Table Of Contents

Roshan Deshmukh

Anuya Rupesh Waghmare

How Clean Label Ingredients Are Transforming the Food Industry

Clean labels are more than just a trend and reflect changing consumer preferences. Understanding clean label ingredients and their importance is crucial for food manufacturers wanting to stay ahead of the curve and meet the demands of today's health-conscious and informed consumers.

Clean Label Revolution in Food and Beverage Industry

Clean labeling is a movement where food companies make labels simpler for consumers. They use natural ingredients and reduce artificial additives. Major players in the food and beverage industry such as Campbell Soup, Nestlé, and Mars, are joining the clean label revolution by removing artificial ingredients from their products. It is becoming crucial for companies to make clean labels to stay ahead worldwide. But consumers have different ideas about what a clean label means. And for companies to switch to natural ingredients rapidly is a difficult process. For instance, in recent years, major food companies such as Nestlé, PepsiCo, and General Mills, have announced plans to reformulate their products to meet consumer demand for cleaner labels. For instance, Nestlé has committed to removing artificial flavors and colors from its products and reducing salt and sugar content. Similarly, PepsiCo has pledged to remove artificial ingredients from its Frito-Lay snack products. However, the process of reformulation and transitioning to natural ingredients can be complex and time-consuming for these companies due to factors such as sourcing, supply chain logistics, and maintaining taste and quality standards. This illustrates the challenge companies face in meeting consumer expectations for clean labels while also balancing other considerations in product development and manufacturing.

The clean label ingredients revolution represents a shift in the food and consumer goods industries, characterized by a growing demand for simplicity, transparency, and authenticity in product formulations. Consumers are increasingly seeking products made with natural, minimally processed ingredients, free from artificial additives and chemicals. This movement reflects a deeper cultural shift towards health-conscious consumption, sustainability, and ethical sourcing. As a result, companies are reevaluating their ingredient sourcing practices and reformulating their products to meet this rising consumer demand for cleaner labels.

A new technology being introduced in clean label ingredients is the use of advanced extraction techniques for natural flavors and colors. Traditional extraction methods often involve the use of solvents or chemicals, which may not align with clean label requirements. However, advancements in technologies such as supercritical fluid extraction (SFE) or enzyme-assisted extraction allow for the extraction of flavors and colors from natural sources without the need for synthetic solvents or chemicals. For instance, Givaudan have invested in research and development to refine extraction processes, such as supercritical fluid extraction (SFE) and enzyme-assisted extraction, to obtain natural flavors and colors from botanical sources without the need for synthetic solvents or chemicals.

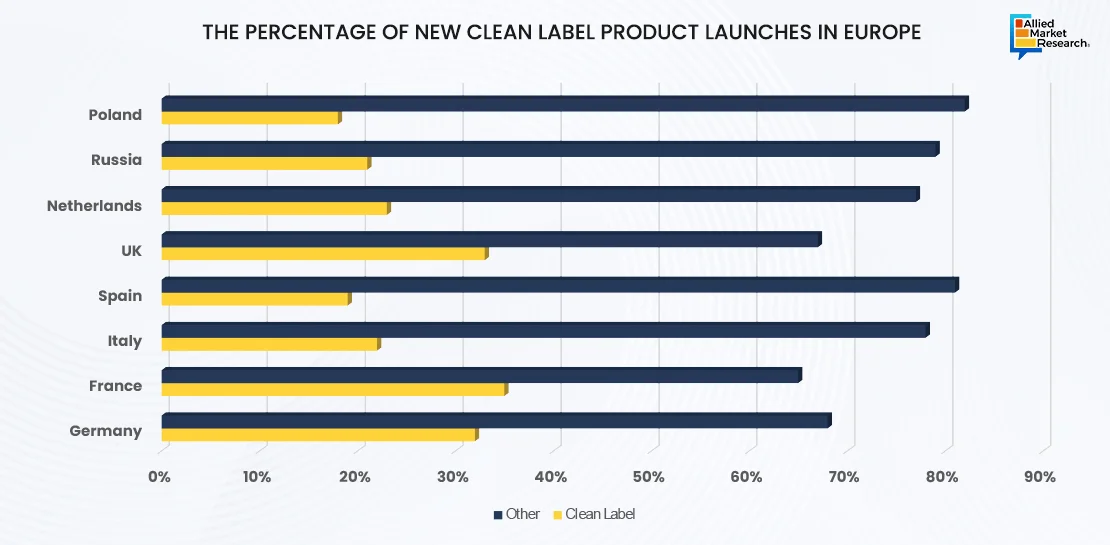

The food sector has begun addressing the growing consumer preference for clean label items by offering food products perceived as more pristine. As an illustration, in 2010, Heinz Tomato Ketchup underwent a reformulation to eliminate high fructose corn syrup from its ingredients, subsequently rebranded as Simply Heinz. Newly released data reveals that approximately 27% of the freshly introduced packaged food items in the European market were characterized by a clean label.

Since 2019, the global market has witnessed the introduction of more than 200,000 clean-label products, marking a notable surge in response to prevailing consumer demands. Particularly amidst the height of the global pandemic, this trend experienced exponential growth. The U.S. has taken the lead in this movement, contributing approximately 36% of these innovative product launches. Notably, there is a discernible shift towards organic and natural food offerings over traditional processed options. Following closely, Europe has accounted for 28% of clean-label product introductions from 2019 to 2023, indicating a widespread adoption of this consumer preference. Australasia, on the other hand, has prioritized additive-free and preservative-free formulations, resulting in the launch of over 20,000 products in the past four years alone.

Consumer Perception About The Clean Label

Consumers are increasingly aware of the correlation between dietary choices and their well-being and environmental sustainability. This heightened consciousness has fostered the emergence of the "clean label" sector, prompting numerous enterprises to reevaluate and adjust their product formulations. This shift entails a strategic emphasis on utilizing minimal, recognizable, and naturally derived ingredients to meet evolving consumer preferences. One notable trend is the rise of plant-based ingredients, as consumers increasingly prioritize plant-derived alternatives over traditional animal-based products. Additionally, there is a growing interest in functional ingredients, such as probiotics, adaptogens, and superfood, which offer specific health benefits beyond basic nutrition.

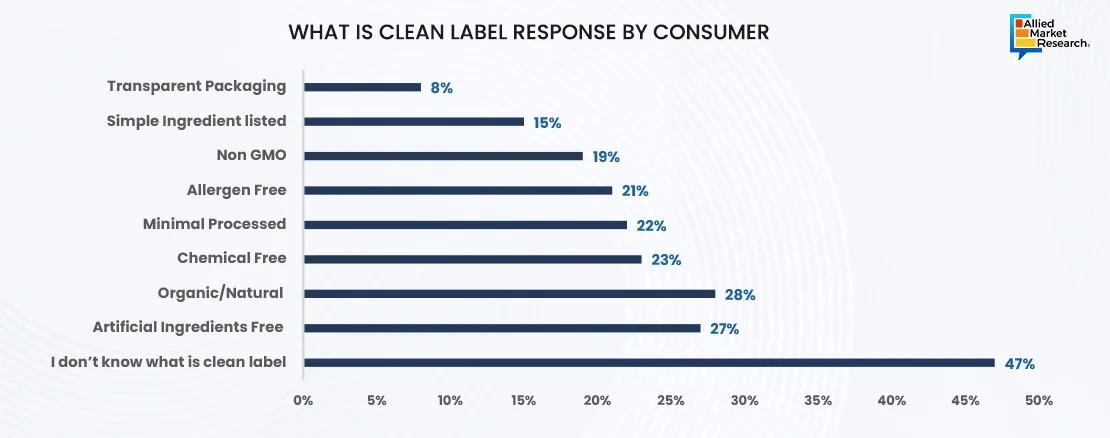

Global food scandals and adverse findings regarding synthetic additives have heightened consumer apprehensions regarding food standards, fostering a preference for natural food items. While the concept of clean labeling has gained momentum due to consumer advocacy, its definition remains ambiguous for many. A 2015 survey conducted in the U.S. revealed that 45% consumers are unfamiliar with the term "clean label," highlighting a generational disparity in comprehension, with individuals aged 18 to 44 years exhibiting differing levels of understanding as compared to those aged 45 and above.

Furthermore, there exists a divergence in the interpretation of clean labeling across different age demographics. Individuals between the ages of 18 and 34 associate "clean label" primarily with descriptors such as "natural" or "organic," a sentiment shared by those aged 35 to 44 who additionally prioritize products labeled as "minimally processed." Conversely, consumers aged 44 and above predominantly understand the concept of "clean label" in terms of products being "free from undesirable ingredients."

Navigating Clean Label Obstacles in the Realm of Plant-Based Offerings

In plant-based products, the issue of clean labeling has significant implications, particularly within the context of evolving dietary preferences such as vegan, vegetarian, and flexitarian lifestyles. Consumers within this market segment exhibit a strong inclination towards natural and health-conscious foods, thereby placing a premium on label transparency. Recent research underscores this trend, revealing that 54% of surveyed individuals perceive plant-based products as synonymous with health and wholesomeness.

However, there exists a notable discrepancy between consumer perceptions and the reality of some plant-based offerings. Concerns arise over the presence of chemical additives or excessive processing, with 19% of respondents expressing hesitance towards purchasing such products. This incongruity highlights the need for greater alignment between consumer expectations and product formulation.

The clean-label trend presents multifaceted complexities and hurdles within the industry. A primary concern revolves around the functionality of natural ingredients. While various chemicals and additives are traditionally employed to safeguard food integrity and prolong shelf life, the exploration of natural alternatives becomes imperative. For instance, essential oils derived from herbs and spices exhibit promising antimicrobial attributes, potentially serving as viable substitutes for conventional preservatives. Nonetheless, thorough efficacy assessments are essential prior to the integration of these alternatives into existing preservative systems.

The secondary factor to contemplate pertains to the impact of this alteration on sensory characteristics. Incorporating spices as preservatives could imbue distinct flavors, potentially enhancing or detracting from the overall appeal of individual food items. It is essential to recognize that clean labeling entails more than merely eliminating ingredients, as these components often interact synergistically within food formulations.

Certain plant-based alternatives, particularly those mimicking meat and dairy, necessitate complex ingredient lists and processing techniques to achieve desired taste and texture profiles. Acknowledging this challenge, numerous companies are actively enhancing the labeling of their plant-based offerings. This includes efforts to streamline ingredient lists and foster transparent communication, thereby empowering consumers to make informed purchasing decisions.

Clean Label Ingredients Market Outlook

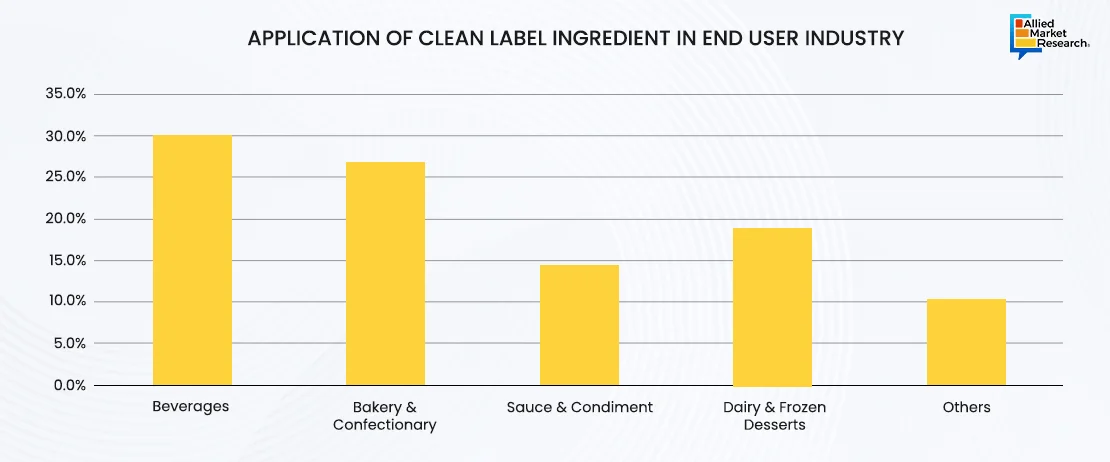

The future of clean label ingredients holds immense potential for innovation and diverse applications across various industries. One significant future capability could involve advancements in ingredient sourcing and production techniques, enabling the development of innovative products with improved functionality and performance. Clean label ingredients such as natural color, natural flavor, starch & sweetener, natural preservative, among others have wide variety of applications in beverage, bakery & confectionary, sauce & condiment, dairy & frozen dessert, and others.

The consumer preference toward organic food is on a constant rise owing to an increase in health consciousness among consumers. Further, surge in disposable income, improvement in living standard, rise in health expenditure, and large-scale promotion of organic food owing to its benefits, such as chemical free and natural, supplement growth of organic food products. According to a recent study, clean label ingredients are majorly used in the beverages such as juices, functional beverages, carbonated drinks, and others, owing to increasing demand for clean label and allergen-free beverages among the consumers in developed as well as developing countries.

India Emerges as a Pioneer in Driving Clean Label Trends Across Asia

A recent market analysis focusing on clean label products across key Asian markets including India, Indonesia, Japan, Singapore, and South Korea has unveiled a discernible shift towards GMO-free offerings. This shift signifies a departure from entrenched culinary traditions within these regions. Despite a historical preference for natural and organic dietary choices, Asian consumers are increasingly recognizing the value proposition of clean-label products to align with their fast-paced lifestyles.

Emerging as a frontrunner among Asian nations in pioneering clean label product introductions is India. In 2023 alone, India witnessed the launch of over 5000 clean label products, constituting a significant 13% of the global tally. These figures emphasize a promising trajectory for the market, presenting a lucrative opportunity for forward-thinking food manufacturers to capitalize upon.