Polyimide Coating Market Overview:

The global polyimide coating market size was valued at $1.2 billion in 2021, and is projected to reach $2.2 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031.

As a specialized engineering material, polyimide has found widespread application in aviation, aerospace, microelectronics, nanoscale, liquid crystal, separation membrane, laser, and other industries. Polyimide material is distinguished by its strong temperature resistance, mechanical and chemical stability, high glass transition temperature, optical transparency, and low dielectric constant. All of polyimide's attributes can vary based on its chemical structure and macromolecular circumstances, such as molecular weight (MW), crystallinity, and intermolecular forces. Polyimide is excellent for coating applications because it adheres to several substrates, including metals, polymers, carbon, and silica-based materials.

How to Describe Polyimide Coating

Polyimide is a class of high-performance polymers with good dielectric properties and high thermal stability at both high and low temperatures. The increase in use of polyimide coatings in end-use sectors such as electronics is anticipated to propel market expansion.

Compact electronic gadgets, such as pocket computers, watches, circuit boards, and digital cameras, utilize polyimide coatings. In the electronics industry, polyimide coatings are in high demand due to their thermal stability, outstanding mechanical and electrical capabilities, and chemical resistance. In a laptop, for instance, the cable that links the main logic board to the display (which must bend each time the laptop is opened and closed) often consists of a polyimide base and a copper conductor. In this business, the demand for polyimide coatings is mostly attributable to their high-temperature qualities, low dielectric constants, resistance to solvents, and long-term stability.

How are Market Dynamics Shaping Industry Competition

Polyimide coatings are widely employed in the electrical industry due to their physical and mechanical qualities. Copper-based electrical circuits are printed on these resins because it has a great degree of flexibility. Polyimide coatings are employed as insulators in electric and magnetic wires, as well as in the fabrication of flexible wires that connect internal circuits in complex systems. Polyimide coatings are utilized in the fabrication of integrated circuits (IC) and micro-electromechanical systems as an insulating layer (micro-coating) (MEMS).

The advancements in the aerospace industry, as well as the increase in affordability of space expeditions and satellite launches, are likely to drive the demand for polyamide coatings. Polyimide coatings are also utilized in medical tubes, such as vascular catheters, since they provide flexibility and appropriate burst pressure resistance, as well as chemical resistance. Polyimide coatings are used to construct solar sails in solar sailing spacecraft. Rise in demand for electric mobility vehicles such as buses and cars, contributes toward the expansion of the polyimide coatings market. In addition, increase in demand for robots and automation is another factor driving the growth of the polyimide coatings market.

As a micro electric coating, polyimide coatings improve mechanical strength and thermal stability. Polyimide is an ideal polymer for use in electronic applications due to its exceptional dielectric properties, which include strong electrical insulation, high ductility, and a low thermal expansion coefficient. The expanding use of micro electric coating in the electric industry is anticipated to contribute toward market expansion. Aerospace industry can benefit from polyimide powder coatings with great performance. This is due to the fact that polyimide-coated items typically possess exceptional thermal characteristics.

The polyimide coating is also applied to optical fibers because it renders them resistant to high temperatures. The rise in use of optical fiber cables in the aircraft industry's fly-by-wire technology is anticipated to contribute to market expansion. The growing aerospace industry as a result of the increase in passenger traffic is predicted to have a substantial impact on the growth of the global market. All these factors boost drive the polyimide coatings market and expected to show lucrative growth over the forecast period.

However, the fluctuations in the price of crude oil affect the cost of producing polyimide, which is derived from petroleum products. High cost of production for polyimide coatings hinders the market growth. Rise in demand for coatings made of transparent polyimide and increase in demand in developing economies are predicted to create substantial potential opportunities for the market during the forecast period. The application of polyimide coatings to the surfaces of the components that are used in automobiles and electrical items of machinery is done to get the desired results. The polyimide coatings market is projected to experience growth owing to rise in developing economies and living standards people residing in China, India, and Brazil.

Polyimide Coating Market Segment Review

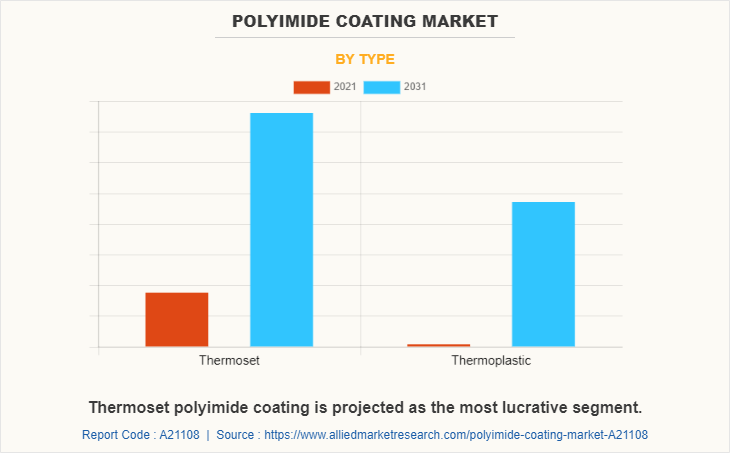

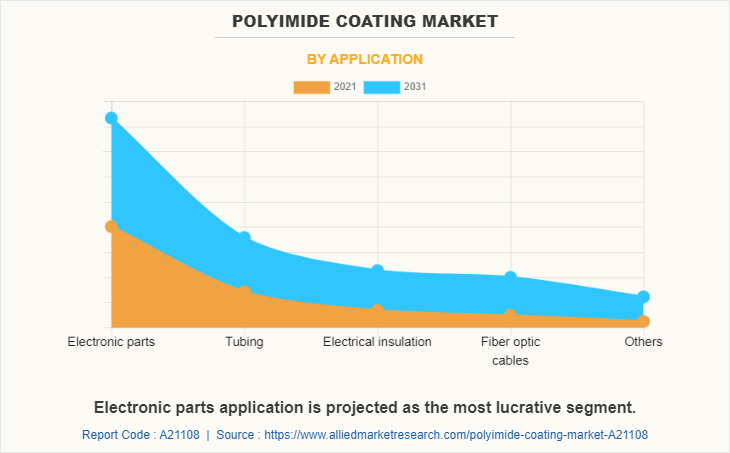

The polyimide coatings market is segmented into type, application and region. On the basis of type, the market is segmented into thermoset and thermoplastic. On the basis of application, it is categorized into electronic parts, tubing, electrical insulation, fiber optic cables and others. Region wise, the market is studied across North America, Europe, Asia-Pacific, and LAMEA.

The thermoset segment accounted for the largest share i.e., 57.14%, As a result of the expanding aerospace and defense industry. Thermoplastic segment is the fastest growing segment, due to rise in need for high-performance engineering materials.

The electronic parts segment accounted for the largest share i.e., 42.52%, owing to their high-temperature properties, low dielectric constants, resistance to solvents, and long-lasting nature. Fiber optic cables segment is the fastest growing segment, owing to increased demand in the telecommunications sector and data centers.

Asia-Pacific contributed 50.49% market share in 2021 and is projected to grow at CAGR of 7.0% during the forecast period owing to the increased demand from medical, aerospace and electronics. Asia-Pacific occupied major Polyimide coatings market share.

Which are the Leading Companies in Polyimide Coating

The major players operating in the global polyimide coatings industry are DuPont, ELANTAS Beck India Ltd, FLEXcon company, Inc., I.S.T Corporation. KANIKA CORPORATION, Mitsui chemicals, Inc, Saint-Gobain, SOLVER POLYIMIDE, Toray Industries, Inc, UBE Corporation. Other players operating in the polyimide coatings industry are TAIMIDE and SKCKOLONPI.

What are the Key Benefits For Stakeholders

- The report provides in-depth polyimide coating market analysis along with the current trends and future estimations.

- This report highlights the key drivers, opportunities, and restraints of the market along with the impact analysis during the forecast period.

- Porter’s five forces analysis helps to analyze the potential of the buyers & suppliers and the competitive scenario of the global Polyimide coatings market for strategy building.

- A comprehensive market analysis covers the factors that drive and restrain the global Polyimide coatings market growth.

- The qualitative data about polyimide coatings market trends, dynamics, and developments is provided in the report.

Polyimide Coating Market Report Highlights

| Aspects | Details |

| Market Size By 2031 | USD 2.2 billion |

| Growth Rate | CAGR of 6.7% |

| Forecast period | 2021 - 2031 |

| Report Pages | 241 |

| By Type |

|

| By Application |

|

| By Region |

|

| Key Market Players | ELANTAS Beck India Ltd, I.S.T Corporation, UBE Corporation, DuPont de Nemours, Inc., FLEXcon Company, Inc., Toray Industries, Inc., MITSUI CHEMICALS, INC., SOLVER POLYIMIDE, Saint-Gobain, KANEKA CORPORATION |

Analyst Review

According to the perspective of the CXOs of leading companies, the market for polyimide coatings is predicted to expand during the forecast period due to factors such as strong demand from the electronics sector and expanding applications in the automotive industry. In addition, the product's excellent mechanical and thermal qualities compared to other polymers contribute towards the expansion of the polyimide coatings market. However, the high cost of the film is a significant market limitation for polyimide coatings.

The polyimide coatings market size valued $1.2 billion in 2021, and is projected to reach $2.2 billion by 2031, growing at a CAGR of 6.7% from 2022 to 2031.

In the polyimide coatings market type, application, and region segments are covered.

Rise in demand for electric mobility vehicles such as buses and cars, contributes toward the expansion of the polyimide coatings market. In addition, increase in demand for robots and automation is another factor driving the growth of the polyimide coatings market.

The major players operating in the global polyimide coatings industry are DuPont, ELANTAS Beck India Ltd, FLEXcon company, Inc., I.S.T Corporation. KANIKA CORPORATION, Mitsui chemicals, Inc, Saint-Gobain, SOLVER POLYIMIDE, Toray Industries, Inc, UBE Corporation.

Due to lockdown and other restrictions imposed by governments to prevent the spread of infections, there was a shortage of raw supplies as well as manpower, further harming the supply chain for the market. Nevertheless, the polyimide coatings business is anticipated to recover fast in the aftermath of COVID-19 due to its greater reliance on the electronics industry. In addition, sales of electronic devices such as wires and cables, televisions, and laptops have surged where polyimide coatings are extensively employed for insulating purposes. It is anticipated that this will improve the performance of the polyimide coatings market after COVID-19.

Loading Table Of Content...