Military Cybersecurity Market Research, 2033

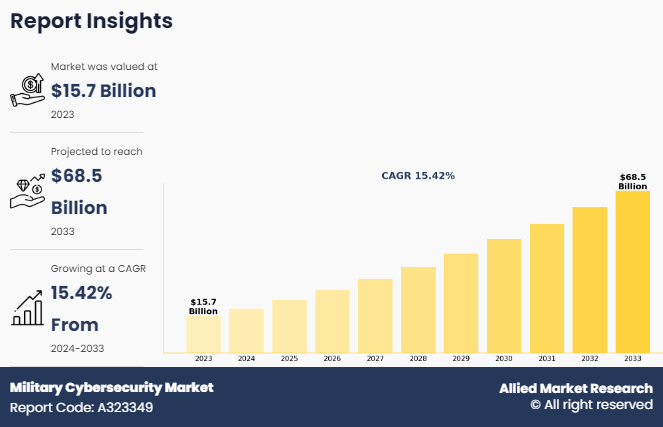

The global military cybersecurity market Size was valued at $15.7 billion in 2023, and is projected to reach $68.5 billion by 2033, growing at a CAGR of 15.4% from 2024 to 2033.

Report Key Highlighters

- The military cybersecurity market studies more than 16 countries. The analysis includes a country-by-country breakdown analysis in terms of value ($million) available from 2022 to 2032.

- The research combined high-quality data, professional opinion, and research, with significant independent opinion. The research methodology aims to provide a balanced view of the global market, and help stakeholders make educated decisions to achieve ambitious growth objectives.

- The research reviewed more than 3,700 product catalogs, annual reports, industry descriptions, and other comparable resources from leading industry players to gain a better understanding of the market.

- The military cybersecurity market share is marginally fragmented, with players such as AT&T, BAE Systems, Boeing, Cisco Systems, Inc., DXC Technology Company, EclecticIQ B.V., IBM Corporation, Intel Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Privacera, Inc., SentineIOne, Secureworks, Inc., and Thales Group. Major strategies such as contracts, partnerships, expansion, and other strategies of players operating in the market are tracked and monitored.

Increase in Demand for Defense IT Expenditure is Boosting the Market Growth

Defense IT expenses are on the surge across various developed economies such as U.S., France, UK, and China. According to an analysis from Govini, a data science firm, in July 2021, the U.S. department of defense requested a 7.8% increase in its 2022 fiscal year budget for IT. The total defense IT expenditure in the U.S. has been growing since 2019. Thus, growth in the use of IT hardware, software, and services have implemented several changes in the defense sector, including real-time combat surveillance, superiority in air & space, smart weapons and battlefield management in a network-centric environment, and force multipliers-related software.

Furthermore, implementing IT solutions in defense operations has become significant, owing to the growing evolution in the type and occurrence of attacks across the globe. This is anticipated to surge in demand for innovative and modern technologies such as 5G, artificial intelligence, cloud computing, data analytics, cyber security, and autonomous systems across various defense systems. Such initiatives lead to the increase in demand for defense IT expenditure, which in turn propels the military cybersecurity industry.

Limited Awareness Related to Cybersecurity are Restricting the Market Growth

The government workforce is the first line of defense against intrusion by criminals, offenders, or antagonistic nations. The internet has made it simpler for antagonists worldwide to attack even the municipality, department, or agency.

Countries with archaic IT technology are easy targets for ransomware attacks or malware infections. Thus, hackers hit under-prepared government bureaucrats with malware, email phishing scams, or stolen passwords to break in and steal confidential and vital government data or lock up critical systems required for operations and services.

For instance, phishing scams are the act of using fake text messages or emails to trick people into clicking on sketchy website links to steal personal information. Government officials must be conscious of the precise ways to avoid cyber-attacks and are constantly kept aware of and involved in the topic. Without suitable training, any government official can make the silly but possibly disturbing error of clicking on a deceitful email or website link. Hence, owing to the limited awareness related to cyber security is expected to hamper the military cyber security market.

Adoption of IoT in Cyber Security Technology Will Create Lucrative Growth Opportunities

Several countries use IoT in military and defense applications to resolve difficulties during conflict and combat. The internet of military things (IoMT), or internet of battlefield things (IoBT), is a kind of IoT used in current warfare and information warfare. IoMT is taking off a lot of physical and mental stress in the field by building a small ecosystem of smart technology that can process sensory data and handle many tasks at once. Its main objective is to solve difficulties that come up during modern conflict.

For instance, in July 2022, the Government of India (GoI) launched 75 newly developed artificial intelligence (AI) products or technologies. The government has already set up the defense artificial intelligence council (DAIC) and targets to give the defense the correct structure to implement IoT applications. Such technology will further enhance the needs and importance of IoT in current problems and challenges and fulfill the gaps in existing methods and ideas for improving surveillance & reconnaissance cyber security in the Indian defense ecosystem and operations. Thus, increasing adoption of IoT and AI will further help in creating market opportunity for the military cybersecurity industry in the forecast period.

The military cybersecurity market is segmented into Deployment, Type and Solution.

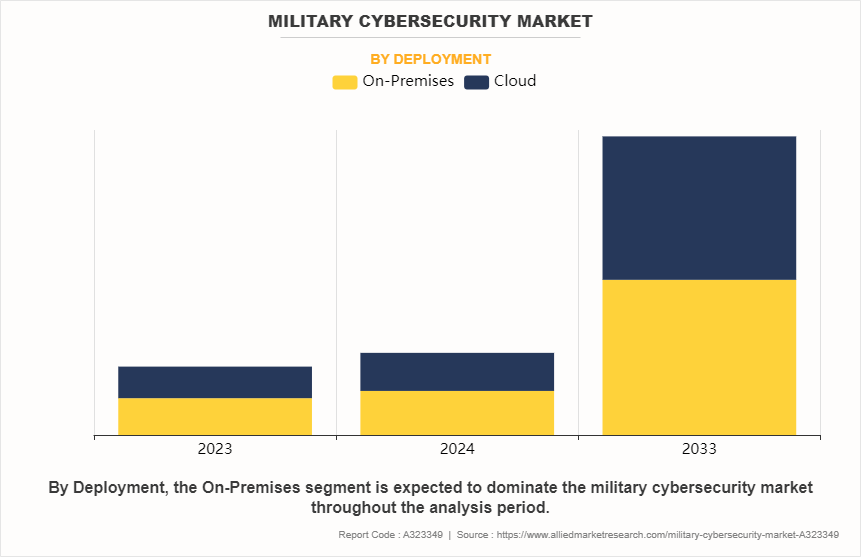

As per deployment, the market is fragmented into on-premises and cloud.

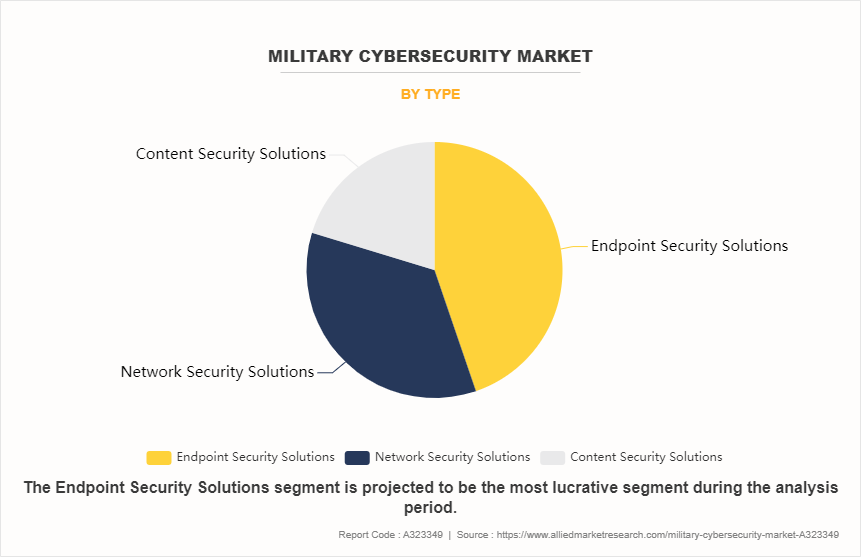

By type, the market is divided into endpoint security solutions, network security solutions, and content security solutions.

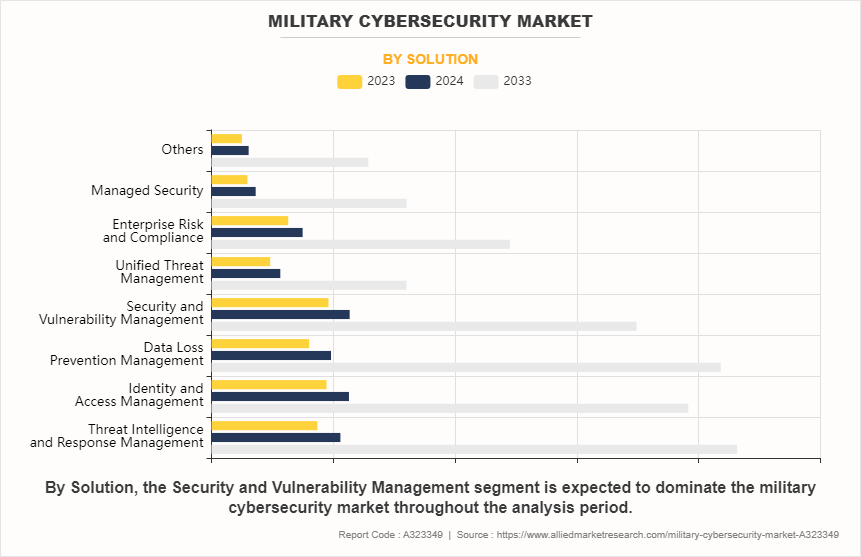

By solution, it is categorized into threat intelligence & response management, identity & access management, data loss prevention management, security & vulnerability management, unified threat management, enterprise risk & compliance, managed security, and others.

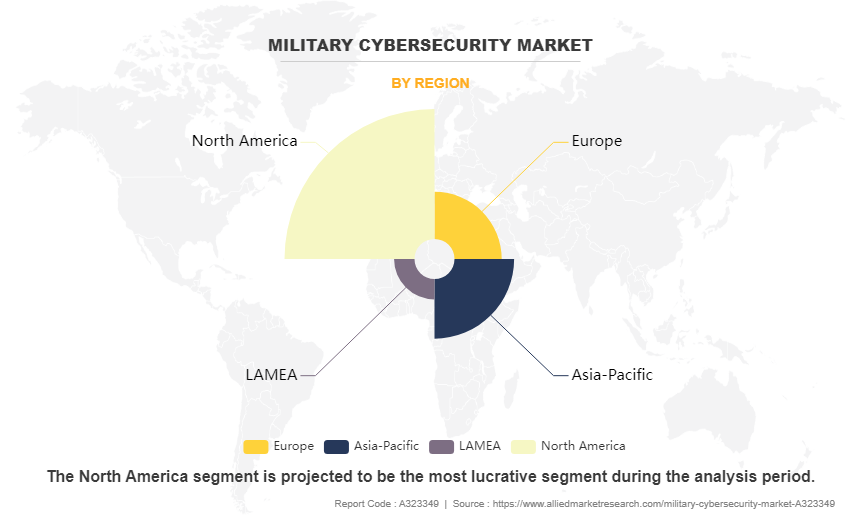

Region wise, the military cybersecurity market trends are analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, Russia, Italy, Spain and rest of Europe), Asia-Pacific (China, India, Japan, Australia, South Korea, and rest of Asia-Pacific), and Latin America (Brazil, Argentina and Rest of Latin America) and Middle East & Africa (Saudi Arabia, UAE, Israel, and Africa).

North America is expected to be the largest market shareholder with a CAGR of 15.11% from 2023 to2033 owing to the consistent demand for advanced military cybersecurity industry.

Impact of Russia-Ukraine War

The Russia-Ukraine conflict has the potential to significantly impact military cybersecurity market due to several interconnected factors. Firstly, disruptions in the supply chain of critical components and technologies could occur, as both Russia and Ukraine are important players in the cybersecurity sector. Any disruption in the supply chain could lead to delays in production of raw materials and delivery of military cybersecurity solutions, affecting manufacturers globally.

Countries involved or situated near the conflict zone are allocating additional resources to strengthen their cybersecurity defenses, aiming to protect military assets and critical infrastructure from potential cyber threats. This surge in demand for cybersecurity solutions has led to an uptick in investments in advanced technologies and services tailored to military needs.

Furthermore, there is a growing emphasis on enhancing cybersecurity resilience and readiness among military organizations and defense contractors to mitigate the evolving cyber risks. The ongoing conflict serves as a catalyst for the expansion and evolution of the military cybersecurity market as stakeholders prioritize safeguarding their digital assets amidst the uncertainty and instability of the geopolitical landscape.

In addition, the economic impact of the Russia-Ukraine conflict can affect throughout the military cybersecurity market. Fluctuations in currency values, trade restrictions, and geopolitical instability can disrupt financial markets and impact the overall economic outlook. Such economic uncertainties can affect demand for military cybersecurity market growth.

Competitive Analysis

Competitive analysis and profiles of the major global military cybersecurity market players that have been provided in the report include AT&T, BAE Systems, Boeing, Cisco Systems, Inc., DXC Technology Company, EclecticIQ B.V., IBM Corporation, Intel Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Privacera, Inc., SentineIOne, Secureworks, Inc., and Thales Group. The key strategies adopted by the major players of the global market are product launch and mergers & acquisitions.

Top Impacting Factors

The global military cybersecurity market is expected to witness notable growth registering a CAGR of 15.4%, owing to an increase in demand for defense IT expenditure. Adoption of IoT in cyber security technology lucrative growth opportunities. On the other hand, limited awareness related to cybersecurity are projected to hinder market growth.

Historical Data & Information

The global military cybersecurity market is fragmented, owing to the strong presence of existing vendors such as AT&T, BAE Systems, Boeing, Cisco Systems, Inc., DXC Technology Company, EclecticIQ B.V., IBM Corporation, Intel Corporation, Lockheed Martin Corporation, Northrop Grumman Corporation, Privacera, Inc., SentineIOne, Secureworks, Inc., and Thales Group. Vendors of the global military cyber defense market with extensive technical and financial resources are expected to gain a competitive advantage over their competitors because they can cater to market demands, which are higher than the supply. The competitive environment in this market is expected to increase owing to technological innovations, product extensions, and different strategies adopted by key vendors.

Key Developments/Strategies in Military Cybersecurity

- In January 2023, NATO announced that they have signed contracts with IBM Belgium and King ICT Croatia to support the organization‐™s cybersecurity. These contracts which are valued at USD 31.7 million will cover the integration of cyber defense capabilities and associated configuration services from February until 2025 with an additional two-year option.

- In April 2023, SAIC was selected for a USD 889 million contract by the (FEDSIM) in support of (DCSA) in order to develop and implement One IT. IT modernization to DCSA's systems will be carried out by One IT. SAIC (Science Applications International Corporation) is to provide DCSA with support as a prime contractor for One IT to simplify and standardize its information technology environment with a view to ensuring that it is cloud-ready. SAICs work will include planning and systems architecture development; digital; network, database, and storage engineering; service desk support; cybersecurity and IT application development and sustainment.

- In December 2022, the United States Army announced that they want to implement a zero-trust cybersecurity framework as the United States is transforming itself into a data-centric force. Moreover, Raytheon Intelligence and Space demonstrated its Operational Zero Trust platform at the Project Convergence experiment which was hosted by the United States Army in 2022.

KEY BENEFITS FOR STAKEHOLDERS

- This study comprises analytical depiction of the global military cybersecurity market size along with the current trends and future estimations to depict the imminent investment pockets.

- The overall global military cybersecurity market analysis is determined to understand the profitable trends to gain a stronger foothold.

- The report presents information related to key drivers, restraints, and opportunities with a detailed impact analysis.

- The current global military cybersecurity market forecast is quantitatively analyzed from 2022 to 2032 to benchmark the financial competency.

- Porters five forces analysis illustrates the potency of the buyers and suppliers in military cyber defense.

- The report includes the market share of key vendors and the global military cybersecurity market.

Military Cybersecurity Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 68.5 billion |

| Growth Rate | CAGR of 15.4% |

| Forecast period | 2023 - 2033 |

| Report Pages | 323 |

| By Deployment |

|

| By Type |

|

| By Solution |

|

| By Region |

|

| Key Market Players | Cisco Systems Inc., North Grumman Corporation, AT&T Inc., BAE Systems, SecureWorks Corp., General Dynamics Corporation, Thales, Lockhead Martin Corporation, Intel Corporation, IBM Corporation |

AT&T, BAE Systems, Boeing, Cisco Systems, Inc., DXC Technology Company, EclecticIQ B.V., IBM Corporation, Intel Corporation, and Lockheed Martin Corporation are the top companies to hold the market share in Military Cybersecurity.

The upcoming trends of military cybersecurity market include increase in demand for defense IT expenditure and adoption of IoT in cyber security technology.

North America is the largest regional market for military cybersecurity.

The endpoint security solutions are the leading type of Military Cybersecurity Market.

The global military cybersecurity market was valued at $15.7 billion in 2023.

Loading Table Of Content...

Loading Research Methodology...