Private Student Loans Market Research, 2032

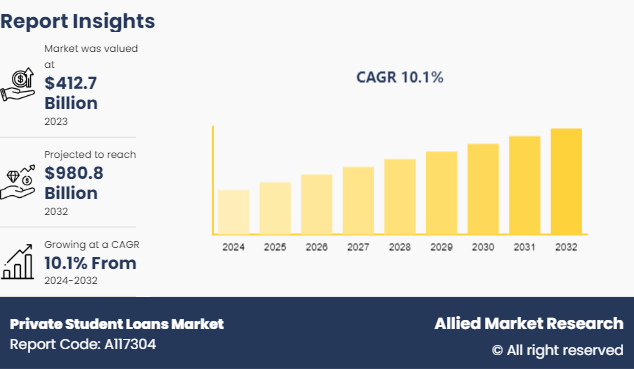

The global private student loans market size was valued at $412.7 billion in 2023, and is projected to reach $980.8 billion by 2032, growing at a CAGR of 10.1% from 2024 to 2032. Private student loans, like federal student loans, can be used to pay for education, but they are obtained from a bank, credit union, or an internet lender rather than the federal government. After exceeding out federal loans, private student loans are the greatest way to bridge the college payment gap. Private loans often have higher interest rates than federal loans.

Market Introduction and Definition

The higher customer's credit score and co-signer's income, the more likely they are to get approved for a low interest rate. Moreover, most private lenders offer two options for interest rates: fixed and variable. A fixed rate stays the same throughout the life of the loan. A variable rate changes periodically. Private student loans do not offer forgiveness programs like federal loans, but some lenders may have hardship assistance programs in place.

Key Takeaways

The private student loans market study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Billion) for the projected period 2024-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major private student loans industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global private student loans market and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key market dynamics

The global private student loans market growth is driving due to several factors such as flexibility in loan amounts and terms, rise in cost of education and increase in initiatives in financial technologies. However, higher interest rate and data security and privacy concerns act as restraints for the private student loans market. In addition, increase in enrollment in higher education will provide ample opportunities for the market's development during the forecast period.

The rising cost of education often exceeds the borrowing limits set by federal student loans, pushing students and families to seek additional funding. Many students, particularly those in graduate and professional programs or attending private institutions, find that federal loans do not cover their total cost of attendance.

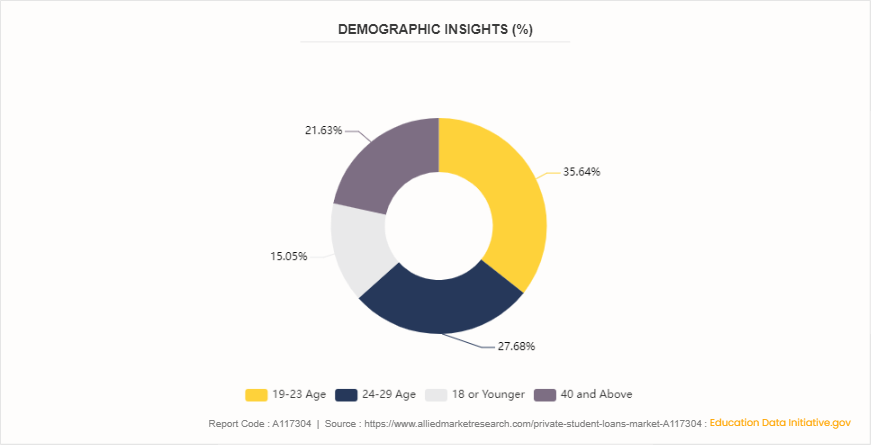

Demographic Insights of Global Private Student Loans Market

The demographic insights of the private student loans market forecast reveal various patterns and trends among borrowers. Traditional students 19 to 23 age group constitutes a significant portion of private loan borrowers. They typically rely on private loans to cover gaps left by federal aid. Moreover, the students between 24 to 29 ages, many in this age bracket pursue advanced degrees, which often come with higher tuition costs, necessitating private loans. Such trends are expected to propel the growth of global private student loans market in these age groups.

FIGURE 1: Demographic Insights (%)

Market Segmentation

The private student loans market share is segmented into type, education level, and region. On the basis of type, the private student loans market is segregated into private only, both federal and private loans and federal only. As per education level, the private student loans market is segregated into undergraduate students, graduate students, professional students and certificate and non-degree programs. Region wise, the market is analyzed across North America, Europe, Asia-Pacific, Latin America and Middle East and Africa.

Regional/Country Market Outlook

The adoption of private student loans market outlook varies across different countries, influenced by factors such as smart educational infrastructure, private student loans industry needs, regulatory frameworks, and investment in research and development. Developed countries like the U.S., Germany, Japan, and South Korea have been at the forefront of private student loan adoption, particularly in professional educational programs. These countries possess advanced financial capabilities, robust research institutions, and a strong focus on innovation, driving widespread adoption of private loan solutions. In emerging economies such as China, India, Brazil, and Russia, there is a growing interest in private student loan fueled by rapid change in education system, and government initiatives to promote digitalization and innovation.

In December 2023, Researchers from Georgia Tech’s School of Computer Science planned to make the technology more efficient and widely accessible. The group, consisting of Associate Professor Yingyan (Celine) Lin, Professor Ling Liu, and Senior Research Scientist Greg Eisenhauer, awarded a $1.198 million grant from the National Science Foundation to accomplish this goal.

In March 2024, Japan's Ministry of Education is expanding the scope of its financial aid provisions for non-Japanese students' university education. The Ministry offers scholarships, loans, and tuition reductions or exemptions through the Japan student services organization.

In June 2023, China’s State Taxation Administration (STA) issued the Guidance on Preferential Tax Policies to Support the Development of Education (hereinafter, “the Guidance”) , which summarized the currently effective tax incentives offered to the education sector in the country.

Industry Trends:

In May 2024, the Biden administration gave borrowers more time to take a key step that will make them eligible for a student-loan forgiveness program. The administration has approved $49.2 billion in cancellation for 996, 000 borrowers under this initiative, known as the income-driven repayment account adjustment program.

In January 2024, Canada is planning to offer universities, colleges low-cost loans to build new student housing. The federal government is modifying an existing program to enable universities, colleges, non-profit organizations, and private developers eligible for low-cost financing to build apartments on and off campus.

In September 2023, the U.S. Department of Education announced more than 4 million student loan borrowers are enrolled in the Biden-Harris Administration's new Saving on A Valuable Education (SAVE) income-driven repayment (IDR) plan, including those who were transitioned from the previous Revised-Pay-As-You-Earn (REPAYE) plan.

Competitive Landscape

The major players operating in the private student loans market include Mpower Financing, Prodigy Finance, Sallie Mae, Citizens Bank, Earnest, College Ave, Ascent Funding, LLC, International Student Loan and Education Loan Finance.

Recent Key Strategies and Developments

In January 2024, Carlyle acquired $415 million private student loan portfolio, and strategic investment into Monogram LLC (“Monogram”) , a leading provider of finance solutions for students and their families. Led by the former management team of Cognition Financial and backed by Carlyle, Monogram will partner with Carlyle to originate, acquire, and manage high-quality third-party private student loan assets.

In November 2023, Card issuer Discover Financial Services is considering selling its $10.4 billion private student loan portfolio as it pursues “strategic alternatives” for that business unit.

In April 2022, Nelnet Bank launched the newest addition to their product lineup: Nelnet Bank Private Student Loans. Launched to give college students a new, flexible option to fulfill their college funding needs, the loans will help borrowers meet education costs and achieve education goals. In addition, Nelnet Bank leverages Nelnet Velocity, a new advanced loan origination and servicing solution to ensure a quick, seamless process for applicants.

Key Sources Referred

Finaid

Lowa Student Loan

MEFA

OEDB

The Institute for College Access & Success

Key Benefits For Stakeholders

This report provides a quantitative analysis of the segments, current trends, estimations, and dynamics of the private student loans market analysis from 2023 to 2032 to identify the prevailing private student loans market opportunity.

The private student loans market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the private student loans market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global private student loans market statistics.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the private student loans market players.

The report includes the analysis of the regional as well as global private student loans market trends, key players, private student loans market segments, application areas, and market growth strategies.

Private Student Loans Market Report Highlights

| Aspects | Details |

| Market Size By 2032 | USD 980.8 Billion |

| Growth Rate | CAGR of 10.1% |

| Forecast period | 2024 - 2032 |

| Report Pages | 210 |

| By Type |

|

| By Education Level |

|

| By Region |

|

| Key Market Players | Earnest, Prodigy Finance, College Ave, International Student Loan, Ascent Funding, Sallie Mae, Education Loan Finance, Citizens Bank, Mpower Financing |

One major trend driving global market growth is the increasing demand for higher education, particularly in developing countries where public funding and scholarships are limited, necessitating private loans.

Both federal and private loan segment is the leading type of Private Student Loans Market in 2023.

North America is the largest regional market for Private Student Loans market in 2023.

$980.8 billion is the estimated industry size of the Private Student Loans Market in 2032.

Mpower Financing, Prodigy Finance, Sallie Mae, Citizens Bank, Earnest, College Ave, Ascent Funding, LLC, International Student Loan and Education Loan Finance are the top companies to hold the market share in Private Student Loans market.

Loading Table Of Content...