Table Of Contents

Roshan Deshmukh

Pooja Parvatkar

Pet Supplements: Exploring the Growing Popularity

In recent decades, the pet care industry has undergone a transformative journey propelled by rapid advancements, with one of its standout achievements being the introduction of pet supplements. Pet supplements are intended to provide additional nutrients to pets, such as dogs and cats, to support their overall well-being. Pet owners often use supplements to address specific nutritional needs and to support certain aspects of their pets' health, such as joint health, skin & coat condition, immune system function, and digestive health. According to the American Pet Products Association (APPA) in 2019, $95.7 billion was spent on pets in the U.S in which, $36.9 billion were spent on pet foods & treats, $19.2 on supplies, $29.3 billion on vet care products, and $10.3 billion on other related services.

The landscape of pet ownership in the U.S. has evolved significantly over the years. This reflects changes in societal attitudes, lifestyles, and economic conditions. Earlier dogs and cats were the most popular pets in the U.S. and were valued for their companionship and utility. In agrarian societies of the past, animals such as horses, mules, and livestock played crucial roles in agricultural activities and transportation, but their numbers have significantly decreased with the changed mechanization of agriculture and transportation. Gradually, as urbanization accelerated in the 20th century, smaller pets such as cats, dogs, birds, and fish have become more popular among city dwellers due to space constraints.

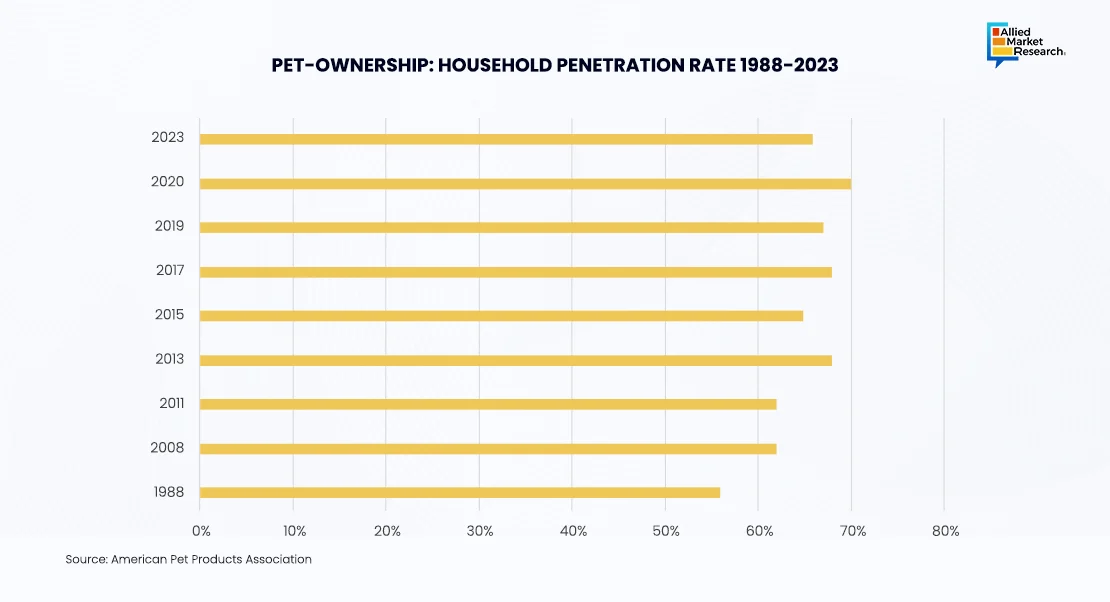

In this ever-busy world, pet ownership has been witnessed to increase notably to overcome stress, depression, and anxiety; encourage playfulness; and deal with loneliness. Pets offer a source of companionship and social connection, especially for individuals living in the chaos of cities where social interactions may be limited. According to American Pet Products Association (APPA), 66% of households in the U.S. owned one or more pets in 2023. Household penetration rates for pet ownership have increased by 10% since 1998.

Intrigued in Ingredients?

Not only are the consumers seeking top-notch quality pet supplements but they are also focusing on specific ingredients. For instance, pet owners are preferring supplements that are associated with a myriad of health benefits such as B complex vitamins, probiotics, and fish oil. As the humanization of pets continue, ingredients that are gaining high traction in human supplements industry—such as botanical flavors as well as antioxidant-rich ingredients, including blueberries and elderberries—are an emerging trend in the pet supplement industry. Yvethe Tyszka, vice president of marketing at Zesty Paws and Solid Gold Pet, says “We’ve found that pet parents approach the pet supplement market the same way they do when considering supplements for themselves.” Thus, in the last 5 to 10 years, the pet supplement category has shifted from focusing not only on deficiency and medicinal prospects to well-being.

Impact of Economic Growth and Rising Income Levels

Increase in disposable income has encouraged pet owners to willingly invest in pet supplements that enhance their pets' health. According to Organization for Economic Cooperation and Development (OECD), in 2019, Americans spent $162 dollars on a per capita basis on such products in that year. Britain secured the second place, spending an average amount of $93 on pet supplements, followed by France, Switzerland, Germany, Italy, Japan, and Spain expending $87, $81, $70, $62, $42, and $42, respectively.

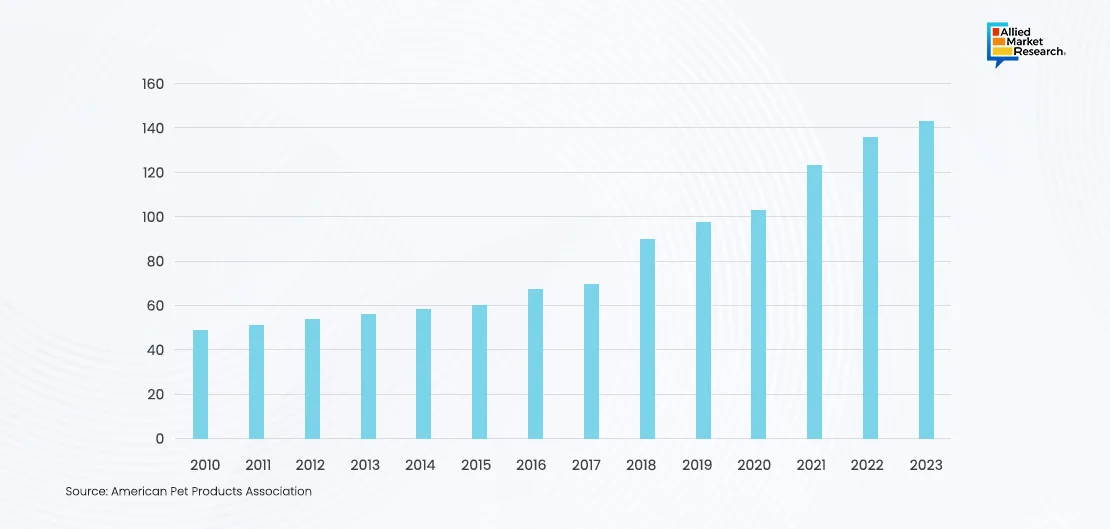

Pet Expenditure Continues to Run High

The pet care expenditure in the U.S. has been experiencing exponentially over the years, reflecting the increasing importance of pets in American households and the rising demand for pet-related products and services. According to APPA, which tracks industry trends and statistics, total pet industry expenditure reached a record high of over $100 billion in 2020. This expenditure encompasses spending on various categories within the pet industry, including pet food; veterinary care; supplies & over-the-counter medications; pet services such as grooming & boarding; and purchases of dogs, cats, and other pets.

Calming Pet Supplements Gaining Traction

In recent years, many pet owners have adopted various ways to help alleviate stress and anxiety among their pets, especially in situations such as thunderstorms, fireworks, separation anxiety, or travel. For instance, calming pet supplements, sometimes referred to as calming chews or calming bites, are dietary supplements intended to soothe pets. They often contain ingredients such as chamomile, valerian root, passionflower, L-theanine, and melatonin, which exhibit relaxing properties that help calm anxious pets without causing sedation or other unwanted side effects.

According to Forbes, pet supplement sales have increased from 11% from August 2021 to July 2022. Moreover, online search volume growth across pet retail channels has indicated a continued interest in dental health, hairball control, and anxiety health products.

In addition, modern veterinary medicine has allowed for a deeper understanding of the specific nutritional needs of different pets based on factors such as age, breed, size, and health conditions. It has led to the development of targeted supplement formulations tailored to address specific issues, such as joint health, skin & coat care, digestive health, and cognitive function along with preventive healthcare.

Higher levels of vaccination and a shift to raising more pets primarily indoors have reduced medical issues. According to Global State of Pet Care, the average life expectancy of pet dogs in the U.S. has increased from 10.5 years to 11.8 years between 2002 and 2016, which is an increase of 11.4%. In Japan, dogs live 50% longer now than they did in the 1980s, while cats’ average life expectancy has increased by 230% in the same period.

Giants Leading the Pack

The competitive landscape of the pet supplement market is characterized by a diverse array of players, including multinational corporations, small- & medium-sized enterprises (SMEs), and niche brands. The giants such as Nestlé Purina PetCare, Mars Petcare, and Hill's Pet Nutrition govern the pet supplement market. For instance, Nestlé Purina PetCare launched pet food containing insect proteins as well as plant protein from fava beans and millet in 2021. The new product is a complete nutritious alternative to conventional companion animal products and contributes to environmental sustainability. The diversification in selection of protein sources is expected to save the earth’s precious resources while serving the concept of sustainability.

To Sum Up

The pet supplement market continues to experience robust growth driven by the humanization of pets, advancements in veterinary medicine, and increasing awareness of preventive pet care. Moreover, the growing concern of pet owners regarding mental health reflects a positive shift toward a more holistic approach to pet care, which emphasizes not only physical health but also emotional well-being. The use of functional ingredients with specific health benefits, such as probiotics, omega-3 fatty acids, glucosamine, and antioxidants, is further expected to continue driving growth in the pet supplement market. In addition, the demand for natural and organic supplements is expected to rise in future. Thus, according to the insights of the key players, premium pet food supplements do not contain artificial additives and fillers and opt for natural and organic components to provide a healthier and more balanced diet for pets.

For further insights, get in touch with AMR analysts.