Micro EV Market, 2031

The global micro electric vehicle market size was valued at $8.9 billion in 2021, and is projected to reach $24.3 billion by 2031, growing at a CAGR of 10.8% from 2022 to 2031.

A micro electric vehicle (micro-EV) is a one- or two-seater vehicle powered by compact battery pack with electric propulsion power. Micro-EVs are small electric vehicles that can carry one or two persons with their luggage. They address transportation difficulties such as parking and congestion. These are ecologically sustainable solutions that are also socially responsible and far less expensive than all other modes of transportation.

Micro electric vehicles offer advantages such as small size for congested road and minimal parking space, great maneuverability, low emissions, ease of usage, and affordable initial and recurring costs. Furthermore, the younger generation seeks mobility services that serve a specific purpose, and micro-EVs could meet these needs. They could also serve as an inexpensive alternative to e-bikes and EVs, as micro-EV prices remain much lower than those of other EV types, and certain models are competitively priced when compared to regular EVs.

Supportive government rules and credits have played an important part in boosting the global adoption of micro electric vehicles. Governments throughout the world have adopted a range of policies and incentives to encourage customers to purchase micro EVs to overcome concerns like high initial investment and insufficient charging infrastructure. The surge in transportation demand in developing economies creates an opportunity for micro EV market.

They offer an economical, effective, and environmentally responsible alternative for individuals and businesses looking for a suitable means of transportation in congested urban regions. While there are barriers to the broad adoption of these cars, the potential benefits make it a promising prospect for innovation and growth in the transportation business.

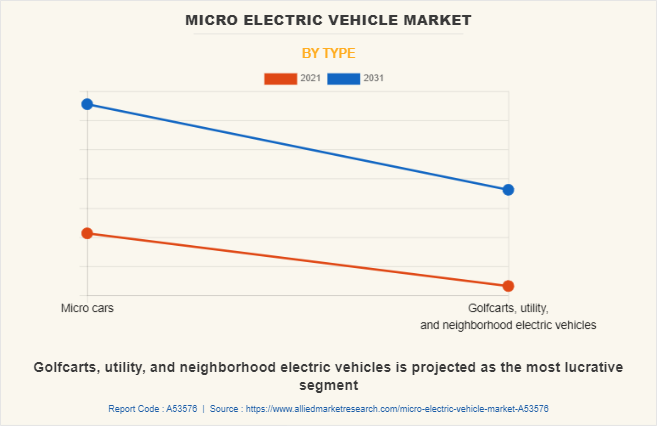

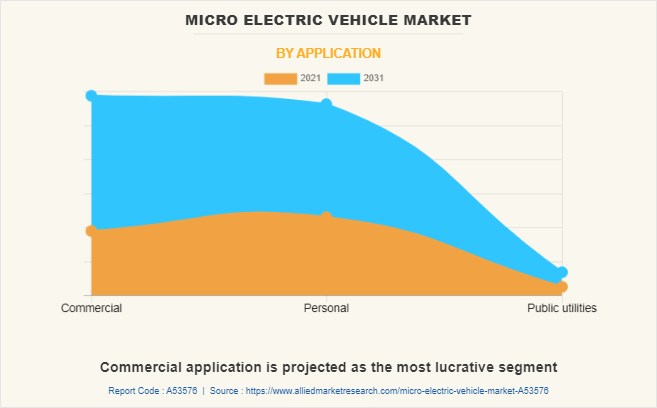

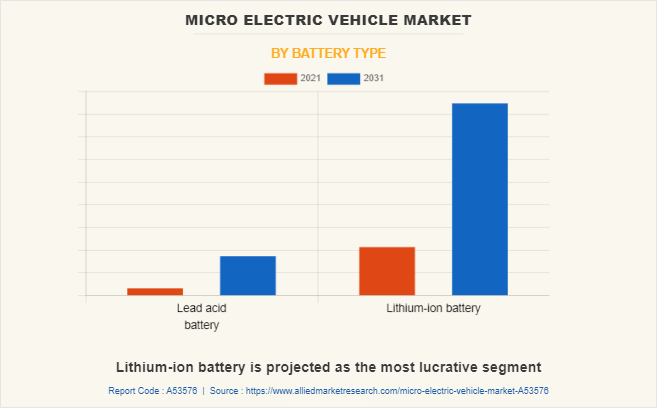

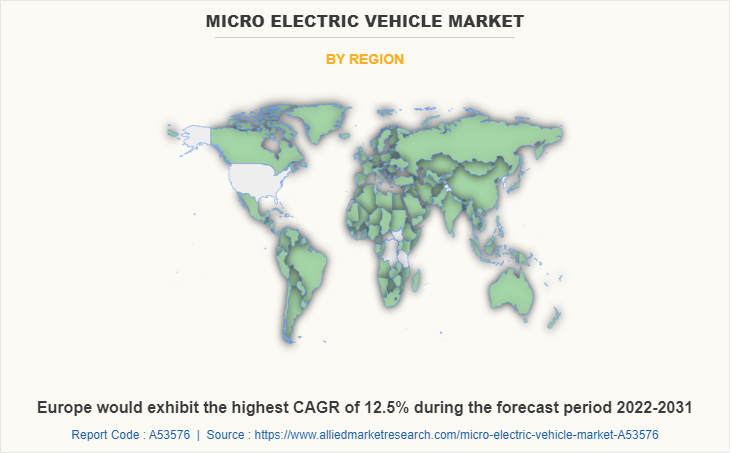

The micro electric vehicle market is segmented based on battery type, application, type, and region. By battery type, it is segmented into lead acid and lithium-ion. As per application, it is classified into commercial, personal, and public utilities. Depending on type, it is categorized into microcars; and golf, utility, and neighborhood electric vehicles. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The Asia-Pacific micro EV market is rapidly expanding, with various countries at different stages of development. China is the largest market for micro electric vehicles, with domestic automakers offering a diverse range of models backed by government subsidies and programs. Japan is also a significant market, with big corporations introducing micro-vehicles and expanding their footprint throughout the country.

Micro electric cars are gaining traction in China because of their small dimensions, low emissions, and low cost. Micro electric vehicles are well-suited for driving in China's congested urban areas, where traffic jams and air pollution are big concerns. Subsidies, tax breaks, and the building of charging stations have been introduced by the Chinese government to encourage the use of electric vehicles, especially micro electric cars.

Numerous Chinese automobile manufacturers have entered the micro electric vehicle industry, offering a diverse selection of models with various features and costs to increase their micro electric vehicle market share. For example, in July 2020, SAIC-GM-Wuling Automobile (SGMW) unveiled the Hong Guang MINI EV, which immediately became one of China's best-selling micro electric cars, with over 270,000 units sold in 2021.

The MINI EV has a single charge range of up to 170 kilometers (106 miles) with a starting price of roughly $4,200. (RMB 28,800). These vehicles provide consumers with a cost-effective and environmentally sustainable option for city driving. Furthermore, in recent years, manufacturers such as NIO, BYD, and Geely have been developing tiny electric cars, which have further fueled the growth of the micro electric market in China. Therefore, automotive manufacturers' support, government-beneficial policies in China, and the rise in demand for micro electric vehicles have created a positive environment for the growth of the micro electric car industry.

Major Japanese companies launched micro vehicles and expanded their presence across the country. For instance, in December 2021, Toyota announced the expansion of sales of its ultra-compact battery electric vehicle, the "C+pod," to all corporate and government customers, as well as the wider public. The ecologically friendly two-seat BEV (battery electric vehicle) is ideal for short routes with few passengers. It will be available through Toyota dealers and rental companies throughout Japan via lease contracts.

Key players operating in the global micro EV market include Toyota Motor Corporation, Yamaha Golf-Car Company, Italcar Industrial S.r.l., Renault Group, Textron Inc., Polaris Inc., Club Car, LLC, PMV Electric Private Ltd., Shandong Shifeng (Group) Co., Ltd., and Mahindra Electric Mobility Limited.The prominent companies operating in the market are adopting strategies such as product launch, contracts, and expansion to strengthen their market position. In November 2022, PMV Electric, India's newest electric vehicle manufacturer launched a new electric four-wheeler namely, "Eas-E".

Supportive Government Policies and Incentives

Numerous governments throughout the world are implementing laws and incentives to encourage the use of electric vehicles, including micro electric vehicles. Tax exemptions, rebates, and subsidies are available to both consumers and manufacturers. To address high initial investment and insufficient charging infrastructure issues, governments around the world have enacted a variety of laws and incentives to encourage customers to buy micro EVs.

For instance, in July 2021, the UK government released a 2035 delivery plan, in combination with the transport decarbonization plan. This plan details the investments and policies being implemented by the government to facilitate the shift toward zero-emission vehicles and vans. Moreover, in March 2022, the government published Taking Charge: The Electric Car Infrastructure Strategy, which outlined the objective of eliminating charging infrastructure as a perceived and real obstacle to the adoption of electric vehicles. In addition, in June 2022, the availability of charging infrastructure was also included in the Building Regulations 2010 modifications.

Furthermore, the US government implemented many subsidiaries and incentives for the purchase of EVs. For instance, from January 1, 2023, the Clean Vehicle Credit (CVC) rule eliminated manufacturer sales limitations, broadened the scope of qualifying vehicles to include both electric vehicles (EV) and fuel cell electric vehicles (FCEV), and required at least a traction battery of 7 kilowatt-hours (kWh). For a vehicle that draws propulsion energy from a battery with at least 7 kWh of capacity, the CVC tax credit is $417, plus an extra $417 for each kilowatt hour of battery capacity more than 5 kWh. The maximum tax credit allowed for a vehicle is $7,500.

Growing Environmental Awareness

Rise in environmental awareness is one of the primary drivers for the growth of the micro electric car market. Many people are seeking ways to minimize their carbon footprint as they become more aware of climate change and environmental deterioration. Micro electric vehicles provide a clean and sustainable means of transportation that emits no pollutants and lowers reliance on fossil fuels.

In addition, many developed and developing countries have initiated plans to phase out gasoline and diesel engine powered vehicles in 10-30 years. For instance, in March 2023, the European Union decided to phase out new fossil-fuel vehicles by 2035. This means that gasoline and diesel vehicles will no longer be sold. Numerous other countries are also planning to cease selling these types of vehicles. Some EU countries, including Ireland, the Netherlands, and Sweden, plan to transition to zero-emission vehicles by 2030. Britain, Israel, and Singapore plan to restrict the sale of new gasoline and diesel vehicles in 2030.

China has taken the lead in the manufacturing of battery electric vehicles, with hundreds of companies producing cars and generous public subsidies available. India also plans for electric automobiles to make up 30% of sales in 2030. Chile, a significant supplier of lithium used in batteries, has plans for 2035. In addition, micro electric vehicles can help to minimize noise pollution in metropolitan areas. They are much quieter than conventional vehicles because they run on electricity, making them perfect for usage in highly crowded places.

Moreover, the growing environmental consciousness is also reflected in the emergence of shared mobility services, including car-sharing and bike-sharing, which are becoming increasingly popular in cities around the world. Many of these services are now introducing micro electric vehicles into their fleets as a practical and sustainable method to get around in congested urban areas.

Therefore, growing environmental awareness is a crucial driver behind the increasing demand for micro electric vehicles, as more people seek out sustainable and eco-friendly ways of transportation. Recent instances from Ireland, the Netherlands, Sweden, India, and China demonstrate that governments are taking steps to encourage the adoption of these vehicles and that customers are responding positively. It is expected that this sector will continue to grow in the coming years as battery technology improves and more shared mobility providers add tiny electric vehicles to their fleets.

Urbanization and traffic congestion are driving the micro electric vehicle market. As more people move to cities, traffic congestion increases, creating obstacles for commuters to travel efficiently and quickly. Because micro electric vehicles are compact, efficient, and emit zero emissions, they are an attractive prospect for city commuters. Micro electric vehicles have emerged as a viable solution to urban pollution and traffic congestion.

Furthermore, microcars have numerous practical advantages. One of the primary benefits of micro electric vehicles is their small size, which allows them to be used for short trips and park in tight locations, significantly decreasing traffic congestion and parking issues. Toyota and Citroen have already built microcars with electric engines to help cities combat pollution and traffic congestion.

The market provides a variety of models, including the Microlino, a Swiss-made electric vehicle with two seats that measures under 2.4 meters. Another product on the market is the Toyota C+Pod, which has a length of 2.5 meters and seats two people. Hence, micro electric vehicles provide practical benefits such as compact size and cheap maintenance costs, making them an excellent solution for traffic congestion and parking concerns in large cities.

The micro electric vehicle market is segmented into Battery Type, Type and Application.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the micro electric vehicle market analysis from 2021 to 2031 to identify the prevailing micro electric vehicle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the micro electric vehicle market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global micro electric vehicle market trends, key players, market segments, application areas, and market growth strategies.

Micro Electric Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 24.3 billion |

| Growth Rate | CAGR of 10.8% |

| Forecast period | 2021 - 2031 |

| Report Pages | 257 |

| By Battery Type |

|

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Yamaha Golf-Car Company, Polaris Inc., Renault S.A., PMV Electric Pvt. Ltd., Shandong Shifeng (Group) Co., Ltd., Club Car, LLC, Textron Inc., Mahindra Electric Mobility Limited, Italcar Industrial S.r.l., TOYOTA MOTOR CORPORATION |

Analyst Review

Shifting consumer preferences are a key driver for the micro electric vehicle market as consumers increasingly seek more sustainable and eco-friendly transportation options that are affordable, convenient, and low emission. Micro electric cars meet these criteria and are becoming increasingly popular as alternatives to traditional gas-powered vehicles.

Moreover, as younger generations become more environmentally conscious and tech-savvy, they are increasingly seeking out products and services that align with their values and lifestyle. Micro EVs offer a unique combination of sustainability, convenience, and innovation that appeals to this demographic. Many models come under European L6e light electric quadricycle and L7e electric quadricycle certification, such as the Zero Junior Minimax 45 and Minimax 80. These micro electric vehicles can be driven by age group above 16 years, which attracts major teenage groups toward micro electric vehicles. Micro electric vehicles are frequently smaller and more agile than standard vehicles, making them easier to park and operate in congested urban environments. They are also less expensive to buy and maintain than bigger electric or gas-powered vehicles, making them an appealing option for budget-conscious buyers.

Furthermore, advances in battery technology have made micro electric automobiles more feasible and convenient for everyday use. Because of their reduced size and shorter-range needs, micro electric vehicles eliminate one of the key hurdles to electric vehicle adoption. Therefore, increasing customer preferences toward more sustainable, convenient, and affordable transportation options are propelling the micro electric motor vehicle industry forward.

The global micro electric vehicle market was valued at $8.9 billion in 2021, and is projected to reach $24.3 billion by 2031, registering a CAGR of 10.8% from 2022 to 2031.

Some leading companies in the market include Toyota Motor Corporation, Yamaha Golf-Car Company, Italcar Industrial S.r.l., Renault Group, Textron Inc., Polaris Inc., Club Car, LLC, PMV Electric Private Ltd., Shandong Shifeng (Group) Co., Ltd., and Mahindra Electric Mobility Limited.

The leading application of micro electric vehicles is personal mobility.

The largest regional market for micro electric vehicles is Asia-Pacific.

The upcoming trends in the micro electric vehicle market include supportive government policies and incentives, growing environmental awareness, and expansion of micromobility services.

Loading Table Of Content...

Loading Research Methodology...