Payment Analytics Software Market Research, 2030

The global payment analytics software market was valued at $3.2 billion in 2021, and is projected to reach $4.8 billion by 2030, growing at a CAGR of 4.6% from 2022 to 2030.

The rise in smartphone penetration around the world, as well as the growth of the m-commerce industry in emerging markets, are the major factors driving payment analytics software market growth. Furthermore, the increased adoption of mobile payment in emerging markets helps fuel market growth. Furthermore, the increased use of NFC, RFID, as well as host card emulation technology in mobile payments, as well as the increased demand for quick and easy transaction services, are expected to provide a lucrative opportunity for the payment analytics software market.

Payment analytics software tracks online payments for subscription-based businesses or e-commerce. It combines payment data from various sources to display consumer payments. Payment analytics software is mostly used by office workers to boost their income and by sales managers to track the effectiveness of their sales strategies. It enables businesses and subscription products to grow their revenue more quickly and consistently. Furthermore, payment software centralizes all data, monitors progress toward goals, visualizes performance trends, collaborates, and makes better decisions for each function within the organization.

However, a lack of network infrastructure, data privacy concerns, a lack of understanding, and other operational challenges and risks may stifle market growth. Several connected devices capture personal data and track users' real-time location, putting them at risk of being used fraudulently and unlawfully by hackers and other elements, stifling progress in the coming years.

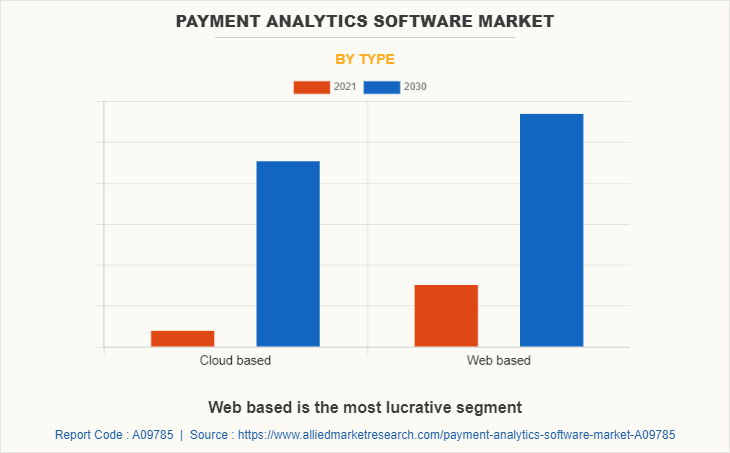

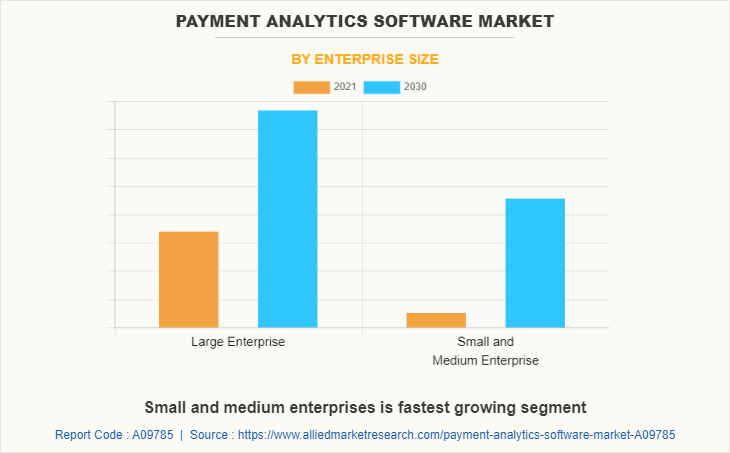

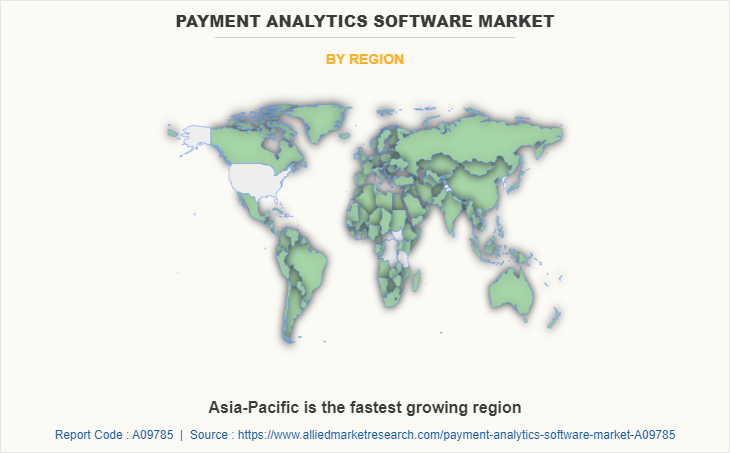

The global payment analytics software market is segmented on the basis of type, enterprise size, and region. By type, the market is classified into cloud based and web based. By enterprise size, the analysis has been divided into large enterprise and small & medium enterprise. By region, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

The key players profiled in this report include ProfitWell, BlueSnap, Databox, Payfirma, Yapstone, CashNotify, HiPay Intelligence, PaySketch, Revealytics, and RJMetrics.

By type, the cloud-based sub-segment is predicted to be fastest growing sub-segment. The increasing use of cloud technology is raising data security concerns (such as data theft and loss of industry-specific information) among business organizations around the world. Cloud integration technology is used in core banking services to integrate various data and applications such as Digital Wallets, Apple Wallet, PayPal Account, and many others through IT and business model transformations.

By enterprise size, large enterprises sub-segment was the dominating sub-segment in 2021. The large enterprises segment held the largest market share owing to growing demand such as lower operating expenses, increased collaboration, greater flexibility, as well as a reduced time to market. Cloud computing enables businesses to delegate routine tasks to technology that can complete them more quickly. As a result, increased usage in major organizations to streamline operations is expected to aid the segment's growth. During the forecast period, the growing number of large enterprises in both developed and developing countries would drive up demand for payment analytics software market.

By region, North America dominated the global payment analytics software market in 2021. North America payment analytics software dominated the global market because companies in the United States place a high value on digitalization and are commonly viewed as adopters of the next technologies such as the Internet of Things, additive manufacturing, big data analytics, linked industries, AI, and most recent communications technology including such 4G, 5G, and LTE. The continued use of cutting-edge new technology by companies based in the United States bodes well for growth prospects. All such factors are anticipated to drive the global payment analytics software market share over the forecast period.

Imapct of COVID-19 on the Market

- During the COVID-19 pandemic, when businesses are dealing with operational challenges, many banks and financial institutions are providing new digital tools and techniques to their customers, among which Mobile Banking has now seen significant adoption.

- Furthermore, the increased popularity of mobile globally provides growth potential again for payment analytics software market. Many banks as well as FinTech businesses have initiated different appealing banking strategies to help customers in adopting Mobile Payout, which is generating numerous market opportunities.

- As a result of the alarming rise in the number of COVID-19 patients around the world, consumers have adopted Phone Payment, which has positively impacted the payment analytics software market growth.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the payment analytics software market analysis from 2021 to 2030 to identify the prevailing payment analytics software market size and opportunities over the forecast period.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the payment analytics software market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global payment analytics software industry trends, key players, market segments, application areas, and market growth strategies.

Payment Analytics Software Market Report Highlights

| Aspects | Details |

| By Type |

|

| By Enterprise Size |

|

| By Region |

|

| Key Market Players | Revealytics, ProfitWell, Databox, YapStone, CashNotify, PaySketch, BlueSnap, RJMetrics, Payfirma, HiPay Intelligence |

Analyst Review

According to the CXOs of the leading companies, the global payment analytics software market possesses a substantial scope for growth in the future. Smartphones are becoming more popular all over the world, particularly in emerging markets, which is catapulting the industry forward. Furthermore, the wide availability of 4G and 5G connectivity has made it easier for clients to universal access via their mobile phones. In addition, the prevalent expansion of smartphone companies' distribution networks has made these devices widely available to end users. Companies and people can now recognize and make the payments using their mobile phones, due to the increased use of smartphones and increased connectivity, propelling the payment analytics software market forward. According to the CXOs, Asia-Pacific is projected to register faster growth as compared to North American and European markets.

Due to the large amount of data generated by various technologies such as AI, machine learning, and big data, payment analytics software is in high demand. Because these technologies generate a large amount of unorganised and irrelevant data, it is critical to construct a machine learning technique using only accurate and relevant data, may create lucrative opportunities for the market.

As banks and financial institutions adopt new business models, developing economies offer significant payment analytics software market opportunities. Furthermore, the market adoption of payment data analytics solutions is accelerating as demand for specialised, secure, and customised payment processing continues to rise. High investments in digitalized payment platforms, adoption of new technologies such as artificial intelligence, big data, analytics, and machine learning, and rapid domestic business expansion, which will ultimately accelerate the global payment analytics software market growth in the next few years.

The report provides an extensive qualitative and quantitative analysis of the current trends and future estimations of the global Payment analytics software market from 2021 to 2030 to determine the prevailing opportunities.

Web based segment held the maximum share of the global payment analytics software market in 2021.

Large enterprises and small & medium enterprises industries include the major customers of global Payment analytics software market.

ProfitWell, BlueSnap, Databox, Payfirma, Yapstone, CashNotify, HiPay Intelligence, PaySketch, Revealytics, and RJMetrics. are the leading market players active in the Payment analytics software market.

Asia-Pacific will provide more business opportunities for global Payment analytics software market in the future.

Agreement, business expansion, and product launch are the key growth strategies of global payment analytics software market players.

Rising popularity of smartphones, online transactions and payments are expected to drive the adoption of Payment analytics software.

Loading Table Of Content...