Purchase Order Financing Market Research, 2033

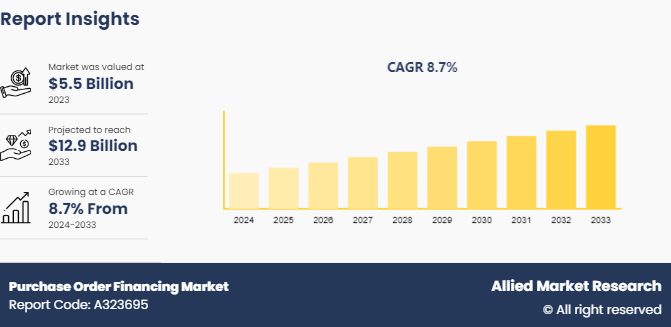

The global purchase order financing market was valued at $5.5 billion in 2023, and is projected to reach $12.9 billion by 2033, growing at a CAGR of 8.7% from 2024 to 2033. The global purchase order financing market is experiencing growth due to several factors such as the necessity for businesses facing cash flow constraints to fulfill large orders, the ability to navigate seasonal demand spikes efficiently, and the opportunity to expand customer bases by leveraging purchase order financing solutions.

Market Introduction and Definition

Purchase order financing is a financial solution utilized when a company lacks the funds to complete a customer's order. Instead of rejecting the order, the company can utilize purchase order financing to settle supplier payments and fulfill the order. Subsequently, the company invoices the customer, who then makes payment directly to the financing provider.

Businesses that receive customer orders through purchase orders can benefit from purchase order financing. This specialized financing option is essential for businesses that need to purchase materials from suppliers to fulfill orders but lack the necessary funds. This scenario commonly occurs in business-to-business models, such as wholesale companies or distributors.

Key Takeaways

The purchase order financing market size study covers 20 countries. The research includes a segment analysis of each country in terms of value ($Million) for the projected period 2023-2032.

More than 1, 500 product literatures, industry releases, annual reports, and other such documents of major purchase order financing industry participants along with authentic industry journals, trade associations' releases, and government websites have been reviewed for generating high-value industry insights.

The study integrated high-quality data, professional opinions and analysis, and critical independent perspectives. The research approach is intended to provide a balanced view of global purchase order financing market opportunity and to assist stakeholders in making educated decisions in order to achieve their most ambitious growth objectives.

Key Market Dynamics

The purchase order financing market growth is influenced by several key drivers including the necessity for businesses facing cash flow constraints to fulfill large orders, the ability to navigate seasonal demand spikes efficiently, and the opportunity to expand customer bases by leveraging purchase order financing solutions. However, the market is hindered by short-term funding availability, typically lasting 30-90 days, and the fact that purchase order financing does not always guarantee 100% financing, often covering only 80-90% of the supplier's invoice amount. On the contrary, there are significant opportunities for businesses, especially small and medium enterprises (SMEs) , to grow and succeed by utilizing purchase order financing. This financing option can enable SMEs to take on larger orders, enter new markets, and manage working capital effectively.

Moreover, purchase order financing presents an opportunity for businesses to enhance their working capital management, secure funding for growth, and maintain healthy customer and supplier relationships. By providing access to immediate capital to fulfill orders, purchase order financing allows businesses to meet high consumer demands, expand product lines, and enter new markets.

Consumer Trends in the Global Purchase Order Financing Market

The latest consumer trends in the purchase order financing industry indicate a growing demand for flexible and accessible financing solutions, particularly among small and medium enterprises (SMEs) facing cash flow challenges. Businesses are increasingly turning to purchase order financing to fulfill large orders, expand their customer base, and navigate seasonal demand spikes efficiently. This trend reflects a shift towards leveraging short-term funding options to optimize working capital, manage inventory effectively, and seize growth opportunities without incurring significant debt. In addition, there is a rising interest in exploring alternative financing options like invoice discounting to meet business funding requirements, highlighting a dynamic landscape where businesses are adapting to changing market conditions and seeking innovative financial solutions to support their operations and growth strategies.

Market Segmentation

The purchase order financing market is segmented into type, interest rate, provider, and region. On the basis of order size, the market is divided into $100, 000 and above $100, 000. On the basis of supplier payment method, the market is differentiated into wire transfer, cash against document, and letter of credit. On the basis of application, the market is categorized into manufacturer, wholesaler, distributor, and import/export company. Region wise, the purchase order financing market share is analyzed across North America, Europe, Asia-Pacific, Latin America, and Middle East & Africa.

Regional/Country Market Outlook

According to Trade Finance Global, for SMEs, navigating the global market is made feasible through the essential support of trade finance. This financial framework, representing about 3% of global trade or roughly $3 trillion annually, offers a variety of instruments such as purchase order finance and letters of credit. These tools are pivotal in helping SMEs manage risks, improve cash flow, grow their operations, and fulfill larger contracts. Such financial support is beneficial for economic development, ensuring the continuity of credit flow within international supply chains.

In the U.S., in February 2023, King Trade Capital announced the completion of a $9 million purchase order finance facility for a private equity-backed athleisurewear company. King Trade Capital was contacted by the bank to investigate PO financing as a solution to help the company scale its business. It quickly assessed the finance need, proposed and underwrote the client company while working along with a large national factoring company brought in by the PE investor.

In August 2022, Star Funding, Inc. a New York City-based provider of purchase order financing and factoring, announced the completion of a $7, 000, 000 purchase order finance and factoring facility to support a fast-growing supplier of hearing products to Walmart. The publicly traded company was invited to increase its exposure and availability in Walmart stores across the country with branded in-store displays. The company needed a pressing capital injection to satisfy several asset-based financing obligations and working capital to support its in-store role.

In April 2021, Jaguar Freight, a leading global freight forwarder, and U.S-based NVOCC., together with King Trade Capital, the largest purchase order finance company in the U.S., announced the addition of a new trade and purchase order finance solution to Jaguar’s portfolio of services. By providing access to purchase orders and trade finance as a part of Jaguar Freight’s suite of services, including its best-in-class logistics technology, customers can extend their business reach and maximize their sales opportunities with fewer limits.

Industry Trends:

In India, supply chain finance has emerged as a game-changer, with products such as Invoice Discounting, Purchase Order Financing, and Demand Financing gaining traction. Collaborations between NBFCs, banks, and platforms have enabled MSMEs to address their working capital gaps more effectively. For instance, in May 2023, Yubi, an online debt marketplace that connects borrowers and lenders for various credit products partnered with Indian Bank to extend digital supply chain financing solutions to small and medium-sized businesses (SMEs) .

In January 2022, EDC (Export Development Canada) and BDC collaborated to support business growth through the EDC-BDC International Purchase Order financing partnership, which provides businesses with vital capital to maximize opportunities in international markets.

Competitive Landscape

The major players operating in the purchase order financing market forecast include OnDeck, Tata Capital Limited, SMB Compass, Star Funding, Inc., Liquid Capital, King Trade Capital, Express Trade Capital, Inc., Trade Finance Global, CAPSTONE, and Kotak Mahindra Bank Limited. Other players in the purchase order financing market outlook include Factor Funding Co., Yubi, Drip Capital Inc. USA, and so on.

Recent Key Strategies and Developments

In April 2024, ToughBuilt Industries, Inc. entered into a strategic alliance with King Trade Capital (KTC) to secure a line of credit that provides substantial support to the company's procurement, direct import, and order fulfillment capabilities.

In September 2022, King Trade Capital (KTC) completed a $5 million purchase order finance facility for a California-based HVAC equipment supplier. King Trade Capital was introduced to the HVAC company by its factoring company, one which KTC has a longstanding relationship.

In July 2022, InnerScope Hearing Technologies Inc., an emerging and disruptive leader in the Direct-to-Consumer Hearing Technology space, announced that its wholly-owned subsidiary HearingAssist received $2, 750, 000 for its Receivable Factoring Agreement with Star Funding Inc. The Factoring Agreement provides InnerScope with needed funding to meet the demand of current, and future orders for its affordable direct-to-consumer hearing aids and other hearing-related products from its wholesale distribution network of major retailers, healthcare service companies, and pharmacy chains.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the purchase order financing market analysis from 2024 to 2033 to identify the prevailing purchase order financing market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the purchase order financing market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global purchase order financing market trends, key players, market segments, application areas, and market growth strategies.

Purchase Order Financing Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 12.9 Billion |

| Growth Rate | CAGR of 8.7% |

| Forecast period | 2024 - 2033 |

| Report Pages | 200 |

| By Order Size |

|

| By Supplier Payment Method |

|

| By Application |

|

| By Region |

|

| Key Market Players | OnDeck, Liquid Capital, Tata Capital Limited, Kotak Mahindra Bank Limited, Trade Finance Global, CAPSTONE, SMB Compass, Express Trade Capital, Inc., King Trade Capital, Star Funding, Inc. |

Rise in technological integration across financial institutions and their product offerings is the major trend in the global purchase order financing market.

The manufacturers segment is expected to contribute a significant share in the global purchase order financing market.

North America is the largest regional market for purchase order financing.

The global purchase order financing market is expected to reach $12.9 billion by 2033.

The companies operating in the market include OnDeck, Tata Capital Limited, SMB Compass, Star Funding, Inc., Liquid Capital, King Trade Capital, Express Trade Capital, Inc., Trade Finance Global, CAPSTONE, and Kotak Mahindra Bank Limited.

Loading Table Of Content...