N-Bromosuccinimide Market Research, 2032

The global N-Bromosuccinimide market was valued at $21.1 million in 2022, and is projected to reach $28.5 million by 2032, growing at a CAGR of 3.2% from 2023 to 2032. The escalating growth of the pharmaceutical industry and the increasing adoption of N-Bromosuccinimide in water treatment processes stand as a pivotal driver for the growth of the N-Bromosuccinimide market.

N-Bromosuccinimide (NBS) is a versatile chemical compound widely used in organic synthesis as a brominating agent. Its molecular formula is C4H4BrNO2. NBS is a white crystalline solid that is soluble in polar solvents such as water and acetone. One of its key properties is its selective bromination of allylic and benzylic positions in organic compounds. This selectivity arises from the formation of a stabilized allylic or benzylic radical intermediate, which reacts preferentially with bromine over other functional groups.

NBS is employed in various reactions including allylic bromination, Hofmann rearrangement, and radical cyclizations. It acts as a convenient and mild source of bromine in organic transformations, avoiding the harsh conditions associated with other brominating agents. In addition, NBS exhibits good thermal stability, making it easier to handle and store compared to other bromine sources. These properties make N-Bromosuccinimide an essential tool in the toolbox of synthetic chemists for modifying organic molecules with bromine functionalities.

Key Takeaways

- Quantitative information mentioned in the global N-Bromosuccinimide market includes the market numbers in terms of value ($Million) concerning different segments, pricing analysis, annual growth rate, CAGR (2023-32), and growth analysis.

- The analysis in the report is provided based on content, application, and region. The study is expected to contain qualitative information such as the market dynamics (drivers, restraints, opportunities), Porter’s five forces analysis, key regulations across the region, and value chain analysis.

- A few companies, including Nanjing Suru Chemical Co., Ltd., HALIDES CHEMICALS PVT. LTD., Anhui Wotu Chemical Co., Ltd., Yizheng East Chemical Co., Ltd., Jiangxi Dasuo Chemical Co., Ltd., Purecha Group, SAMUH LAXMI CHEMICALS (BOM) P. LTD., and Resins & Allied Products Maharashtra, India hold a large proportion of the N-Bromosuccinimide industry.

- This report makes it easier for existing market players and new entrants to the N-Bromosuccinimide business to plan their strategies and understand the dynamics of the industry, which helps them make better decisions.

Market Dynamics

The pharmaceutical industry's growth serves as a significant driver for the expansion of the N-Bromosuccinimide market share. NBS plays a crucial role in pharmaceutical synthesis, particularly in the production of pharmaceutical intermediates and active pharmaceutical ingredients (APIs). As the demand for new drugs, generics, and specialty pharmaceuticals continues to escalate globally, so there is an increasing need for efficient and reliable chemical synthesis processes. NBS offers unique bromination capabilities that are indispensable in the creation of specific molecular structures required for drug development. In addition, NBS's selective bromination reactions make it a preferred choice in pharmaceutical synthesis, ensuring high yields and purity levels crucial for pharmaceutical applications. Moreover, as pharmaceutical companies strive for cost-effective and environmentally sustainable manufacturing processes, NBS stands out as a versatile and eco-friendly brominating agent.

The increasing prevalence of chronic diseases and the aging population are expected to drive demand for innovative pharmaceuticals, leading to growth in the pharmaceutical industry. For instance, in 2023, the American Cancer Society reported 1.93 million new cancer cases in the United States, up from 1.9 million in 2022. Additionally, according to the Centers for Disease Control's National Diabetes Statistics Report for 2022, diabetes prevalence in the United States reached 37.3 million in 2022. These global trends in chronic diseases are forecasted to boost pharmaceutical demand and consequently, stimulate growth in pharmaceutical manufacturing.

Furthermore, Australia estimated an increase in lung cancer cases from 14,529 in 2022 to 14,800 in 2023, as per the Australian Institute of Health and Welfare. Moreover, pharmaceutical companies are focusing on expansion and making significant investments to enhance production. For instance, in December 2023, Piramal Pharma Solutions invested $57.15 million (GBP 45 million) in a new manufacturing facility in Scotland, UK, to produce antibody-drug conjugates (ADC). This investment strengthened the company's ADC manufacturing capabilities.

Similarly, in April 2022, Ferring Pharmaceuticals inaugurated an integrated R&D and manufacturing facility in Hyderabad with a total investment of $31.78 million (EUR 30 million). This facility primarily aims to accelerate the production of solid dosage formulations. Hence, the projected growth in the pharmaceutical industry, driven by factors such as aging populations, increased healthcare spending, and the prevalence of chronic diseases, is poised to fuel the demand for NBS in the foreseeable future, positioning it as a vital component in pharmaceutical manufacturing supply chains.

The escalating demand for N-Bromosuccinimide (NBS) in water treatment is expected to be a significant driver for N-Bromosuccinimide market growth. NBS is utilized as a powerful disinfectant and oxidizing agent in water treatment processes, particularly for the removal of organic impurities, microorganisms, and disinfection by-products. Its effectiveness in controlling microbial growth and eliminating harmful contaminants make it a preferred choice in various water treatment applications, including municipal water treatment plants, swimming pools, and industrial wastewater treatment facilities.

Moreover, NBS offers advantages such as stability, ease of handling, and compatibility with existing treatment processes. With growing concerns over water pollution, increasing regulatory standards, and the need for safe and clean water sources, the demand for NBS in water treatment is projected to rise.

China has approximately 1,944 municipal wastewater treatment plants situated in urban areas and 1,599 in counties, with respective daily processing capacities of 140 and 29 million cubic meters. In its 14th five-year plan (FYP), China has issued new directives for wastewater reuse, aiming to elevate the proportion of treated sewage to reuse standards to 25% by 2025. Government initiatives are anticipated to drive significant growth in water purification endeavors. Collaborative efforts such as the 2030 Water Resources Group and the Council on Energy, Environment, and Water (CEEW) aim to enhance wastewater management in India and bolster private investments in water treatment chemical manufacturing companies to establish wastewater treatment facilities and procure raw materials. In addition, the Stormwater Treatment Area 1 West Expansion project involves erecting water treatment facilities across 2,509 hectares of land in Florida, the U.S., with an investment totaling $170 million.

Additionally, municipal water treatment facilities across various municipalities in the nation are experiencing a notable uptick, thanks to government initiatives aimed at granting rural communities improved access to safe and ample drinking water within their households. As per data from the Ministry of Jal Shakti under the Government of India, during the fiscal year 2022, the proportion of rural inhabitants with access to safe and ample drinking water within their premises rose to 61.52%, up from 55.23% in FY2021. Moreover, the Indian government is targeting to ensure 100% of its populace has access to safe and ample drinking water within their premises by 2024 or 2025, thereby enhancing the operations of municipal water treatment plants throughout the country.

Thus, the expanding investments in water infrastructure globally further bolster its adoption in the water treatment sector. As a result, the increasing demand for NBS as a key component in water treatment solutions is poised to drive the growth of the N-Bromosuccinimide market size in the coming years.

The health and safety issues pose significant challenges to the growth of the N-Bromosuccinimide market. NBS is a potent brominating agent widely used in organic synthesis, but its handling and exposure can present serious health risks. Direct contact with NBS can cause skin irritation, burns, and respiratory issues, while inhalation or ingestion may lead to more severe health complications, including lung damage and systemic toxicity. Furthermore, NBS reacts violently with certain substances, posing explosion hazards if mishandled. These health and safety concerns not only endanger workers involved in the production and handling of NBS but also raise liability issues for companies throughout the supply chain.

Strict regulations governing the safe handling, storage, and transportation of NBS further add to compliance costs and operational complexities for manufacturers and distributors. Moreover, heightened awareness of occupational health risks and increasing emphasis on workplace safety standards necessitate robust safety protocols and investments in protective equipment and training, adding to the overall cost of NBS production and utilization. As a result, industries reliant on NBS may seek alternatives with lower health and safety risks, limiting the growth potential of the NBS market.

Technological innovations present lucrative opportunities for the N-Bromosuccinimide market forecast by enhancing production processes, improving efficiency, and expanding the range of applications. Advancements in chemical engineering, process optimization, and automation enable manufacturers to produce NBS more cost-effectively and with higher purity levels. In addition, innovations in synthesis methodologies and reaction conditions contribute to the development of novel derivatives and formulations of NBS, expanding its utility across various industries. For instance, the introduction of flow chemistry techniques allows for continuous production of NBS, reducing manufacturing costs and increasing overall efficiency.

Moreover, advancements in analytical techniques enable better monitoring and control of NBS production processes, ensuring consistent quality and compliance with regulatory standards. These technological innovations not only streamline NBS production but also open new avenues for its use in emerging applications such as advanced materials, nanotechnology, and biotechnology. As industries continue to seek innovative solutions to address complex challenges, the NBS market stands to benefit from ongoing technological advancements that improve product performance, reliability, and sustainability. Companies investing in research and development to leverage these technological innovations will position themselves for growth and competitiveness in the dynamic NBS market landscape.

Segment Overview

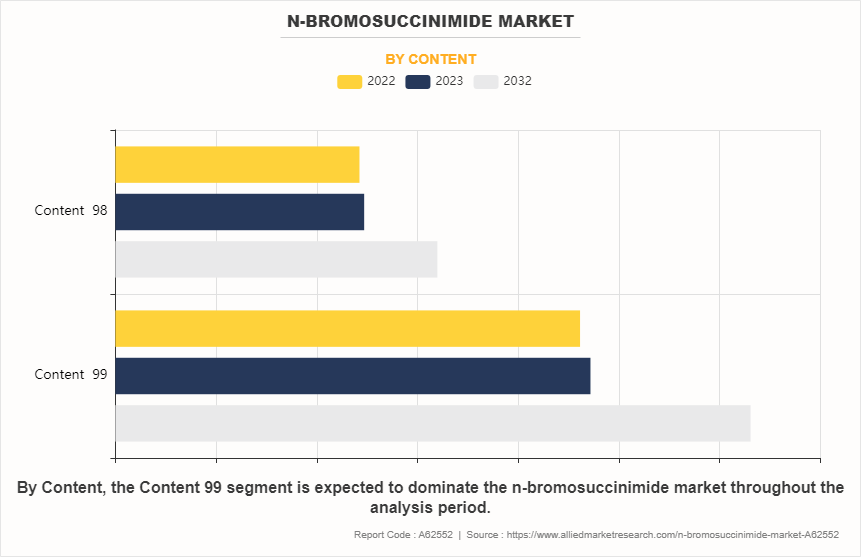

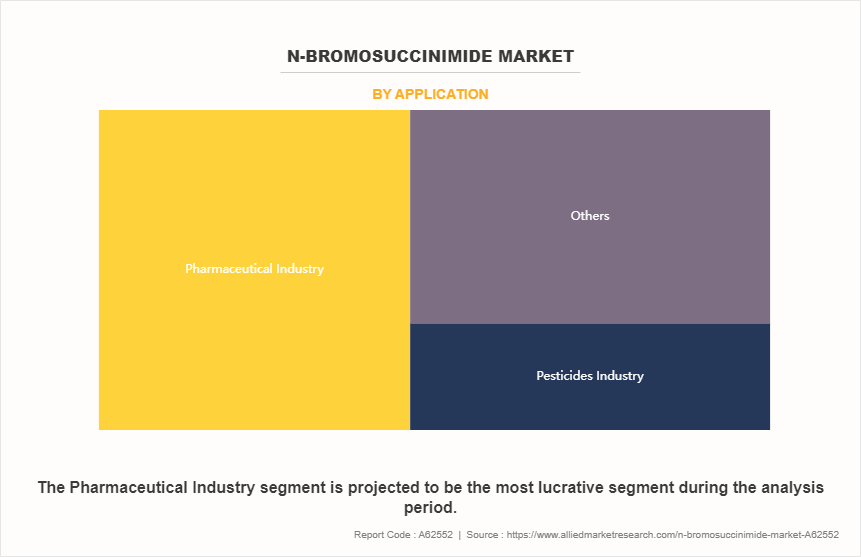

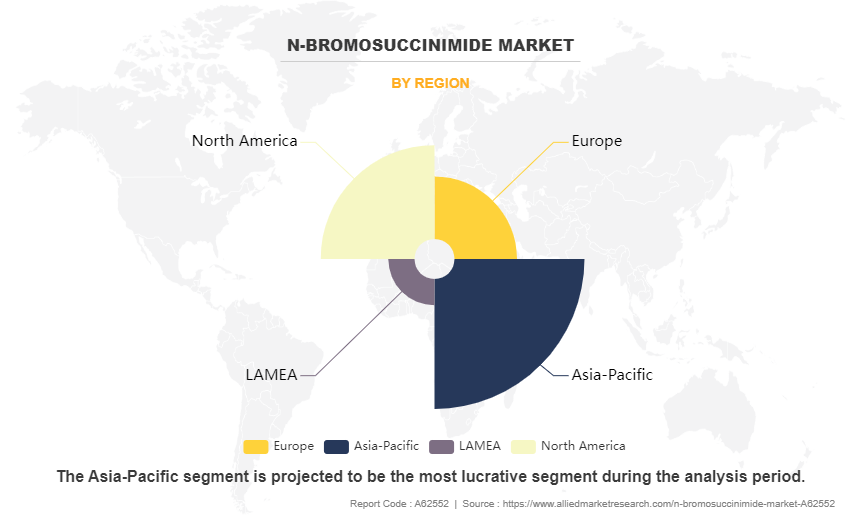

The N-Bromosuccinimide market is segmented based on content, application, and region. By content, the market is bifurcated into content 99% and content 98%. By application, it is categorized into pharmaceutical industry, pesticides industry, and others. Region-wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The Content 99% segment accounted for the largest share in 2022 and is expected to register the highest CAGR of 3.3%. Increased demand for N-Bromosuccinimide (NBS) content is driven by its versatile applications in organic synthesis, particularly in bromination reactions. Factors contributing to this surge include its effectiveness as a brominating agent, its stability, and its role in the pharmaceutical and chemical industries. Additionally, its compatibility with various substrates and its contribution to the synthesis of valuable intermediates further bolster demand.

The pharmaceutical Industry segment accounted for the largest share in 2022. The demand for N-Bromosuccinimide (NBS) in the pharmaceutical industry is increasing due to its vital role as a brominating agent in organic synthesis. Its versatility in selectively brominating substrates, especially in drug development processes, contributes to its high demand. Additionally, its efficiency, reliability, and compatibility with various reaction conditions further fuel its usage in pharmaceutical manufacturing.

Pesticides industry is expected to register the highest CAGR of 3.6%. The demand for N-Bromosuccinimide (NBS) in the pesticides industry is increasing due to its effectiveness as a brominating agent in pesticide synthesis. Its ability to selectively brominate organic compounds makes it valuable for producing pesticide intermediates and active ingredients. Additionally, NBS facilitates the synthesis of compounds with enhanced pesticidal properties, contributing to its rising demand in the industry.

Asia-Pacific garnered the largest share in 2022. The increasing demand for N-Bromosuccinimide in the Asia-Pacific region can be attributed to several factors including the growing pharmaceutical and chemical industries, rising R&D activities, expanding applications in organic synthesis, and increasing investments in infrastructure. Additionally, the region's burgeoning manufacturing sector and favorable government policies further drive the demand for this chemical compound.

Competitive Analysis

The major players operating in the global N-Bromosuccinimide market are Nanjing Suru Chemical Co., Ltd., HALIDES CHEMICALS PVT. LTD., Anhui Wotu Chemical Co., Ltd., Yizheng East Chemical Co., Ltd., Jiangxi Dasuo Chemical Co., Ltd., Purecha Group, Zhejiang Kente Catalysts Technologies Co., Ltd., SAMUH LAXMI CHEMICALS (BOM) P. LTD., Resins & Allied Products Maharashtra, India, and MODY CHEMI PHARMA LTD.

Other players include HARIKRISHNA ENTERPRISE, Global Pharma Chem., Haihang Industry, Fengchen Group Co., Ltd., Spectrum Chemical, and Clever Pathway Private Limited.

Recent Developments in N-Bromosuccinimide Industry

- In 2023, Albemarle announced plans to build a new NBS factory in China with patented, energy-efficient production technologies.

- In 2023, Sanofi collaborated with Zhejiang Medicine (China) to develop a new NBS production facility in China, to ensure long-term supply for their pharmaceutical pipeline.

- In 2022, Lanxess developed a new, environmentally friendly NBS production process called electrochemical bromination, which reduces wastewater creation and CO2 emissions.

- In 2022, TCI Chemicals acquired Kanto Chemical's NBS business, which strengthened its position in the Asian market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the n-bromosuccinimide market analysis from 2022 to 2032 to identify the prevailing n-bromosuccinimide market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the n-bromosuccinimide market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global n-bromosuccinimide market trends, key players, market segments, application areas, and market growth strategies.

N-Bromosuccinimide Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 28.5 million |

| Growth Rate | CAGR of 3.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 200 |

| By Content |

|

| By Application |

|

| By Region |

|

| Key Market Players | SAMUH LAXMI CHEMICALS (BOM) P. LTD, Zhejiang Kente Catalysts Technologies Co., Ltd., Resins & Allied Products Maharashtra, India, Anhui Wotu Chemical Co., Ltd., Nanjing Suru Chemical Co., Ltd, HALIDES CHEMICALS PVT. LTD., MODY CHEMI PHARMA LTD., Jiangxi Dasuo Chemical Co., Ltd, Purecha Group, Yizheng East Chemical Co., Ltd. |

Analyst Review

According to the insights of the CXOs of leading companies, increasing demand from various industries such as pharmaceuticals, polymers, and agrochemicals drives the growth of the market. NBS is widely utilized as a brominating agent in organic synthesis, making it indispensable in these sectors for the production of pharmaceutical intermediates, specialty chemicals, and crop protection chemicals. Moreover, the rising focus on sustainable practices and environmental regulations favor the adoption of NBS due to its efficiency in selective bromination reactions, minimizing unwanted by-products and enhancing process sustainability.

However, the N-Bromosuccinimide market faces certain restraints that could hinder its growth potential. The availability and pricing of raw materials hamper the growth of the market. Bromine, a key raw material for NBS production, is subject to fluctuating prices influenced by factors such as geopolitical tensions, supply-demand dynamics, and regulatory changes. Instabilities in the supply chain can lead to cost escalations, impacting the profitability of NBS manufacturers and posing challenges for market expansion. In addition, stringent regulatory frameworks governing the handling and transportation of bromine derivatives pose compliance challenges, thereby impeding market growth to a certain extent.

The CXOs further added that the expanding applications of NBS in emerging sectors such as water treatment, cosmetics, and organic synthesis offer avenues for market players to diversify their product portfolios and tap into new revenue streams. Furthermore, technological advancements aimed at enhancing the efficiency and eco-friendliness of NBS production processes hold significant potential for market growth. Collaborations and strategic partnerships among industry participants can facilitate knowledge exchange and innovation, driving the development of novel applications and expanding market reach.

Asia-Pacific is the largest regional market for N-Bromosuccinimide.

The shift towards bromine-based reagents is the upcoming trend of N-Bromosuccinimide Market in the world.

Pharmaceutical Industry is the upcoming trend of N-Bromosuccinimide Market in the world.

The escalating growth of the pharmaceutical industry and the increasing adoption of N-Bromosuccinimide in water treatment processes are the drivers of the of the N-Bromosuccinimide Market.

The N-Bromosuccinimide market attained $21.1 million in 2022 and is projected to reach $28.5 million by 2032, growing at a CAGR of 3.2% from 2023 to 2032.

The top companies to hold the market share in N-Bromosuccinimide are Nanjing Suru Chemical Co., Ltd., HALIDES CHEMICALS PVT. LTD., Anhui Wotu Chemical Co., Ltd., Yizheng East Chemical Co., Ltd., Jiangxi Dasuo Chemical Co., Ltd., Purecha Group, Zhejiang Kente Catalysts Technologies Co., Ltd., SAMUH LAXMI CHEMICALS (BOM) P. LTD., Resins & Allied Products Maharashtra, India, and MODY CHEMI PHARMA LTD.

Loading Table Of Content...

Loading Research Methodology...