Passenger Car T-Box Market Research, 2033

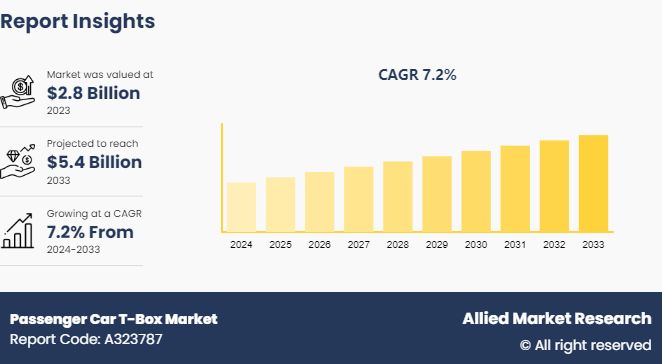

The global passenger car t-box market size was valued at $2.8 billion in 2023, and is projected to reach $5.4 billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033.

Market Introduction and Definition

The T-box of the vehicle establishes communication with the host via the CAN bus in order to transmit instructions and information. This allows for the retrieval of important data such as vehicle status, key status, and transmission control instructions. Additionally, the T-box enables audio connectivity, allowing both parties to share microphone and speaker output. Indirect communication with the mobile app occurs through a data link in the background system, facilitating two-way interaction. The communication between the T-box and background system encompasses both voice and short message formats. Short messages are primarily utilized for convenient one key navigation and remote-control functions.

The Automobile T-box has the capability to analyze automobile CAN bus data and private protocols extensively. By utilizing the OBD module and MCU, the T-box terminal gathers bus data and can even perform reverse control of private protocols. Additionally, the T-box can pinpoint the vehicle's location using the GPS module and transmit the data to the ECS via the network module. The passenger car t-box market size is expanding due to the rising demand for connected car technologies.

Key Takeaways

The passenger car T-box market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

More than 1,500 product literatures, industry releases, annual reports, and other such documents of major passenger car T-box industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Recent Key Strategies and Developments

In January 2024, Jingwei Hirain introduced a new 5G T-Box product featuring the latest 5G chips from Qualcomm. This innovative product is tailored for a mainstream intelligent all-electric model and is set to enter mass production by the year's end. With the Qualcomm SA522 chip released in early 2023, the T-Box offers a range of advanced functions including Gigabit Ethernet, V2X, high-precision positioning, WiFi6, CAN FD, Dual SIM Dual Standby (DSDS) , and RTMP audio transmission. It delivers a variety of efficient telematics services for both the intelligent driving and infotainment sectors of vehicles, for enhanced platform scalability.

Key Market Dynamics

T-Box gadgets provide real-time tracking, useful emergency resources, and faraway diagnostics, all of which enhance the general protection and safety of the vehicle and its passengers. Companies along with Tesla and BMW incorporate T-Box structures to offer advanced protection capabilities that automatically notify emergency offerings in the occasion of a crash. The passenger car t-box market growth is driven by the increasing adoption of connected car technologies.

The automobile T-box is capable of efficiently analyzing automobile CAN bus data and private protocols. By utilizing the OBD module and MCU, the T-box terminal collects automobile bus data and enables reverse control of private protocols. Additionally, the T-box can accurately determine the vehicle's location through the GPS module and transmit the data to the ECS via the network module. Through the mobile app, car owners can access a wide range of information from the cloud server, including vehicle condition reports, driving reports, fuel consumption statistics, fault reminders, violation queries, location tracking, driving behavior analysis, security and anti-theft features, reservation services, remote car search, and more.

The car owner can also indirectly interact with the network module through the mobile app's connection with the server. The MCU and network module work together to provide various services such as controlling car doors, windows, lights, locks, horns, double flashing, reflector folding, skylight operation, monitoring central control warnings, and checking airbag status. Government mandates for vehicle safety and connectivity are expected to positively influence the passenger car t-box market forecast.

The integration of T-Box inside the automobile region is experiencing a full-size increase, as confirmed by using General Motors, BMW, and AUDI along with other organizations embracing AI-powered predictive maintenance answers. rising demand for passenger Car T-Box can be attributed to various factors, together with the demand for stepped forward protection and protection functions, the popularity of related car services, compliance with regulatory standards, the growth of shared mobility, and the improvements in IoT and AI technology.

Value Chain Analysis of Passenger Car T-Box Market

The passenger car T-Box undergoes a comprehensive value chain analysis, which uncovers the various activities and processes required to create and deliver this advanced telematics device to the final customer. The value chain commences with research and development (R&D) , where engineers and designers concentrate on enhancing and innovating T-Box functionalities. Notably, companies such as Continental AG allocate significant resources to R&D to create state-of-the-art telematics systems that provide exceptional connectivity, safety, and diagnostics capabilities.

Continental AG's investments in advanced telematics systems highlight how engineers constantly innovate and enhance T-Box functionalities.

Bosch guarantees precision and reliability by sourcing and assembling top-notch components such as sensors and microprocessors.

Real-time tracking and diagnostics are made possible through the integration of hardware with telematics software. An example of a company that excels in this field is Qualcomm, which specializes in developing advanced software platforms for T-Box systems.

Logistics partners such as DHL are responsible for the efficient delivery of finished T-Box units to automotive assembly plants, guaranteeing timely transportation.

Emphasizing the advantages of T-Box such as safety and connectivity is crucial. For example, Tesla showcases the advanced telematics features of its vehicles.

Market Segmentation

The passenger car t-box industry is segmented into type, application, and region. On the basis of type, the market is divided into 4G, 5G, and others. As per application, the market is segregated into MPV, SUV, and Others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America, and the Middle East and Africa.

Regional/Country Market Outlook

North America stands as a dominant hub for passenger car T-Box systems, driven by the rapid uptake of cutting-edge automotive technologies and robust regulatory structures. The U.S., specifically, takes the lead with renowned automakers such as Ford and General Motors seamlessly incorporating state-of-the-art telematics systems into their vehicles. Moreover, especially the U.S., has gained a reputation for its swift embrace of state-of-the-art automotive technologies. In this region, consumers exhibit a strong inclination towards advanced safety features, connectivity, and in-car entertainment, thereby fueling the demand for sophisticated telematics systems such as the T-Box. Strict regulations that require the incorporation of telematics systems to improve vehicle safety and ensure compliance with emissions standards.

The adoption of telematics is being boosted by the requirement of electronic logging devices (ELDs) in commercial vehicles by the Federal Motor Carrier Safety Administration (FMCSA) in the U.S. Increase in connected car services, such as internet access, real-time navigation, and advanced infotainment systems, are experiencing a significant surge in consumer demand. This demand is fueled by the extensive availability of high-speed internet and advanced wireless communication networks across North America. Moreover, there is a substantial passenger car t-box market opportunity in developing countries with a growing automotive sector.

Competitive Landscape

The major players operating in the passenger car t-box market include LG Electronics, Valeo, Denso, Lan-You Technology, Continental AG, Neusoft, Flaircomm Microelectronics, Harman, Visteon, Bosch. Other players in passenger Car T-Box market includes Ficosa, Thread Technology, HiRain Technologies, Huawei, and ECARX. Leading automakers are competing to enhance their passenger car t-box market share by offering advanced telematics solutions.

?????Industry Trends

In June 2023, the LG Vehicle Component Solutions Company, which encompasses T-Box, achieved an impressive annual revenue of $7.55 billion (KRW10.1 trillion) and an operating profit of $99.5 million (KRW133 billion) . Since the initiation of financial reporting in 2015, this business division has consistently experienced growth for eight consecutive years, making a significant contribution of 12% to the total revenue in 2023.

In 2023, the installation of 5G T-Box in 1.452 million passenger cars in China signified a remarkable surge. 5G networks are known for their high speed and low latency capabilities. To meet the demands of OEMs in deploying 5G technology, T-Box suppliers have introduced a wide range of 5G products.

Key Sources Referred

Telematics Update (TU-Automotive)

Global Telematics Association (GTA)

Automotive Information Sharing and Analysis Center (Auto-ISAC)

National Highway Traffic Safety Administration (NHTSA)

European Automobile Manufacturers Association (ACEA)

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the passenger car t-box market analysis from 2024 to 2033 to identify the prevailing passenger car t-box market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the passenger car t-box market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global passenger car t-box market trends, key players, market segments, application areas, and market growth strategies.

Passenger Car T-Box Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 5.4 Billion |

| Growth Rate | CAGR of 7.2% |

| Forecast period | 2024 - 2033 |

| Report Pages | 340 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | Visteon , Harman , Flaircomm Microelectronics , Neusoft , Valeo , Denso , LG Electronics, Continental AG , Lan-You Technology , Bosch |

The major players operating in the passenger car t-box market include LG Electronics, Valeo, Denso, Lan-You Technology, Continental AG, Neusoft, Flaircomm Microelectronics, Harman, Visteon, Bosch.

The global passenger car t-box market was valued at $2.8 billion in 2023, and is projected to reach $5.4 Billion by 2033, growing at a CAGR of 7.2% from 2024 to 2033.

Asia-Pacific is the largest regional market for Passenger Car T-Box

SUV is the leading application of Passenger Car T-Box Market

Predictive maintenance and fleet management and data monetization and new business models are the upcoming trends of Passenger Car T-Box Market in the globe.

Loading Table Of Content...