Mortgage Lending Market Research, 2031

The global mortgage lending market was valued at $11,487.23 billion in 2021, and is projected to reach $27,509.24 billion by 2031, growing at a CAGR of 9.5% from 2022 to 2031.

An arrangement to purchase or refinance a property without having to pay the whole amount up front is known as a mortgage, often known as a mortgage loan, and it is made between the borrower and a mortgage lender. In the event that the borrower defaults on the conditions of the mortgage, which is often accomplished by failing to pay back the amount borrowed plus interest, this arrangement grants lenders the legal right to reclaim the property.

As many nonbank lenders have made significant investments in digital interfaces that facilitate the submission of applications, the uploading of supporting data, and the communication with lenders, have made it convenient for the consumers to opt for mortgage lending processes. Moreover, increase in the innovations in software designs to speed up the mortgage-application process, lower costs for the lender, and improve the overall customer experience is benefiting the mortgage lending market growth. This factor notably promotes the growth of market. However, the higher interest rate on mortgage loans and additional costs such as arrangement fees, valuation fees, remortgaging fees on mortgage loans are limiting industry expansion. On the contrary, increasing digitization in mortgage lending market is expected to boost the growth of the mortgage lending market in upcoming years. Moreover, rise in developments & initiatives toward mortgage lending is anticipated to provide a potential growth opportunity for the mortgage lending market.

The report focuses on growth prospects, restraints, and trends of the mortgage lending market forecast. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the mortgage lending market outlook.

The mortgage lending market is segmented into Type of Mortgage Loan, Mortgage Loan Terms, Interest Rate and Provider.

Segment Review

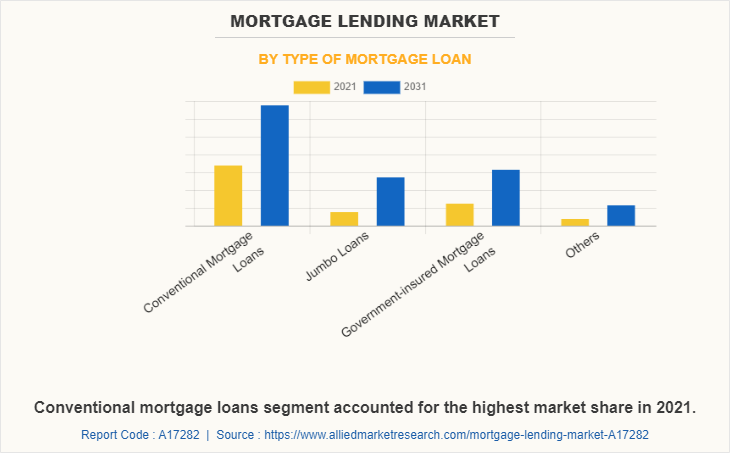

The mortgage lending market is segmented into type of mortgage loan, mortgage loan term, interest rate, provider, and region. By type of mortgage loan, the mortgage lending market is differentiated into conventional mortgage loans, jumbo loans, government-insured mortgage loans and others. Depending on mortgage loan term, it is fragmented into 30-year mortgage, 20-year mortgage, 15-year mortgage and others. The interest rate segment is divided into fixed-rate mortgage loan, adjustable-rate mortgage loan. The provider segment is segregated into primary mortgage lender and secondary mortgage lender. The primary mortgage lender is further segmented into banks, credit unions, NBFC’s and others. The NBFC’s is further segregated in online and offline. Region wise, the mortgage lending market is analysed across North America, Europe, Asia-Pacific, and LAMEA.

By type of mortgage loan, the conventional mortgage loans segment acquired highest share in the mortgage lending market size. This is attributed to the fact that conventional loans need fewer paperwork and be approved faster. The usual delays associated with FHA or government-backed loans can be avoided when mortgage lenders accept conventional loans.

Region wise, North America dominated the mortgage lending market share and maintained the largest market share in 2021. This was attributed to the fact that the federal government created several programs, or government sponsored entities, to foster mortgage banking, construction and encourage home ownership. These programs include the Government National Mortgage Association (known as Ginnie Mae), the Federal National Mortgage Association (known as Fannie Mae) and the Federal Home Loan Mortgage Corporation (known as Freddie Mac). Hence, the region has largest mortgage lenders globally. Thus, these increasing initiatives by the government are fuelling the growth of the mortgage lending market in the region.

The key players operating in the global mortgage lending market include Ally Financial Inc., Bank of America Corporation, BNP Paribas Fortis, Citigroup, Inc., Fannie Mae, JPMorgan Chase & Co, Mr. Cooper Group Inc., PT Bank Central Asia Tbk, QNB, Royal Bank of Canada, Rocket Mortgage, LLC, Social Finance, Inc., Standard Chartered, Truist, Wells Fargo, ClearCapital.com, Inc. and Roostify, Inc. These players have adopted various strategies to increase their mortgage lending market penetration and strengthen their position in the mortgage lending industry.

Top Impacting Factors

Shorter loan application processes

Mortgage lending aims to approve loan applications within 24 hours. The application usually takes less time as mortgage finance application involves filling out an online form, sending a few documents via email, and chatting through terms of loan by providing flexible in mortgage payment. With this short application process, small business owners can easily apply for mortgage loan with the best mortgage interest rates. The mortgage lender uses these documents and decides if borrowers qualify for their financing. If the borrower qualifies, lenders then use this information to determine the loan amount. Moreover, mortgage lending provides cash injection that borrowers need to invest in new equipment, meet payroll, or afford other business expenses. Therefore, this factor propels the growth of the market.

Increased focus toward digitalizing lending process

Digitization has been one of the most widely adopted strategies in financial services to improve core processing capabilities and offer better consumer services and insights in mortgage market. In addition, FinTech organizations have reportedly increased their sales percentage by focusing on digitalization of their financial services. A study has revealed that investments in financial technologies witnessed an impressive growth in 2018, which was almost twice that of 2015. In addition, more than half of these investments have been associated with lending and payments. Digitization in lending landscape has helped FinTech and their customers for better loan management decisions as well as rapid application and disbursement process. Thus, increase in focus of organizations on digitalizing their lending process to achieve business efficiency and enhanced outcomes drives the growth of the global mortgage lending market.

Access to large sums of money

Small business owners often do not have the financial capability to raise funding in the debt or equity markets. This can make starting a business extremely expensive and risky. However, with a mortgage lending sector, it is possible to cover all business startup expenses with availing mortgage loan. This also makes it significantly less intimidating for business owners without extensive resources to obtain a relatively large amount of funding. In addition, by consolidating all financing on one loan, mortgage lending platform helps to access large sum of money for small businesses. Therefore, this is a major driving factor for the mortgage lending market.

Report Coverage & Deliverables

Type Insights:

The mortgage lending market is diverse, encompassing various mortgage lending market services such as fixed-rate mortgages, adjustable-rate mortgages, and government-backed loans. Each service type caters to different borrower needs, influencing overall market dynamics and consumer preferences.

Technology Insights:

The mortgage lending market growth is significantly driven by advancements in technology. Innovations such as automated underwriting systems, digital mortgage platforms, and AI-driven risk assessment tools are streamlining the lending process, enhancing efficiency, and expanding market reach. These technological advancements are crucial for meeting the increasing demand for faster and more transparent mortgage solutions.

Application Insights:

The mortgage lending market share is heavily influenced by the application of various lending solutions in residential and commercial real estate. Residential mortgages dominate the market, but the growth in commercial and investment property financing is also notable. These applications reflect the market’s ability to cater to diverse borrowing needs and economic conditions.

Regional Insights:

The mortgage lending market value varies significantly across different regions. North America, particularly the United States, holds a substantial market share due to a well-established mortgage system and high demand for housing. In contrast, emerging markets in Asia-Pacific are experiencing rapid growth due to increasing urbanization and economic development.

Key Companies & Market Share Insights:

Major players in the mortgage lending market include companies like Wells Fargo, JPMorgan Chase, and Bank of America, which hold significant market shares due to their extensive service offerings and strong financial capabilities. The competitive landscape is characterized by a mix of large institutions and innovative fintech start-ups, each vying to capture market share through differentiated services and technological advancements.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the mortgage lending market analysis from 2021 to 2031 to identify the prevailing market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the mortgage lending market segmentation assists to determine the prevailing mortgage lending market opportunity.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global mortgage lending market trends, key players, market segments, application areas, and market growth strategies.

Mortgage Lending Market Report Highlights

| Aspects | Details |

| By Type of Mortgage Loan |

|

| By Mortgage Loan Terms |

|

| By Interest Rate |

|

| By Provider |

|

| By Region |

|

| Key Market Players | Rocket Mortgage, LLC, Mr. Cooper, Federal National Mortgage Association (FNMA), Roostify, Royal Bank of Canada, China Zheshang Bank, Sofi, Qatar National Bank, Bank of America Corporation, Mitsubishi UFJ Financial Group, BNP Paribas, JP Morgan & Chase, Standard Chartered PLC, Truist financial corporation, Ally, Clear Capital, PT Bank Central Asia Tbk |

Analyst Review

The market for mortgage lending is witnessing a rise, owing to increased demand for automated underwritings, growth in internet of things (IoT) & cloud-based service use, and increase in acceptance of these technologies. In addition, lending and mortgages have undergone a considerable transition similar to other sectors of banking, which is in many respects reinventing and redefining this vital area for both current and future market participants. Furthermore, automated follow-up calls, automated loan granting, automated document management, automated reporting, and even more automation is anticipated to boost the growth of the market in upcoming years.

The COVID-19 outbreak has a moderate impact on the mortgage lending market. Moreover, the pandemic has led to a huge demand for digital lending services that are provided through channels that don't require on physical touch, including over the phone via the contact center, on mobile devices, or via desktop applications.

The mortgage lending market is fragmented with the presence of regional vendors such as Ally Financial Inc., Bank of America Corporation, BNP Paribas Fortis, Citigroup, Inc., Fannie Mae, JPMorgan Chase & Co, Mr. Cooper Group Inc., PT Bank Central Asia Tbk, QNB, Royal Bank of Canada, Rocket Mortgage, LLC, Social Finance, Inc., Standard Chartered, Truist, Wells Fargo, ClearCapital.com, Inc. and Roostify, Inc. Major players operating in this market have witnessed significant adoption of strategies that include business expansion and partnership to reduce supply and demand gap. With increase in awareness & demand for mortgage lending across the globe, major players are collaborating their product portfolio to provide differentiated and innovative products

The mortgage lending market is projected to reach $27,509.24 billion by 2031.

The mortgage lending market is estimated to grow at a CAGR of 9.5% from 2022 to 2031.

The key players profiled in the report include Ally Financial Inc., Bank of America Corporation, BNP Paribas Fortis, Citigroup, Inc., Fannie Mae, JPMorgan Chase & Co, Mr. Cooper Group Inc., PT Bank Central Asia Tbk, QNB, Royal Bank of Canada, Rocket Mortgage, LLC, Social Finance, Inc., Standard Chartered, Truist, Wells Fargo, ClearCapital.com, Inc. and Roostify, Inc.

Shorter loan application processes and increased focus towards digitalizing lending process majorly contribute toward the growth of the market.

The key growth strategies of Mortgage lending market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...