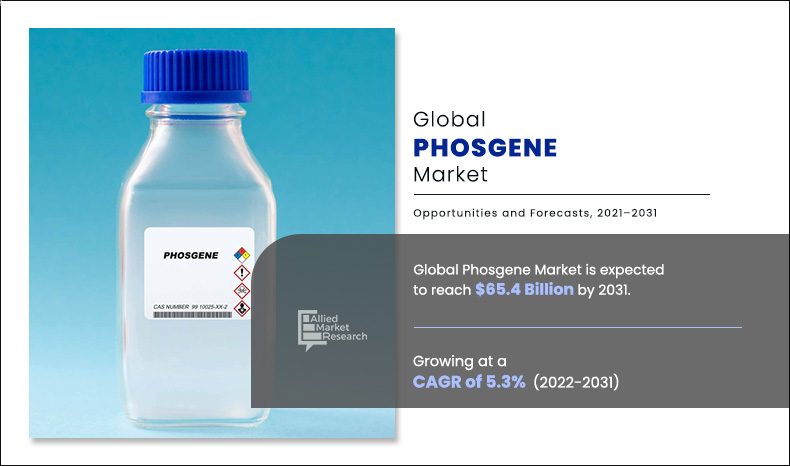

Phosgene Market Outlook - 2022–2031

The global phosgene market size was valued at $39.2 billion in 2021, and is projected to reach $65.4 billion by 2031, growing at a CAGR of 5.3% from 2022 to 2031.

Phosgene is a colorless gas with chemical formula COCl2. It is produced by reacting chlorine and carbon monoxide. In general, a small amount of phosgene is released in nature from volcanoes. It is mainly produced artificially and is extremely toxic and thus, it was even used as a chemical weapon during wars. Phosgene is used for deriving a number of chemical compounds used in various industrial sectors.

The increased usage of phosgene in production of diethyl carbomoyl chloride, which is further utilized to hydrolyze water insoluble compound that acts as an intermediate for the production of pharmaceuticals, pesticides and dyes, accelerates the growth of the phosgene market. Rise in utilization for platinum, plutonium, uranium and niobium metal extraction and its wide use in chemical such as beryllium chloride, aluminum chloride and boron trichloride further influence the growth of the phosgene market. In addition, growth of pharmaceutical sector, increase in R&D activities, rise in need for enhanced treatments, and surge in investments positively affect the phosgene market growth. In the chemical industry, phosgene is widely used for production of aromatic di-isocyanates such as toluene diisocyanate (TDI) and methylene diphenyl diisocyanate (MDI), which are precursors for production of polyurethanes and some polycarbonates. Surge in demand for flexible polyurethane foams in applications such as furniture and as a cushioning material in automobiles and furniture, is expected to drive the demand for TDI during the forecast period. In addition, rise in use of MDI in the building and construction industry for applications such as roof insulation, insulated panels, and gap fillers for the space around doors and windows, is anticipated to surge the demand for phosgene to increase the production of TDI and MDI to meet the rise in demand during the forecast period. All these factors collectively surge the demand for phosgene, thereby augmenting the global phosgene market growth.

However, exposure to phosgene may cause irritation to eyes, dry burning throat, vomiting, cough, foamy sputum, breathing difficulty, and chest pain. In addition, workers of various industries such as chemical, agrochemical, and pharmaceutical may suffer from exposure to phosgene. The level of exposure depends upon the dose, duration, and work being done. This factor is anticipated to restrain the growth of the phosgene market during the forecast period.

On the contrary, according to the Food and Agriculture Organization (FAO), the global food demand is expected to increase

from 50.0% to 90.0% by 2050, owing to expected increase in the global population by 2,300.0 million people, between 2009 and 2050. The global food production needs are expected to increase by about 70.0% by 2050 to meet the growth in food demand due to increase in population globally. This implies that there must be a significant increase in the production of certain food commodities. For instance, the production of cereals must reach around 3,000.0 million metric tons by 2050, an increase from nearly 2,100.0 million metric tons in 2018. The increased demand for food security has surged the production of several agrochemicals such as pesticides and herbicides, where phosgene gas is widely used for pesticide manufacturing and is anticipated to offer new growth opportunity in the phosgene market.

The phosgene market is segmented on the basis of derivative, application, and region. On the basis of derivative, the market is categorized into isocyanates, chloroformates, and carbamoyl chlorides. By application, it is classified into agrochemicals, pharmaceuticals, polycarbonates, dyes, fine chemicals, and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The major companies profiled in this report include BASF SE, Dow, Covestro A.G., VanDemark Chemical Inc., Vertellus, Synthesia, a.s., Atul Ltd., Paushak Ltd., Hodogaya Chemical Co. Ltd., Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC Ltd), UPL Limited, Shandong Tianan Chemicals Co. Ltd., Altivia, Tokyo Chemical Industry Co. Ltd., Lanxess, Hangzhou Better Technology Co. Ltd., Chuo Kaseihin Co. Inc., PMC Isochem, KPX Life Science Co. Ltd., and Nippon Soda Co. Ltd.

By Region

Asia-Pacific would exhibit highest CAGR of 5.7% during 2021-2030.

Phosgene Market, by Region

The Asia-Pacific phosgene market accounted for 33% of the market share in 2021, and is projected to grow at the highest CAGR of 5.7% during the forecast period. Increase in demand for agricultural products and the resultant commercialization of agriculture induced a rise in use of agricultural chemicals in the Asia-Pacific. The crop damage by insects is the highest, followed by pathogens and weeds. Agrochemicals account for a prominent share in total pesticide use in the Asia-Pacific. In countries such as India, there is a significant increase in imports of agrochemicals from countries such as China and Germany. Owing to an increased focus toward environmental sustainability, while maintaining the crop output, the demand for agrochemicals in the region is expected to increase in the coming years. With companies such as Syngenta CropScience, Bayer AG, and FMC Corporation setting up their own manufacturing plants and

launching products that cater to the needs of farmers in this region, the demand for agrochemicals is expected to increase during the next few years. This factor is anticipated to surge the demand for phosgene from agrochemicals manufacturers across the region.

By Derivative Polyethylene

Isocyanates derivative is the most lucrative segment

Phosgene Market, by Derivative

In 2021, the isocyanate derivative was the largest revenue generator, and is anticipated to witness growth at a CAGR of 5.6% during the forecast period. Significant growth in the automotive industry along with rapid industrialization across the globe, especially in the emerging economies, is one of the key factors driving the demand for isocyanate. Furthermore, widespread adoption of isocyanate-based products in the construction industry is also providing a boost to the demand for isocyanates. Isocyanates exhibit excellent insulation properties, owing to which they are used in the form of rigid PU foams for insulating panels and gap fillers in the spaces around doors and windows. They are also used on the exterior components of automobiles to minimize the overall vehicular weight and improve the fuel efficiency. Various advancements, such as the development of bio-based variants, are acting as another demand inducing factor.

By Application

Polycarbonates application is projected as the fastest growing segment

Phosgene Market, by Application

By application, the polycarbonate application dominated the global market in 2021, and is anticipated to grow at a CAGR of 6.2% during the forecast period. In the electrical and electronics industry, polycarbonates are used to make numerous corresponding equipment such as electrical enclosures, junction boxes, and others. Some of these most common parts include switching relays, sensor parts, LCD sections, connectors, cell phones, and computers, owing to their lightweight and high impact strength. Hollow polycarbonates are perfect thermal insulators, making them a preferred choice in most wire insulation applications in the electrical and electronics industry. Polycarbonate sheets are used in electrical accessories, hardware gadgets, and optical plates. Growth in demand for more innovative and technologically advanced electronic products across the globe is anticipated to boost the demand for polycarbonates, which is expected to escalate the demand for phosgene from polycarbonate manufacturers during the forecast period.

Key benefits for stakeholders

- Porter’s five forces analysis helps analyze the potential of buyers & suppliers and the competitive scenario of the industry for strategy building.

- It outlines the current market trends and future estimations of global phosgene market from 2021 to 2031 to understand the prevailing opportunities and potential investment pockets.

- The major countries in the region have been mapped according to their individual revenue contribution to the regional market.

- The key drivers, restraints, and opportunities and their detailed impact analysis are explained in the study.

- The profiles of key players and their key strategic developments are enlisted in the report.

IMPACT OF COVID-19 ON THE GLOBAL PHOSGENE MARKET

- The novel coronavirus is an incomparable global pandemic that has spread to over 180 countries and caused huge losses of lives and economy around the globe. According to the International Monetary Fund (IMF), owing to the outbreak of novel coronavirus (COVID-19), the global economy shrunk by 3.0% in 2020. Many countries are under strict lockdowns, which have forced several sectors to shut down their operations. This has halted manufacturing activities and reduced the demand and production of phosgene.

- Phosgene is widely used in production of agrochemicals. The crop protection sector is in huge demand in recent years, with its increasing importance on the yield growth of food grains. The components that are used in the production of agrochemicals are sometimes chemicals and sometimes biological species, which ultimately help in controlling the pests from damaging the crops or help improve soil fertility. This results in healthy crop production with no health issues. With these concerns, farmers have started usage of various agrochemicals to prevent damage and hence, increase productivity.

- Due to emergence of the COVID-19 pandemic, there has been a supply chain disruption, because of which the agricultural sector had to face problems such as labor unavailability, pharmaceuticals barriers, restriction for market access, and lack of inventories in some regions. Many fertilizer and pesticide manufacturers were facing issues due to lack of raw material availability, which has led to reduction in manufacturing of various agrochemical products. Thus, the demand for phosgene from agrochemical manufacturers across the globe has declined significantly, thereby reducing the growth of the market during the forecast period.

- Phosgene is widely used as an intermediate compound in manufacturing of polycarbonates. The outbreak of the COVID-19 pandemic has restricted the operating activities of several industries, including the end-user industries of the market studied.

- Construction activities across the globe have been slowed down, due to shortage of labor, and in some cases, activities have been suspended owing to lockdown regulations. The disruption of the global supply chain, due to the lockdown, has been a key factor behind the decline in construction activities and in turn, downfall in demand for the polycarbonate. Due to decline in use of polycarbonate, the demand for phosgene from polycarbonate manufacturers has also been significantly reduced, thereby affecting the growth of the phosgene market negatively.

Phosgene Market Report Highlights

| Aspects | Details |

| By Region |

|

| By Derivative |

|

| By Application |

|

| Key Market Players | Synthesia A.S., Vertellus, Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC Ltd), Shandong Tianan Chemicals Co. Ltd., Paushak Ltd., Atul Ltd., Dow, UPL Limited, Hodogaya Chemical Co. Ltd., VanDemark Chemical Inc., Covestro A.G., BASF SE, Altivia |

Analyst Review

According to CXOs of leading companies, the global phosgene market is anticipated to witness growth during the forecast period, owing to increase in the use of the chemical in pharmaceutical, agrochemical, polycarbonates and chemical industries, which acts as one of the major factors driving the growth of phosgene market. The increased usage of the product in the production of diethyl carbomoyl chloride, which is further utilized to hydrolyze water insoluble compound that acts an intermediate for the production of pharmaceuticals, pesticides and dyes, accelerates the growth of the phosgene market. Rise in utilization for platinum, plutonium, uranium and niobium metal extraction and its wide use in chemical such as beryllium chloride, aluminum chloride and boron trichloride further influence the growth of the phosgene market. In addition, growth of pharmaceutical sector, increase in R&D activities, rise in need for enhanced treatments, and surge in investments positively affect the phosgene market growth.

However, high toxicity of phosgene is expected to hamper the growth of the phosgene market during the forecast period. Furthermore, increase in consumption of phosgene in pesticides and insecticides is expected to provide growth opportunities for the phosgene market during the forecast period.

Escalating demand from chemical industry and growing demand for bedding & furniture sectors are the key factors boosting the phosgene market growth.

The global phosgene market was valued at $39.2 billion in 2021, and is projected to reach $65.3 billion by 2031, growing at a CAGR of 5.3% from 2022 to 2031.

BASF SE, Dow, Covestro A.G., VanDemark Chemical Inc., Vertellus, Synthesia A.S., Atul Ltd., Paushak Ltd., Hodogaya Chemical Co. Ltd., and Gujarat Narmada Valley Fertilizers & Chemicals Limited (GNFC Ltd). are the most established players of the global phosgene market

Polycarbonates and agrochemicals industry is projected to increase the demand for phosgene market.

The global phosgene market size is segmented on the basis of derivative, application, and region. By derivative, it is analyzed across isocyanates, chloroformates, and carbamoyl chlorides. By application, it is segmented into agrochemicals, pharmaceuticals, polycarbonates, dyes, fine chemicals, and others. Region-wise, it is studied across North America, Europe, Asia-Pacific, and LAMEA.

Demand for phosgene is expected to be driven by its utilization in pharmaceutical, agrochemical, polycarbonates, and chemical industries. It is widely used to manufacture diethylcarbomoyl chloride which is used to hydrolyze water insoluble compound and is extensively used as an intermediate for the production of pesticides, pharmaceuticals, and dyes.

According to the International Monetary Fund (IMF), owing to the outbreak of novel coronavirus (COVID-19), the global economy shrunk by 3.0% in 2020. Many countries are under strict lockdowns, which have forced several sectors to shut down their operations. This has halted manufacturing activities and reduced the demand and production of phosgene.

Loading Table Of Content...