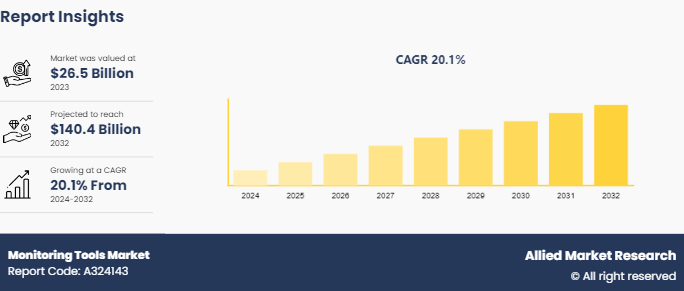

The monitoring tools market was valued at $26.5 billion in 2023 and is estimated to reach $140.4 billion by 2032, exhibiting a CAGR of 20.1% from 2024 to 2032. The market is experiencing significant growth, driven by the rising demand for real-time performance tracking and enhanced security across IT infrastructures. With increasing adoption of cloud computing, DevOps practices, and digital transformation initiatives, businesses are leveraging monitoring tools to ensure system reliability, optimize operations, and improve overall efficiency.

Market Introduction and Definition

Monitoring tools are essential technologies designed to oversee, manage, and ensure the optimal performance of IT infrastructure, applications, and networks. These tools provide real-time visibility into system operations, enabling proactive identification and resolution of issues before they impact business operations. In addition, the monitoring tools includes tracking system metrics, analyzing performance data, detecting anomalies, and generating alerts for potential problems. Furthermore, the rise in complexity of IT environments is driven by cloud computing, IoT, and hybrid infrastructures, as the demand for sophisticated monitoring tools increase. Moreover, the advanced monitoring tools integrate AI and ML to enhance predictive analytics and automate responses, which is improving efficiency and reducing downtime. The market for the monitoring tools includes multiple industries, such as IT and telecom, healthcare, BFSI, and manufacturing, each leveraging them to maintain service quality, ensure security, and comply with regulatory requirements.

Key Takeaways

The monitoring tools industry study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major monitoring tools industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The monitoring tools market forecast is driven by the increasing complexity of IT environments and the critical need for real-time visibility and proactive management. The organizations rely heavily on digital infrastructure. There is a growing demand for advanced monitoring solutions that can detect performance issues, ensure system reliability, and resolve potential disruptions. Thus, the rise in adoption of monitoring tools fuels the market growth. Factors such as cloud adoption, cybersecurity threats, and the proliferation of IoT devices further propel the monitoring tools market growth.

In addition, the demand for real-time monitoring boosts market growth, as businesses strive to detect and resolve issues proactively, minimizing downtime and ensuring optimal performance. Moreover, the regulatory compliance requirements across industries such as finance, healthcare, and government also fueled the need for comprehensive monitoring, thereby driving the demand for monitoring tools. However, the market faces restraints due to the high costs associated with implementing and maintaining robust monitoring solutions, particularly for small and medium-sized enterprises with limited budgets.

Furthermore, the integration of artificial intelligence and machine learning technologies can enhance monitoring tools ability to detect anomalies, predict issues, and provide intelligent recommendations for resolution. The rise in adoption of cloud services increases the complexity and scale of IT infrastructures, necessitating monitoring tools which provide real-time insights into cloud environments, enabling proactive management and rapid issue resolution, thereby fueling demand for monitoring tools. Moreover, the integration of monitoring tools with IT management solutions, such as configuration management and automation tools offers organizations comprehensive capabilities to manage their IT operations efficiently, which provides lucrative opportunity to the monitoring tools market analysis.

Government Regulations for Monitoring Tools Market

The government policies for monitoring tools market aim to promote the adoption of various tools, in sectors such as finance, healthcare, and national security. Governments worldwide implemented the policies and regulations that mandate the use of monitoring tools for ensuring compliance, data security, and system reliability. For instance, the Health Insurance Portability and Accountability Act (HIPAA) in the U.S. requires healthcare organizations to implement monitoring tools to track and audit access to electronic protected health information (ePHI) . Similarly, the Payment Card Industry Data Security Standard (PCI DSS) requires businesses handling credit card transactions to monitor their systems for potential security breaches.

In addition, regulations such as the Sarbanes-Oxley Act (SOX) and the Basel Accords mandate the use of monitoring tools in the finance sector for risk management, auditing, and reporting purposes. Similarly, government agencies and infrastructure providers required to deploy monitoring tools to detect cyber threats and maintain the availability and integrity of their systems. This proactive approach mitigates risks associated with potential cyber-attacks and ensures the security of sensitive data and operational continuity against unauthorized access or disruption.

In addition, the finance sector, regulations such as Sarbanes-Oxley Act (SOX) and the Basel Accords necessitate the use of monitoring tools for risk management, auditing, and reporting purposes. Furthermore, government agencies and infrastructure providers required to deploy monitoring tools to detect cyber threats and ensure the availability and integrity of their systems. This proactive step is important in reducing risks linked to cyber-attacks, protecting sensitive data, and ensuring uninterrupted operations. Continuous monitoring enables swift responses to threats, preventing unauthorized access or disruption. These efforts not only boost cybersecurity resilience, but also fulfill legal requirements aimed at ensuring the dependability and security of critical infrastructure and public services

Market Segmentation

The monitoring tools market size is segmented into component, deployment, type, vertical and region. On the basis of component, the market is divided into software and services. As per mode of deployment, the market is segregated into cloud and on-premises. On the basis of type, the market is divided into infrastructure monitoring tools, application performance monitoring tools, security monitoring tools and end-user experience monitoring tools. On the basis of vertical, the market is divided into BFSI, retail & e-commerce, healthcare, IT & telecom, media & entertainment, manufacturing and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America leads the monitoring tools market share owing to its advanced IT infrastructure, high adoption of cloud technologies, and strong presence of key market players. However, the Asia-Pacific region is experiencing rapid expansion in the monitoring tools market, fueled by the growing adoption of cloud computing, IoT, and smart technologies. Countries such as China, India, and Japan are leading the charge, driven by their robust economic growth, burgeoning IT sectors, and increasing investments in digital infrastructure. The region’s diverse industrial landscape and the rising demand for enhanced cybersecurity measures are also significant contributors to market growth. Furthermore, LAMEA is gradually catching up, with growing awareness of the importance of monitoring tools in enhancing operational efficiency and security. For instaance, according to Government of Canada in February 2023, the Minister of Fisheries, Oceans and the Canadian Coast Guard, announced $46.5 million in funding over five years to Ocean Networks Canada, to enhance their world-class ocean monitoring system. This investment supports the development and deployment of advanced monitoring technologies, increasing demand for innovative tools. Real-time, open data generated from these systems fosters collaboration and further research, boosting market opportunities.

Industry Trends

In February 2024, the U.S. Environmental Protection Agency announced the availability of $81 million in funding for eligible air agencies to expand and upgrade the nation’s air quality monitoring networks as part of President Biden’s Investing in America agenda.

In August 2023, Cybersecurity and Infrastructure Security Agency (CISA) released the Remote Monitoring and Management (RMM) Cyber Defense Plan, the first proactive Plan developed by industry and government partners through the Joint Cyber Defense Collaborative (JCDC) . This plan addresses systemic risks facing the exploitation of RMM software.

Competitive Landscape

The major players operating in the monitoring tools market include Amazon Web Services, Inc., Cisco Systems, Inc., Dynatrace, Inc., Google LLC, IBM Corporation, Microsoft, NETSCOUT Systems, Inc., New Relic, Inc., Riverbed Technology LLC and Splunk Inc

Recent Key Strategies and Developments

In March 2023, Cisco Systems Inc. announced the introduction of new artificial intelligence capabilities within its AppDynamics On-Premises solution, which aimed at automating anomaly detection and expediting root cause analysis to boost the security of business-critical applications.

In November 2023, Cisco announced new business metrics for Cisco Cloud Observability, leveraging the Cisco Observability Platform to enhance visibility and business context for modern applications on Amazon Web Services (AWS) . This release integrates seamlessly with AWS services, which offers advanced application performance monitoring (APM) correlation, and provides comprehensive insights into the performance of cloud-native applications.

Key Sources Referred

Centre for Development of Telematics

Cybersecurity and Infrastructure Security Agency

Ministry of Electronics and Information Technology

Department of Homeland Security

Federal CIO Council

Key Benefits for Stakeholders

This report provides a quantitative analysis of the monitoring tools market size segments, current trends, estimations, and dynamics of the market analysis to identify the market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the monitoring tools market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global monitoring tools market Statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global monitoring tools market trends, key players, market segments, application areas, and market growth strategies.

Monitoring Tools Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 140.4 Billion |

| Growth Rate | CAGR of 20.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 200 |

| By Component |

|

| By Deployment |

|

| By Type |

|

| By Vertical |

|

| By Region |

|

| Key Market Players | Amazon Web Services, Inc., Microsoft, IBM Corporation, Microsoft Corporation, Splunk Inc, Cisco Systems, Inc., NetScout Systems, Inc., Riverbed Technology LLC, New Relic, Inc., Dynatrace, Inc., NETSCOUT Systems, Inc., Google LLC |

The global market size of monitoring tools market was valued at $26.5 billion in 2023.

The healthcare industry contributed a significant share in the global monitoring tools market in 2023

North America is the largest regional market for monitoring tools.

The global monitoring tools market is estimated to read $140.4 billion by 2032.

The major players operating in the monitoring tools market include Amazon Web Services, Inc., Cisco Systems, Inc., Dynatrace, Inc., Google LLC, IBM Corporation, Microsoft, NETSCOUT Systems, Inc., New Relic, Inc., Riverbed Technology LLC and Splunk Inc.

Loading Table Of Content...