Peptone Market Research, 2035

The global peptone market was valued at $135.2 million in 2019, and is projected to reach $240.5 million by 2035, growing at a CAGR of 4.2% from 2024 to 2035. According to the World Health Organization (WHO), 254 million people were living with chronic hepatitis B infection in 2022, with 1.2 million new infections each year. This rising prevalence of infectious diseases highlights the critical need for advanced biologic & vaccine solutions, further emphasizing the demand for peptone in cell culture.

Peptone is a water-soluble protein derivative commonly used in microbiology and biotechnology as a nutrient source in culture media for the growth of microorganisms, including bacteria and fungi. It is obtained by the partial hydrolysis of proteins, typically derived from animal or plant sources such as casein, meat, or soybean, through enzymatic or acid digestion. Peptones are rich in peptides, amino acids, and other nitrogenous compounds, making them ideal for supporting microbial growth in laboratory and industrial applications. They serve as an essential component in media formulations for research, diagnostics, and the production of antibiotics, enzymes, and vaccines. With their ability to provide readily available nutrients, peptones play a critical role in the field of microbiology and bioprocessing.

Key Takeaways

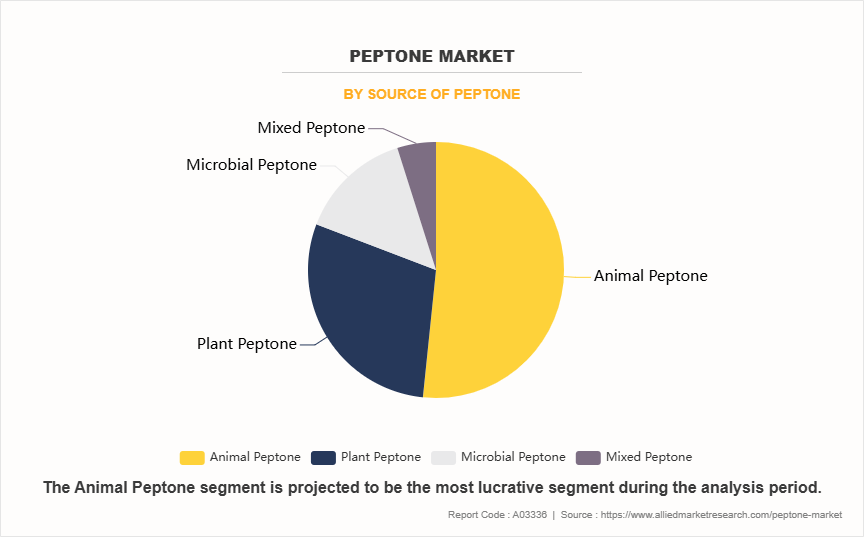

- On the basis of source of peptone, the animal peptone segment dominated the peptone market size in terms of revenue in 2023. However, the mixed peptone segment is anticipated to grow at the fastest CAGR during the forecast period.

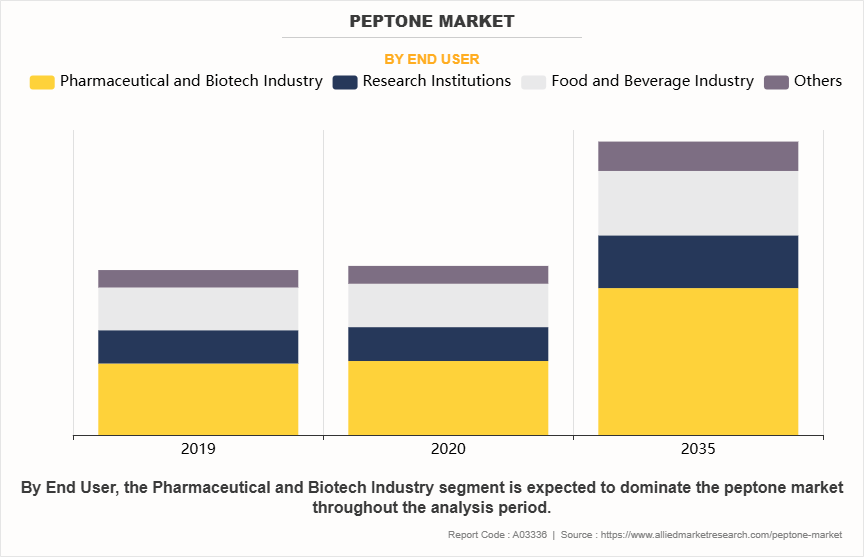

- As per end user, the pharmaceutical & biotech industry segment held largest market share in 2023 and is expected to remain dominant throughout the forecast period.

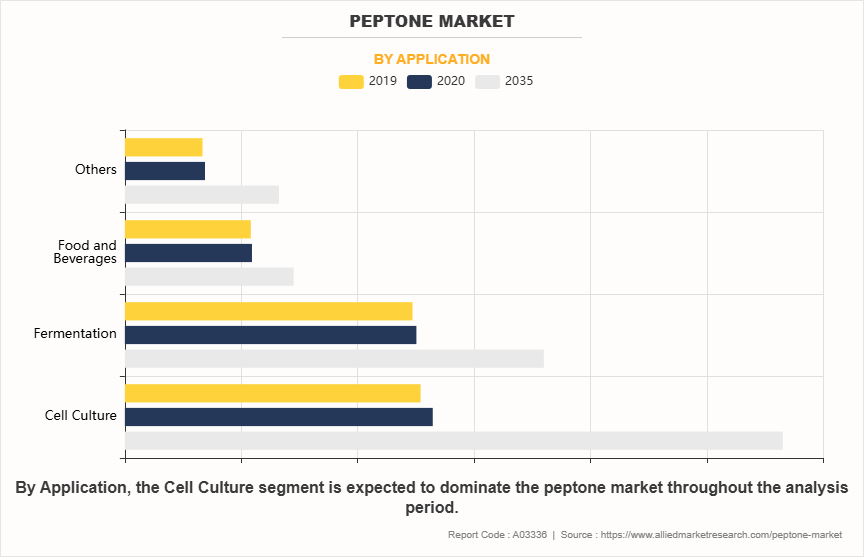

- Depending on application, the cell culture segment held the largest peptone market share in 2023.

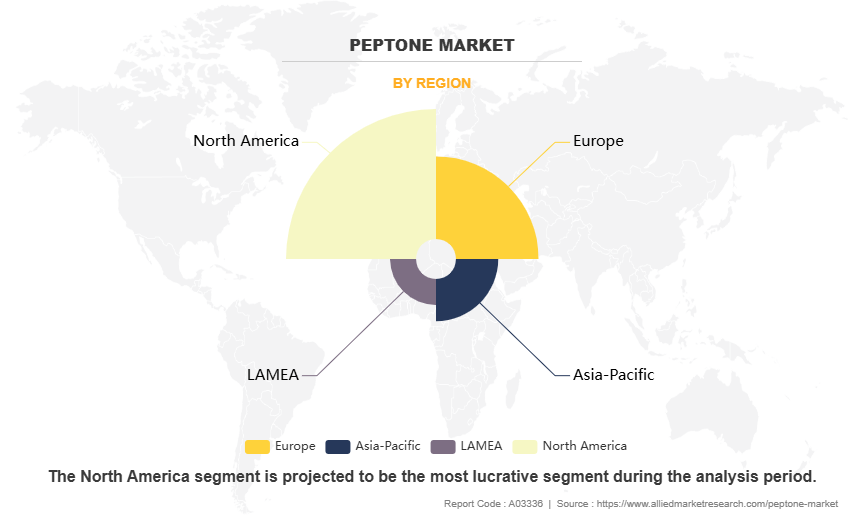

- Region wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Market Dynamics

The peptone market growth is driven by the growing demand for microbiological research, biopharmaceutical production, and industrial applications such as enzyme and vaccine manufacturing. The rise in infectious diseases and the need for rapid diagnostic solutions have fueled the demand for high-quality culture media, with peptone as a key component. Additionally, the increasing adoption of plant-based peptones, as seen in the growing trend toward sustainable and animal-free alternatives, bolsters market expansion.

On the other hand, expanding biopharmaceutical drug development, in emerging countries, along with a focus on

vaccines, further enhances peptone market opportunity in this space, as more pharmaceutical and biotech companies invest in novel technologies to meet diverse and growing healthcare needs globally. In addition, rise in adoption in food & beverage industry offers high growth potential in emerging countries and provides an opportunity for the peptone market growth.

However, the market faces restraints, including fluctuating raw material costs and the complex regulatory guidelines governing the use of animal-derived products. The stringent quality control requirements in pharmaceutical and food-grade applications can also act as a barrier, especially for smaller manufacturers. Despite these challenges, opportunities abound with advancements in fermentation technologies and the expansion of personalized medicine. The development of innovative peptone formulations, such as those tailored for specific microbial strains or bioprocessing requirements, offers significant growth potential. Moreover, the rising focus on emerging markets, such as Asia-Pacific, where investments in biotechnology are surging, creates numerous opportunities for market expansion, thereby driving the peptone market forecast.

Segmental Overview

The peptone market is classified on the basis of source of peptone, end user, application, and region. Depending on the source of peptone, the market is classified into animal peptone, plant peptone, microbial peptone, and mixed peptone. Depending on the end user, the market is classified into pharmaceutical & biotech industry, research institutions, food & beverage industry, and others. Depending on application, the market is classified into cell culture, fermentation, food & beverages, and others. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

By Source of Peptone

On the basis of source of peptone, the animal peptone segment was the largest revenue contributor to the peptone market size in 2023. This is attributed to its superior nutrient composition and widespread application across various industries. Animal peptones are derived from sources such as meat, milk, and gelatin, which are rich in essential amino acids, peptides, and other growth-promoting nutrients. These qualities make them highly effective for use in microbiological culture media, particularly in the pharmaceutical, biotechnology, and food industries. Furthermore, the availability of well-established production processes and the ability to produce consistent and high-quality products further contribute to their preference.

The mixed peptone segment is expected to register the fastest growth during the forecast period. This is attributed to its versatile nutrient profile, combining the benefits of both animal- and plant-based peptones. This balanced composition enhances its applicability in diverse culture media, catering to the growing demands of biopharmaceutical production and advanced microbial research. Additionally, increasing preferences for sustainable and efficient bioprocessing solutions further drives the adoption of mixed peptones in various industries.

By End User

By end user, the pharmaceutical and biotech industry segment was the highest revenue contributor to the peptone market share in 2023 and is expected to remain dominant during the forecast period. This is attributed to extensive use of peptones in biopharmaceutical production, vaccine development, and microbial fermentation processes. The growing focus on innovative therapeutics and increasing investments in R&D further drive demand in this segment.

By Application

On the basis of application, the cell culture segment was the largest revenue contributor to the peptone industry in 2023. This growth is attributed to the rising demand for peptones as essential supplements in cell culture media used for biopharmaceutical production, including monoclonal antibodies and vaccines. Their role in enhancing cell growth and productivity makes them indispensable in research and manufacturing processes, further boosting their adoption.

By Region

Region wise, North America was the largest shareholder in the peptone industry in 2023, owing to presence of advanced biotechnology and pharmaceutical industries, which heavily utilize peptones in research and production. Additionally, the strong presence of key market players, coupled with significant investments in biopharmaceutical R&D and vaccine development, further supported market growth in the region.

However, Asia-Pacific is anticipated to register the highest CAGR during the forecast period owing to rapid expansion of the biotechnology and pharmaceutical industries, driven by increasing investments in biopharmaceutical R&D and manufacturing. Additionally, the region's growing demand for vaccines, advancements in healthcare infrastructure, and cost-effective production capabilities further contribute to this robust growth.

Competition Analysis

Competitive analysis and profiles of the major players in the Peptone market include Thermo Fisher Scientific Inc, Solabia Group, Kerry Inc, Nu-Tek Biosciences, Becton Dickinson and Company, Himedia Laboratories, Liofilchem S.R.L, Neogen Corporation, Merck KGaA, and Titan Biotech Ltd. The key players have adopted strategies such as product approval to expand their product portfolio.

Recent Developments in the Pharmaceutical Suppository Industry

- In September 2024, Nu-Tek BioSciences announced the launch of two new versions of soy peptone designed to support applications requiring either high nitrogen or low carbohydrates. These products, HSP-N Soy Peptone and HSP-I Soy Peptone respectively, are being produced in the Austin Manufacturing Center (AMC) located in Austin, Minnesota. AMC is a brand-new state of the art facility raising the bar for manufacturing critical raw materials with robust quality programs, improved traceability and investments in characterization to fuel variability reduction programs.

- In March 2021, Nu-Tek Biosciences announced that the company will build a new manufacturing facility in Austin, Minnesota. This will be the first dedicated, animal-free peptone, and protein hydrolysate manufacturing facility in the U.S. This U.S.-owned peptone manufacturing plant will help meet the rapidly growing demand for materials used to manufacture biologics. It reportedly has invested $40 million in the new manufacturing facility.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the peptone market analysis from 2019 to 2035 to identify the prevailing peptone market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the peptone market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global peptone market trends, key players, market segments, application areas, and market growth strategies.

Peptone Market Report Highlights

| Aspects | Details |

| Market Size By 2035 | USD 240.5 million |

| Growth Rate | CAGR of 4.2% |

| Forecast period | 2019 - 2035 |

| Report Pages | 321 |

| By Source of Peptone |

|

| By End User |

|

| By Application |

|

| By Region |

|

| Key Market Players | Neogen Corporation, Thermo Fisher Scienctific, Becton, Dickinson and Company, HiMedia Laboratories, Titan Biotech Ltd., Liofilchem S.r.l, Kerry Group plc, Solabia Group, Merck KGaA, Nu-Tek BioSciences |

Analyst Review

This section provides various opinions of top-level CXOs in the global peptone market. According to the insights of

CXOs, the peptone market is expected to exhibit high growth potential attributable to increase in demand for more

effective drugs, and vaccines to combat chronic diseases. The market is projected to experience significant growth,

driven by the rising demand for high-quality peptones in biopharmaceutical, food & beverages, and other industrial

sectors. The growing need for efficient cell culture processes in vaccine production, drug discovery, and enzyme

manufacturing plays a key role in this expansion. In addition, advancements in bioprocessing technologies along

with an increase in emphasis on sustainable and cost-effective production methods, are further supporting market

development.

Advancements in vaccine technology, rise in investments in research and development and growth in public health

initiatives worldwide contribute to this growth. The focus on improving vaccine efficacy and safety also enhances the

market's prospects. CXOs further added that the growth in prevalence of chronic diseases coupled with the need for

enhanced drugs & vaccines, is a key driver for the adoption of peptone. They emphasized that public-private

partnerships, increase in healthcare investments, and the expansion in emerging markets are expected to further fuel

the demand.

Furthermore, North America dominated the market share, in terms of revenue in 2023, owing to presence of major

biopharmaceutical companies and a strong focus on drugs & vaccine innovation, along with favorable government

policies. However, Asia-Pacific is anticipated to witness notable growth owing to advancements in biotechnology

manufacturing capabilities and expansion of the pharmaceutical sector, presents significant opportunities for the

rapid growth of the peptone market.

2023 is the base year of the peptone market in the globe.

Cell Culture is the leading application of peptone market

North America is the largest regional market for peptone

The peptone market was valued at $149.5 million in 2023 and is estimated to reach $240.9 million by 2035, exhibiting a CAGR of 4.2% from 2024 to 2035.

Major key players that operate in the global peptone market are Thermo Fisher Scientific Inc, Solabia Group, Kerry Inc, Nu-Tek Biosciences, Becton Dickinson and Company, Himedia Laboratories, Liofilchem S.R.L, Neogen Corporation, Merck KGaA, and Titan Biotech Ltd. are the top companies to hold the market share in peptone.

Pharmaceutical and biotech industry is the leading end user of peptone market.

Loading Table Of Content...

Loading Research Methodology...