp, or bio-based resins, are gaining traction as viable alternatives to traditional composites derived from fossil fuels. Mexican automotive manufacturers tap into this opportunity by incorporating these sustainable materials into their production lines, meeting both performance and environmental objectives. All these factors are anticipated to offer new growth opportunities for the Mexico automotive composites market during the forecast period.

Market Segmentation

The Mexico automotive composites market is segmented into fiber type, resin type, and application. By fiber type, the market is classified into glass fiber, carbon fiber, and others. By resin type, the market is divided into thermosets and thermoplastics. By application, the market is categorized into exterior, interior, and others.

Passenger Vehicle Sales in Mexico

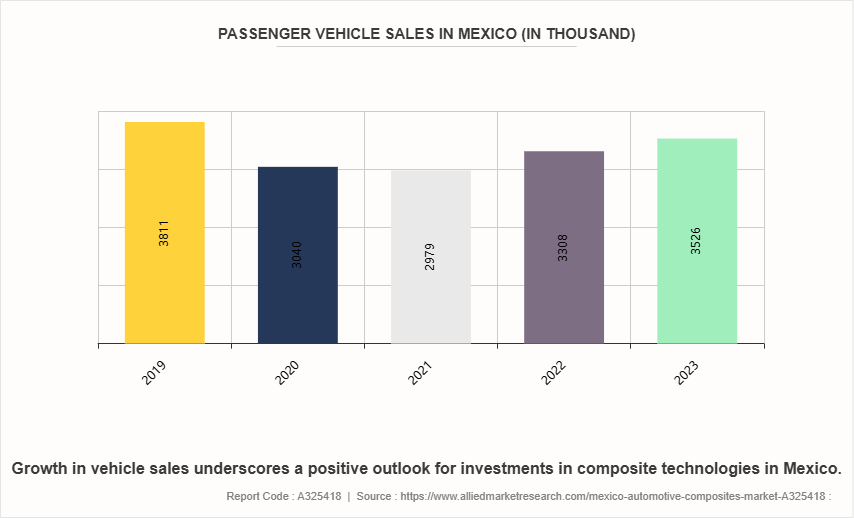

The fluctuating trends in passenger vehicle sales in Mexico, as evidenced by the data from 2019 to 2023, significantly impact the automotive composites market. Despite a dip in sales during 2020 and 2021, likely attributed to the global pandemic and supply chain disruptions, the subsequent recovery in 2022 and 2023, with sales rebounding to 3, 308 and 3, 526 thousand units respectively, indicates a resurgence in consumer demand and automotive production. This upward trajectory suggests increased opportunities for automotive composites, as manufacturers seek to enhance vehicle performance and efficiency through lightweight materials. As the automotive industry focuses on improving fuel economy and reducing emissions particularly with the growing push towards electric vehicles which drive the demand for advanced composites in Mexico. Moreover, the steady growth in vehicle sales underscores a positive outlook for investments in composite technologies, further solidifying their role in the evolving automotive landscape.

Competitive Landscape

The major players operating in the Mexico automotive composites market include Toray Industries, Inc, TEIJIN AUTOMOTIVE TECHNOLOGIES, Hexcel Corporation, SGL Carbon, Mitsubishi Chemical Corporation, Solvay S.A., Huntsman Corporation, Owens Corning, Plasan, and Gurit Services AG.

Key Sources Referred

- International Trade Administration

- Sociedad Mexicana de Materiales A.C.

- Center for Automotive Research

- Institute for New Economic Thinking

- Automotive Industry Action Group

- New Mexico Automotive Dealers Association

Key Benefits for Stakeholders

- Enable informed decision-making process and offer market analysis based on current market situation and estimated future trends.

- Analyze the key strategies adopted by major market players in Mexico automotive composites market.

- Assess and rank the top factors that are expected to affect the growth of Mexico automotive composites market.

- Top Player positioning provides a clear understanding of the present position of market players.

- Detailed analysis of the Mexico automotive composites market segmentation assists to determine the prevailing market opportunities.

- Identify key investment pockets for various offerings in the market.

Mexico Automotive Composites Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 533.5 Million |

| Growth Rate | CAGR of 4% |

| Forecast period | 2024 - 2033 |

| Report Pages | 310 |

| By Fiber Type |

|

| By Resin Type |

|

| By Application |

|

| Key Market Players | SGL Carbon, Solvay S.A., Owens Corning, TEIJIN AUTOMOTIVE TECHNOLOGIES, Hexcel Corporation, Toray Industries, Inc, Huntsman Corporation, Mitsubishi Chemical Corporation, Plasan, Gurit Services AG |

The Mexico Automotive Composites Market is projected to grow at a CAGR of 4 % from 2024 to 2033

Toray Industries, Inc, TEIJIN AUTOMOTIVE TECHNOLOGIES, Hexcel Corporation, SGL Carbon, Mitsubishi Chemical Corporation, Solvay S.A., Huntsman Corporation, Owens Corning, Plasan, Gurit Services AG are the leading players in Mexico Automotive Composites Market

Interior is the major application in the Mexico Automotive Composites Market

Mexico Automotive Composites Market is classified as by fiber type, by resin type, by application

Loading Table Of Content...