Performance Bank Guarantee Market Research, 2032

The global performance bank guarantee market was valued at $8.8 billion in 2022, and is projected to reach $20.7 billion by 2032, growing at a CAGR of 9.2% from 2023 to 2032.

A performance bank guarantee is issued by a bank on behalf of a contractor or supplier to assure the client that the contracted services or goods will be delivered in accordance with the terms and conditions specified in the contract. It serves as a form of security for the client, providing assurance that if the contractor fails to meet their obligations the client can claim a specified amount from the bank. This guarantee acts as a safeguard, mitigating the risk for the client and instilling confidence in the contractor's ability to fulfill their contractual obligations. It acts as a binding commitment, ensuring that the project or transaction proceeds smoothly and according to the agreed-upon terms, fostering trust between parties involved in the business arrangement.

Performance bank guarantee market promotes cross border trading between the countries by providing financial assurance to various importers and exporters to successfully execute those transactions. In addition, performance bank guarantee provides assurance to the seller that the payment will be made accordingly, thus lowering the financial risks. However, exchange rate fluctuations and lack of credit facilities for small & medium-sized enterprises in various countries hamper growth of the performance bank guarantee market. On the contrary, rapid increase in import and export activities in various countries along with the government support towards increasing trade activities & share of trade in the country economy are anticipated to provide a potential growth opportunities for the performance bank guarantee market.

The key players operating in the global performance bank guarantee market include HDFC Bank Ltd, DBS Bank, Wells Fargo & Company, Citigroup, United Overseas Bank Limited, JPMorgan Chase & Co, UBS Group AG, Macquarie Group Limited, Duetsche Bank, and Federal Bank. These players have adopted various strategies to increase their market penetration and strengthen their position in the performance bank guarantee industry.

Segment Review

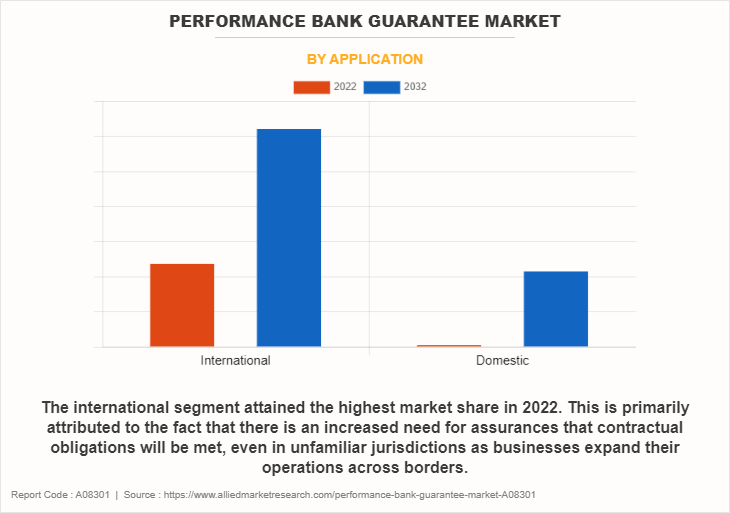

The performance bank guarantee market is segmented into application, enterprise size, end user, and region. By application, the market is categorized into international and domestic. Depending on enterprise size, the performance bank guarantee industry is segregated into large enterprises and small and medium-sized enterprises. On the basis of end user, the performance bank guarantee industry is segmented into exporters and importers. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Based on application, the international segment attained the highest market share in 2022 in the performance bank guarantee market growth. There is an increased need for assurances that contractual obligations will be met, even in unfamiliar jurisdictions as businesses expand their operations across borders. International transactions often involve higher risks due to varying legal and economic environments, making performance bank guarantees a critical component in fostering trust between parties from different countries.

Furthermore, international trade and commerce rely heavily on timely and reliable delivery of goods and services, further emphasizing the importance of performance guarantees in cross-border transactions. On the other hand, the domestic segment is expected to experience significant growth during the forecast period. This can be attributed to the resurgence of local economies and increased government emphasis on infrastructure development and domestic projects. There is a surge in demand for performance bank guarantees to ensure that contractors and suppliers meet their obligations as countries invest in their own infrastructure, construction, and development projects. In addition, domestic contracts often involve a diverse range of industries, including construction, manufacturing, and services, all of which benefit from the security provided by performance guarantees.

Based on region, Asia-Pacific secured the highest market share in the performance bank guarantee market in 2022 and it is poised for significant growth in the performance bank guarantee market during the forecast period. This can be attributed to the region's rapid economic expansion, driven by emerging markets like China, India, and Southeast Asian nations. As businesses in Asia-Pacific increasingly engage in cross-border transactions and international contracts, there is a heightened demand for performance bank guarantees to mitigate risks associated with unfamiliar partners or suppliers.

The report focuses on growth prospects, restraints, and trends of the performance bank guarantee market analysis. The study provides Porter’s five forces analysis to understand the impact of various factors such as bargaining power of suppliers, competitive intensity of competitors, threat of new entrants, threat of substitutes, and bargaining power of buyers on the performance bank guarantee market outlook.

Competition Analysis

Recent Product Launch in the Performance Bank Guarantee Market

On January 13, 2023, State Bank of India (SBI) launched e-Bank Guarantee (e-BG) facility in association with National e-Governance Services Ltd (NeSL). This facility will bring about a revolutionary change in the banking ecosystem, where bank guarantee is frequently used in large volumes. Bank has taken this initiative to enhance transparency and reduce turnaround time from days to minutes. NeSL’s Digital Document Execution (DDE) platform, which provides e-Stamp and e-Sign functions, will facilitate the e-Bank Guarantee process.

Recent Partnership in the Performance Bank Guarantee Market

On May 11, 2023, Bank of Baroda announced the launch of the Electronic Bank Guarantee (BG) system in partnership with National E-Governance Services Limited (NeSL), the government-backed Information Utility appointed by the Insolvency and Bankruptcy Board of India. The new facility will enable the public sector bank to issue inland bank guarantees electronically on its digital platform BarodaINSTA.

Top Impacting Factors

Digitalization of Performance Bank Guarantee Platforms

The modernization and digitalization of performance bank guarantee market platforms have revolutionized the way these guarantees are processed and managed. Traditionally, the process was paper-intensive and time-consuming. However, with the introduction of digital platforms, the issuance, monitoring, and settlement of bank guarantees have become more efficient and streamlined. This not only saves time but also reduces administrative costs. The digitalization of these processes also enhances transparency and accessibility, making it easier for businesses of all sizes to participate in international trade. Therefore, digitalization of performance bank guarantee platform is driving the growth of the market.

Trade Wars between Countries

Geopolitical tensions and trade conflicts between nations can have a negative impact on the performance bank guarantee market. These disputes can lead to increased uncertainty and risks associated with international trade. In such situations, banks and financial institutions may become more cautious about issuing guarantees, or they may impose stricter terms and conditions. This can create barriers for businesses looking to engage in cross-border transactions and can disrupt the flow of goods and services between countries.

Rising Import and Export Activities between the Countries

The increase in volume of import and export activities between countries presents a significant opportunity for the growth of the performance bank guarantee market. Businesses are looking to tap into new markets and establish international trade relationships as globalization continues to expand. This surge in cross-border transactions creates a growing demand for performance bank guarantees to mitigate risks and instill confidence among trading partners. Financial institutions can play a vital role in supporting and facilitating global commerce by capitalizing on this trend..

Key Benefits For Stakeholders

- The study provides in-depth analysis of the global performance bank guarantee market share along with current trends and future estimations to illustrate the imminent investment pockets.

- Information about key drivers, restrains, and opportunities and their impact analysis on the global performance bank guarantee market size are provided in the report.

- The Porter’s five forces analysis illustrates the potency of buyers and suppliers operating in the performance bank guarantee market opportunity.

- An extensive analysis of the key segments of the industry helps to understand the performance bank guarantee market trends.

- The quantitative analysis of the global performance bank guarantee market forecast from 2021 to 2030 is provided to determine the market potential.

Performance Bank Guarantee Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 20.7 billion |

| Growth Rate | CAGR of 9.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 387 |

| By Application |

|

| By Enterprise Size |

|

| By End User |

|

| By Region |

|

| Key Market Players | DBS Bank, UBS Group AG, JPMorgan Chase & Co, United Overseas Bank Limited, HDFC Bank Ltd, Macquarie Group Limited, Wells Fargo & Company, Duetsche Bank, Citigroup, Federal Bank |

Analyst Review

Businesses engaging in cross-border transactions seek assurances that goods and services will be delivered as agreed as international commerce continues to surge. This drives an increased demand for performance bank guarantees, making them an indispensable tool for secure and trustworthy international dealings. In addition, stringent regulatory environments in various industries, such as construction and procurement, necessitate the provision of performance guarantees, further stimulating market growth. Moreover, a growing awareness among businesses about risk management strategies has increased the popularity of performance bank guarantees as an effective means of safeguarding investments and ensuring contractual compliance. Furthermore, the increase in complexity of business transactions and a desire for transparent and reliable financial instruments have solidified the importance of performance bank guarantees in the contemporary business landscape. These factors collectively contribute to the sustained growth and relevance of the performance bank guarantee market.

Moreover, financial assurance provided by the bank as guarantee for the importer and exporters which reduces the risk of fraud in cross border transactions and rapid growth of import and export activities, is some of the major trends in the market. Furthermore, the consumer trend shifted toward technologically advanced banking services, during the COVID-19 pandemic. For instance, two of Australia's big banks, the Commonwealth Bank of Australia and ANZ, are working with leading Singapore-based blockchain company XinFin to boost automation and transparency in providing bank guarantee for trade asset and risk distribution.

The performance bank guarantee market is consolidated with the presence of key vendors such as HDFC Bank Ltd, DBS Bank, Wells Fargo & Company, Citigroup, United Overseas Bank Limited, JPMorgan Chase & Co, UBS Group AG, Macquarie Group Limited, Duetsche Bank, and Federal Bank. These players have adopted various strategies to increase their market penetration and strengthen their position in the industry.

The major trends in the performance bank guarantee market were influenced by several factors. There was an increasing demand for digitalization and automation in the banking industry, which also impacted the issuance and management of bank guarantees.

A performance bank guarantee is issued by a bank on behalf of a contractor or supplier to assure the client that the contracted services or goods will be delivered in accordance with the terms and conditions specified in the contract.

Asia-Pacific is the largest regional market for Performance Bank Guarantee

The estimated industry size of Performance Bank Guarantee is is projected to reach $20.67 billion by 2032, growing at a CAGR of 9.2% from 2023 to 2032.

The top companies to hold the market share in Performance Bank Guarantee are HDFC Bank Ltd, DBS Bank, Wells Fargo & Company, Citigroup, United Overseas Bank Limited, JPMorgan Chase & Co, UBS Group AG, Macquarie Group Limited, Duetsche Bank, and Federal Bank.

Loading Table Of Content...

Loading Research Methodology...