The global one-man flight vehicle market was valued at $2.5 billion in 2021, and is projected to reach $4.4 billion by 2031, growing at a CAGR of 6% from 2022 to 2031.

One man flight vehicle has developed into specially designed aircraft of very low weight and power but with flying characteristics similar to conventional light aircraft. The scope of application includes training, police patrol, and other activities.

Growth of the one man flight vehicle market is driven by factors such as low cost of acquisition and maintenance, and absence of regulatory norms limiting civilians to fly a one man flight vehicle in certain regions. Placement of one man flight vehicle in recreational and sports activities are backed by increasing expenditure trends by civilians across the globe to support business opportunities within the region. Rise in disposable income across the globe and increase in delays in delivery of conventional aircraft is expected to impact one man flight vehicle in a positive manner to a certain extent. Rise in sports, tourism, and recreational activities post COVID-19 is supporting business opportunities within the segment. In Q1 2022, there were an expected 117 million foreign visitors, up from 41 million in Q1 2021, an increase of 182% year over year. About 47 million of the additional 76 million overseas arrivals were counted in March 2022.

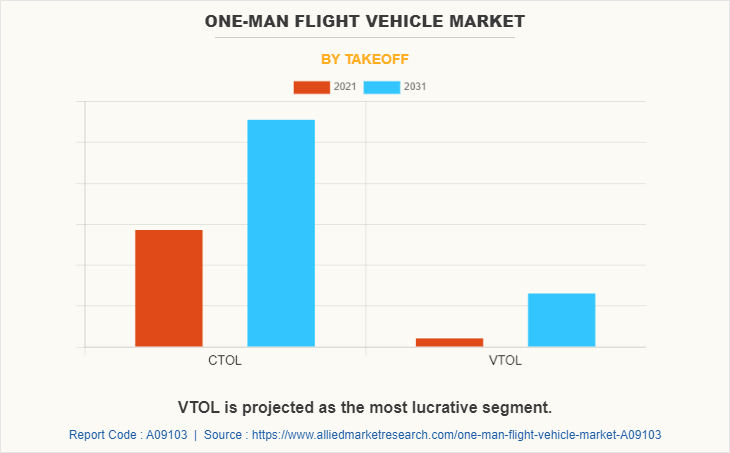

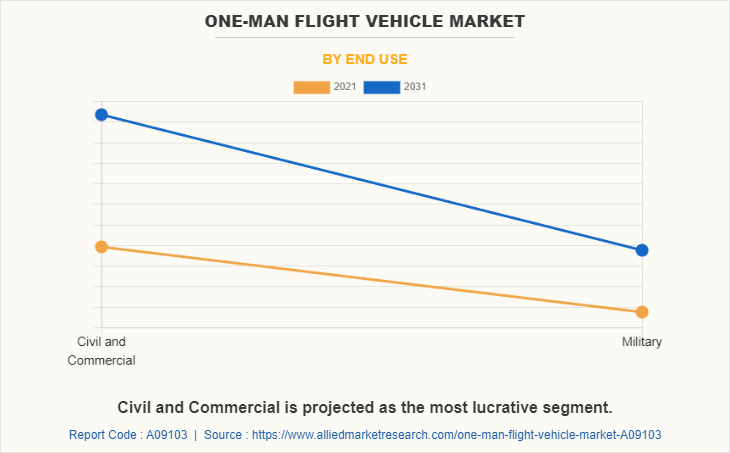

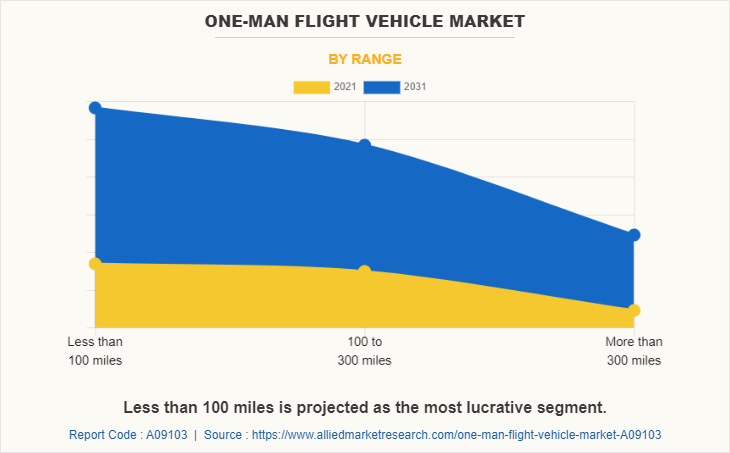

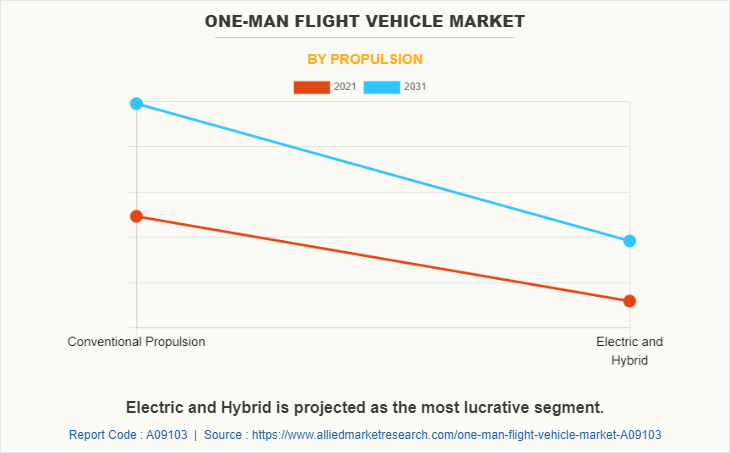

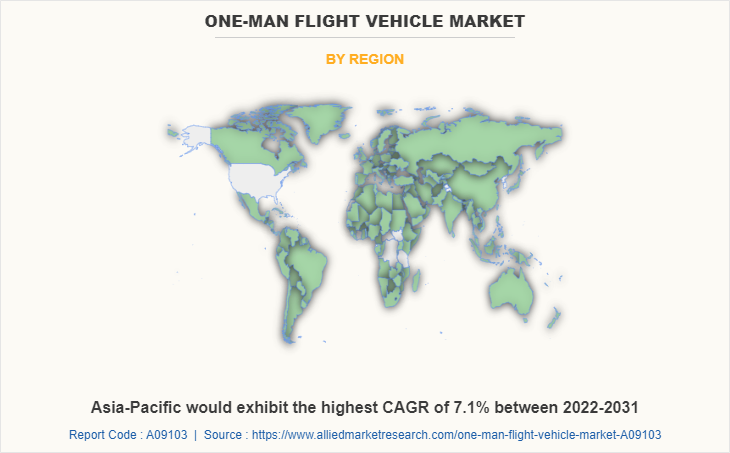

The one man flight vehicle market is segmented on the basis of range, propulsion, takeoff, end use, and region. By range, it is categorized into less than 100 miles, 100 to 300 miles, and more than 300 miles. The propulsion segment is further sub divided into conventional propulsion and electric & hybrid propulsion. Depending on takeoff, the market is fragmented into commercial takeoff and landing (CTOL) and vertical takeoff and landing (VTOL). The end use segment is bifurcated into civil and commercial & military. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Companies have adopted product development and product launch as their key development strategies in the air defnse system industry. Moreover, collaborations and acquisitions are expected to enable leading players to enhance their product portfolios and expand into different regions. The key players that operate in the one man flight vehicle market AutoGyro, Pilatus Aircraft Ltd, Pipistrel, Textron Inc, VOLOCOPTER GMBH, Cirrus Aircraft, Vulcanair, Piper Aircraft, Neva Aerospace, and Boeing among others.

Low cost of acquisition, maintenance, and operation

The dimensions and weight of one-man flight vehicle are significantly less than those of commercial aircraft. The definition of one-man flight vehicle is based on maximum takeoff weight (MTOW). Purchasing a one-man flight vehicle is simpler due to lenient ownership laws in many nations. In developed nations like the U.S., Canada, and Australia, one-man flight vehicle is often used for leisure and sporting activities. Some one-man flight vehicle aircrafts also utilize fuel intended for automobiles, which lowers the cost of operating the aircraft.

Inefficient supply chain and increase in backlogs of general aviation and commercial aircraft

The sudden outbreak of COVID-19 in 2019, imposition of global trade and travel restriction in 2020 and 2021, followed by the Ukraine-Russia war in 2022 has posed notable challenges in business operations, majorly in cross border trade. Governments across the globe have limited their trade dependencies on European regions and are aligning their inclination toward Asia-Pacific, African and Middle East nation. The inter-European trade infrastructure is also undergoing a major shift, casing notable business losses.

Airbus pleaded with European decision-makers not to put restrictions on Russian titanium imports. Sanctions on the metal, according to Airbus, would harm European aircraft while scarcely affecting the Russian economy. Comparatively, just one-third of Boeing's titanium demands are met by sources other than Russia for Airbus. Boeing said that it has stopped buying Russian titanium at the beginning of March. Despite this obstacle, Airbus recently reiterated its 2022 guidance and declared that its titanium sourcing requirements are met in the short and medium term. The business is stepping up its quest for non-Russian sources, though. Titanium has recently been accumulated by both Airbus and Boeing. Boeing anticipates that up to 141 of its aircraft on order, 90 of which are 737 MAX models, might be impacted by the developments in Ukraine and the sanctions imposed on aircraft supplies to Russia.

Rise in concerns related to operational safety and regulatory landscape

There have been notable debates and increasing concerns toward operational safety of one man flight vehicle. Major countries such as the U.S., Russia, UK, Germany, India, and China have minimal to no regulatory landscape towards acquisition and operations of one man flight vehicle. With technological advancements of one man flight vehicles, such as allowing them to cruise at higher speed and automated operations has raised several concerns toward safe operation of these aircrafts. Moreover, design modifications and integration of more electric components and commercialization of all electric one man flight vehicle has generated requirement to have a comprehensive regulatory framework toward manufacturing these vehicles as well.

Technological innovations and increase in R&D activities

Major companies across the globe are heavily investing in R&D of one man flight vehicle. These aircrafts are heavily perceived as the future source of day-to-day transportation and witness and strong growth potential during the forecast period. Complete electrification of one man flight vehicle, vertical takeoff and landing, using novel ultralight materials to ensure operational efficiency, and infrastructure development are among the primary focus areas of major industry players. Proactive initiatives by government organizations to support such innovative ideas is also one of the major factors driving opportunities within the one man flight vehicle market.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the one-man flight vehicle market analysis from 2021 to 2031 to identify the prevailing one-man flight vehicle market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the one-man flight vehicle market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global one-man flight vehicle market trends, key players, market segments, application areas, and market growth strategies.

One-man Flight Vehicle Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 4.4 billion |

| Growth Rate | CAGR of 6% |

| Forecast period | 2021 - 2031 |

| Report Pages | 274 |

| By Takeoff |

|

| By End Use |

|

| By Range |

|

| By Propulsion |

|

| By Region |

|

| Key Market Players | Experimental Aircraft Association Inc., Team Mini-Max LLC, AutoGyro, AeroplanesDAR, VOLOCOPTER GMBH, Pipistrel, Ehang, PAL-V, Neva Aerospace, SPACEK s.r.o. SD Planes, Opener, Elektra Solar GmbH, Ekolot, Pilatus Aircraft Ltd, Skfly Technologies, Jetson AB, Boeing |

Analyst Review

The one man flight vehicle market is expected to undergo a major shift in the coming years. Optimizing supply chain, streamlining manufacturing processes, increasing pace of deliveries and catering to a larger audience are some of the pressing concerns of one man flight vehicle market.

The market has grown quickly as a result of leading market participants investing in development of lightweight aircrafts that can be used in civil, government, and military markets to meet the rise in demand for one man flight vehicle. Low cost of operation and acquisition has allowed all these sectors to have specific needs to support business opportunities. Within the commercial segment, the one man flight vehicle is used for business, recreational or personal purpose, followed by government sector that use one man flight vehicle for law-and-order activities. The military sector majorly uses one man flight vehicle for training, and intelligence, surveillance and reconnaissance (ISR) purpose.

The demand for one man flight vehicle was steadily increasing, but the market was notably hit by COVID-19. Even the largest one man flight vehicle manufacturers faced operating problems, owing to supply chain disruptions and restricted site access. Numerous governments imposed a countrywide lockdown, forcing businesses to shut down their factories. Defense firms were immediately impacted by extended state of lockdown in some nations, which forced them to put off ordering aircraft and their suppliers. In addition, demand for one man flight vehicle was affected by sudden decline in tourism and recreational activities. Increase in cost of storing aircraft has put a significant financial strain on market participants.

Among the analyzed regions, North America is the highest revenue contributor, followed by Europe, Asia-Pacific, and LAMEA. Asia-Pacific is expected to witness highest growth rate during the forecast period, owing to increase in efforts of the Indian and Chinese governments to develop indigenous aviation infrastructure.

The global one man flight vehicle market was valued at $2,523.4 million in 2021, and is projected to reach $4,423.7 million by 2031, registering a CAGR of 6.0% from 2022 to 2031.

The key players that operate in the one man flight vehicle market AutoGyro, Pilatus Aircraft Ltd, Pipistrel, Textron Inc, VOLOCOPTER GMBH, Cirrus Aircraft, Vulcanair, Piper Aircraft, Neva Aerospace, and Boeing among others.

The adoption of a one-man flight vehicle in domestic commutation is one of the upcoming market trends.

Civil and commercial are among the major application of the market.

North America is the largest regional market for one-man flight vehicles.

Loading Table Of Content...