Microsurgery Market Research, 2033

The global microsurgery market size was valued at $2.7 billion in 2023, and is projected to reach $4.8 billion by 2033, growing at a CAGR of 6% from 2024 to 2033. The microsurgery market is driven by advancements in medical technology, an increase in demand for minimally invasive procedures, and a rise in prevalence of chronic diseases requiring precise surgical interventions. Innovations in surgical instruments and imaging techniques enhance surgical accuracy, supporting the microsurgery market growth. In addition, increased healthcare spending and improved access to specialized procedures further expand the market. The aging population and surge in the number of reconstructive and cosmetic surgeries contribute to market growth

Market Introduction and Definition

Microsurgery is a highly specialized surgical field that involves intricate procedures using advanced magnification and precise instruments to repair small and delicate structures, such as nerves, blood vessels, and other tissues. It is commonly used in reconstructive, ophthalmic, neurological, and vascular surgeries, allowing for enhanced accuracy in treating complex conditions that would otherwise be challenging or impossible to address. Microsurgery equipment includes operating microscopes, micro-forceps, micro-scissors, and micro-needles, all designed for stability and precision in tiny surgical areas. Advanced robotic systems and microsurgical instruments with ergonomic designs are also becoming essential, providing surgeons with improved control and dexterity. These tools enable the successful reconnection of tiny blood vessels and nerves, promoting quicker recovery and lessening complications. Ongoing advancements in microsurgery technology, such as robotic assistance and high-definition imaging, are further expanding its applications, improving patient outcomes in both medical and cosmetic fields.

Key Takeaways

- The microsurgery market share study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major microsurgery industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

According to microsurgery market forecast analysis the key factors driving the growth of the market are the increase in prevalence of chronic diseases, rise in demand for minimally invasive procedures, aging population, and rise in incidence of trauma cases. The increasing prevalence of chronic diseases is a major driver for the growth of the microsurgery market, as these conditions often necessitate advanced surgical interventions. According to the National Cancer Institute, in 2022, there were almost 20 million new cases and 9.7 million cancer-related deaths worldwide. Chronic diseases such as cardiovascular disorders, diabetes, and cancer frequently result in complications requiring delicate surgical procedures, including tissue reconstruction, vascular repair, and nerve regeneration. For instance, diabetic patients with severe complications such as diabetic foot ulcers or peripheral neuropathy may require microsurgical techniques to restore function and prevent amputations.

In addition, according to microsurgery market opportunity analysis, rise in demand for minimally invasive procedures is a major driver for the market, as these techniques offer numerous advantages over traditional surgical methods. Patients and healthcare providers increasingly prefer minimally invasive approaches due to reduced trauma, shorter recovery times, and lower risks of complications. These procedures typically involve smaller incisions, leading to less post-operative pain, minimal scarring, and quicker returns to daily activities. Advances in microsurgical tools and technologies, such as precision instruments and high-resolution imaging systems, have further enhanced the feasibility and effectiveness of these procedures. In addition, rise in prevalence of chronic diseases, such as cancer and cardiovascular disorders, has increased the need for advanced surgical interventions that preserve healthy tissue while targeting affected areas. The shift towards outpatient care, which aligns with the cost-efficiency and shorter hospital stays associated with minimally invasive microsurgery, is also fueling the microsurgery market growth.

Moreover, the rise in the aging population is a major driver for the growth of the microsurgery market, primarily due to rise in prevalence of age-related health conditions and degenerative diseases that require specialized surgical intervention. As people age, they face a higher chance of developing conditions like cardiovascular diseases, cancers, and neurological disorders, which often demand precise surgical solutions for effective treatment. Microsurgery, which enables highly detailed, minimally invasive procedures, is particularly suited to treating elderly patients who may be at higher risk for complications from traditional surgeries.

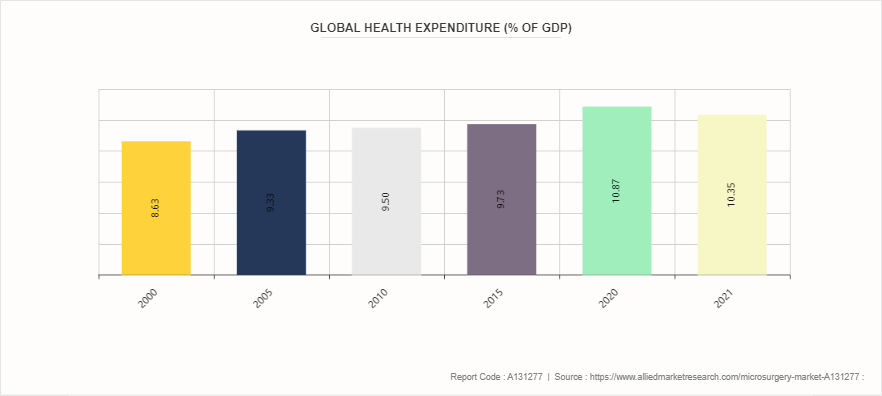

Growing Healthcare Expenditure

The growing healthcare expenditure has emerged as a major driver for the microsurgery market size, enabling advancements in surgical technologies and improving access to specialized procedures. Increased funding in healthcare systems globally has facilitated the adoption of state-of-the-art microsurgical equipment, allowing for more precise and minimally invasive surgeries. This trend is particularly significant in developed nations, where higher healthcare budgets are allocated to cutting-edge medical interventions, and in developing regions, where governments and private entities are investing heavily to modernize healthcare infrastructure. Moreover, the rise in spending on healthcare has encouraged research and development in microsurgical techniques, leading to innovations that enhance surgical outcomes and reduce patient recovery times. As healthcare expenditure continues to rise, the demand for advanced microsurgical procedures for treating complex conditions, such as cancer, vascular diseases, and neurological disorders, is expected to grow, further driving market expansion.

Market Segmentation

The microsurgery industry is segmented on the basis of equipment, procedure, application, end user, and region. By equipment, the market is classified into operating microscopes, micro sutures, micro forceps, microsurgery needle holder, and others. By procedure, the market is classified into transplantation, suture & grafting, free tissue transfer, and others. By application, the market is divided into orthopedic, neurology, gynecological & urological, microsurgery, ophthalmic, plastic & reconstructive, oncology, and others. By end user, the market is divided into hospitals & clinics, ambulatory surgical centers, academics and research institutes, and others. Region-wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America dominated the microsurgery market share in 2023, owing to well-established healthcare facilities, growing prevalence of chronic diseases, and high healthcare spending in North America. However, Asia-Pacific is expected to register the highest CAGR during the forecast period. The region is experiencing a rise in incidence of cancer due to lifestyle changes, urbanization, and aging population. This trend is leading to a greater demand for minimally invasive procedures, thereby driving the need for microsurgery. Countries such as India and Thailand are becoming popular destinations for medical tourism. The growing number of international patients seeking advanced medical care is boosting the demand for microsurgery in Asia-Pacific.

- According to the National Cancer Center of Japan, there were estimations of 1, 019, 000 new cancer cases and 380, 400 cancer deaths in 2022.

- According to the Government of India, the medical tourism in India has increased by 175.41% from 2020 to 2023.

- According to the European Commission, as of 1 January 2023, around 21.3% of total European population was aged 65 years and over.

- According to Invest India’s Investment Grid, there are nearly 600 investment opportunities worth $32 billion in the country’s hospital/medical infrastructure sub-sector

Industry Trends

- For instance, in October 2023, Microsure secured $40 million funding for the development of a microsurgical robot called Musa-3 to offer surgeons precision and stability during procedures.

- According to American Society of Plastic Surgeons, in 2023 there were about 2% growth in head and neck reconstruction (including microsurgical) and 1% growth in lower extremity reconstruction (including microsurgical) .

- According to Center of Disease Control and Prevention, in 2022, 702, 880 people died from heart disease in the U.S.

- According to World Cancer Research Fund International, breast cancer accounted for 2, 296, 840 new cases in 2022.

- According to an article published by the NCBI in October 2021, an estimated 22.6 million patients suffer from neurological disorders or injuries that further need a neurosurgeon's expertise, of which 13.8 million require surgery.

Competitive Landscape

Microsurgery market report summarizes top key players overview including HAAG-STREIT GROUP, Olympus Corp, Leica Microsystems, B. Braun Melsungen Inc., Accurate Surgical & Scientific Instruments Corp, Surtex Instruments Ltd., Scanlan International, Carl Zeiss AG, KLS Martin Group, Topcon Corp, and Integra LifeSciences. Other players in the microsurgery market are Alcon Inc., and Johnson & Johnson.

Recent Key Strategies and Developments

- In October 2023, Micro Medical Devices (MMD) , Inc. collaborated with Device Technologies to distribute Symani system in the Philippines, Hong Kong, Singapore, Thailand, Vietnam, Malaysia, Indonesia, Macau, and New Zealand.

- In October 2022, a segment of Zeiss Group, which is the parent company of Carl Zeiss Meditech AG, announced a new microsite featuring nine researchers and 24 areas of study. This announcement was made to celebrate the breakthrough achieved by Zeiss instruments.

- In July 2022, Micro Medical Devices (MMD) , Inc., secured 75 million to expand the commercialization of its Symani microsurgery system in the U.S.

- In October 2021, Leica Microsystems announced the launch of a new generation of its M320 dental microscope, which offers ultra-high-resolution imaging with an integrated camera. The product was expected to enhance the outcome of dental treatments and increase a dentist’s comfort while working.

- In November 2023, Surtex Instruments Limited launched the Infinex instrument series that consists of micro scissors, forceps, and needle holders for microsurgeries.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the microsurgery market analysis from 2024 to 2033 to identify the prevailing microsurgery market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the microsurgery market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global microsurgery market trends, key players, market segments, application areas, and market growth strategies.

Microsurgery Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 4.8 Billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Equipment |

|

| By Procedure |

|

| By Application |

|

| By End User |

|

| By Region |

|

| Key Market Players | Olympus Corporation, KLS Martin Group, B. Braun Melsungen Inc, Leica microsystems, HAAG-STREIT GROUP AG, Accurate Surgical & Scientific Instruments Corporation, Carl Zeiss AG, Scanlan International, Inc., Integra LifeSciences Holdings Corporation, Surtex Instruments Ltd |

The total market value of Microsurgery market is $2.7 billion in 2023

The forecast period for Microsurgery market is 2024-2033.

The market value of Microsurgery market in 2033 is projected to reach $4.8 billion by 2033

The base year is 2023 in Microsurgery market

The Microsurgery market growth is driven by increase in prevalence of chronic diseases, rise in demand for minimally invasive procedures, aging population, and rise in incidence of trauma cases

Loading Table Of Content...