Plastic Water Storage Systems Market Research, 2033

The global plastic water storage systems market size was valued at $1.7 billion in 2023, and is projected to reach $2.7 billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

Market Introduction and Definition

Plastic water storage systems are containers made from durable plastics such as polyethylene, polypropylene, or polyvinyl chloride (PVC) designed for storing water. These systems come in various shapes and sizes, ranging from small tanks for household use to large industrial-grade reservoirs. Their construction typically involves UV-resistant materials to prevent degradation from sunlight exposure and ensure longevity. The uses of plastic water storage systems are diverse. They are commonly used in residential settings for storing potable water, providing a reliable backup during water shortages or supply interruptions. In agriculture, they store irrigation water, ensuring crops receive adequate hydration even during dry periods. Industrial applications include storing water for manufacturing processes, firefighting, and cooling systems. In addition, these systems are utilized in rainwater harvesting, allowing for the collection and storage of rainwater for later use, which promotes water conservation. Their lightweight nature, ease of installation, and resistance to corrosion make plastic water storage systems a practical and versatile solution for water storage needs across various sectors.

Key Findings

- Over 1, 500 product literatures, industry releases, annual reports, and various documents from major plastic water storage systems market participants, along with credible industry journals, trade association releases, and government websites, have been reviewed to generate valuable industry insights.

- The plastic water storage systems market study covers 20 countries. The research includes a segment analysis of each country in terms of value for the projected period.

- The study integrated high-quality data, expert opinions and analysis, and crucial independent perspectives. This research approach aims to provide a balanced view of global markets and plastic water storage systems market overview, assisting stakeholders in making informed decisions to achieve their most ambitious growth objectives.

- Plastic water storage systems market news and key industry trends are also included in the report.

Market Dynamics?

The plastic water storage systems market growth is driven by the surge in demand for reliable and cost-effective water storage solutions, especially in regions with irregular water supply where consistent access to water is a challenge. As urbanization continues to accelerate, the need for efficient water management in densely populated areas becomes more critical, further increasing the demand for these systems. In addition, the rise in construction activities, both residential and commercial, necessitates dependable water storage solutions to support ongoing projects and ensure a steady water supply. These factors collectively contribute to the expanding market for plastic water storage systems.

However, restraints include environmental concerns related to plastic use and the availability of alternative materials like concrete and metal. Plastic water storage systems market opportunities are driven by advancements in plastic technology, which have led to more durable, safe, and cost-effective storage solutions. Increasing awareness about water conservation has boosted demand for efficient storage systems, particularly in regions facing water scarcity. In addition, the development of eco-friendly and recyclable plastic storage solutions addresses growing environmental concerns, appealing to environmentally conscious consumers and businesses. These trends collectively create a favorable market environment for innovative and sustainable water storage products, opening new avenues for growth and investment.

Market Segmentation?

The plastic water storage systems market is segmented on the basis of application, end use, and region. By application, the market is classified into rainwater harvesting, stormwater management, fire suppression reserve & storage, and others. By end-use, the market is classified into residential, commercial, industrial, and municipal. Region-wise, the plastic water storage systems market share is studied across areas such as North America, Europe, Asia-Pacific, and LAMEA.?

Regional/Country Market Outlook

The plastic water storage systems market in Asia-Pacific is experiencing rapid growth due to urbanization, industrial expansion, and increasing awareness of water conservation. Countries such as India, China, and Japan are major contributors to market demand, driven by residential, agricultural, and industrial needs. In India, regulations focus on promoting sustainable water storage practices and using materials that are safe for potable water. The Bureau of Indian Standards (BIS) sets the quality standards for plastic water tanks. In China, regulations emphasize stringent water management and environmental protection, with guidelines to minimize plastic pollution and enhance the durability of storage systems. Japan has advanced regulations ensuring the safety and quality of water storage systems, focusing on technological innovation and environmental sustainability. These regulations collectively aim to enhance water security and reduce environmental impact.

Competitive Landscape

Key players in the plastic water storage systems industry include Sintex Industries Ltd., Supreme Industries Ltd., National Plastics, Ashirvad Pipes, Vectus Industries Limited, Penguin Tank, Niplast Storage Tanks, Emiliana Serbatoi, Caldwell Tanks, and Plasto Group of Companies.

Key Developments

- In March 2024, Sintex, a division of Welspun World and a leading innovator in water storage tanks in India, announced the groundbreaking of its new manufacturing unit in Madhya Pradesh. This facility will focus on producing plastic pipes and water storage tanks, with an estimated investment of approximately $47 million.

- In December 2023, Welspun Corp Limited announced that its wholly owned subsidiary, Sintex BAPL, will invest approximately $98 million to establish a new manufacturing unit in Telangana. This facility, to be built over the next three financial years, will produce around 59 KMTPA of plastic pipes, 5, 300 MTPA of water storage tanks, and 8, 900 MTPA of sandwich moulded tanks. The investment will be funded through a mix of debt and equity, aiming to strengthen Sintex's position in the plastic pipes and water storage market.

Water Consumption Facts

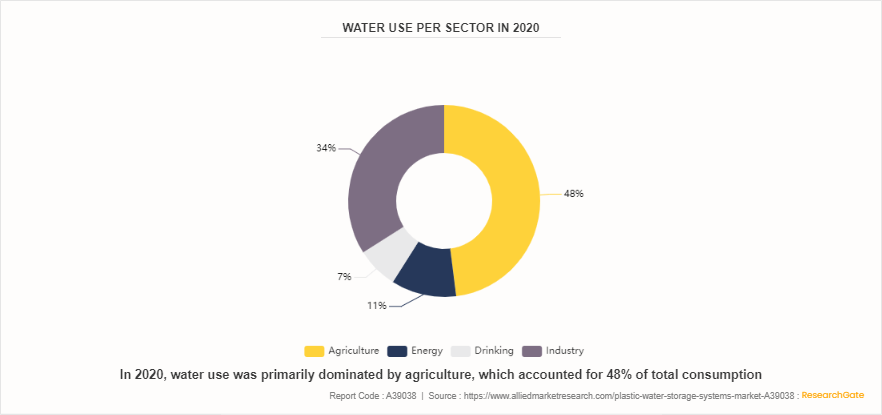

In 2020, water use was distributed across various sectors with agriculture accounting for the largest share at 48%. This significant usage is attributed to the water-intensive nature of crop irrigation and livestock farming. The industry sector was the next largest consumer, using 34% of the total water, reflecting the high-water demand for manufacturing processes and industrial cooling. Energy production accounted for 11% of water use, driven by the need for cooling in power plants and other energy generation processes. Drinking water comprised 7% of total use, highlighting the smaller but essential need for potable water for human consumption. This distribution underscores the critical role of water management in supporting diverse economic activities and ensuring sustainable water use across different sectors.

Public Policies

Regulations for plastic water storage systems ensure safety, health, and environmental protection. They mandate that plastic materials used must meet safety standards for potable water, such as food-grade polyethylene (PE) and polyvinyl chloride (PVC) , free from harmful substances. Regulations require testing and certification to prevent toxic leaching into the water. Design guidelines include secure closures and proper sealing to prevent contamination. Regular maintenance and cleaning are mandated to maintain water quality. In addition, environmental regulations promote recycling and proper disposal of plastic materials to minimize ecological impact.

In the U.S., plastic water storage systems must comply with FDA regulations ensuring materials like polyethylene and PVC are safe for potable water, with the Safe Drinking Water Act overseeing water quality and material safety. In China, water storage plastics are regulated under National Standards (GB Standards) to ensure they are free from harmful substances, with the Ministry of Ecology and Environment enforcing guidelines to prevent contamination and promote proper maintenance and disposal. In India, the Bureau of Indian Standards (BIS) sets quality standards for materials used in water storage, and the Water (Prevention and Control of Pollution) Act, along with guidelines from the Central Pollution Control Board (CPCB) , ensures the safety and cleanliness of water, while the Ministry of Environment, Forest and Climate Change oversees environmental impact and recycling practices.

Key Sources Referred

- Bureau of Indian Standards (BIS)

- Japan Water Works Association (JWWA)

- Plastics Industry Association (PLASTICS)

- European Plastics Converters (EuPC)

- Association of Rotational Molders (ARM)

- American Society for Testing and Materials (ASTM)

- International Association of Plumbing and Mechanical Officials (IAPMO)

Key Benefits for Stakeholders

- This Plastic water storage systems market report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the Plastic water storage systems market analysis to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the Plastic water storage systems market forecast assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional and global Plastic water storage systems market trends, market statistics, key players, market segments, application areas, and market growth strategies.

Plastic Water Storage Systems Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 2.7 Billion |

| Growth Rate | CAGR of 4.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 280 |

| By Application |

|

| By End Use |

|

| By Region |

|

| Key Market Players | Caldwell Tanks, Supreme Industries Ltd., National Plastics, Sintex Industries Ltd., Vectus Industries Limited, Niplast Storage Tanks, Penguin Tank, Ashirvad Pipes, Plasto Group of Companies., Emiliana Serbatoi |

Key players in the plastic water storage systems industry include Sintex Industries Ltd., Supreme Industries Ltd., National Plastics, Ashirvad Pipes, Vectus Industries Limited, Penguin Tank, Niplast Storage Tanks, Emiliana Serbatoi, Caldwell Tanks, and Plasto Group of Companies.

The plastic water storage systems market was valued at $1.7 billion in 2023, and is estimated to reach $2.7 billion by 2033, growing at a CAGR of 4.6% from 2024 to 2033.

The plastic water storage systems market growth is driven by rapid urbanization and industrialization, which increases the need for reliable water storage. Government initiatives promoting water conservation and sustainable management further support market growth.

Rainwater harvesting is the leading application of Plastic Water Storage Systems Market.

Asia-Pacific is the largest regional market for Plastic Water Storage Systems.

Loading Table Of Content...