Perovskite Solar Cell Market Overview

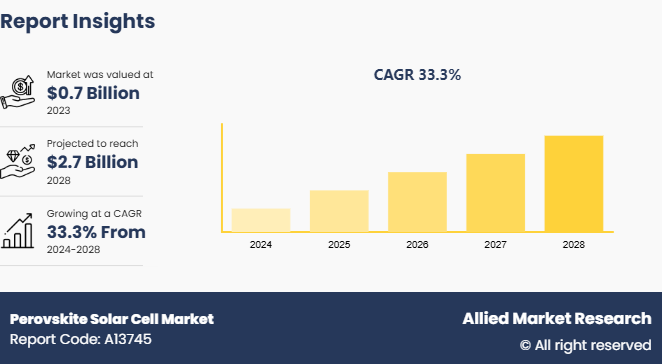

The global perovskite solar cell market size was valued at USD 0.7 billion in 2023, and is projected to reach USD 2.7 billion by 2028, growing at a CAGR of 33.3% from 2024 to 2028. Rising demand for renewable energy and IEA’s forecast of doubled solar PV and wind additions by 2028 in key regions boost interest in building-integrated solar. Perovskite solar cells, with flexibility, light weight, and design adaptability, offer architects and developers seamless, aesthetic, and sustainable energy solutions.

Key Market Trend

- Renewables to reach 42% of global power by 2028; wind & solar PV share to double to 25% (IEA).

- PSC lab efficiencies exceed 25%, nearing silicon solar cell performance.

- China, Japan & South Korea lead in pilot projects, manufacturing, and investments.

- Growing competition from startups and established players.

- Academia–industry collaborations speeding innovation and market entry.

Market Size & Forecast

- 2028 Projected Market Size: USD 2.7 billion

- 2023 Market Size: USD 0.7 billion

- Compound Annual Growth Rate (CAGR) (2024-2028): 33.3%

Market Introduction and Definition

Perovskite solar cells (PSCs) are a type of photovoltaic cell that utilizes perovskite-structured materials to convert sunlight into electricity. The term "perovskite" refers to the crystal structure of the light-absorbing material used in these solar cells, which is typically a hybrid organic-inorganic lead or tin halide-based material. Perovskite solar cells have witnessed a rise in demand in recent years due to their high efficiency potential, low manufacturing costs, and versatility in terms of fabrication techniques. They are more efficient and are a cheaper alternative to traditional silicon-based solar cells.

Key Takeaways

- The perovskite solar cell market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- More than 1,500 product literatures, industry releases, annual reports, and other such documents of major aluminum scrap recycling industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

- The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global markets and to assist stakeholders in making educated decisions to achieve their most ambitious growth objectives.

Key Market Dynamics

The increase in use of lightweight and flexible solar panels is being driven by various industries and applications that drive the demand for the perovskite solar cell. For instance, the consumer electronics industry is increasingly seeking energy solutions that are lightweight and integrated seamlessly into wearable devices, smartphones, and other portable gadgets. In the architectural sector, there is a rising interest in building-integrated photovoltaics, where solar panels are integrated into building materials such as windows, facades, and roofing systems. All these factors are expected to drive the demand for perovskite solar cells in during the forecast period.

However, concerns regarding the stability, durability, and long-term performance of perovskite solar cells have hindered their widespread adoption. Perovskite materials are known to be susceptible to degradation from moisture, heat, and light exposure, which impacts the efficiency and reliability of solar cell devices over time. In contrast, silicon-based solar cells offer proven durability and stability, backed by decades of field testing and performance data, providing a higher level of confidence for investors, project developers, and end users. All these factors hamper the perovskite solar cell market growth.

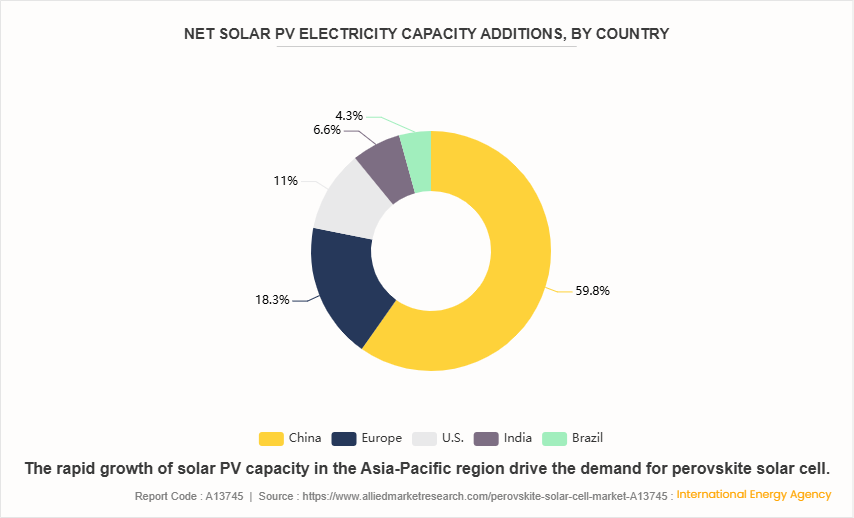

As the demand for renewable energy solutions continues to rise, there is a growing interest in incorporating solar energy generation directly into building infrastructure. According to the Internation Energy Agency (IEA) , solar PV and onshore wind additions through 2028 is expected to more than double in the U.S., the European Union, India and Brazil compared with the last five years. Perovskite solar cells offer several advantages for integration into building materials, including their flexibility, lightweight nature, and potential for customization, that makes them an attractive option for architects, developers, and building owners seeking to integrate sustainable energy solutions into their projects. By integrating solar cells directly into building materials, the need for traditional solar panels mounted on rooftops or ground-mounted arrays is eliminated, resulting in a more aesthetically pleasing and integrated design. All these factors are anticipated to offer new growth opportunities for the perovskite solar cell market.

Market Segmentation

The perovskite solar cell market is segmented into structure, product, method, end use, and country. On the basis of structure, the market is bifurcated into planar perovskite solar cells and mesoporous perovskite solar cells. By product, the market is divided into rigid perovskite solar cells and flexible perovskite solar cells. On the basis of method, the market is categorized into solution method, vapor-deposition method and vapor-assisted solution method. By end use, the market is segmented into aerospace, industrial automation, consumer electronics, energy, and others. Region-wise the market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

Regional Market Outlook

The rapid growth of solar PV capacity in the Asia-Pacific region, combined with surge in energy demand, urbanization, and industrialization, is a significant driving factor for the adoption of perovskite solar cells. The region's commitment to reducing carbon emissions and enhancing energy security creates a favorable environment for innovative solar technologies. Countries such as China, Japan, and India are leading the charge in renewable energy investments, providing substantial support through policies, subsidies, and research funding. Perovskite solar cells, with their potential for high efficiency and low production costs, are well-positioned to benefit from these favorable conditions. Moreover, the region's technological innovation ecosystem, with its numerous research institutions and collaborations between academia and industry, accelerates the development and commercialization of perovskite solar cells. This synergy between manufacturing prowess and technological innovation can lead to significant advancements in the efficiency, stability, and cost-effectiveness of perovskite solar cells.

- Countries such as China, Japan, South Korea, and Australia are heavily investing in R&D to improve the efficiency, stability, and scalability of PSCs. Leading academic institutions and research centers in these countries are collaborating with industry players to advance PSC technology.

- Governments in the Asia-Pacific region is implementing policies and incentives to promote renewable energy, including PSCs. Subsidies, tax incentives, and favorable regulations are encouraging the adoption and development of PSCs.

- Innovations in materials, such as the use of more stable perovskite compounds and advanced encapsulation techniques, are improving the longevity and performance of PSCs.

Which are the top perovskite solar cell companies

The following are the leading companies in the market. These players have adopted various strategies to increase their market penetration and strengthen their position in the perovskite solar cell industry.

- Oxford Photovoltaics

- Front Materials Co. Ltd.

- Xiamen Weihua Solar Co. Ltd.

- Saule Technologies

- Hanwha Group

- Toshiba Corporation

- Panasonic Holdings Corporation

- LONGi

- SKY ENERGY INDONESIA

- Phono Solar Technology Co., Ltd.

Industry Trends

According to the International Energy Agency (IEA) , in 2028 renewable energy sources account for over 42% of global electricity generation, with the share of wind and solar PV doubling to 25%.

Ongoing R&D efforts are focused on improving the efficiency and stability of PSCs. Efficiencies above 25% have been achieved in lab settings, bringing PSCs closer to the performance of traditional silicon solar cells.

Companies and research institutions in the Asia-Pacific region are establishing pilot projects and scaling up manufacturing facilities. China, Japan, and South Korea are leading the charge with significant investments in production capabilities.

A growing number of startups and established companies are entering the PSC market, leading to a competitive landscape with diverse approaches to technology development and commercialization.

Collaborations between academic institutions and industry players are driving innovation and commercialization efforts. These partnerships are essential for overcoming technical challenges and accelerating market entry.

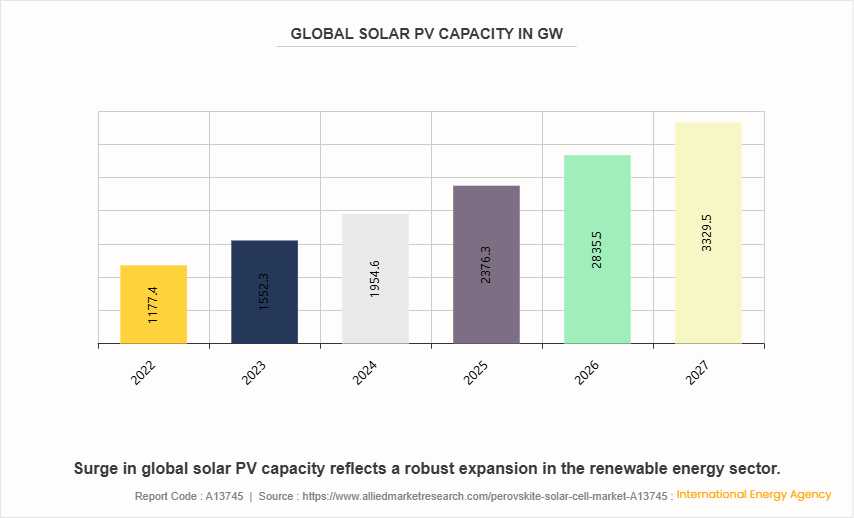

Global Solar PV Capacity

The projected increase in global solar PV capacity from 1, 177.4 GW in 2022 to 3, 329.5 GW by 2027 reflects a robust expansion in the renewable energy sector. This growth signifies a substantial market opportunity for emerging solar technologies such as perovskite solar cells. As the demand for solar energy rises, the market is expected to seek more efficient, cost-effective, and versatile solutions, positioning perovskite solar cells as a critical player. Perovskite solar cells, known for their high efficiency, low production costs, and flexibility that cater to the increasing need for innovative solar technologies that integrated into various applications, including building-integrated photovoltaics and portable solar devices. Furthermore, the substantial growth in solar PV capacity drives significant investments in R&D. This influx of capital accelerates the commercialization of perovskite solar cells by overcoming existing challenges such as stability, scalability, and durability. As a result, perovskite solar cells achieve higher efficiencies and longer lifespans that makes them more competitive with traditional silicon-based solar cells.

Key Sources Referred

International Energy Agency (IEA)

International Renewable Energy Agency (IRENA)

National Research Development Corporation (NRDC)

The Renewable Energy Institute

Solar Energy International

U.S. Department of Energy

United Nations Economic Commission for Europe

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the perovskite solar cell market analysis from 2024 to 2028 to identify the prevailing perovskite solar cell market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the perovskite solar cell market forecast and segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of perovskite solar cell market share.

The report includes the analysis of the regional as well as global perovskite solar cell market trends, key players, market segments, application areas, and market growth strategies.

Perovskite Solar Cell Market Report Highlights

| Aspects | Details |

| Market Size By 2028 | USD 2.7 Billion |

| Growth Rate | CAGR of 33.3% |

| Forecast period | 2024 - 2028 |

| Report Pages | 380 |

| By Structure |

|

| By Product |

|

| By Method |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Hanwha Vision Co., Ltd. (Hanwha Group), Phono Solar Technology Co., Ltd, Toshiba Corporation, Panasonic Holdings Corporation, LONGi, Saule Technologies, Front Materials Co. Ltd., Oxford Photovoltaics Limited, SKY ENERGY INDONESIA, Xiamen Weihua Solar Co. Ltd. |

The global perovskite solar cell market was valued at $0.7 billion in 2023, and is projected to reach $2.7 billion by 2028, growing at a CAGR of 33.3% from 2024 to 2028.

Asia-Pacific is the largest regional market for Perovskite Solar Cell.

Energy is the leading end use of Perovskite Solar Cell Market.

Integration into building materials is the upcoming trends of Perovskite Solar Cell Market in the globe.

The major players operating in the perovskite solar cells market include Oxford Photovoltaics, Front Materials Co. Ltd., Xiamen Weihua Solar Co. Ltd., Saule Technologies, Hanwha Group, Toshiba Corporation, Panasonic Holdings Corporation, LONGi, SKY ENERGY INDONESIA, and Phono Solar Technology Co., Ltd.

Loading Table Of Content...