Ready-To-Drink Green Tea Market Research, 2033

Market Introduction and Definition

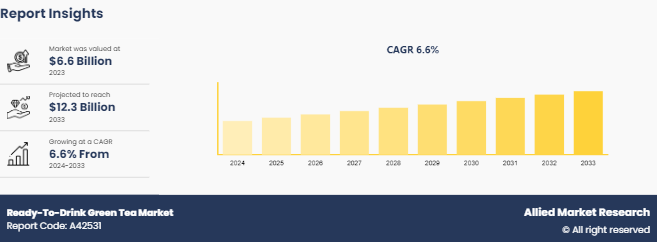

The global ready-to-drink green tea market was valued at $6.6 billion in 2023, and is projected to reach $12.3 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.Ready-to-drink (RTD) green tea refers to pre-packaged, ready-for-consumption beverages made from green tea extracts or brewed green tea leaves. Known for its health benefits, including antioxidants and detoxifying properties, ready-to-drink green tea has gained immense popularity among health-conscious consumers. The convenience of RTD beverages, combined with rising awareness about the health benefits of green tea, has made it a preferred choice in the global beverage market.

Key Takeaways

The Ready-To-Drink Green Tea Industry study encompasses over 20 countries, with detailed segment analysis provided for each country in terms of value ($Million) for the forecast period from 2024 to 2035.

More than 1, 800 industry publications, market reports, annual reviews, and health-focused studies were analyzed, along with consumer trends and government food and beverage data, to ensure comprehensive insights.

The research approach integrates robust data analysis, expert opinions, and independent market perspectives to provide actionable insights for stakeholders.

Key Market Dynamics

The growing consumer preference for healthier beverage alternatives is a major growth driver for the ready-to-drink green tea market. Rising awareness about the antioxidant and weight management benefits of green tea has bolstered its adoption across various demographics. As people become more aware of the negative health impacts of sugary sodas, energy drinks, and other high-calorie beverages, many are opting for drinks that are naturally low in calories and rich in nutrients. Green tea is particularly popular because it offers a wide array of health benefits without the excess sugar or calories found in traditional soft drinks. With growing emphasis on preventative healthcare and healthy aging, consumers are increasingly turning to green tea for its ability to support weight loss, improve metabolism, and boost immunity. The perceived wellness benefits have led to an increase in demand for ready-to-drink green tea, especially among health-conscious individuals and those focused on natural wellness solutions, increasing the Ready-To-Drink Green Tea Market Size.

In addition, the convenience of ready-to-drink beverages, coupled with rapid urbanization and busier lifestyles, has increased demand for portable, ready-to-consume options. Government initiatives promoting healthy dietary habits further support market growth and Ready-To-Drink Green Tea Market Share.

Challenges include fluctuating raw material prices and intense competition from other RTD beverage categories, such as kombucha and herbal drinks. However, opportunities exist in expanding product lines with innovative flavors and functional benefits and leveraging e-commerce platforms for distribution. Green tea production is highly dependent on weather patterns and agricultural conditions, which can lead to price volatility. Adverse weather conditions, such as droughts, flooding, or pests, can disrupt the supply of high-quality tea leaves, making it difficult for manufacturers to maintain a stable supply and control costs. This price instability can lead to increased production costs, which may be passed on to consumers, potentially reducing demand.In addition to this, fluctuations in the cost of packaging materials and other essential ingredients, such as sweeteners or flavors, further complicate the market. Manufacturers need to find ways to mitigate the risks associated with price changes, whether by hedging, contract agreements, or long-term partnerships with suppliers to ensure consistent supply and pricing, affecting the Ready-To-Drink Green Tea Market Growth.

Value Chain of the RTD Green Tea Market

The value chain of the ready-to-drink green tea market begins with sourcing high-quality tea leaves, typically from regions known for green tea cultivation, such as China, Japan, and India. These leaves are processed into concentrates or extracts, blended with other ingredients like natural sweeteners or flavor enhancers, and packaged for retail distribution. Distribution channels include supermarkets, convenience stores, and online platforms. Innovations in flavor and ingredient combinations continue to drive product development.

Market Segmentation

The ready-to-drink green tea market is segmented into type, packaging, distribution channel, and region. By type, it is divided into sweetened, unsweetened, and flavored. By packaging, it is classified into bottles, cans, and others. By distribution channel, it is bifurcated into offline and online. Region-wise, it is categorized into North America, Europe, Asia-Pacific, and LAMEA.

Regional/Country Market Outlook

North America led the ready-to-drink green tea market, accounting for the highest revenue share in 2023, fueled by increase in health awareness and the rise in popularity of functional beverages. The U.S. market is particularly dynamic, with consumers showing strong interest in unsweetened and flavored RTD green tea varieties.

According to Ready-To-Drink Green Tea Market Forecast, Asia-Pacific is experiencing rapid growth. This region is driven by a strong cultural affinity for green tea, particularly in countries like Japan and China, where RTD green tea is a staple beverage. The increasing urban population and rising disposable incomes in the region further bolster demand.

Industry Trends

The surge in demand for low-calorie, sugar-free, and functional beverages is a significant trend driving the RTD green tea market. Consumers are increasingly opting for green tea infused with additional health-promoting ingredients, such as vitamins, herbs, and probiotics.

Innovations in packaging, including eco-friendly and recyclable options, are becoming pivotal, with companies focusing on sustainability to align with environmental goals.

Competitive Landscape

The key players analyzed in the RTD green tea market includeThe Coca-Cola Company, PepsiCo, Ito En Ltd., Nestlé S.A., Arizona Beverage Company, Tata Global Beverages, Unilever, Danone S.A., Nongfu Spring and Tenfu Group.

Recent Key Strategies and Developments

In June 2023, PepsiCo expanded its Lipton Pure Green Tea line, introducing new flavors and eco-friendly packaging.

In March 2023, Ito En Ltd. launched a premium RTD green tea targeting the U.S. and European markets, emphasizing organic and sugar-free variants.

Key Benefits For Stakeholders

- This report provides a quantitative analysis of the market segments, current trends, estimations, and dynamics of the ready-to-drink green tea market analysis from 2024 to 2033 to identify the prevailing ready-to-drink green tea market opportunities.

- The market research is offered along with information related to key drivers, restraints, and opportunities.

- Porter's five forces analysis highlights the potency of buyers and suppliers to enable stakeholders make profit-oriented business decisions and strengthen their supplier-buyer network.

- In-depth analysis of the ready-to-drink green tea market segmentation assists to determine the prevailing market opportunities.

- Major countries in each region are mapped according to their revenue contribution to the global market.

- Market player positioning facilitates benchmarking and provides a clear understanding of the present position of the market players.

- The report includes the analysis of the regional as well as global ready-to-drink green tea market trends, key players, market segments, application areas, and market growth strategies.

Ready-To-Drink Green Tea Market Report Highlights

| Aspects | Details |

| Market Size By 2033 | USD 12.3 Billion |

| Growth Rate | CAGR of 6.6% |

| Forecast period | 2024 - 2033 |

| Report Pages | 155 |

| By Type |

|

| By Packaging |

|

| By Distribution Channel |

|

| By Region |

|

| Key Market Players | Nongfu Spring, Ito En Ltd., Tata Global Beverages, Danone S.A., The Coca-Cola Company, Tenfu Group, Nestlé S.A., Unilever, PepsiCo, Arizona Beverage Company |

The global ready-to-drink green tea market was valued at $6.6 billion in 2023, and is projected to reach $12.3 billion by 2033, growing at a CAGR of 6.6% from 2024 to 2033.

The key players analyzed in the RTD green tea market includeThe Coca-Cola Company, PepsiCo, Ito En Ltd., Nestlé S.A., Arizona Beverage Company, Tata Global Beverages, Unilever, Danone S.A., Nongfu Spring and Tenfu Group.

The upcoming trends in the global Ready-to-Drink Green Tea market include increasing demand for health-focused, organic, and functional beverages, with innovations in packaging and flavor variety, as well as growing interest in plant-based and low-sugar options.

The leading application of the Ready-to-Drink Green Tea market is in the beverage sector, where it is primarily consumed as a refreshing, healthy alternative to sugary drinks, appealing to health-conscious consumers seeking functional beverages with antioxidant benefits.

The largest regional market for Ready-to-Drink Green Tea is Asia-Pacific, driven by the strong cultural preference for tea, particularly in countries like China and Japan, alongside increasing demand in emerging markets like India.

Loading Table Of Content...