Power Amplifier Market Research, 2032

The Global Power Amplifier Market was valued at $10.2 billion in 2022 and is projected to reach $28 billion by 2032, growing at a CAGR of 10.7% from 2023 to 2032.

The increasing demand for wireless connectivity, 5G deployment, IoT expansion, consumer electronics innovation, technological advancements, and expanding network infrastructure investments is boosting the market growth at a healthy rate during the forecast period.

A power amplifier is an electronic apparatus utilized to boost the power level of a signal. It takes a low-energy input signal and enhances it to generate a higher-power output signal suitable for driving speakers, antennas, or similar loads. Power amplifiers are indispensable components within audio systems, radio transmitters, and various electronic gadgets requiring signal amplification. Their operation entails the utilization of active elements like transistors or vacuum tubes to modulate the power supply voltage or current in response to the input signal, thereby yielding an amplified output signal. Power amplifiers are distinguished by their power gain, bandwidth, efficiency, linearity, and distortion properties.

Key Takeaways of the Power Amplifier Market Report

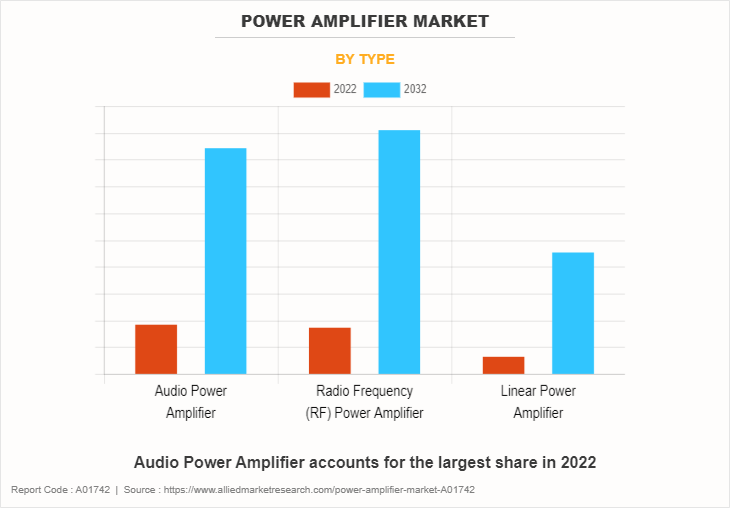

- By type, the audio power amplifier segment held the largest share of the power amplifier market in 2022. However, the radio frequency RF Power Amplifier segment is anticipated to grow at the fastest CAGR during the forecast period.

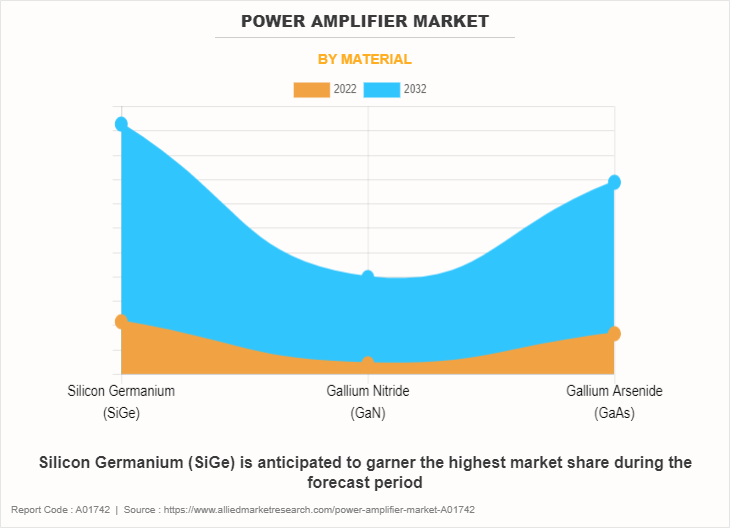

- By material, the silicon germanium segment dominated the power amplifier market size in terms of revenue in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

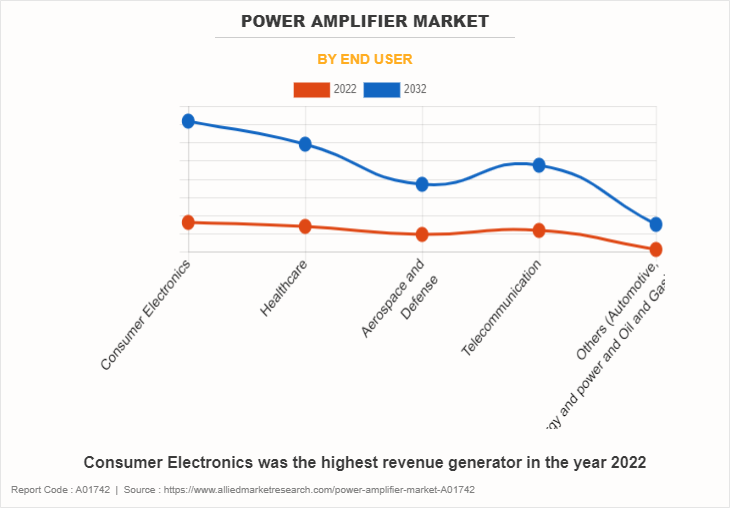

- By end user, the consumer electronics segment held the largest share in the power amplifier industry in 2022 and is anticipated to grow at the fastest CAGR during the forecast period.

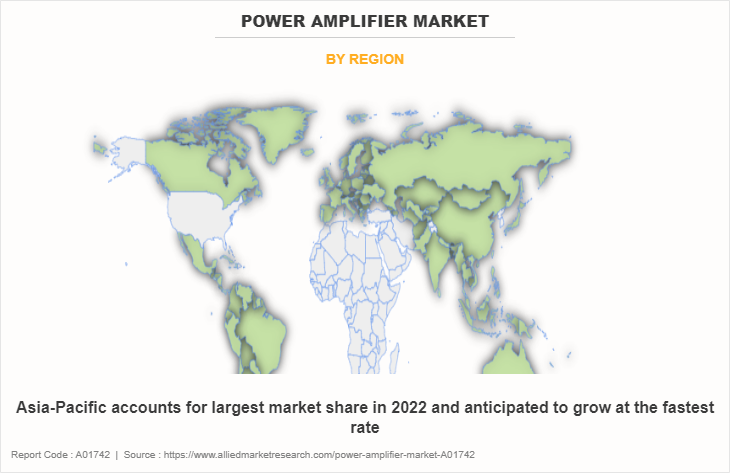

- Region-wise, Asia-Pacific held the largest market share in 2022 and is expected to witness the highest CAGR during the forecast period.

Segment Overview

The global power amplifier market is analyzed by type, material, end-user, and region.

By Product Type

Based on type, the power amplifier market is segmented into audio power amplifiers, radio frequency RF power amplifiers, and linear power amplifiers. In 2022, the audio power amplifiers segment held the largest share of the market due to its integral components nature in a wide range of consumer electronics devices such as smartphones, tablets, laptops, home theaters, and audio systems.

By Material

On the basis of material, the market is classified into silicon germanium (SiGe), gallium nitride (GaN), and gallium arsenide (GaAs). In 2022, the Silicon Germanium (SiGe) segment dominated the power amplifier market size in terms of revenue due to its superior performance in high-frequency applications, lower production costs, and widespread adoption in telecommunications and wireless communication systems.

By End User

On the basis of end users, the market is fragmented into consumer electronics, automotive, military & defense, telecommunication, and others. In 2022, the consumer electronics segment held the largest share in the power amplifier industry due to the widespread integration of amplification components in devices such as smartphones, audio systems, televisions, and gaming consoles, driving significant market demand.

By Region

Based on region, the power amplifier market size by country is analyzed across North America (U.S., Canada, and Mexico), Europe (UK, Germany, France, and rest of Europe), Asia-Pacific (China, Japan, India, South Korea, and rest of Asia-Pacific), Latin America (Brazil, Argentina, rest of Latin America ), and Middle East & Africa (Saudi Arabia, South Africa, rest of MEA). In 2022, Asia-Pacific held the largest market share in the Pa amplifier industry due to its robust electronics manufacturing ecosystem, increasing consumer demand for electronic devices, and growing investments in telecommunications infrastructure across the region.

Competitive Analysis

The power amplifier market analysis report highlights the highly competitive nature of the market, owing to the strong presence of existing vendors. Vendors with extensive technical and financial resources are expected to gain a competitive advantage over their counterparts by effectively addressing market demands. Competitive analysis and profiles of the major power amplifier companies, such as Texas Instruments Inc, Infineon Technologies AG, NXP Semiconductors N.V., Analog Devices, Inc., STMicroelectronics N.V., Toshiba Corporation, Maxim Integrated Products, Inc., Skyworks Solutions, Inc., Broadcom Inc., and Qualcomm Incorporated, are provided in this report. Business strategies such as product launches, acquisitions, and partnerships were adopted by the major market players in 2022.

Market Dynamics

Surge in demand for wireless communication

The increasing demand for wireless communication is a key driver propelling the growth of the power amplifier market statistics. With the widespread adoption of smartphones, IoT devices, and 5G infrastructure, there is a growing need for high-power amplifier companies to support efficient signal transmission and reception in wireless networks. Power amplifiers are essential components in wireless communication systems, where they are used to boost the power of radio frequency signals before transmission, ensuring reliable connectivity and extended coverage. In addition, the deployment of advanced wireless technologies, such as beamforming and massive MIMO, further amplifies the demand for power amplifiers, capable of delivering higher output power, improved efficiency, and enhanced spectral efficiency. As the demand for faster and more reliable wireless communication continues to rise, power amplifier growth projections

High production cost

The adoption of cutting-edge materials and fabrication processes in the power amplifier market share by the company can lead to increased production costs in the power amplifier industry. Advanced materials such as gallium nitride (GaN) and silicon carbide (SiC) offer superior performance characteristics, including higher power densities and greater efficiency. However, these materials often require specialized equipment and processes for fabrication, driving up manufacturing expenses. In addition, the R&D investment required to optimize these materials for power amplifier applications contributes to higher upfront costs. As a result, manufacturers may face challenges in balancing the benefits of improved performance with the need to maintain competitive pricing. Rising production costs can ultimately impact pricing strategies, market competitiveness, and the accessibility of advanced power amplifier technologies to a broader range of consumers and industries.

Emerging applications like electric vehicles, renewable energy systems, and 5G infrastructure drive demand for power amplifiers.

The emergence of new applications such as electric vehicles (EVs), renewable energy systems, and 5G infrastructure, presents a significant opportunity for the power amplifier market. In electric vehicles, power amplifiers are utilized in various systems, including motor drives, battery management, and onboard charging, driving demand for high-efficiency and compact amplifiers. Renewable energy systems, such as solar and wind power, rely on power amplifiers for efficient energy conversion and distribution, creating opportunities for innovative amplifier solutions. Moreover, the deployment of 5G networks requires advanced power amplifiers to support higher data rates, increased capacity, and improved coverage. As these industries continue to grow and evolve, there is a growing need for power amplifiers tailored to their specific requirements, including higher efficiency, compact form factors, and enhanced reliability. Thus, the power amplifier market is expected to benefit from the expansion of these new and emerging applications.

Report Coverage & Deliverables

This report delivers in-depth insights into the power amplifier market covering type, material, end user and key strategies employed by major players. It offers detailed market forecasts and emerging trends.

Type Insights

Audio Power Amplifiers dominate consumer electronics, enhancing sound quality in devices like speakers and headphones. Radio Frequency (RF) Power Amplifiers are critical in telecommunications and wireless networks, including 5G. Linear Power Amplifiers are used in applications requiring precise signal amplification, such as medical and scientific instrumentation.

Material Insights

Gallium Nitride (GaN) is favored for its high efficiency and thermal performance, ideal for 5G applications. Gallium Arsenide (GaAs) offers excellent signal integrity, making it suitable for RF and satellite communications. Silicon Germanium (SiGe) combines performance with cost-effectiveness and is commonly used in consumer electronics and telecommunications.

End User Insights

The power amplifier market serves various end users, with consumer electronics leading due to high demand for audio and video equipment. Healthcare relies on amplifiers for medical imaging and monitoring devices. The aerospace and defense sector requires robust amplification for communication and radar systems. Telecommunications drive growth through expanding networks, while others include industries like automotive and industrial applications, enhancing overall market diversity.

Regional Insights

The power amplifier market shows strong regional insights, with Asia-Pacific leading due to rapid technological advancements and high consumer electronics demand. North America follows, driven by 5G infrastructure growth and strong defense sectors. Europe is also significant, focusing on telecommunications and automotive innovations, while emerging markets in Latin America and Africa present new opportunities.

Recent Developments in the Power Amplifier Market

August 2023 - Apex Microtechnology announced the release of PA198, the latest member of their family of precision power operational amplifiers. The PA198 is a precision power amplifier with voltage supply rails capable of up to 215 V with a dual supply (+440 V with a single supply) and output currents up to 200 mA. The PA198 has a remarkable power bandwidth of up to 2 MHz and a slew rate of up to 2000 V/s.

- May 2023 - Filtronic announced the product launch of a new E-band power amplifier and active diplexer. The Hades X2 active diplexer is a next-generation device with improved performance, a typical PSAT of 30 dBm, and two powerful amplifiers. This device also includes two GaAs MMICs that are performance-matched and power-combined in a waveguide, to give the most power and linearity. Taurus, a high-power E-band amplifier with market-leading linear mmWave power and unmatched performance for long-range E-band communications, will also be introduced by the business.

Key Benefits for Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the power amplifier market from 2022 to 2032 to identify the prevailing market opportunities.

- Market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders to make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the power amplifier market segmentation assists in determining the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market insights.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global power amplifier market trends, key players, market segments, application areas, and market growth strategies.

Power Amplifier Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 28 billion |

| Growth Rate | CAGR of 10.7% |

| Forecast period | 2022 - 2032 |

| Report Pages | 250 |

| By Type |

|

| By Material |

|

| By End User |

|

| By Region |

|

| Key Market Players | Broadcom Inc., NXP Semiconductors N.V., Texas Instruments Inc., Infineon Technologies AG, Renesas Electronics Corporation., Toshiba Corporation, Qualcomm Incorporated., Skyworks Solutions, Inc., Analog Devices, Inc, STMicroelectronics N.V. |

Analyst Review

The global power amplifier market holds high potential for the electronics and telecommunications sectors. The business scenario witnesses increase in demand for power amplifier devices, particularly in developing regions, such as China, Japan, South Korea, U.S., UK, and others. Companies in this industry are adopting various innovative techniques to provide customers with advanced and innovative product offerings.?

Increase in adaptation of LTE technology drives the growth of the market. However, high production cost for GaAs wafers impedes this growth. Furthermore, ongoing rollout of 5G networks worldwide is expected to create lucrative opportunities for the key players operating in the market.

The market participants are expected to introduce technologically advanced products to remain competitive in the market. Product launch and collaboration are the prominent strategies adopted by market players. For instance, a series of five GaN amplifiers of power (PAs) for mmWave 5G and communications via satellite (Satcom) frequencies between 22 and 41 mmTron, Inc disclosed GHz. All five family members were created to maximize uniformity for high data rate communications waveforms, and they come in various frequency coverage and output power choices.

Increasing adoption of gallium nitride (GaN) and silicon carbide (SiC) technologies for higher efficiency, are the upcoming trends of Power Amplifier Market in the world.

Audio Power Amplifier is the leading application of Power Amplifier Market

Asia-Pacific is the largest regional market for Power Amplifier

28035.02 Million is the estimated industry size of Power Amplifier

Texas Instruments Inc, Infineon Technologies AG, NXP Semiconductors N.V., Analog Devices, Inc, STMicroelectronics N.V., Toshiba Corporation, Maxim Integrated Products, Inc., Skyworks Solutions, Inc., Broadcom Inc., and Qualcomm Incorporated.

Loading Table Of Content...

Loading Research Methodology...