Radiopharmaceuticals Market Research, 2033

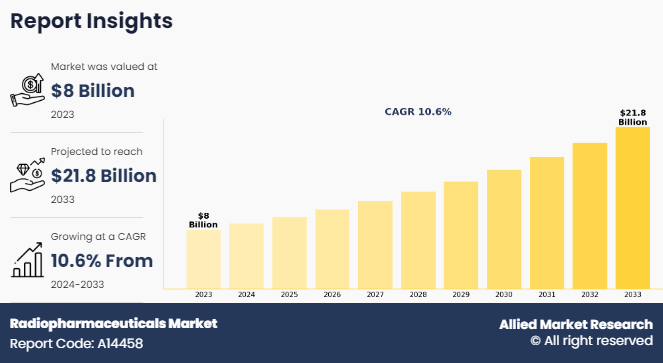

The global radiopharmaceuticals market size was valued at $7.9 billion in 2023, and is projected to reach $21.8 billion by 2033, growing at a CAGR of 10.6% from 2024 to 2033. For instance, an article published by Centers for Disease Control and Prevention (CDC) estimated that around 129 million people in the U.S. has at least 1 major chronic disease in 2024. In addition, an article published by World Nuclear Association in 2024 states that over 50 million nuclear medicine procedures are performed each year, and demand for radioisotopes is increasing.

Key Takeaways

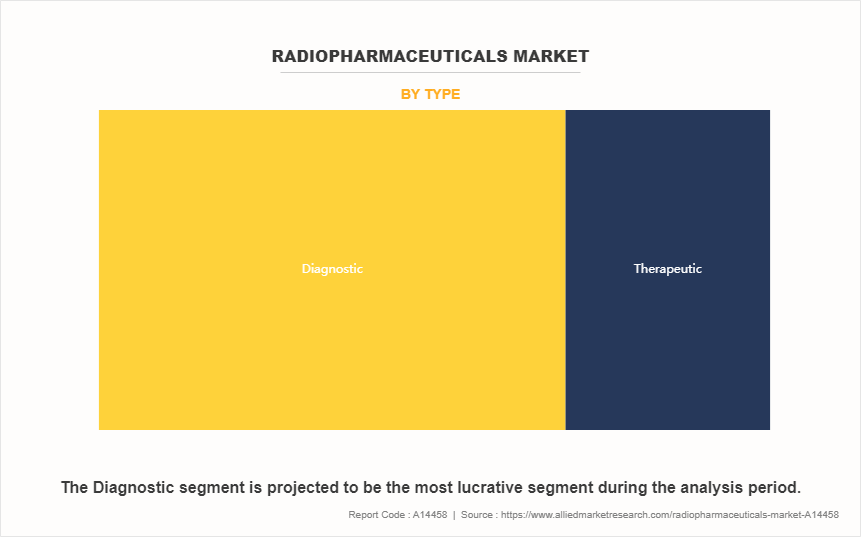

- By type, the diagnostic segment was largest contributor to the market in 2023. However, the therapeutic segment is anticipated to grow at the highest CAGR during the forecast period.

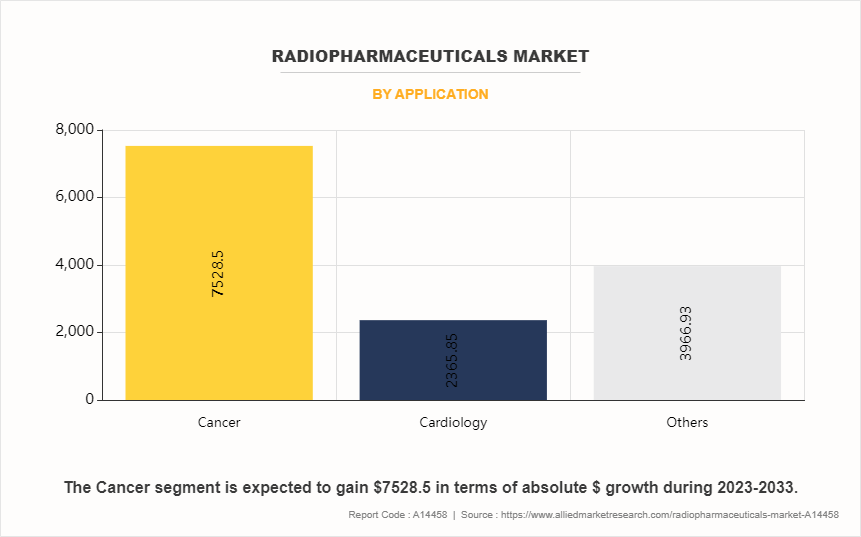

- By application, the cancer segment dominated the radiopharmaceuticals market share in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

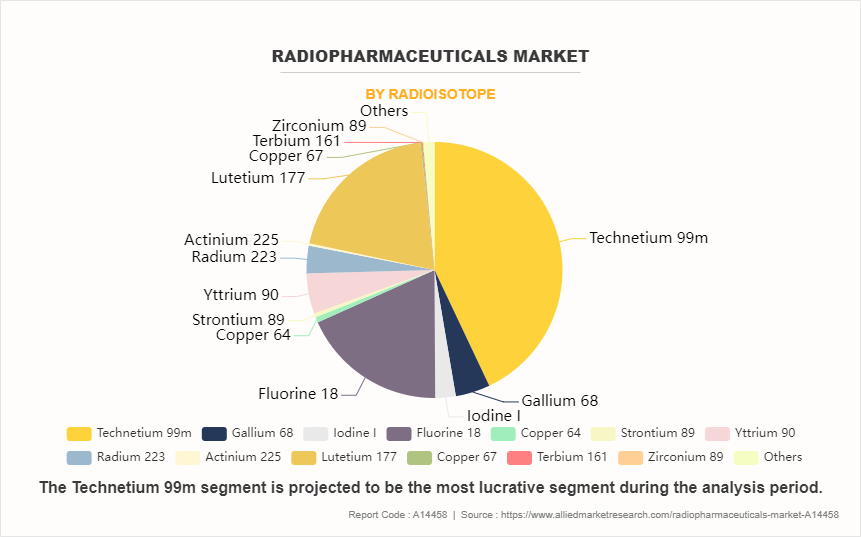

- By radioisotope, the Technetium 99m segment dominated the market in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

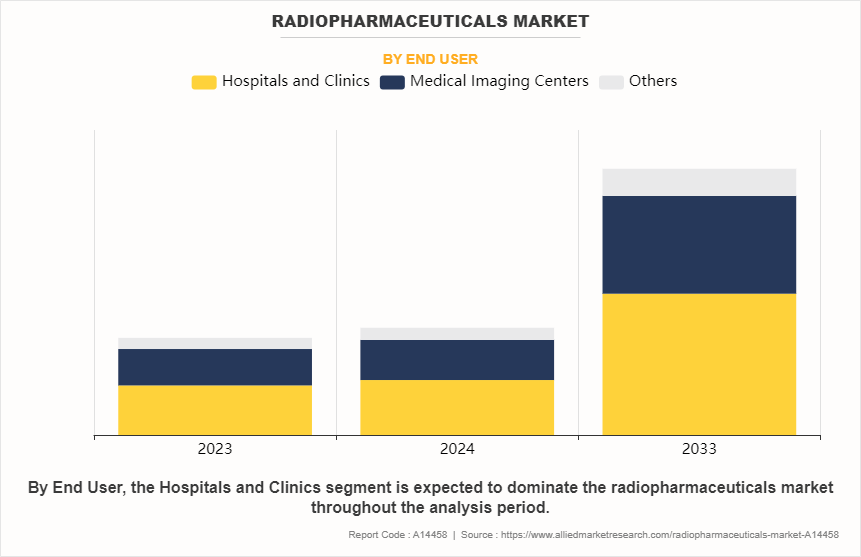

- By end user, the hospitals and clinics segment dominated the radiopharmaceuticals market size in 2023 and is anticipated to grow at the highest CAGR during the forecast period.

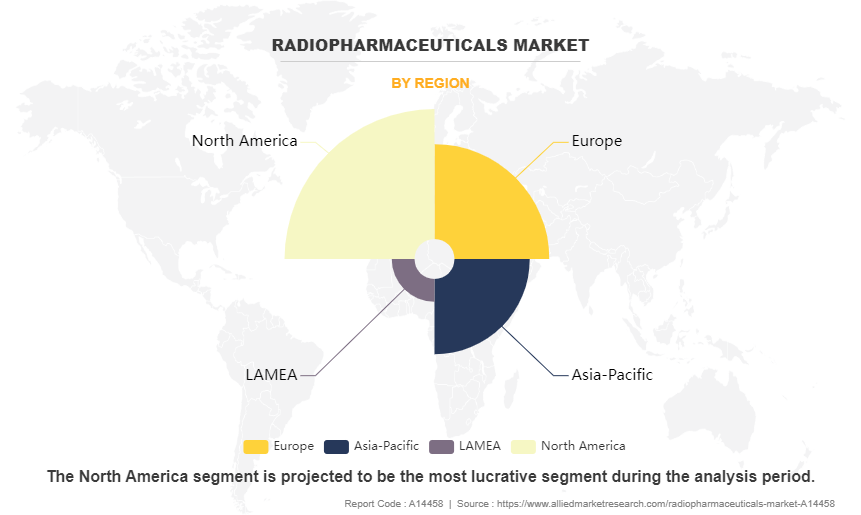

- Region wise, North America generated the largest revenue in 2023. However, Asia-Pacific is anticipated to grow at the highest CAGR during the forecast period.

Radiopharmaceuticals are drugs that contain radioisotopes. These isotopes emit radiation which can be detected by imaging equipment outside the body, for example gamma cameras or PET scanners. Normally, such isotopes are combined with certain molecules to target specific organs, tissues or physiological processes of interest in the patient‐™s body. Healthcare professionals use radiopharmaceuticals for diagnostic imaging in nuclear medical procedures, functional examination, and treatment of different illnesses or disorders by enabling a visualization and evaluation of various life functions within an organism.

Market Dynamics

Radiopharmaceuticals market trends include technological advancements such as positron emission tomography (PET) and single photon emission computed tomography (SPECT) that allow more accurate diagnosis and monitoring of diseases; which increase the demand for radiopharmaceuticals in these procedures. Additionally, rise in the number of people suffering from cancer along with other chronic diseases, particularly among elderly individuals, necessitates wider applications as well as diagnostic imaging, thus fueling the market‐™s growth rate. Furthermore, there is increasing knowledge about benefits associated with using radiation therapy methods among healthcare providers which has resulted in higher uptake rates, thereby driving the market growth.

The radiopharmaceuticals market growth is due to investment in healthcare infrastructure such as nuclear medicine units that have modern imaging technology. Another factor that has created opportunities for growth is the increased use of therapeutic applications in areas such as cancer treatment through targeted radionuclide therapy. The evolving landscape of precision medicine and personalized healthcare has led to the development of novel radiopharmaceuticals tailored to specific patient populations, thus driving innovation and investment in the sector.

However, the high cost associated with the development, production, and distribution of radiopharmaceuticals limits the adoption rate. The specialized facilities and equipment required for radiopharmaceutical manufacturing, along with stringent quality control measures and safety regulations, contribute to high production costs. Additionally, the short half-life of many radioisotopes used in radiopharmaceuticals necessitates just-in-time production and distribution, further adding to the expenses. These high costs can limit accessibility and affordability, particularly in emerging markets, thereby impeding the radiopharmaceuticals market forecast.

Segments Overview

The radiopharmaceuticals market analysis is segmented on the basis of type, application, radioisotope, end user, and region. By type, it is segregated into diagnostic, and therapeutic. By application, it is classified into cancer, cardiology and others. On the basis of radioisotope, it is segmented into Iodine I, Gallium 68, Technetium 99m, Fluorine 18, Copper 64, Strontium 89, Yttrium 90, Radium 223, Actinium 225, Lutetium 177, Copper 67, Terbium 161, Zirconium 89, others. By end user, the market is categorized into hospitals and clinics, medical imaging centers, and others. Region wise, the market is analyzed across North America (U.S. and Canada), Europe (Germany, UK, France, Spain, Italy, and Rest of Europe), Asia-Pacific (India, China, Australia, Japan, South Korea, Thailand, Malaysia, Indonesia, Singapore, Taiwan, Province Of China, and Rest of Asia-Pacific), and LAMEA (Brazil and Rest of LAMEA).

By Type

The diagnostic segment dominated the market share in 2023. This is attributed to diagnostic imaging procedures using radiopharmaceuticals play a critical role in disease detection, characterization, and monitoring across various medical specialties. However, the therapeutics segment is expected to register the highest CAGR during the forecast period owing to advancements in targeted radionuclide therapy (TRT) that have expanded the applications of radiopharmaceuticals in the treatment of various cancers and other medical conditions. In addition, increase in prevalence of cancer and other chronic diseases has fueled the demand for novel therapeutic interventions thereby driving the radiopharmaceuticals market opportunity.

By Application

The cancer segment dominated the radiopharmaceuticals market share in 2023 and is expected to register the highest CAGR during the forecast period. This is attributed to the increase in prevalence of cancer, rise in technological advancements, shift towards personalized medicine approaches, and investment in oncology care. In addition, the growing adoption of personalized medicine approaches in oncology, driven by advancements in genomics, molecular profiling, and biomarker identification, is fueling the demand for tailored therapeutic strategies, including radiopharmaceutical-based precision oncology.

By Radioisotope

The Technetium 99m segment dominated the radiopharmaceuticals market size in 2023 and is expected to register the highest CAGR during the forecast period. This is attributed to it being a most widely used radioisotope in nuclear medicine due to its favorable characteristics, including its suitable physical properties, availability from generator systems, and compatibility with a variety of radiopharmaceutical formulations.

By End User

The hospitals and clinics segment dominated the radiopharmaceuticals market share in 2023 and is expected to register the highest CAGR during the forecast period. This is attributed to the increase in prevalence of cancer and other chronic diseases, combined with the aging population, which has led to a growing demand for diagnostic imaging and therapeutic interventions in hospitals and clinics. In addition, advancements in imaging technologies and the development of novel radiopharmaceuticals have expanded the applications of nuclear medicine in hospitals and clinics, thereby supporting the segment growth.

By Region

The radiopharmaceuticals industry is analyzed across North America, Europe, Asia-Pacific, and LAMEA. North America accounted for the largest share in the radiopharmaceuticals market and is expected to remain dominant during the forecast period. This dominance is attributed to its advanced healthcare infrastructure and a well-established pharmaceutical industry, facilitating the development, production, and distribution of radiopharmaceuticals. In addition, favorable regulatory policies and supportive reimbursement frameworks encourage investment in radiopharmaceutical research and development and thereby drive the radiopharmaceuticals market growth in this region. However, the Asia-Pacific region is anticipated to register the highest CAGR during the forecast period. This is attributed to growing healthcare infrastructure, with increased investments in hospitals, diagnostic centers, and research facilities and rise in prevalence of chronic diseases such as cancer, cardiovascular disorders, and neurological conditions.

Competitive Analysis

Key players such as Novartis AG and Telix Pharmaceuticals Limited have adopted product approval, acquisition, and clinical trials as key developmental strategies to improve the product portfolio of the radiopharmaceuticals industry. For instance, in March 2024, Telix Pharmaceuticals Limited has entered into an agreement to commercially partner the QDOSE dosimetry software platform with ABX-CRO Advanced Pharmaceutical Services Forschungsgesellschaft mbH (ABX-CRO), a full-service contract research organization (CRO) based in Dresden, and its development partner, Stockholm-based Quantinm AB. Telix intends to integrate the QDOSE platform into its therapeutic radiopharmaceutical programs and clinical collaborations to enable the development of personalized treatment regimens.

Recent Developments in the Radiopharmaceuticals Industry

In April 2024, The Bracco Group announced the newly created Bracco Japan. Bracco Japan is expected to extend its presence in the Japanese market by providing a comprehensive range of products and services in the field of diagnostic imaging.

In April 2024, Curium, a world leader in nuclear medicine, announced that it has entered into an agreement with Eczacibasi Holding and Bozlu Group for the acquisition of Eczacibasi Monrol Nuclear Product Co. (Monrol), a dedicated specialist in nuclear medicine. This acquisition is expected to bring together highly complementary geographical footprints, lutetium-177 (Lu-177) capabilities, and PET & SPECT nuclear medicine infrastructure, as well as facilitate the development of cutting-edge radionuclides and radiopharmaceuticals pipelines for diagnostic and therapeutic purposes.

In April 2024, Telix, announced the completion of the acquisition of radioisotope production technology firm ARTMS Inc. (ARTMS), its advanced cyclotron-based isotope production platform, manufacturing plant and stockpile of ultra-pure rare metals required for consumable target production. This acquisition further enhances the vertical integration of Telix‐™s supply chain and manufacturing by providing a greater level of supply chain and regulatory control over the production of key isotopes.

In April 2024, Clarity Pharmaceuticals announced the signing of a clinical supply agreement with NorthStar Medical Radioisotopes, LLC to produce 67Cu-SAR-bisPSMA drug product for Phase I/II and Phase III trials.

In February 2024, Lantheus Holdings, Inc. announced a collaboration agreement with a National Institute on Aging (NIA)-sponsored study called the Consortium for Clarity in ADRD Research Through Imaging (CLARiTI). This agreement enables the consortium to use MK-6240, Lantheus‐™ clinical-stage F18-labeled Positron Emission Tomography (PET) imaging agent, in its investigation of Alzheimer‐™s disease and related dementias.

In January 2024, Novartis presented data from the Phase III NETTER-2 trial showing that Lutathera (lutetium Lu 177 dotatate) plus long-acting release (LAR) octreotide reduced the risk of disease progression or death by 72% as first-line therapy in patients with somatostatin receptor-positive (SSTR+) well-differentiated grade 2/3 advanced gastroenteropancreatic neuroendocrine tumors (GEP-NETs) versus high-dose octreotide LAR alone.

Key Benefits for Stakeholders

This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the radiopharmaceuticals market analysis from 2023 to 2033 to identify the prevailing radiopharmaceuticals market opportunities.

The market research is offered along with information related to key drivers, restraints, and opportunities.

Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

In-depth analysis of the radiopharmaceuticals market segmentation assists to determine the prevailing market opportunities.

Major countries in each region are mapped according to their revenue contribution to the global market.

Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

The report includes the analysis of the regional as well as global radiopharmaceuticals market trends, key players, market segments, application areas, and market growth strategies.

Radiopharmaceuticals Market Report Highlights

| Aspects | Details |

| Forecast period | 2023 - 2033 |

| Report Pages | 500 |

| By End User |

|

| By Radioisotope |

|

| By Application |

|

| By Type |

|

| By Region |

|

| Key Market Players | Actinium Pharmaceuticals, Inc., Lantheus, Eli Lilly and Company, Telix Pharmaceuticals Limited, Nihon Medi-Physics Co. Ltd, SOFIE, South African Nuclear Energy Corporation (Necsa), Curium Pharma, Bracco, Novartis AG, Jubilant Pharmova Limited, Eckert & Ziegler, Bayer AG, GE Healthcare, Eczacibasi, PRECIRIX, The State Atomic Energy Corporation ROSATOM, Isotopia Molecular Imaging, Cardinal Health, ITM Isotope Technologies Munich SE, Clarity Pharmaceuticals, NorthStar Medical Radioisotopes, Fusion Pharmaceuticals Inc. |

Analyst Review

This section provides various opinions of top-level CXOs in the global radiopharmaceuticals market. According to the insights of CXOs, the global radiopharmaceuticals market is driven by surge in prevalence of chronic disease, rise in investments for R&D activities, upsurge in demand for sophisticated healthcare facilities, and rise in healthcare expenditure. However, side effects of radiopharmaceuticals and high cost of development and implementation of radiopharmaceuticals limit the growth of the radiopharmaceuticals market.?

CXOs further added that the key players have adopted various strategies to strengthen their foothold in the competitive market. In addition, ongoing advancements in imaging technology, such as hybrid imaging modalities (PET-CT, SPECT-CT), molecular imaging probes, and imaging software, create opportunities for improved diagnostic accuracy, enhanced visualization, and personalized treatment planning, which further propels the market growth.

Furthermore, North America dominated the market share, in terms of revenue, owing to surge in cases of cancer, easy availability of radiopharmaceuticals, high healthcare expenditure, and strong presence of key players in this region. However, Asia-Pacific is anticipated to witness notable growth owing to an initiative by government & non-governmental organizations (NGOs) to promote awareness regarding use of radiopharmaceuticals and increase in public–private investments in the healthcare sector.

The total market value of radiopharmaceuticals market is $7.9 billion in 2023.

The market value of radiopharmaceuticals market in 2033 is $21.8 billion.

The forecast period for radiopharmaceuticals market is 2024 to 2033.

The base year is 2023 in radiopharmaceuticals market.

North America is accounted for the largest market share in 2023 owing to well established healthcare infrastructure, substantial investments in research and development, and the widespread availability of radiopharmaceuticals products.

Radiopharmaceuticals are pharmaceutical compounds that contain radioactive isotopes, known as radionuclides. These substances are used in nuclear medicine for diagnostic or therapeutic purposes.

The growth of the radiopharmaceuticals market is primarily driven by increasing prevalence of chronic diseases such as cancer and cardiovascular disorders, advancements in radiopharmaceutical research and development, rising demand for personalized medicine, and supportive regulatory frameworks and reimbursement policies

Commonly used radiopharmaceuticals include Technetium-99m (Tc-99m), Fluorine-18 (F-18) for PET imaging, and Iodine-131 (I-131) for thyroid cancer therapy, among others.

Loading Table Of Content...

Loading Research Methodology...