Global Pallets Market Research, 2032

The global pallets market size was valued at $57.4 billion in 2010, and is projected to reach $130.5 billion by 2032, growing at a CAGR of 4.1% from 2023 to 2032. Pallets are a tertiary form of packaging that can be used for stacking, storing, protecting, or transporting of goods in supply chains. It is utilized as a base for unitization of goods for logistics and warehousing. Moreover, pallets can be manufactured using materials such as wood, plastic, metal, and corrugated paper, which can be handled using material handling equipment such as forklifts, pallet jacks, or conveyors. Pallets find applications in nearly all supply chains including industries such as chemicals, food & beverage, retail, and others.

Pallets Market dynamics

The unprecedented growth in e-commerce industry is expected to drive the demand for pallets on a significant scale. The COVID-19 pandemic has enhanced the inclination of population towards e-commerce platforms, especially in countries such as India and others, where e-commerce had lesser prevalence. The rise in e-commerce has challenged supply chains to develop transportation and logistics to control flow and cost of outgoing and incoming goods. Online orders are generally in smaller quantities and more frequent, thus requiring more assets for goods management. This creates a demand for pallets for e-commerce-based logistics, which in turn drives the pallets market growth.

Moreover, the rise in focus toward sustainable packaging and pallets is also expected to drive the growth of the pallets market . The majority of the pallets in use today are produced with wood and are one of the largest contributors to municipal solid waste (MSW). In addition, the waste wooden pallets are rich in energy, which is generally wasted during MSW disposal. Thus, companies are now adopting recycling techniques to reduce the wastage of wood for pallet manufacturing. For instance, companies such as Brambles, Ltd., based in Australia, and CABKA Group GmbH based in Germany, are striving toward production of fully recyclable or 100% reusable wooden and plastic pallets.

However, the fluctuations in prices of wood, especially in Europe and North America, limit the growth of the pallets market. Europe and North America are the largest consumers of wooden pallets collectively, hence, the price changes in lumber affect the consumer patterns in the pallets industry. In addition, the outbreak of the COVID-19 pandemic has negatively affected the international trade and manufacturing supply chains. This affected the demand for pallets.

The demand for pallets decreased in 2020, owing to low demand from different industries due to lockdowns imposed by the government of many countries. The COVID-19 pandemic had shut down the production of various industries, mainly owing to prolonged lockdowns in major global countries. This hampered the growth of the pallets market significantly during the pandemic. The major demand for pallets was previously noticed from giant manufacturing countries including the U.S., Germany, Italy, the UK, and China, which was severely affected by the spread of coronavirus, thereby halting demand for pallets. Moreover, the market has recovered due to the launch of COVID-19 vaccine and the government has relaxed the lockdown norms.

On the contrary, the adoption of new technologies in supply chains such as use of internet of things (IoT), automation, collaborative robots (cobots), and others, can promote pallet manufacturers to produce pallets with RFID tags, GPS sensors, and others, which can create new opportunities for pallets in the near future.

Pallets Market Segmental Overview

The global pallets market is segmented on the basis of material, type, application, end-user industry, and region.

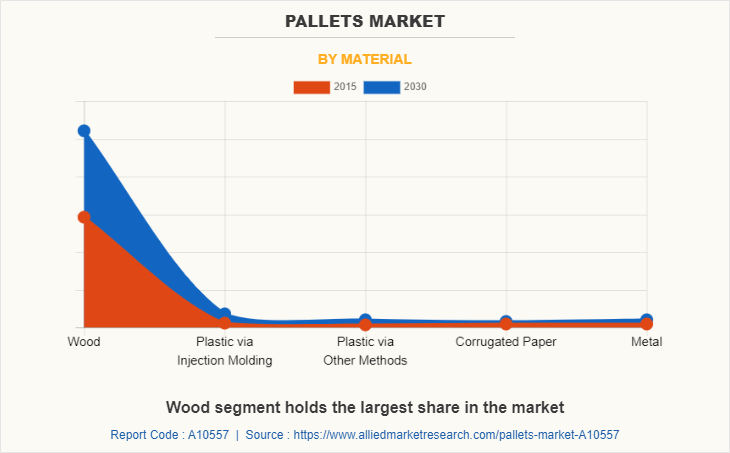

By material, it is classified into wood, plastic via injection molding, plastic via other methods, corrugated paper, and metal.

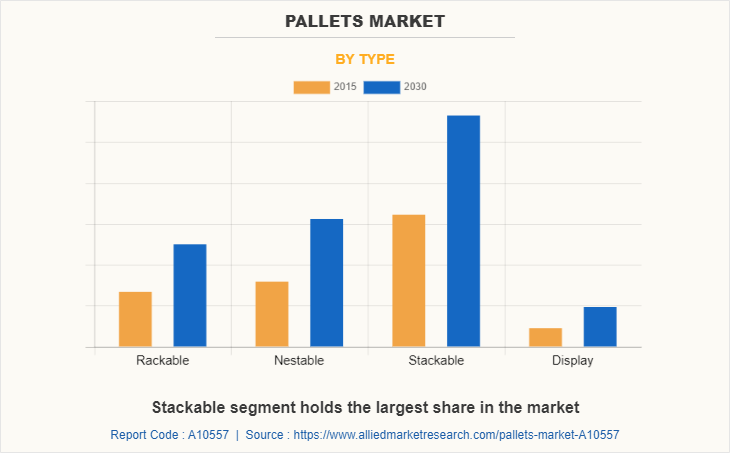

By type, it is categorized into rackable, nestable, stackable, and display pallets.

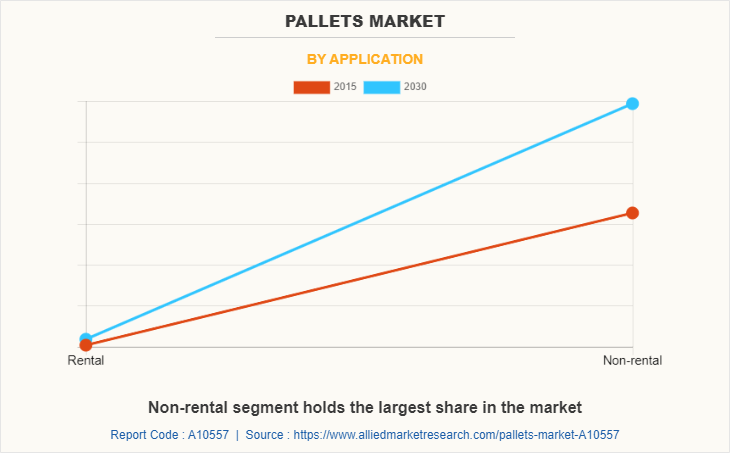

By application, it is categorized into rental and non-rental.

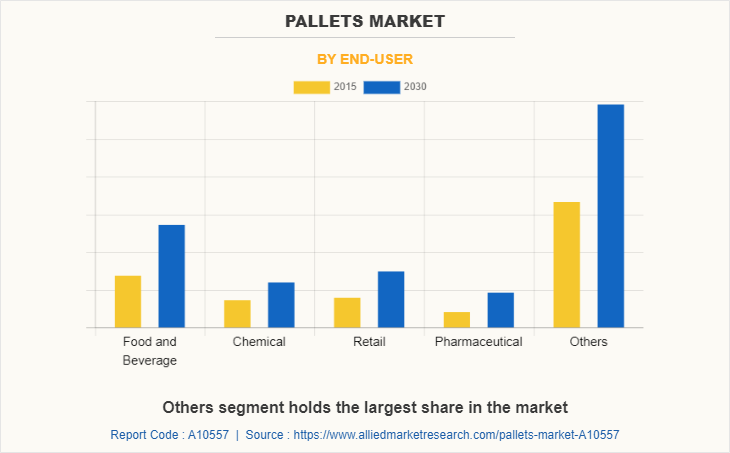

By end-user industry, it is categorized into food & beverage, chemical, retail, pharmaceutical, and others.

Region wise, the market is analyzed across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Italy, and rest of Europe), Asia-Pacific (China, Japan, India, Indonesia, Malaysia, Thailand, Vietnam, Cambodia, Lao, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By material:

The pallets market is categorized into wood, plastic via injection molding, plastic via other methods, corrugated paper, and metal. Wooden pallets are manufactured using hardwood or softwood timber; however, pallet manufacturing wood differs according to region depending on the availability of trees for wood extraction. Softwood such as Douglas fir, pine, yew, and spruce are commonly used for pallet production, whereas maple, oak, teak, mahogany, teak, and walnut are a few hardwoods used for manufacturing of wooden pallets. Pallets manufactured using high-pressure injection molding are made from high-density polyethylene (HDPE) or copolymer polypropylene resins. The melting temperature of the resin is maintained around 250°C, and the plastic is injected under high pressure into a mold. Plastic pallets manufactured using thermoforming, rotational molding, and compression molding are considered in this segment. Corrugated paper pallets, also called paper pallets or cardboard pallets, are a highly efficient alternative for wooden pallets and exhibit features such as lightweight and environmental sustainability. Metal pallets are manufactured using stainless steel and aluminum. The wood segment is expected to exhibit the largest revenue contributor during the forecast period and plastic via injection molding segment is expected to exhibit the highest CAGR share in the by material segment in the pallets market during the forecast period.

By type:

The pallets market is categorized into rackable, nestable, stackable, and display pallets. Rackable pallets are designed for handling heavy loads and mostly have a runner with a picture frame at bottom to offer high stability in racking operations. It is designed to hold a specified amount of weight in an open span racking system. Rackable pallets are available in wood and plastic materials. Nestable pallets have a nine-leg bottom, which allows it to gain grip or nest into other pallets. Nestable pallets are the most space-saving pallets compared to stackable and rackable pallets. Stackable pallets are often used in closed loop shipping and warehouse applications. The structure and design of the pallet allow the user to stack pallets on top of one another. Display pallets can be manufactured using wood, plastic, corrugated paper, or metal and find application in retail stores for application on floor display. The stackable segment is expected to exhibit the largest revenue contributor during the forecast period and the display and nestable segment is expected to exhibit the highest CAGR share in the by type segment in the pallets market during the forecast period.

By application:

The pallets market overview for application segment is classified into rental and non-rental. Pallets that are sold with a purpose of further renting them to different end users are considered in this segment. Pallets on rental basis are an affordable option for consumers. The consumers need to pay for the pallets only till the time they use them. It helps in saving maintenance, replacement, administration, and transportation cost of the pallets. The non-rental pallets are the type of pallets for which customers get authority or ownership to purchase the pallets. In the case of non-rental pallets, customers do not need to sign an agreement and it does not include any monthly payment. Purchasing pallets cost more as compared to rental pallets due to maintenance, repairing, transportation, and ownership costs. The non-rental segment is expected to exhibit the largest revenue contributor during the forecast period and rental is expected to exhibit the highest CAGR share in the by application segment in the pallets market during the forecast period.

By end-user industry:

The pallets market is divided into food & beverage, chemical, retail, pharmaceutical, and others. The chemical industry implements special pallets resistant to high-concentration and corrosive chemicals, which may react with the pallet material to create unforeseen damage to the pallet. Thus, pallets used in the chemical industry have high-quality material and usually undergo practical trials to withstand harsh conditions in the industry. Pharmaceutical applications require pallets with hygienic and cost-effective features. The others segment includes agriculture, metal & machinery, electronics, and construction industries. Agriculture and metal & machinery industries exhibit a high demand for pallets. Furthermore, the others segment is expected to exhibit the largest revenue share in the end-user industry segment in the pallets market during the forecast period. The pharmaceutical segment is expected to exhibit the largest CAGR during the forecast period.

By region:

The pallets market forecast is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2022, Asia-Pacific had the highest revenue in pallets market share, and is expected to exhibit the highest CAGR during the forecast period.

Competition Analysis

The major players profiled in the global pallets market include Brambles Limited, CABKA Group GmbH (CABKA), Craemer Holding GmbH (CRAEMER), Falkenhahn AG (Falkenhahn), LOSCAM International Holdings Co., Ltd. (LOSCAM), Menasha Corporation, Millwood, Inc., Rehrig Pacific Holdings, Inc. (Rehrig Pacific), Schoeller Allibert Services B.V. (Schoeller Allibert), and UFP Industries, Inc. (PalletOne).

Major companies in the market have adopted acquisition, product launch, business expansion, and other strategies as their key developmental strategies to offer better products and services to customers in the pallets market.

Some examples of product launch in the market

In September 2020, Menasha, through its subsidiary ORBIS Corporation, launched a new Odyssey pallet. The Odyssey rackable pallet is designed for heavy-duty racking applications and holds more than 2,800 pounds in unsupported racking. The product is available in 40 x 48 inches size and also includes optional molded-in frictional elements and steel reinforcements.

In September 2021, Menasha, through its subsidiary ORBIS Corporation, launched 44 X 56 new Universal Container Pallet (UCP) to its reusable products portfolio.

In July 2020, Menasha, through its subsidiary ORBIS Corporation, opened a new ORBIS RPM service center in Winston-Salem, North Carolina, U.S. The ORBIS Reusable Packaging Management (RPM) is a global supply chain company engaged in cleaning, repair, management, and replenishment of reusable layer pads, plastic pallets, and top frames. The expansion is aimed at offering efficient shipping, operating, and repairing using automated processes.

Some examples of business expansion and acquisition that support the pallets market growth

In March 2023, Craemer Holding GmbH has expanded its new plastic pallet production business Craemer UK. With this expansion, lead times were cut, customers received their orders more quickly, and transportation costs from Craemer's facility in Germany were eliminated. Additionally, there was a significant drop in CO2 emissions, which will be appealing to Craemer consumers in the UK.

In December 2022, Millwood Inc. acquired Red Express Pallet in order to expand its business facility in Texas. This will enhance the company's customer reach in Texas.

In November 2022, Millwood Inc. acquired Southworth Wood Products in order to expand its business facility in Southern Ohio. This acquisition will strengthen the product portfolio and sales of the company.

In September 2022, Millwood Inc. acquired Austin Pallet. With this acquisition, Millwood welcomed nearly 30 new team members to its staff of more than 1,800 people nationwide.

In November 2021, UFP Industries, Inc. (PalletOne) acquired Ficus Pax Private Limited which is a leading manufacturer of wooden pallets, nail-less plywood boxes mixed-material, cases and crates and other packaging products.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pallets market analysis from 2010 to 2032 to identify the prevailing pallets market opportunity.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pallets market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global pallets market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the pallets market players.

- The report includes the analysis of the regional as well as global pallets market trends, key players, market segments, application areas, and market growth strategies.

Pallets Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 130.5 billion |

| Growth Rate | CAGR of 4.1% |

| Forecast period | 2010 - 2032 |

| Report Pages | 340 |

| By Application |

|

| By Material |

|

| By End-user |

|

| By Type |

|

| By Region |

|

| Key Market Players | Craemer Holding GmbH (CRAEMER), Millwood, Inc., LOSCAM International Holdings Co., Ltd. (LOSCAM), Schoeller Allibert Services B.V. (Schoeller Allibert), CABKA Group GmbH (CABKA), Brambles Limited, UFP Industries, Inc. (PalletOne), Menasha corporation, Falkenhahn AG (Falkenhahn), Rehrig Pacific Holdings, Inc. (Rehrig Pacific) |

Analyst Review

The global pallets market is anticipated to exhibit high growth potential in China. This is attributed to the fact that China has been the largest economy in the global logistics market, and garners a major share in the pallets market, owing to large export of electronics and metal & machinery. The companies such as Loscam and Brambles Ltd. have a monopoly in the Chinese pallet industry. Loscam entered the Taiwan market and has gained a significant share in the country.

The key players in the market have focused on business expansion strategy to strengthen their foothold in the pallets industry. For instance, in May 2021, Craemer, based in the U.S., opened a new corporation office at Aurea Industrial Park, Europe. The corporation office is expected to serve CRAEMER’s existing clients in the Europe as well as increase the engagement of prospective clients for the Craemer plastic pallets and container business.

Similarly, in July 2020, the company Menasha Corporation, headquartered in the U.S., through its subsidiary ORBIS Corporation opened a new ORBIS RPM service center in Winston-Salem, North Carolina, U.S.

The ORBIS Reusable Packaging Management (RPM) is a global supply chain company engaged in cleaning, repair, management, and replenishment of reusable layer pads, plastic pallets, and top frames. The expansion is aimed at offering efficient shipping, operating, and repairing using automated processes.

The global pallets market was valued at $57,389.4 million in 2010, and is projected to reach $130,453.7 million by 2032, registering a CAGR of 4.1% from 2023 to 2032.

The forecast period considered for the global pallets market is 2023 to 2032, wherein, 2022 is the base year, 2023 is the estimated year, and 2031 is the forecast year.

The latest version of the global pallets market report can be obtained on demand from the website.

The base year considered in the global pallets market report is 2022.

The major players profiled in the pallets market include Brambles Limited, CABKA Group GmbH (CABKA), Craemer Holding GmbH (CRAEMER), Falkenhahn AG (Falkenhahn), LOSCAM International Holdings Co., Ltd. (LOSCAM), Menasha Corporation, Millwood, Inc., Rehrig Pacific Holdings, Inc. (Rehrig Pacific), Schoeller Allibert Services B.V. (Schoeller Allibert), and UFP Industries, Inc. (PalletOne).

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies, and recent developments.

Based on type, the stackable segment dominated the market in 2022.

Loading Table Of Content...

Loading Research Methodology...