Pet Food Packaging Market Research, 2031

The Global Pet Food Packaging Market Size was valued at $10.1 billion in 2021, and is projected to reach $17.1 billion by 2031, growing at a CAGR of 5.2% from 2022 to 2031. Pet food packaging keeps items fresh, long-lasting, and clean. It helps to keep the food contamination-free and ensures freshness & hygiene of animal feed. Concerns over pets' nutritional intake have prompted an increase in the production of diverse pet foods, as well as increased demand for superior materials for pet food packaging. The expansion in pet population has boosted pet dietary options, which is good news for the pet food packaging industry.

Pet adoption for households has increased dramatically in both developed and developing countries over the last several years. For instance, according to the American Pet Products Organization's '2019-2020 APPA National Pet Ownership' poll, 67% of U.S. households owned a pet in 2020, up from 56% in 1988. The growth in pet population has increased pet dietary choices, which has a positive impact on the pet food packaging market outlook. Moreover, good packaging can have a significant impact on a customer's purchase decision.

Hence, all such factors are expected to drive market growth during the forecast period. Rise in demand for convenience & high-quality food products, surge in urban population, which leads to increased pet adoption, increase in consumption of processed & packaged food for animals around the world, upsurge in disposable income of pet owners, and multi-functionality of pet food packaging, all drive the growth of the pet food packaging market. For instance, in February 2020, Nestle S.A. launched ‘Unleashed’ a global pet care industry's international innovation program. This program aimed to provide funding to start-up companies involved in the production of various pet care items from Europe, North America, and the Middle East.

Market Dynamics

Stringent food packaging regulation by governments all over the world have become more aware and stricter about the hazards posed by food packaging materials, and have enacted a variety of regulations. For instance, according to the UNEP, 127 countries have passed legislation restricting the manufacture, distribution, use, and import of plastic bags, mostly in the form of manufacturing, distribution, use, and import restrictions. Plastic bag manufacturing or import restrictions have been enacted in 61 of these nations, and a number of them have also taken action to eliminate other single-use plastics. Only after the packaging has passed the quality check can it be used. Moreover, increase in raw material prices and rapid technological evolution necessitates the use of highly skilled labor. The creation of packing materials necessitates highly skilled and experienced people. This, combined with the high cost of the production process and the high cost of labors drive the cost of packing materials. As a result, these materials are only available in high-income areas where consumers can purchase high-quality packaged food. All such instances are restraining the pet food packaging market growth.

The demand for pet food packaging has decreased in the year 2020, owing to low demand from different regions due to lockdown imposed by the government of many countries. The COVID-19 pandemic has shut-down production of pet food packaging for the end-user, mainly owing to prolonged lockdowns in major global countries. This has hampered the growth of the pet food packaging market significantly during the pandemic. The major demand for pet food packaging was previously noticed from giant manufacturing countries including China, the U.S., Germany, Spain, and the UK which was badly affected by the spread of coronavirus, thereby halting demand for pet food packaging. This is expected to lead to the re-initiation of the manufacturing industry at its full-scale capacities, which is likely to help the pet food packaging market to recover by end of 2022.

Growing urbanization and promising technological development have occurred in recent years. As the humanization of pet’s spreads, pet owners want their pets to eat as well as they do. With more brands launching premium pet food lines, quality packaging is required to protect and preserve the ingredients. For instance, in November 2020, Indorama Ventures invested in recycling plants in France and Poland. This investment targeted recycling 10 billion PET bottles in Europe by 2023. In the pet food packaging industry, flexible packaging is one of the most commonly used formats. It has good barrier properties such as resistant to heat, and lasts a long time while being inexpensive. To keep their nutrients and health benefits, high-quality pet food ingredients need to have good barrier properties. Flexible packaging films extend the shelf life of pet food by preventing the transfer of aromas, moisture, and oxygen. Premium Pouches with reseal food type aid in preserving the freshness of pet food. All such instances are expected to offer lots of opportunities to pet food packaging market forecast period.

Segmental Overview

The market is segmented on the basis of material type, animal type, food type, and region. On the basis of material type, the market is divided into paper & paperboard, plastic, and metal. On the basis of animal type, the market is divided into dogs, cats, and others. On the basis of food type, the market is divided into dry food, wet food, and others. Region wise, the global pet food packaging market analysis is conducted across North America (the U.S., Canada, and Mexico), Europe (the UK, France, Germany, Spain, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), and LAMEA (Latin America, the Middle East, and Africa).

By Material Type:

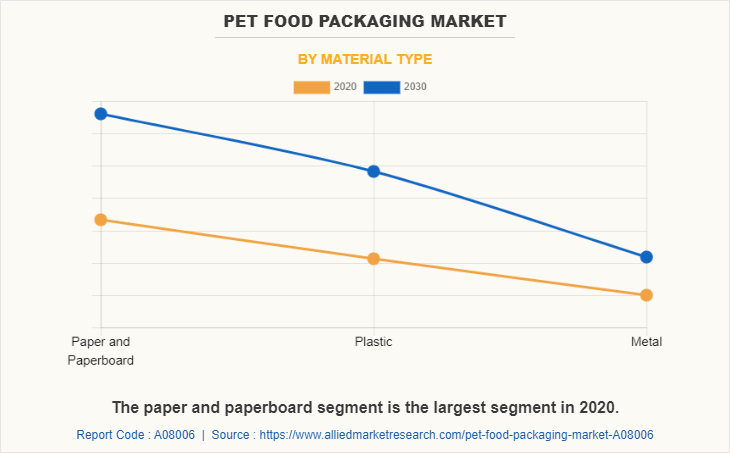

The pet food packaging market is categorized into paper & paperboard, plastic, and metal. Paper and paperboard are the most common packaging raw materials. Paper is used in corrugated board manufacture and spiral tube making. Paperboard is a thick paper-based material that is commonly used in packaging. It is made from wood pulp as basic material. It is sustainable and used for pet food packaging. Plastic is the most essential key segment for packaging products, accounting for yet more than 40% of global plastic usage. Plastic is commonly used for pet food packaging due to its flexibility and easy availability.

Metal packaging encompasses a wide range of enclosing and protective materials made from steel and aluminum sheets. Aerosol and beverage cans, containers, barrels, drums, foil tops and closures are some of the most prevalent metal packaging materials used for pet food packaging. They keep contents dry and bacteria-free while allowing perishables to be stored without refrigeration. Other food contains chilled & frozen, teats and fried foods. Foods that have been freeze-dried are not the same as those that have been dehydrated. Freeze-drying cools the food, whereas dehydration necessitates the use of heat. Protein molecules and other nutrients do not change structure when they are cooled. As a result, freeze-dried food resembles fresh food exactly. Plastic segment is expected to exhibit the largest revenue contributor during the forecast period. Paper and paperboard is expected to exhibit the highest CAGR share in the material segment in the pet food packaging market during the forecast period.

By Animal Type:

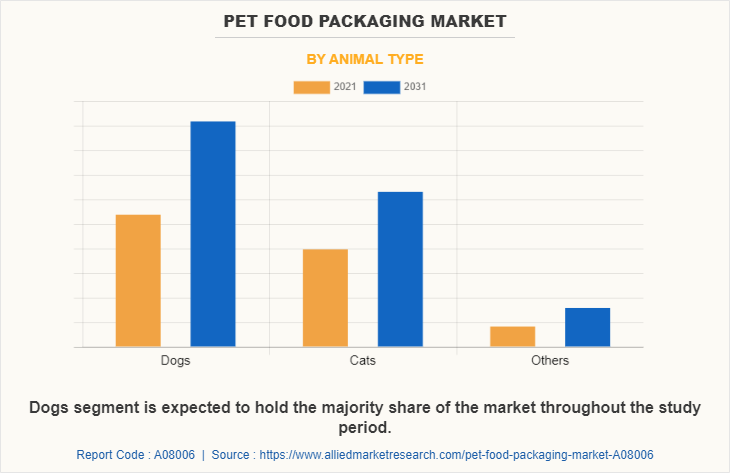

The pet food packaging market is classified into dogs, cats, and others. Dogs are presently amongst the most popular pets all around the world. A dog's diet should include a variety of carbohydrates, minerals, proteins, fats, vitamins, and water. Cats are one of the most popular companion pets all over the world because they are small, independent, and can groom themselves. Owners used to feed their cats milk and homemade food, which included leftovers and scraps from family meals. However, the demand for commercially prepared cat food has gradually increased around the world because it provides essential nutrients for cats' weight and energy requirements.

The other segment includes fish food, bird food, and raw feeding are just a few of the options. Dogs, cats, birds, and fish are just a few of the pets that eat pet meals. The global consumption of pet meals is increasing as a result of the growing number of dog pets combined with their larger hunger than other pets. Dogs segment is expected to exhibit largest revenue during forecast period, and the others segment expected to exhibit highest CAGR share in animals type segment in pet food packaging market during the forecast period.

By Food Type:

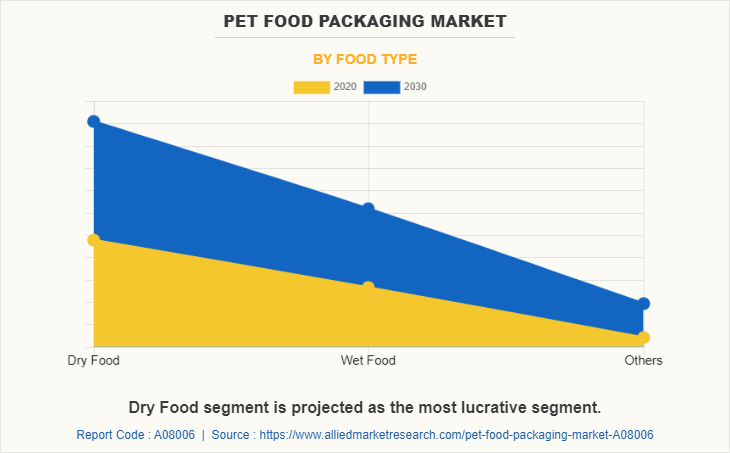

The pet food packaging market is divided into dry food, wet food, and others. Dried food is created by eliminating the moisture from food or product in order to extend its shelf life while preserving nutrients and flavor’s. Furthermore, the drying of foodstuffs contributes in the prevention of bacterial growth in food. Wet pet food is made up of a high moisture content (between 75 and 80%), as well as additional dry components. Wet pet food is becoming widely attractive among pet owners since it helps animals gain energy, create muscles and lean mass, and increase their overall growth mechanisms.

Wet pet food serves to supply vital nutrients to pets, such as proteins, vitamins, and minerals, to keep them nourished and hydrated. Dry food is expected to exhibit the largest revenue share in the food type segment in the pet food packaging market during the forecast period. The others segment is expected to exhibit the largest CAGR during the forecast period.

By region: The Pet food packaging market is analyzed across North America, Europe, Asia-Pacific, and LAMEA. In 2021, Europe had the highest revenue in Pet food packaging market share. And Asia-Pacific is expected to exhibit the highest CAGR during the forecast period.

COMPETITION ANALYSIS

The major players profiled in the Pet food packaging market include Amcor Limited, American Packaging Corporation, Berry Plastics, Constantia Flexibles, Crown Holdings, Huhtamaki Flexible Packaging, Mondi Group, ProAmpac, Sonoco Products and WINPAK LTD.

Major companies in the market have adopted product launch, acquisition and partnership as their key developmental strategies to offer better products and services to customers in the Pet food packaging market.

Some examples of acquisition and collaboration in the market

In November 2022, Sonoco a global leader in diversified packaging, has expanded Sonopost cornerpost manufacturing in Europe. A new protective packaging production facility is set to open in Bursa, Turkey in November, one year after Sonoco established the first Sonopost operation in Sochaczew, Poland.

In January 2022, Sonoco has acquired Ball Metalpack, a leading manufacturer of sustainable metal packaging for food and household products and the largest aerosol can producer in North America. Ball Metalpack was a joint venture owned by Platinum Equity and Ball Corporation in order established sustainable packaging portfolio to include metal packaging.

In August 2022, Constantia Flexibles has acquired FFP Packaging Solutions to see it gain its first consumer plant in the United Kingdom that focuses on developing recyclable laminates for flow wraps, lidding films, and pre-made pouches. FFP Packaging Solutions reportedly represent over 80% of its sales in sustainable packaging in the United Kingdom, offering expertise in recyclable laminates for flow wraps, lidding films, and pre-made pouches.

In August 2022, Amcor has acquired a world-class flexible packaging plant in the Czech Republic. The site's strategic location immediately increased Amcor's ability to satisfy strong demand and customer growth across its flexible packaging network in Europe. The plant is a greenfield development commissioned by DG Pack in 2019 and features state-of-the-art specialized equipment for attractive segments, including coffee and pet food.

In May 2022, Coveris is collaborated with Ultra-Premium Direct, a French manufacturer of natural premium pet food, on mono-material and recyclable polyethylene (PE) bags for the Protein Boost pet food product range.

In February 2020, Silgan Holdings has acquired Cobra Plastics Inc. With this acquisition, the companies are looking to combine with Cobra's overcap product line.

The investment in the market

In July 2022 Simmons Pet Food has firm invested USD 500 million in a strategic growth strategy that included the start-up of the second line of canned pet food at its Dubuque, Iowa, plant, a new pet food distribution facility in the area of Edgerton, Kansas, and a fourth high-speed canning line at its facility in Emporia, Kansas.

In November 2020, Indorama Ventures has invested in recycling plants in France and Poland. This investment motive to recycling 10 billion PET bottles in Europe by 2023.

The product launch and product development in the market

In February 2020, Nestle S.A. has launched ‘Unleashed’ a global pet care industry's international innovation program. This program aimed to provide a total of $ 51,922.4 in funding to start-up companies involved in the production of various pet care items from Europe, North America, and the Middle East by the end of March 31, 2020.

In 2022, Dogs Plate, a polish pet food company has launched a new range of wet dog food products with insect protein.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the pet food packaging market analysis from 2021 to 2031 to identify the prevailing pet food packaging market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the pet food packaging market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global pet food packaging market trends, key players, market segments, application areas, and market growth strategies.

Pet Food Packaging Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 17.1 billion |

| Growth Rate | CAGR of 5.2% |

| Forecast period | 2021 - 2031 |

| Report Pages | 210 |

| By Material Type |

|

| By Food Type |

|

| By Animal Type |

|

| By Region |

|

| Key Market Players | Constantia Flexibles Group, WINPAK LTD., Huhtamaki Flexible Packaging, Crown Holdings, American Packaging Corporation, Berry Global Group Inc, Amcor Plc, Mondi plc, Sonoco Products Company, Proampac |

Analyst Review

The global pet food packaging market witnessed a huge demand in Europe followed by North America. The highest share of the Europe market is attributed to increasing demand for pet food packaging due to increase in pet humanization.

Pet food packaging is in demand due to the variety of food available in categories such as wet food and dry food. Different pets, such as dogs and cats, require a different portion of food, creating demand for various pet food packaging sizes. Moreover, pet food consumption has grown due to the growth in the pet population, which has a beneficial influence on the pet food packaging sector. Furthermore, as animal health problems related to food items have grown, their owners have become more worried and seek products with the greatest packaging that is both appealing and instructive.

Various market players have adopted strategies such as product launches, business expansion, acquisitions, and agreements to expand their business and strengthen their market position. For instance, in March 2021, PRO-EVP launched a multiwall bag, which are made from fiber-based renewable resources and paper/poly hybrid materials and are meant for sustainable pet food packaging. Similarly, PRO-DURA is a woven polypropylene bag series from the company that provides flexibility and durability. As a result, all such factors are expected to drive the global pet food packaging market

The key players that operate in the pet food packaging market are Amcor Limited, American Packaging Corporation, Berry Plastics, Constantia Flexibles, Crown Holdings, Huhtamaki Flexible Packaging, Mondi Group, ProAmpac, Sonoco Products and WINPAK LTD.

The global pet food packaging market was valued at $10,144.3 million in 2021, and is projected to reach $17,047.5 million by 2031, registering a CAGR of 5.2% from 2022 to 2031.

The forecast period considered for the global pet food packaging market is 2022 to 2031, wherein, 2021 is the base year, 2022 is the estimated year, and 2031 is the forecast year.

The latest version of global pet food packaging market report can be obtained on demand from the website.

The base year considered in the global pet food packaging market report is 2021.

The major players profiled in the pet food packaging market include Amcor Limited, American Packaging Corporation, Berry Plastics, Constantia Flexibles, Crown Holdings, Huhtamaki Flexible Packaging, Mondi Group, ProAmpac, Sonoco Products and WINPAK LTD.

The top ten market players are selected based on two key attributes - competitive strength and market positioning.

The report contains an exclusive company profile section, where leading companies in the market are profiled. These profiles typically cover company overview, geographical presence, market dominance (in terms of revenue and volume sales), various strategies and recent developments.

Based on food type, dry food segment dominated the market in 2021.

Loading Table Of Content...