Personal Finance Software Market Research, 2032

The global personal finance software market was valued at $1.4 billion in 2022, and is projected to reach $4.2 billion by 2032, growing at a CAGR of 12.2% from 2023 to 2032.

Personal finance software helps to manage individual’s money and even helps users to discover ways to meet their long-term financial goals. This software is available as per requirements such as money-management programs, free web-based money-management sites, and tax-preparation programs. Moreover, personal finance software refers to an advanced solution that is designed for integrating, interpreting, and segregating information related to the financial data of a user. It involves budgeting, banking, insurance, mortgages, investments, retirement, and tax and estate plans. These programs aid in organizing the budget, accounting finances, and making financial decisions to meet long-term financial goals. In addition to this, personal finance software assists users in tracking transactions, managing bank records, tracing investments, and preventing interest on late payments by providing scheduled reminders for bills and deposits.

Rise in need to track and manage income and increase in dependency on the internet is boosting the growth of the global personal finance software market. In addition, increase in use of digital transformation technology is positively impacts growth of the personal finance software market. However, lack of awareness about personal finance software and increasing security concerns is hampering the personal finance software market growth. On the contrary, increased adoption of personal finance software among developing economies is expected to offer remunerative opportunities for expansion of the personal finance software market during the forecast period.

Segment Review

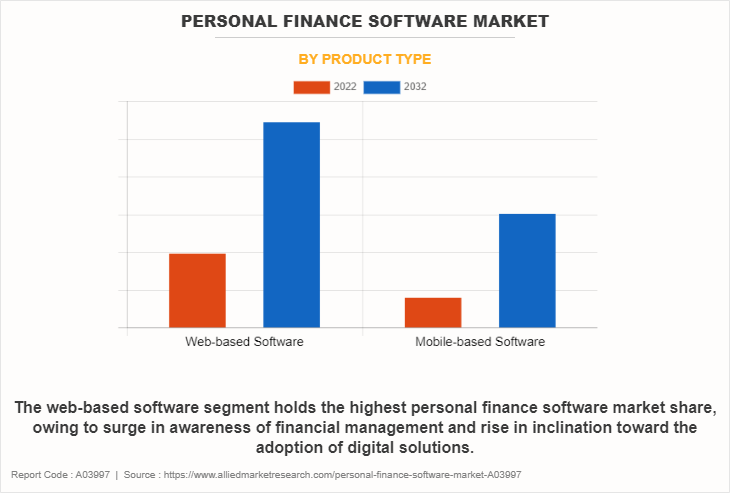

The personal finance software market is segmented on the basis of by product type, end user, and region. On the basis of product type, the market is categorized into web-based software and mobile-based software. By end user, it is classified into small businesses users, and individual customers. By region, the personal finance software market is analyzed across North America, Europe, Asia-Pacific, and LAMEA.

In terms of product type, the web-based software segment holds the highest market personal finance software market share, owing to growing awareness of financial management, and rising inclination towards the adoption of digital solutions. However, the mobile-based software segment is expected to grow at the highest rate during the forecast period, owing to, an increase in the adoption of personal finance software by end-users to ensure secure money transfers and effective management of money flow.

Region wise, the personal finance software market size was dominated by North America in 2022 and is expected to retain its position during the forecast period, owing to high adoption of mobile-based personal finance software and the increasing market penetration of global vendors. However, Asia-Pacific is expected to witness significant growth during the forecast period, owing to rapid growth of fintech companies in the region along with increasing investment to advance financial technology infrastructure.

The key players that operate in the personal finance software market are Quicken Inc., The Infinite Kind, You Need a Budget LLC, Microsoft, Moneyspire Inc., doxo Inc., BUXFER INC., Personal Capital Corporation, Money Dashboard, PocketSmith Ltd., and others. These players have adopted various strategies to increase their market penetration and strengthen their position in the personal finance software industry.

Digital Capabilities

The term personal finance software refers to a specialized computer program or application created to assist people in effectively managing their personal money. Users track income, expenses, assets, budgets, and financial objectives using a wide range of tools and services that are offered by the platform. To import and categorize transactions automatically and do away with the necessity for manual data entry, customers link their bank accounts, credit cards, and other financial accounts. By presenting a summary of income and expenses, it enables users to analyze their spending habits, pinpoint areas for saving, and make wise financial decisions. Personal accounting software assists users in monitoring their financial status, reminds them when payments are due, and helps them avoid late fees and other consequences by sending timely notifications.

Top Impacting Factors

Rise in need to Track and Manage Income

The adoption of personal finance software market has increased over a period due to the rise in need to track and manage the income flow of an individual or of a small business. The use of this software has made handling financial details easy as it track investments and every small transaction. Moreover, personal finance software even be linked with internet banking to give live updates of transactions and help the end users in money management.

Furthermore, personal finance software track all the liabilities and assets effectively in a balance sheet. It enables business owners to focus on business without spending much time on taxes as personal finance software create tax reports on business income, deductions, and expenses, thereby accelerating the market growth. In addition, numerous benefits are provided by personal finance software, which include quick and easy account reconciliation, budget planning, availability of online bill payment, help to track and analyze investments, and others boost the adoption of this technology in the personal finance software market.

Increase in Dependency on the Internet

Continuous growth in the penetration of the internet worldwide and its increase in use for day-to-day activities and critical operations is one of the key drivers of this market. Banks, financial institutions, and payment card companies enable customers to make transactions using the Internet. Personal finance software helps keep track of such transactions and manage money flow. In addition, digital banking penetration is also on an increase in the developing countries such as China, India, and others, which in turn is expected to drive the demand for personal finance software market.

For instance, in May 2023, according to a joint report ‘Internet in India Report 2022 by Internet and Mobile Association of India (IAMAI) and Kantar, the number of internet users in India reached to 759 million in 2021. Moreover, the number of users opting for online banking in India is expected to double to reach 900 million users by 2025, from the current 45 million active urban online banking users.

Increasing Security Concerns

The surge in cyber-attacks on personal finance software for gaining personal data of the clients hampers market growth. Moreover, the increase in adoption of public networks supporting the endpoints running on public servers without proper cybersecurity poses huge threat to the end users. Some of the leading players in the global cloud market, including Amazon Web Services (AWS) and Google, Inc. provide layered security models for encapsulated cloud environments.

However, systems and applications running in the cloud require security far more beyond relying on cloud providers for VPN, firewall, and WAF security. As exposure of information and data of applications in the cloud, these interfaces require security aspects more than just access control. Furthermore, the increase in adoption of personal finance software among smartphones and tablets users is a major factor that hampers the growth of the market. This is attributed to data being shared via cloud computing platform, which in turn poses threat to these devices through malicious activity due to exposure of data.

Increased Adoption of Personal Finance Software Among Developing Economies

Developing economies of Asia-Pacific and LAMEA possess high potential for expansion of financial technology (fintech) services, which is expected to drive market growth during the forecast period. Furthermore, the continuous rise in internet and mobile phones penetration in the developing countries provide numerous opportunities for the market. For instance, in 2022, according to survey conducted by Marqeta, the company surveyed 4,000 people across the U.S., UK, and Australia and found that, on average, 75% of respondents had used a mobile wallet in the last year.

Furthermore, AI and machine learning assist financial institutes at various stages of risk management process ranging from identifying risk exposure, measuring, estimating, to assessing its effects. Moreover, increase in investments in AI and machine learning offers the potential to transform the area of automation for time-consuming, mundane processes, and offers a far more streamlined and personalized customer experience, which enhances the growth of the market. In addition, major financial institutes such as Bank of America, JPMorgan, and Morgan Stanley, invest heavily in ML technologies to develop automated investment advisors and train systems to detect flags such as money laundering techniques and for other fraud cases, which in turn is expected to provide lucrative opportunity for the growth of the personal finance software market.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the personal finance software market analysis from 2023 to 2032 to identify the prevailing opportunity.

- The market research is offered along with information related to personal finance software market outlook, key drivers, restraints, and personal finance software market opportunity.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the personal finance software market segmentation assists to determine the prevailing personal finance software market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global personal finance software market forecast.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the personal finance software market players.

- The report includes the analysis of the regional as well as global personal finance software market trends, key players, market segments, application areas, and market growth strategies of personal finance management software.

Personal Finance Software Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 4.2 billion |

| Growth Rate | CAGR of 12.2% |

| Forecast period | 2022 - 2032 |

| Report Pages | 173 |

| By Product Type |

|

| By End User |

|

| By Region |

|

| Key Market Players | The Infinite Kind, Quicken Inc., BUXFER INC, doxo Inc, Money Dashboard Limited, Moneyspire Inc, You Need a Budget LLC, PocketSmith Ltd, Microsoft Corporation, Personal Capital Corporation |

Analyst Review

Personal finance software helps manage bank accounts, financial transactions, credit cards, investments, income, and expenditure of an individual in a smartphone or PC. The software has the capability to manage monetary transactions and payrolls by helping an individual to manage monthly expenses efficiently. Personal finance software acts like a dashboard for the users financial transactions and helps in tracking transactions and alerting the user when a problem arises. The adoption of these software has increased among small or home business user, which drives the growth of the market. It helps the small or home businesses to easily manage their funding and business operations as it enables the effective planning and management of the inflow and outflow of monetary funds.

The global personal finance software market is expected to register high growth, owing to increasing demand for safe, secure, and efficient finance tracking solutions among individuals and small businesses represents are driving the growth of the personal finance software market. Thus, the increase in adoption of personal finance software, owing to increasing smartphone penetration and the growing demand for effective financial solutions is one of the most significant factors driving the growth of the market. With the surge in demand for personal finance software, various companies have established alliances to increase their capabilities. For instance, in October 2020, Standard Chartered partnered with Moneythor for personal finance tools. It aims to help customers better manage their finances, driven by data.

In addition, with further growth in investment across the world and the rise in demand for personal finance software, various companies have expanded their current product portfolio with increased diversification among customers. For instance, in June 2023, SAP Fioneer a joint venture between technology company SAP and private equity firm Dediq launched tailored banking offering for SMEs. The solution will allow banks and neobanks to cater to SMEs which have traditionally struggled to access financial services that meet their needs, as the perceived risks and costs associated are deemed too high.

Moreover, with increase in competition, major market players have started acquisition companies to expand their market penetration and reach. For instance, August 2022, Axo AS acquired Defero, a digital credit-scoring and financial management platform to make better financial decisions through its free credit-scoring and financial management platform that is tailored to each member’s credit profile and financial needs.

The Personal finance software market is estimated to grow at a CAGR of 12.2% from 2023 to 2032.

The Personal finance software market is projected to reach $4,221.1 million by 2032.

Rise in need to track and manage income and increase in dependency on the internet is boosting the growth of the global personal finance software market. In addition, increase in use of digital transformation technology is positively impacts growth of the personal finance software market. However, lack of awareness about personal finance software and increasing security concerns is hampering the personal finance software market growth. On the contrary, increased adoption of personal finance software among developing economies is expected to offer remunerative opportunities for expansion of the personal finance software market during the forecast period.

The key players profiled in the report include Quicken Inc., The Infinite Kind, You Need a Budget LLC, Microsoft, Moneyspire Inc., doxo Inc., BUXFER INC., Personal Capital Corporation, Money Dashboard, PocketSmith Ltd.

The key growth strategies of Personal finance software market players include product portfolio expansion, mergers & acquisitions, agreements, geographical expansion, and collaborations.

Loading Table Of Content...

Loading Research Methodology...