Mobile Logistics Robots Market Overview:

The global mobile logistics robot market was valued at $2,420.7 million in 2017, and is projected to reach $11,269.1 million by 2025, registering a CAGR of 21.2% from 2018 to 2025.

Mobile logistics robots are automated machines that improve the efficiency of logistics operations. The use of robots in logistic networks serves as an efficient alternative to the customary belt-based transportation system. These robots are intelligent devices equipped with sensors, manipulators, control systems, power supply, and software to perform a task with increased efficiency. Integration of warehouse and robotics technology has helped to ensure that there is accuracy and automation while increasing the warehouse storage space and operation efficiency.

The evolution of the logistic robotic setup as per business requirements has reduced the associated time losses and theft intimidations. For instance, according to the International Federation of Robotics, mobile logistics robot industry experienced robust growth in 2017 with 69,000 units installed, which involves 162% increase over 2016. A total of 485,000 units are estimated to be sold between 2019 and 2021. This increases the CAGR by 18%. Moreover, the logistics robots are expected to be equipped with features such as active binocular 3D cameras & fish eye cameras, ultrasonic sensors, 10 hours battery life, 50 kg capacity payload, and fleet management software & cloud services.

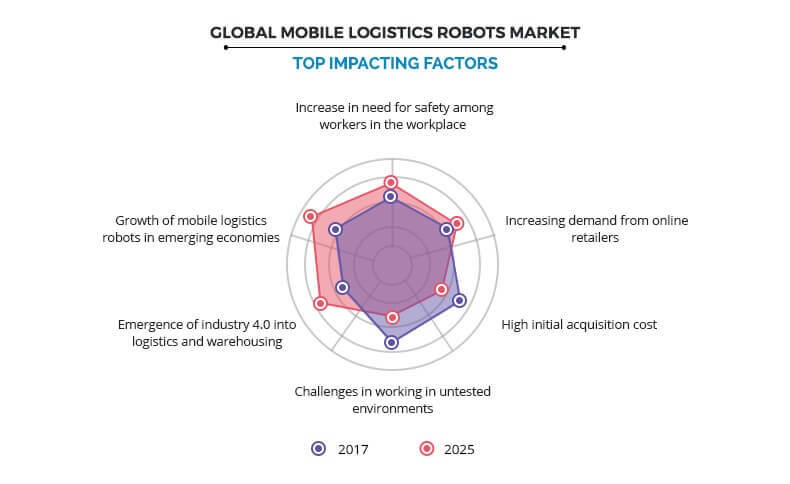

Factors such as increase in need for safety among workers in the workplace and rise in demand from online retailer are expected to drive the growth of the mobile logistics robot market in the future. However, high initial acquisition cost and challenges faced while working in untested environments majorly hamper the mobile logistics robot market growth. Furthermore, factors such as emergence of industry 4.0 into logistics and warehousing and growth of mobile logistics robots into emerging economies are expected to offer lucrative opportunities for the market globally.

The key players in this market would engage in collaborations, partnership and business expansion to strengthen their mobile logistics robot market share.

Segmentation

The global mobile logistics robot market size is segmented into industry vertical, function, and region. Based on industry vertical, the market is classified into healthcare, factory/warehouse, hospitality, and others. Based on function, the market is divided into pick & place, palletizing & de palletizing, transportation, and packaging. Based on region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Top Impacting Factors

The factors such as increase in need for safety among workers in the workplace, rise in demand from online retailers, high initial acquisition cost, challenges in working in untested environment, and emergence of industry 4.0 into logistics and warehousing are expected to significantly affect the growth of the global mobile logistics robot market. These factors are anticipated to either drive or hamper the mobile logistics robot market growth.

Increase in need for safety among workers in the workplace

There has been a high demand for automation globally. Companies are automating their manufacturing processes to reduce cost, save time, and deliver better quality products. Warehouse robotics is versatile and easy to integrate due to their ability to work safely around human workers while maintaining high levels of autonomy. With stringent safety regulations, companies are now employing robots for dangerous and hazardous environments. The technological breakthrough has made integration more flexible and easier. It also fastens the process of transporting the goods and confirms higher safety levels among the workers, which majorly drive the growth of the mobile logistics robot market.

High initial acquisition cost

High installation cost and integration capabilities required for the initial setup of mobile logistics robots restrain their adoption among the end users. Initial investment and maintenance cost of employing robotics systems are high due to the integration of high-quality hardware coupled with efficient software control system. The need for high initial investment limits the use of mobile robotics in the logistics and warehouse segments. Mobile logistics robots are predominantly used in manufacturing, automotive, food & beverage, and other industries. Large amount of initial investments limit the use of robotics to heavy manufacturing firms. The robotic systems are majorly used in the automotive industry. SMEs are hesitant to adopt robotic solutions due to the high set-up and maintenance costs, which hampers the growth of the mobile logistics robot market globally.

Emergence of industry 4.0 into logistics and warehousing

The increase in networking of industrial production requires more intelligent solutions in the field of logistics. Industry 4.0 into logistics and warehousing is on the rise due to automation and the ubiquity of computing power. Emergence of industry 4.0 harness inter-connectivity of machines and its processing. It also enables autonomous production methods powered by Internet of Things (IoT). For instance, according to an online portal PICK-PLACE, it is estimated that by 2018, 45% of the 200 leading global-commerce companies deployed robotics system in their order fulfillment, warehouse and delivery operations. Therefore, emergence of industry 4.0 represents a giant leap in forming connectivity with machines, physical environment, and people, which offer lucrative opportunities for the growth of the mobile logistics robot market globally.

Key Benefits for Mobile Logistics Robot Market:

- This study includes the analytical depiction of the global mobile logistics robot industry along with the current trends and future estimations to determine the imminent investment pockets.

- The in-depth mobile logistics robot market analysis provides market intelligence with respect to segments based industry vertical and function

- The report presents information regarding the key drivers, restraints, and opportunities.

- The current market is quantitatively analyzed from 2017 to 2025 to highlight the financial competency of the industry.

- Porter’s five forces analysis illustrates the potency of the buyers and suppliers in the industry.

Mobile Logistics Robot Market Report Highlights

| Aspects | Details |

| By Industry Vertical |

|

| By Function |

|

| By Region |

|

| Key Market Players | AMAZON ROBOTICS, CLEARPATH ROBOTICS INC., MOBILE INDUSTRIAL ROBOT APS (TERADYNE, INC.), KUKA AG, AETHON (ST ENGINEERING LTD), SAVIOKE, FETCH ROBOTICS, INC., OMRON ADEPT TECHNOLOGIES, INC. (OMRON CORPORATION), GREYORANGE, ASIC ROBOTICS AG |

Analyst Review

Robotics technology is a combination of machine tools and computer applications used for various activities that include designing, manufacturing, and others. Use of robotics technology allow consumers to automate processes, increase productivity, enhance quality, and reduce human errors.

According to the International Federation of Robotics, mobile logistics robots experienced robust growth in 2017 with 69,000 units installed, which involves 162% increase over 2016. A total of 485,000 units are estimated to be sold between 2019 and 2021. This increases the CAGR by 18%. In addition, on November 2018, Chinese startup Syrius Robotics, co-founded by Alibaba’s former director of robotics, Luo Xuan, is building autonomous mobile robots with JD logistics. This collaboration helps integrate the robots into two model warehouses for further testing and optimization.

Industrial logistics robotics projects are enduring worldwide with an emphasis on end-to-end process automation owing to reduction in the cost. Adoption of existing tools, implementation of commercial mechanisms, as well as loading and unloading pallets are the factors that make way to build viable robots.

The key players profiled in the report include Aethon Inc., Asic Robotics AG, Clearpath, Fetch Robotics Inc., Kuka AG, Mobile Industrial Robots, Omron Corp Adept Technology Inc., Amazon Robotics, Savioke, and GreyOrange.

Loading Table Of Content...