Optogenetics Market Research, 2032

The global optogenetics market size was valued at $114.1 million in 2022, and is projected to reach $196.3 million by 2032, growing at a CAGR of 5.6% from 2023 to 2032. Optogenetics is a field of research that combines genetic engineering and optics to control the activity of specific cells in living tissue using light. This technique involves inserting genes for light-sensitive proteins into specific cells, which can then be activated or inhibited by shining light of a specific wavelength onto them. By using optogenetics, researchers can precisely control and manipulate the activity of individual cells and neural circuits, allowing them to study their function. Optogenetics has wide-ranging applications in neuroscience, medicine, synthetic biology, and robotics.

Market dynamics

Optogenetics has become a popular technique in various fields of research such as neuroscience, synthetic biology, and medicine. Optogenetics tools allow researchers to control the activity of cells and tissues with high precision and temporal resolution. This has led to the increase in use of optogenetics in research activities, such as studying neural circuits, developing new treatments for neurological disorders, and engineering biological systems. For instance, researchers are using optogenetics to study neural circuits and brain function. They use optogenetics to control the activity of specific neurons in the brain and observe the resulting behavior. This has led to significant advances in understanding of brain function and has the potential to lead to new treatments for neurological disorders. The growth of the optogenetics market is expected to be driven by developed countries such as U.S., Canada, and Germany, due to availability of advanced healthcare infrastructure, increase in R&D activities for optogenetic, rise in prevalence of neurological diseases, and surge in demand for neuroscience research. Furthermore, the healthcare industry in emerging economies is developing at a significant rate, owing to significant investments by government to improve healthcare infrastructure, rise in demand for enhanced healthcare services, and development of the research institutes in emerging countries.

In addition, rise in technological advancement such as development of more precise and efficient optogenetic tools further propels the optogenetics market Growth. For instance, the development of optogenetic actuators such as Channelrhodopsin-2 (ChR2) and Halorhodopsin (NpHR) have enabled researchers to control neural activity with greater precision and specificity. These optogenetic actuators allow researchers to control the activity of neurons in specific regions of the brain, providing a powerful tool for studying neural circuits and developing new treatments for neurological disorders. In addition, newly developed actuators for optogenetics such as ChrimsonR, ChRmine, and OptoSTIM1 are useful for various optogenetic experiments.

Furthermore, rise in demand for neuroscience research is driving the growth of the optogenetics market. Rise in prevalence of neurological disorders, such as Parkinson's disease and Alzheimer's disease, is driving the demand for neuroscience research. Optogenetics provides researchers with a powerful tool for studying neural circuits and developing new treatments for these disorders and supports the market growth. Moreover, increase in funding for optogenetic research by government agencies and non-profit organizations further boost the market growth. For instance, National Institute of Health (NIH), in November 2020, stated that it will fund nearly $500 million, through its Brain Research through Advancing Innovative Neurotechnology (BRAIN) Initiative, for the development of more effective therapies in the field of neurological disorders.

However, optogenetics research and applications require specialized equipment and resources such as specialized light sources, optical fibers, genetically modified organisms, and sophisticated imaging systems. These tools are expensive, which limit the ability of researchers and companies to invest in optogenetics projects and products. For instance, Laserglow Technologies offers 561 nm DPSS Green Laser System that costs about $19,000-$19,500. In addition, technical challenges and strict regulatory guidelines in the development of optogenetic tools negatively impact the market growth.

On the other hand, rise in approvals for preclinical studies in the field of optogenetics and awareness about potential applications of optogenetic among researchers is expected to create lucrative opportunities for the market growth.

The outbreak of COVID-19 has disrupted workflows in the health care sector around the world. The disease has forced a number of industries to shut their doors temporarily, including several sub-domains of health care. The global optogenetics market experienced a decline during the pandemic due to disruption in research activities and supply of optogenetic tools to research institutes led to delays in the completion of ongoing optogenetics studies. On the other hand, the pandemic has accelerated the adoption of digital technologies, including remote monitoring and virtual collaborations. This has created new opportunities for companies that provide optogenetics tools and services, as researchers seek to maintain their research activities despite restrictions on in-person interactions.

Segmental Overview

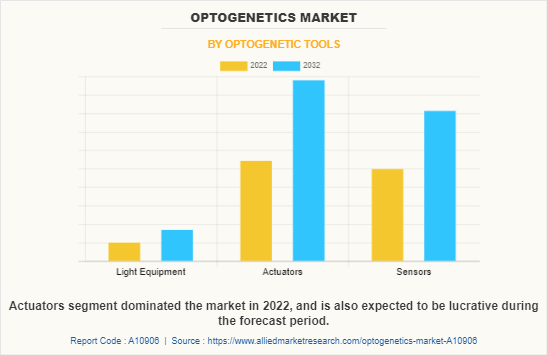

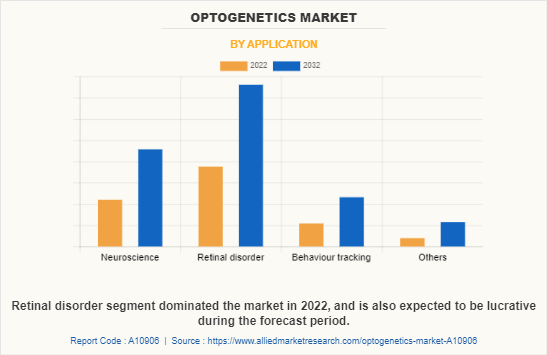

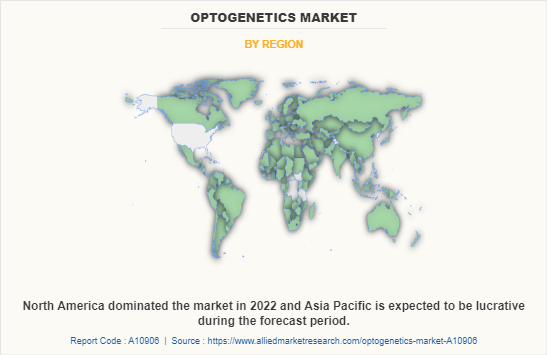

The optogenetics market size is segmented on the basis of optogenetic tools, application, and region. On the basis of optogenetic tools, the market is classified into light source, actuators, and sensors. As per application, the market is segmented into neuroscience, retinal disorders, behavior tracking, and others. Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (Germany, France, the UK, Italy, Spain, and rest of Europe), Asia-Pacific (China, Japan, Australia, India, South Korea, and rest of Asia-Pacific), and LAMEA (Brazil, South Africa, Saudi Arabia, and rest of LAMEA).

By Optogenetic Tool

The optogenetics market share is segmented into light source, actuators, and sensors. The actuators segment dominated the market in 2022, and is expected to remain dominant throughout the optogenetics market forecast period, owing to development of modified actuators for use in optogenetic experiments such as ChrimsonR, OptoSTIM1, and Jaws and increase in availability of optical switches.

By Application

Optogenetics market share is segregated into neuroscience, retinal disorders, behavior tracking, and others. The retinal disorders segment dominated the global market in 2022, and is anticipated to continue this trend during the forecast period. This is attributed to potential for optogenetic therapies to restore vision in patients with retinal degeneration. In addition, optogenetics offers a promising approach to treating retinal degenerative diseases by introducing light-sensitive proteins into the remaining retinal cells to restore visual function. Researchers have demonstrated the effectiveness of optogenetic therapies in animal models of retinal degeneration and are now working to develop these therapies for human use.

By Region

The optogenetics market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for a major share of the optogenetics market in 2022, and is expected to maintain its dominance during the forecast period.

Presence of several optogenetics industry, such as Coherent, Inc., Elliot Scientific Ltd., GenSight Biologics, and Thorlabs Inc. and advancement in manufacturing technology of optogenetics in the region drive the growth of the market. In addition, strong research infrastructure, with a large number of research institutions, universities, and research funding agencies has led to the development of a robust research ecosystem that supports the growth of the optogenetics market. Furthermore, the U.S. government has provided significant funding for optogenetics research, particularly through the National Institutes of Health (NIH). This has helped to spur innovation and growth in the optogenetics market. Moreover, North American companies have been at the forefront of technological advancements in optogenetics. Companies like Inscopix and Laserglow Technologies have developed innovative optogenetics tools and systems which further boost the market growth in this region.

Asia-Pacific is expected to grow at the highest rate during the forecast period. The market growth in this region is attributable to increase in research activities related to optogenetics in recent years, particularly in China, Japan, and South Korea. This growth is driven by increased government funding for research and development, as well as a growing interest in optogenetics as a tool for understanding biological systems. In addition, rise in awareness about optogenetic potentials and adoption of optogenetics as a tool for research and development boost the growth of the market. This has led to increased demand for optogenetics tools and services, including optogenetics actuators and sensors, optogenetics kits, and custom optogenetics equipment. Asia-Pacific offers profitable opportunities for optogenetics industry , thereby registering the fastest growth rate during the forecast period, owing to the growing infrastructure of industries, rising disposable incomes, as well as well-established presence of domestic companies in the region. In addition, rise in contract manufacturing organizations within the region provides great opportunity for new entrants in this region.

Competition Analysis

Competitive analysis and profiles of the major players in the optogenetics market, such as Bruker Corporation, Coherent, Inc., Elliot Scientific Ltd., GenSight Biologics, Laserglow Technologies, Mightex, Prizmatix, Profacgen, Shanghai Laser & Optics Century Co., Ltd., and Thorlabs Inc. are provided in this report. There are some important players in the market such as Inscopix, Inc., Judges Scientific plc, and The Jackson Laboratory. Major players have adopted product launch as key developmental strategy to improve the product portfolio and gain strong foothold in the optogenetics market.

Recent Product Launch in the Optogenetics Market

In 2022, Brucker Corporation, a global biotechnology research company launched its enhanced 3D holographic stimulation system for optogenetics on its Ultima 2Pplus Multiphoton Microscope. This system is designed to allow for precise stimulation of multiple neurons in 3D with high temporal resolution, enabling researchers to investigate complex neural circuits and their interactions. The enhanced 3D holographic stimulation system is compatible with Bruker's Ultima 2Pplus Multiphoton Microscope, which features high-speed scanning and deep-tissue imaging capabilities.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the optogenetics market analysis from 2022 to 2032 to identify the prevailing optogenetics market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the optogenetics market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global optogenetics market trends, key players, market segments, application areas, and market growth strategies.

Optogenetics Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 196.3 million |

| Growth Rate | CAGR of 5.6% |

| Forecast period | 2022 - 2032 |

| Report Pages | 216 |

| By Optogenetic tools |

|

| By Application |

|

| By Region |

|

| Key Market Players | Bruker Corporation, Laserglow Technologies, GenSight Biologics, Coherent, Inc., Elliot Scientific Ltd., Prizmatix, Shanghai Laser & Optics Century Co., Ltd., Mightex, Thorlabs Inc., Profacgen |

| Other Key Players | Judges Scientific plc, Addgene, Noldus Information, Merck KGaA |

Analyst Review

Optogenetics is a field of science that combines optics and genetics to enable the control of specific cells in living tissue using light. Increase in neurological research and development of advanced optogenetic tools such as actuators, sensors, and light equipments boost the growth of the market.

Furthermore, key strategies adopted by market key players such as product launches and increase in R&D activities are expected to create opportunities for the market growth. For instance, in June 2022, Brucker Corporation launched its NeuraLight 3D Ultra module for advancing optogenetics and neuroscience research application on ultima multiphoton microscopes. In addition, GenSight Biologics, in October 2021, received Food and Drug Administration (FDA) Fast Track Designation for optogenetic therapy GS030 to treat retinitis pigmentosa.

The top companies that hold the market share in optogenetics market are include Bruker Corporation, Coherent, Inc., Elliot Scientific Ltd., GenSight Biologics, Laserglow Technologies, Mightex, Prizmatix, Profacgen, Shanghai Laser & Optics Century Co., Ltd., and Thorlabs Inc.

Asia-Pacific is anticipated to witness lucrative growth during the forecast period, owing to increase in healthcare expenditure, development in healthcare facilities, and surge in research activities.

The key trends in the optogenetics market are due to increase in use of optogenetic tools in neuroscience research, rise in funding for optogenetic research by government and research institutes, and growing advancement in genetic engineering and optics

The base year for the report is 2022.

North America is the largest regional market for optogenetics Market

The total market value of optogenetics Market market is $114.052 million in 2022 .

The forecast period in the report is from 2023 to 2032

Major restraints in the optogenetics Market are the high cost of optogenetic tools, and technical complexity of specialized equipment

Loading Table Of Content...

Loading Research Methodology...