Online Trading Platform Market Insights, 2031

The global online trading platform market size was valued at USD 8.9 billion in 2021, and is projected to reach USD18.4 billion by 2031, growing at a CAGR of 7.8% from 2022 to 2031. Factors such as increase in use of AI in form of robo-advisory, need for market surveillance, rise in demand for customized trading platforms from end users, and simple and less expensive features propel the online trading platform market growth.

The online trading platform market is influenced by factors such as increase in use of smartphones and internet access throughout the globe. In addition, increase in demand for customized trading platforms from end users, such as government and non-profitable banks, is anticipated to drive demand for these solutions. Technological advancements and integration of trading platforms on smartphones are few major factors expected to create various market opportunities for key players.

In addition, companies in the market are focused on expanding their business units globally. In addition, rise in demand for cloud-based solutions is anticipated to be opportunistic for the market growth during the forecast period. They have countless number of advantages over previous used trading strategies.

Depending on component, the market is divided into platform and services. On the basis of type, it is categorized into commissions and transaction fees. On the basis of deployment model, it is bifurcated into on-premise and cloud. On the basis of application, it is segmented into institutional investors and retail investors. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

On the basis of component, the platform segment dominated the online trading platform market in 2021, and is expected to maintain the dominance in the upcoming years. Various factors such as rise in demand for fast, reliable, and effective order execution; growth in demand for market surveillance; and increase in government regulations fuel growth of this segment. However, the services is expected to witness the highest growth rate during the forecast period, as it ensures effective functioning of online trading platform with transparency and control throughout the process. Online trading services include professional and managed services.

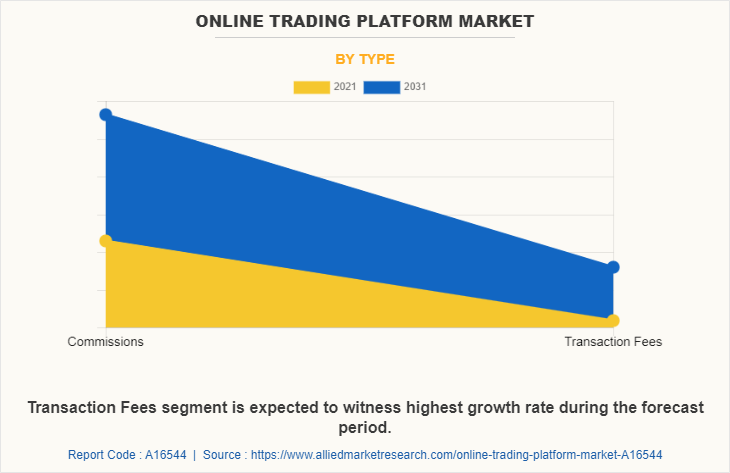

On the basis of type, the commissions segment dominated the online trading platform market share in 2021, and is expected to maintain the dominance in the upcoming years. It is because commissions could be assessed on a per-order basis. Orders placed over the course of more than one day is handled as distinct order for commission purposes. However, the transaction fees is expected to witness the highest growth rate during the forecast period, as because buyers and sellers pay transaction fees, which are payments made to banks and brokers for their services. Investors care about transaction fees as they are one of the most important predictors of net returns.

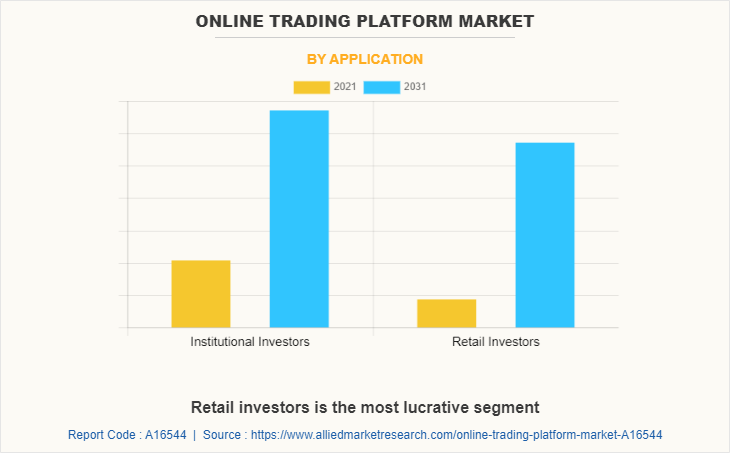

On the basis application, the institutional investors segment dominated the online trading platform market size in 2021, and is expected to maintain its dominance in the upcoming years. This is because move large blocks of shares and can have a tremendous influence on movements of the stock market. It is defined as sophisticated investors who are well-informed and thus less inclined to make rash decisions and investments. However, the retail investors segment is expected to witness the highest growth rate during online trading platform market forecast period, as have access to a wealth of information but has less access to information that are reserved for institutional investors. Also, retail investment is more user friendly and is mostly done by new clients.

North America is a rapidly growing region in the global online trading platform market, owing to rise in technological advancements and adoption. It possesses well-equipped infrastructure and the ability to afford online trading platform solutions. Furthermore, it is projected to show strong growth, owing to favorable urban and modern environments. Top global companies in North America are focused on the U.S., which contributes significantly in the market.

However, Asia-Pacific is expected to be the fastest growing regional segment during the forecast period, with the highest CAGR. Leading players are focused on Asia-Pacific to increase their business as the region is expected to witness high growth in deployment of online trading platform. Moreover, Asia-Pacific has witnessed a surge in self-directed trading via online trading platforms as the pandemic disrupted normal social interactions upon clients and brokers. Some banks in the regions are yet to develop and launch online trading platform.

Top Impacting Factors

Surge in Robo-Advisory

Artificial intelligence is predicted to change the way electronic trading platform operate in the future. In the guise of robo-advisors, companies are incorporating AI into their trading systems. AI-enabled software supports users in observing millions of trade data pointers and executing activities at the best possible pricing. The platform also allows analysts to do in-depth market research and assist trading organizations in effectively mitigating risks to maximize profits.

For instance, Kavout Corporation in Seattle, Washington, is one of the organizations that has integrated AI and its applications into their trading platforms. Kavout is an artificial intelligence platform that combines predictive analytics, big data, and machine learning with the Kai quantitative analysis methodology. The software assists traders and users in identifying prospective stock market short-term winners and losers.

Need for Market Surveillance

Market abuse surveillance or trade surveillance includes capturing trade data, and then analyzing and monitoring it to detect potential market abuse as well as other forms of financial crime, such as rogue trading. Legal definition of trade surveillance varies by country. For instance, in the UK, market surveillance includes insider dealing, market manipulation, unlawful disclosure, and attempted manipulation.

In addition, increase in high-frequency related incidences has raised global concerns about market stability and integrity. Hence, there is rise in need for market surveillance, which fuels the demand for online trading solutions with market surveillance capabilities, driving the growth of the Online Trading Platform Industry. For instance, Software AG offers a trade surveillance solution based on Complex Event Processing (CEP) engine that processes vast volumes of information, including both historical and live streaming data to detect positive and negative trading patterns.

COVID-19 Impact Analysis

The current estimation of 2031 is projected to be higher than pre-COVID-19 estimates. The COVID-19 outbreak has low impact on growth of the online trading platform industry as the adoption of online trading solutions has increased in unprecedented circumstances. However, during the pandemic, the World Trade Organization (WTO) predicts a decline in foreign trade of between 13% and 32%. On the other hand, in post COVID-19 pandemic, the penetration of Electronic Trading Platform is expected to increase significantly as they offer several advantages such as they are simple to use, less expensive, and chances of error are less.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the online trading platform market analysis from 2021 to 2031 to identify the prevailing online trading platform market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the online trading platform market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global online trading platform market trends, key players, market segments, application areas, and market growth strategies.

Online Trading Platform Market Report Highlights

| Aspects | Details |

| By Component |

|

| By Type |

|

| By Deployment Mode |

|

| By Application |

|

| By Region |

|

| Key Market Players | TD Ameritrade, Devexperts, Pragmatic Coders, Charles Schwab Corp., EffectiveSoft Ltd., Profile Software, E-Trade, Interactive Brokers, Chetu |

Analyst Review

The online trading market is going through enormous transformation and growth. Online trading has become an emerging technology for financial institutions to gain an edge over other market participant. There is very less possibility that traders are profitable; however, online trading has improved such odds through better strategy testing, design, and execution; thus, increasing profitability. More number of investors are adopting online trading technology to bring superior efficiency to financial markets.

In the digital era where computers and smartphones are monopolizing communication and life, there seems to be a comparatively less growth rate of traditional marketing than digital marketing. Various studies have observed that offline trading might be one of the most powerful tools for end users; however, more number of SMEs, as well as, large enterprises are focusing more on online trading in past few years. In addition, rise in number of brokers and trade partners is increasing number of traders around the globe, which, in turn, is improving business of online trading platforms. For instance, in June 2021, Reliance Industries Limited established an AI chatbot to assist shareholders in the trading market. Chatbot-assisted trading platforms allow users to stay on top of market trends, mathematical computations, and projections, as well as automate routine trading tasks. For instance, Tracxn Technologies (Epoque Plus)- Epoque's fully automated AI trading that consist of three AI-powered engines: a strategy engine that analyzes prospective trades, an order engine that executes operational operations, and an active engine that improves its performance through machine learning.

In addition, during the COVID-19 pandemic, people stayed home to be safe. In 2021, the online trading platform market witnessed massive changes, owing to the COVID-19 pandemic, which completely altered the way users worked. There has been a drastic loss in number of brokers, owing to online trading. Users have information on their fingertips, which affected brokers by giving information about stocks directly to the users. For instance, In January 2021, Binomo launched an online trading platform based on real-time analysis and forecasting. The platform consists of around ~900,000 brokers from over 130 countries. In addition, Deutsche Bank integrated with Sharekhan Ltd. to develop and launch db TradePro, an online trading platform. The trading platform offers users services such as interactive account options, competitive brokerage rates, effective research, and online banking services.

Furthermore, the online trading platform market is competitive and comprises a number of regional and global vendors competing based on factors such as cost of solutions, reliability, and support services. Growth of the market is impacted by rapid advances in the electronic trading offerings, whereas the vendor performance is impacted by COVID-19 conditions and industry development. Moreover, vendors operating in the market are offering advanced online trading products and services to improve experience of traders using an online trading platform.

The online trading platform market size is estimated to grow from $8,943.0 million in 2021, to reach $18,439.5 million by 2031, at a CAGR of 7.8%.

Institutional investors

Rise in demand for cloud-based solutions and ongoing technological advancements

North America

Td Ameritrade Holding Corporation, Interactive brokers, E-Trade, Profile Software, Chetu, Inc., Empirica, Pragmatic Coder, EffectiveSoft Ltd., Charles Schwab, and Devexperts llc.

Loading Table Of Content...