Oil & Gas Seals Market Research: 2031

The Global Oil & Gas Seals Market was valued at $6.3 billion in 2021, and is projected to reach $8.1 billion by 2031, growing at a CAGR of 2.6% from 2022 to 2031. A seal is a relatively impermeable layer of rock that forms a barrier or cap above and around a reservoir rock. A seal, which is commonly made of shale, chalks, clays, anhydrite, or salt, prevents fluids from migrating beyond the reservoir. The increase in demand for energy, growing exploration and production of oil & gas, and increasing use of hydraulic fracturing in unconventional oil & gas production are the major factors projected to drive the market growth.

Other factors that contribute to the growth of the market include the increase in demand for cost-effective and environmentally friendly solutions, the rise in the use of high-performance materials in the production of seals, and an increase in focus on the maintenance and repair of aging oil & gas infrastructure. The oil & gas seals industry has grown significantly in recent years and is expected to continue in the future, owing to an increase in investments in oil & gas exploration activities around the globe.

Market Dynamics

The regulatory environment for the oil & gas industry is highly complex and stringent, requiring companies to adhere to strict standards for product quality and safety. This can also add to the cost of production, further limiting the entry of small and medium-sized companies into the market. Furthermore, the high capital investment required to produce oil & gas seals is a significant limitation to the growth of the market, especially for small and medium-sized companies. This can result in fewer players in the market, leading to decreased competition and higher prices for the end-users. All these factors are expected to hinder the market growth during the forecast period.

Increase in energy demand has led to rising exploration and production activities, leading to an increase in demand for oil & gas seals. These seals are essential in ensuring the safe and efficient functioning of oil & gas production and transportation systems. Therefore, the oil & gas seals market is expected to grow significantly in the upcoming years. With the growing energy demand, new oil & gas reserves are being discovered and used, leading to the expansion of production activities. This has resulted in the need for advanced and reliable sealing solutions, driving the oil & gas seals market growth in the upcoming years.

The key players profiled in this report include -

MG Sealing Limited, BRUSS Sealing Systems GmbH, Cooper Standard, Daetwyler Holding Inc., Dana Limited, ElringKlinger AG, Flowserve Corporation, Freudenberg Sealing Technologies, GARLOCK FAMILY OF COMPANIES, and KLINGER Holding GmbH.

The oil & gas seals market is segmented on the basis of type, material, application, and region. By type, the market is divided into single processing seals and double processing seals. By material, the market is classified into metal, elastomers, and face materials. By application, the market is classified into upstream, midstream, and downstream. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The oil & gas seals market is segmented into Type, Material and Application.

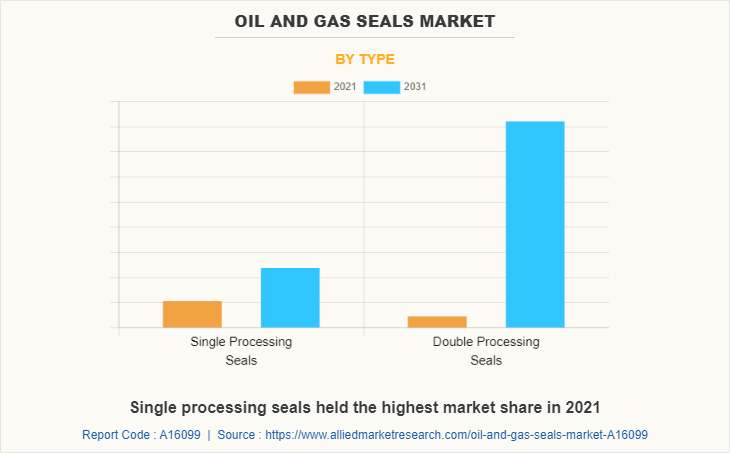

By Type:

The double processing seals segment is estimated to show the fastest growth during the forecast period. Double seals are effective for high pressure and temperature and are frequently used to keep items from spilling out. These seals assist to reduce the waste of expensive liquids and also serve as an alternative when the process fluid is not stable and consistently lubricated. Double seals give a degree of safety emissions compliance that single seals do not. This is important when pumping or mixing a potentially dangerous or toxic chemical. These are predicted to be the major factors affecting the oil & gas seals market during the forecast period.

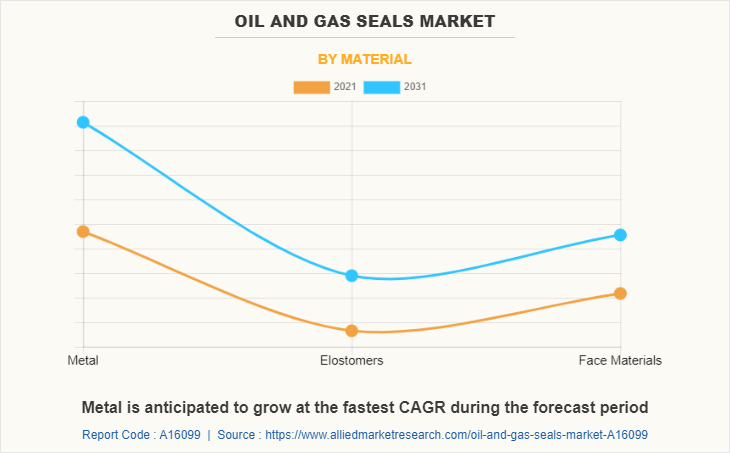

By Material,

The metal sub-segment dominated the global oil & gas seals market share in 2021. The growth of this sub-segment can be attributed to the use of Oil & gas seals for circumstances when high temperatures are required. Metal seals are impermeable and can withstand severe temperatures and pressures. Furthermore, they are used in extreme environmental situations to protect against corrosion, cryogenic temperatures, chemical resistance, and radiation. Oil & gas materials such as metal are bound to create a scope of growth for the sub-segment during the forecast period.

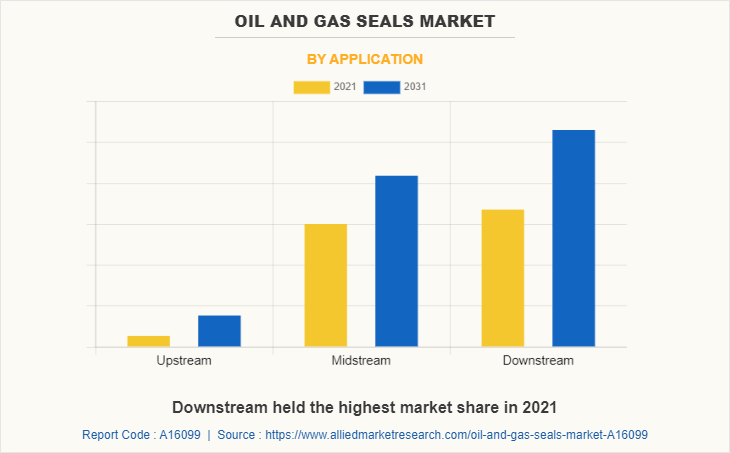

By Application,

The downstream sub-segment dominated the market in 2021. Oil & gas processing seals are significantly used in the downstream process to transport and store them in various containers. Furthermore, seals of various types are necessary for reactors, extraction chambers, and distillation chambers to prevent leakage. The downstream process includes the final refining and market distribution of oil & gas products. Throughout this technique, highly harsh chemistry is utilized, necessitating the usage of specially developed sealing solutions. These are predicted to be the major factors affecting the oil & gas seals market during the forecast period.

By Region,

Asia-Pacific is projected to be the fastest-growing region during the forecast period. This is mostly due to an increase in industrial investment and the recent discovery of significant oil & gas deposits. In APAC, China and India are anticipated to witness the fastest rise in demand and revenue. This is mostly due to an increase in industrial investment and the recent discovery of significant oil & gas deposits. As the oil & gas sector grows, demand for more durable, high-performance seals increases. Many facilities are being constructed to accommodate the increase in oil & gas production in the region. These are predicted to be the major factors in this region affecting the oil & gas seals market size during the forecast period.

Impact of COVID-19 on the Global Oil & Gas Seals Industry

- The COVID-19 pandemic had a significant impact on the oil & gas seals market. The reduction in demand for oil & gas products, due to the lockdowns and travel restrictions, led to a decrease in the demand for oil & gas seals.

- China is the leading producer and exporter of raw materials such as metal, elastomers, and feedstock required for oil & gas seal production. However, China being the epicenter of the coronavirus pandemic, its export was affected, leading to a decline in oil & gas seals production. In addition, supply chain disruptions caused by the pandemic also affected the market.

- However, this in turn led to a slowdown in the production and sales of oil & gas seals industry was greatly affected owing to import-export restrictions, closed borders, and supply chain disruptions due to the outbreak of the COVID-19 pandemic

- The economic slowdown has affected the setup of new oil & gas seals projects across the world as the majority of government funding was diverted towards the healthcare sector owing to the rapid spread of the COVID-19 virus, impacting the market to the great extent

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the oil & gas seals market forecast, segments, current trends, estimations, and dynamics of the oil & gas seals market analysis from 2021 to 2031 to identify the prevailing oil & gas seals market opportunities.

- Market research is offered along with information related to key oil & gas seals market opportunity, drivers, and restraints.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- An in-depth analysis of the oil & gas seals market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global oil & gas seals market trends, key players, market segments, application areas, and market growth strategies.

Oil & Gas Seals Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 8.1 billion |

| Growth Rate | CAGR of 2.6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 293 |

| By Type |

|

| By Material |

|

| By Application |

|

| By Region |

|

| Key Market Players | Freudenberg Group , Flowserve Corporation , Sinoseal Holding Co., Ltd. , john crane, NAK Sealing Technologies Corporation , EnPro Industries , EagleBurgmann , Trelleborg AB , Hallite Seals , Parker Hannifin Corporation |

Analyst Review

An increase in oil exploration and production is projected to drive the market growth. The developing oil & gas, chemical, and petrochemical sectors are expected to boost demand for oil & gas processing seals soon. Emerging countries are aggressively attempting to adopt cutting-edge petroleum technology and manufacturing practices. The substantial capital expenditure necessary to create oil & gas seals is a significant impediment to industry expansion, particularly for small and medium-sized businesses. This may result in fewer participants in the market, resulting in less competition and higher pricing for end-users, which are predicted to hinder the industry growth. Furthermore, the oil & gas industry's growing emphasis on reducing its carbon impact is boosting demand for energy-efficient and sustainable seals.

Among the analyzed regions, Asia-Pacific is expected to account for the highest revenue in the market by the end of 2031, followed by LAMEA, North America, and Europe. Rapid industrialization and urbanization are the key factors responsible for the leading position of Asia-Pacific and LAMEA in the global oil & gas seals market.

Rising investment in the exploration of new oil & gas fields, particularly in emerging economies around the world, is propelling the oil & gas processing seals market forward. Furthermore, the chemical and petrochemical industries are driving growth in the oil & gas processing seals market in these developing economies. The use of these seals contributes to improved offshore oil production efficiency, which is another major factor driving the oil & gas processing seals market.

The downstream sub-segment of the application acquired the maximum share of the global oil & gas seals market in 2021.

The growing application of oil & gas seals in energy, the growing exploration and production of oil & gas, and the increasing use of hydraulic fracturing in unconventional oil & gas production are anticipated to boost the oil & gas seals market in the upcoming years.

Asia-Pacific will provide more business opportunities for the global oil & gas seals market in the future.

AMG Sealing Limited, BRUSS Sealing Systems GmbH, Cooper Standard, Daetwyler Holding Inc., Dana Limited, ElringKlinger AG, Flowserve Corporation, Freudenberg Sealing Technologies, GARLOCK FAMILY OF COMPANIES, and KLINGER Holding GmbH are the major players in the oil & gas seals market.

The major growth strategies adopted by oil & gas seals market players are investment and agreement.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global oil & gas seals market from 2022 to 2031 to determine the prevailing opportunities.

Loading Table Of Content...