Oleochemicals Market Research, 2032

The global oleochemicals market size was valued at $29.9 billion in 2022, and is projected to reach $55.2 billion by 2032, growing at a CAGR of 6.5% from 2023 to 2032.Increase in demand for oleochemicals in industrial application, which is used to produce surfactants, lubricants, and plasticizers, has expanded the oleochemicals market share across different sectors. In surfactants, oleochemicals are key in personal care products, detergents, and agricultural chemicals, offering biodegradable and non-toxic alternatives to petrochemicals. This surge in preference for eco-friendly surfactants has expanded the market.

Introduction

Oleochemicals are a broad group of chemicals derived from natural fats and oils, predominantly sourced from plants and animals. These chemicals serve as an eco-friendly alternative to petrochemicals, which are derived from crude oil. Oleochemicals include a range of substances such as fatty acids, fatty alcohols, methyl esters, glycerol, and others. These chemicals are produced through the chemical or enzymatic breakdown of triglycerides found in natural oils, resulting in fatty acids, glycerol, fatty alcohols, and esters. Oleochemicals are a key alternative to petrochemicals, offering sustainability and biodegradability due to their renewable sources. The process of creating oleochemicals involves methods such as hydrolysis, transesterification, and hydrogenation.

One of the primary applications of oleochemicals is in the personal care and cosmetics industry. Fatty acids and their derivatives are widely used in the production of soaps, detergents, shampoos, and creams. These chemicals act as emulsifiers, surfactants, and moisturizers, providing texture and stability to cosmetic products. Glycerol, a byproduct of oleochemical processes, is a common humectant used in lotions and creams to retain moisture on the skin. The biodegradable nature of oleochemicals makes them preferable over synthetic chemicals in products aimed at skin care, contributing to the demand for natural, sustainable, and eco-friendly beauty products.

Oleochemicals are essential in the formulation of soaps and detergents, a market that has a significant consumer base worldwide. Fatty acids, particularly from palm and coconut oils, are key ingredients in soaps due to their ability to create lather and break down oils and grease. In laundry detergents, fatty alcohols and their sulfate derivatives act as surfactants, helping to remove dirt and stains. Moreover, the biodegradable and non-toxic properties of oleochemicals align with the rise in consumer preference for eco-friendly household products, driving their adoption in both liquid and powder detergent formulations

Key Takeaways

- The oleochemicals market study covers 20 countries. The research includes a segment analysis of each country in terms of both value and volume for the projected period 2023-2032.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global oleochemicals markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

- Over 3,700 product literatures, annual reports, industry statements, and other comparable materials from major industry participants were reviewed to gain a better understanding of the oleochemicals market.

- The oleochemicals market is highly fragmented, with several players including Emery Oleochemicals, Wilmar International, Croda International, Evonik Industries AG, Oleon NV, Cargill Incorporated, Musim Mas Group, IOI Group, Procter & Gamble and Twin River Technologies. Also tracked key strategies such as acquisitions, product launches, mergers, expansion etc. of the players operating in the helium market.

Market Dynamics

Factors such as surge in demand for green chemicals, high demand from end-use industries, and easy availability of raw materials are expected to drive the growth of oleochemicals market. As industries and consumers increasingly prioritize sustainability and environmental responsibility, oleochemicals, derived from renewable resources such as plant oils and animal fats, offer a viable alternative to petrochemicals. These bio-based chemicals are biodegradable and less toxic, making them a preferred choice across various sectors such as personal care, food, and agriculture. Moreover, the high demand from end-use industries such as cosmetics, detergents, pharmaceuticals, and food packaging are boosting market growth. Oleochemicals are versatile and find application in a wide array of products, ranging from surfactants and lubricants to plasticizers and emulsifiers. According to the A.I.S.E. Activity & Sustainability Report 2022, the detergents and maintenance products industry in Europe was valued at approximately EUR 39.8 billion (equivalent to around $44.67 billion). Additionally, the sector's value chain contributed a gross value-added of EUR 24.6 billion (around $27.61 billion) to the European Union's economy.

Fluctuating raw material prices are expected to restrain of the oleochemicals market growth. Key feedstocks such as palm oil, soybean oil, and tallow are highly dependent on agricultural conditions, which are influenced by factors such as weather patterns, natural disasters, and seasonal variations. For example, droughts or floods can drastically reduce crop yields, leading to shortages and price hikes for these essential raw materials. In addition, geopolitical factors such as trade restrictions, tariffs, and export bans further exacerbate price volatility. Political instability in major raw material producing regions, such as Southeast Asia for palm oil, disrupts supply chains, increasing the unpredictability of raw material availability and costs. This volatility directly impacts oleochemical production costs, making it difficult for manufacturers to maintain stable pricing and profitability, affecting the competitiveness of bio-based chemicals compared to petrochemical alternatives. According to Statistics Malaysia, soap production in the country reached about 15.47 thousand metric tons in 2022, showing a decline from 16.92 thousand metric tons in 2021.

Segments Overview

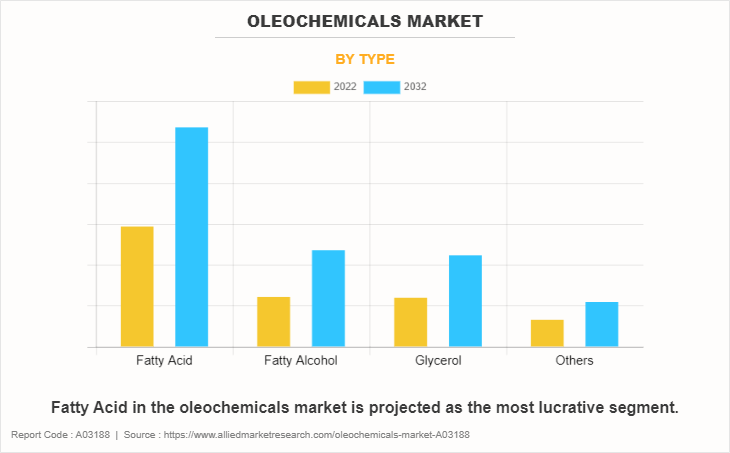

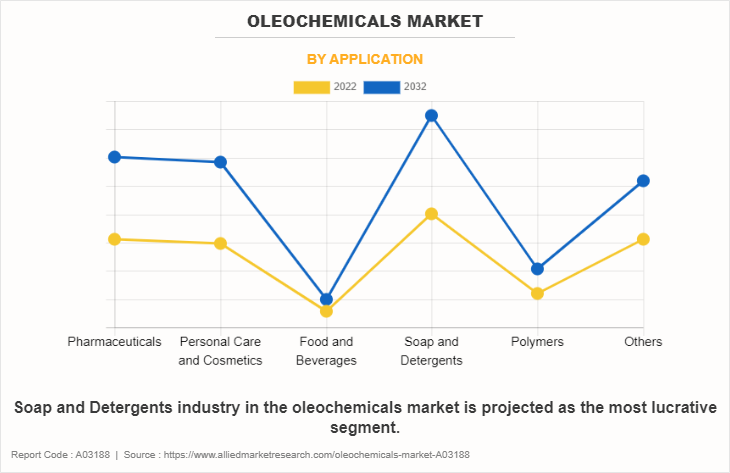

The oleochemicals market is segmented into type, application, and region. On the basis of type, the market is divided into fatty acids, fatty alcohol, glycerol, and others. By application, the oleochemicals industry is categorized into pharmaceuticals, personal care & cosmetics, food & beverages, soap & detergents, polymers, and others. Region-wise, the oleochemical market is studied across North America, Europe, Asia-Pacific, and LAMEA.

Oleochemicals Market, By Segment

The fatty acids segment is expected to grow at a 6.4% rate of CAGR in terms of revenue during the forecast period while fatty alcohol segment is projected to be fastest growing segment growing at 7% CAGR. Increased demand for bio-based fatty acids from end-use industry, including pharmaceuticals, personal care, cosmetics, food & beverages, chemicals, and others is anticipated to drive the segment’s growth while increasing demand from pharmaceutical and cosmetics industry is driving the demand for fatty alcohol. Fatty alcohols are being used in pharmaceuticals and cosmetics owing to their specific properties, such as emollients.

Oleochemicals Market, By Application

By application, the pharmaceutical segment accounted for the largest market share and the personal care and cosmetics segment is the fastest growing segment, growing around 7.2% CAGR during the forecast period, in terms of revenue. Oleochemicals is used in many pharmaceutical drugs, and the ever-increasing demand for pharmaceuticals drugs across the globe drives the demand for oleochemical in pharmaceutical application. In skin care, oleochemicals are frequently used as moisturizing agents, providing long-lasting hydration and forming a protective barrier on the skin. Fatty acids such as stearic acid and palmitic acid, for instance, help in conditioning and softening the skin, making them popular in creams and lotions.

Oleochemicals Market,By Region

Region wise, Asia-Pacific was the highest revenue contributor and fastest growing region representing a CAGR of 6.7% during the forecast period. In China and India, oleochemicals are extensively utilized in the production of personal care and household products. These countries have substantial domestic markets for soaps, detergents, and cosmetics, which rely heavily on oleochemicals like fatty acids and esters. In Japan and South Korea, oleochemicals are used in high-tech industries, including electronics and automotive. These countries have witnessed a surge in demand for specialty oleochemicals, which are used in applications such as coatings, adhesives, and advanced materials. The focus in these markets is often on high-purity and performance-specific oleochemicals to meet stringent industrial standards. According to Invest India, the personal care and hygiene market in India was valued at $13.74 billion in FY2022 and is projected to grow to $15.7 billion by FY2026. The primary export destinations for this sector from India include the U.S., the United Arab Emirates, China, and Bangladesh. In FY2022, India imported personal care and hygiene products worth $1.7 billion, while exports were significantly higher at $2.9 billion

Competitive Analysis

The key players profiled in the oleochemicals market report are Emery Oleochemicals, Wilmar International, Croda International, Evonik Industries AG, Oleon NV, Cargill Incorporated, Musim Mas Group, IOI Group, Procter & Gamble and Twin River Technologies. The other players in the oleochemical market include Evyap Oleo, Godrej Industries, Kao Corporation, CREMER, and Pacific Oleochemicals Sdn Bhd.

In June 2023, Oleon NV launched a new oleochemicals production facility powered entirely by natural-origin proteins, specifically enzymes. The INCITE project, which represents a total investment of EUR 17.4 million (approximately $19.56 million), received EUR 13.3 million (about $14.95 million) in subsidies from European sources.

Historic Trends of Oleochemicals Market

- 1907: The establishment of the first commercial production of oleochemicals in the United States marked a significant industrial milestone. This period saw the growth of soap and detergent industries.

- 1960s: The development of new technologies and the increasing awareness of environmental concerns led to innovations in oleochemical production and applications.

- 1970s: The emergence of bio-based chemicals and renewable resources gained momentum. This period saw an increased focus on sustainability and the environmental impact of oleochemicals.

- 2000s: The oleochemical industry began to diversify, with significant growth in renewable and sustainable chemicals. This period also saw the rise of biofuels and other bio-based products derived from oleochemicals

- 2010s: The focus on sustainability and the circular economy drove innovation in oleochemicals, leading to the development of more environmentally friendly products and processes.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the oleochemicals market analysis from 2022 to 2032 to identify the prevailing oleochemicals market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the oleochemicals market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global oleochemicals market trends, key players, market segments, application areas, and market growth strategies.

Oleochemicals Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 55.2 billion |

| Growth Rate | CAGR of 6.5% |

| Forecast period | 2022 - 2032 |

| Report Pages | 410 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Wilmar International Ltd, Emery Oleochemicals, Cargill Incorporated., Twin Rivers Technologies, Inc., IOI Oleochemical, Oleon NV, Evonik Industries AG, Musim Mas, Croda International plc, Procter & Gamble |

Analyst Review

According to the insights of the CXOs of leading companies, the global market for oleochemicals is expanding swiftly due to the rise in demand for personal care products. Many governments worldwide have implemented policies and regulations that encourage the use of bio-based raw materials as part of efforts to promote sustainability and reduce dependence on fossil fuels. Incentives, subsidies, and regulations play a crucial role in driving the adoption of oleochemicals. Furthermore, the oleochemical industry has diversified its feedstock sources to include a wide range of vegetable oils, such as palm oil, soybean oil, coconut oil, and others. This diversification helps ensure a stable supply of raw materials and reduces dependency on a single source.

The prices of vegetable oils and fats, which are primary raw materials for oleochemical production, are volatile and subject to market fluctuations. This affects the cost of production and impacts the profit margins of oleochemical manufacturers. This factor is anticipated to hamper the oleochemicals market expansion.

Increased demand for sustainable and biodegradable products

Pharmaceutical is the leading application of Oleochemicals Market.

Asia-Pacific is the largest regional market for Oleochemicals.

The Oleochemicals Market was valued for $29.9 billion in 2022 and is estimated to reach $55,2 billion by 2032, exhibiting a CAGR of 6.46% from 2023 to 2032.

The key players profiled in the oleochemicals market are Emery Oleochemicals, Wilmar International, Croda International, Evonik Industries AG, Oleon NV, Cargill Incorporated, Musim Mas Group, IOI Group, Procter & Gamble and Twin River Technologies.

Loading Table Of Content...

Loading Research Methodology...