Table Of Contents

Roshan Deshmukh

Vidit Gite

Instant Coffee: Navigating the Evolving Landscape

The instant coffee market has been experiencing substantial growth, primarily fueled by the convenience offered through single-serve packaging. Single-serve instant coffee is a convenient option for individuals with busy schedules and time limitations. The compact and portable nature of individual-sized packaging makes it perfect for on-the-go consumption, which leads to a high demand for single-serving instant coffee packages. Moreover, single serve packaging offers pre-measured portion control, which ensures that consumers receive the appropriate amount of coffee with each serving. This attribute is especially attractive for those who are conscious of their coffee intake or are seeking to manage their caffeine consumption more effectively.

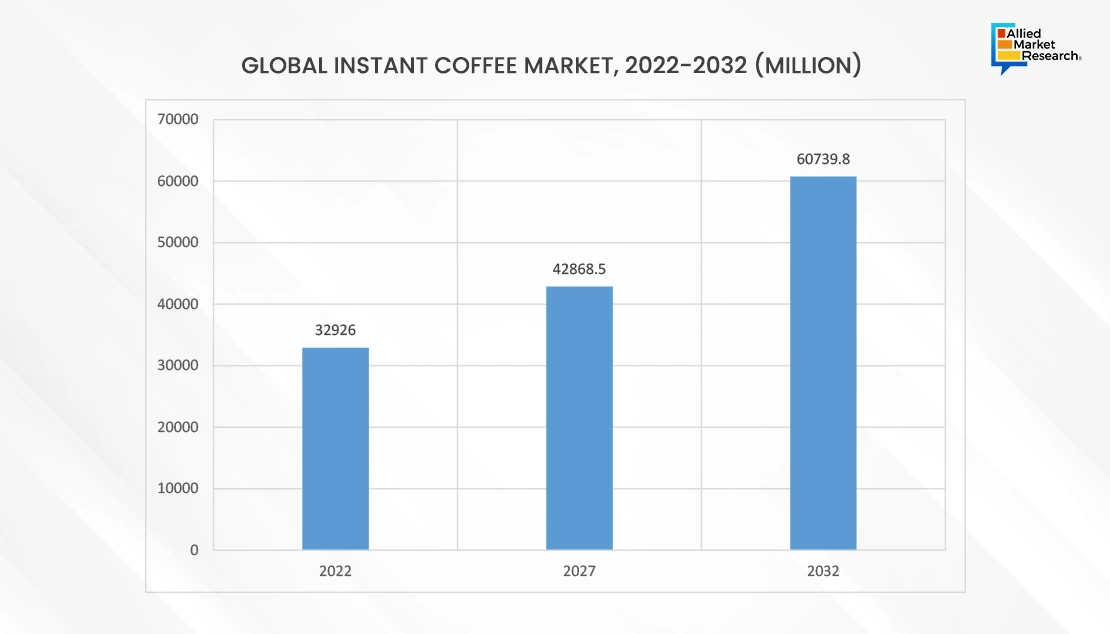

The global instant coffee market was valued at $32,926.0 million in 2022, and is projected to reach $60,739.8 million by 2032, registering a CAGR of 6.4% from 2023 to 2032.

Trends and Factors Impacting Market Growth

Manufacturers have started investing in R&D activities to create innovative packaging solutions that enhance the convenience of instant coffee products. This includes specialty blends and even 3-in-1 options that include coffee, creamer, and sweetener in a single serving. For instance, Nescafe 3-in-1 strong intense & rich instant coffee, Jacobs Milka 3 in1 instant coffee sachets, G7 3-in-1 gourmet instant coffee, NY salted caramel instant white coffee with sugar 3 in 1 sachet, Narusa’s 3 in 1 Coffee Premix Stick Pack, are few examples of different packages and categories available in the instant coffee market.

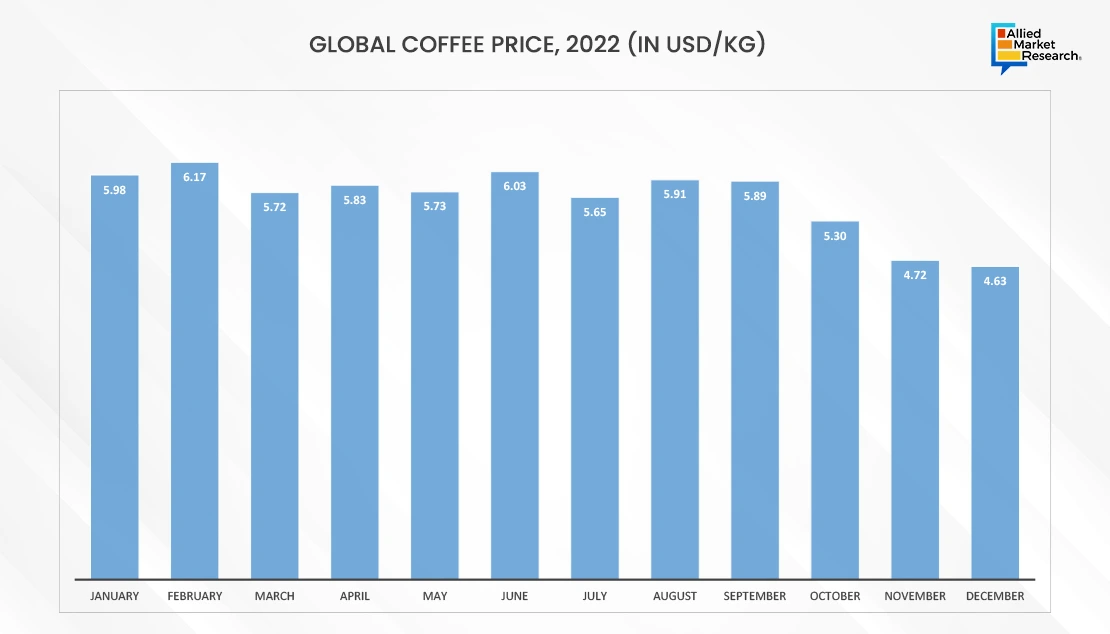

Although the instant coffee market has expanded, it still faces challenges owing to the fluctuation in raw material prices. Instant coffee is made from processed coffee beans, and any fluctuations in the prices of raw coffee beans directly affect the production cost of instant coffee. Extreme weather changes such as drought, frosts, and pests significantly damage coffee crops, which reduces production and disrupts the timely supply of coffee beans to the market. For instance, in November 2021, global coffee prices surged due to challenging conditions in Brazil, including drought, frost, and unusual weather patterns. This trend continued into 2022, with a 14.8% increase in coffee product prices observed in grocery stores. Moreover, the return of El Nino weather conditions has been officially confirmed by the U.S. Climate Prediction Center, and forecasters anticipate it to be possibly even a strong weather event. This weather phenomenon is expected to bring about hotter and drier conditions, particularly in key coffee-growing regions such as Vietnam and Indonesia. The increased risk of adverse weather conditions poses a threat to crucial coffee supplies from these areas, thus contributing to supply shortages and fluctuations in prices of coffee beans used in instant coffee production.

As per the data provided by the International Monetary Fund (IMF), the global price of coffee exhibited fluctuations throughout the year 2022, ranging from a high of 279.83 U.S. cents per pound in February to a low of 210.38 U.S. cents per pound in December. The manufacturers of instant coffee often operate with tight profit margins. Rapid or unpredictable increases in raw material prices erode these margins, affecting the overall profitability of the business operating in the instant coffee market. These uncertainties affect the quality of instant coffee and hinder potential investments and expansion efforts in the industry, thereby impeding overall instant coffee market growth

Current Growth Factors in the Industry

- Increasing Adoption of Western Trends

- Dine-out Trends

- Rise in Adoption of Experimental Coffee

- Increasing Capitalization by Manufacturers

A notable growth factor is the expansion of the retail market. The increase in the number of retail stores has led to a more extensive selection of instant coffee products for consumers, which has helped to boost the instant coffee market share. According to the Bureau of Labor Statistics, there were 1,045,422 retail establishments in the U.S. as of Q3 2020. This has marked an increase of 4,801 establishments compared to Q2 2020, which represents the highest third-quarter establishment count in the last decade. The expansion of retail outlets ensures that consumers can conveniently purchase instant coffee during routine shopping trips owing to the increased visibility of these products. This convenience factor enhances the overall shopping experience for consumers, that encourages regular and impromptu purchases. Consumers can select from a wide variety of instant coffee flavors, mixes, and brands, which provides them with an extensive array of options to cater to their preferences.

Moreover, the expansion of the retail industry allows instant coffee manufacturers to penetrate new markets and regions. They can tap into previously untapped consumer segments, which leads to business growth and an increased market share of instant coffee. The expansion of the retail industry also includes the growth of ecommerce platforms. Through online sales, instant coffee manufacturers can leverage online retail channels to reach a broader audience in different parts of the world. This enables instant coffee manufacturers to compete in the digital marketplace and expand their customer base globally.

Key Players Making a Difference

The major players in the instant coffee industry include Nestle SA, The Kraft Heinz Company, Starbucks Corporation, Tata Consumer Products Limited, and Strauss Group Inc. These manufacturers are increasingly focusing on their business expansion by adopting multiple strategies such as product launch, mergers, and others.

In April 2023, Nestle S.A. announced the introduction of Nescafe Ice Roast instant coffee to strengthen its product portfolio with instant cold beverages. The initial launch will be in China, followed by a subsequent introduction in Mexico. This development is driven by the increasing inclination of Generation Z consumers to replicate cafe-style cold coffee experiences within their home environments.

In December 2022, Strauss Group acquired Norddeutsche Kaffeewerke GmbH (NDKW) that includes the German freeze-dried instant coffee plant, which was previously leased since 2012. The acquired production site features state-of-the-art micro-grinding technology, which will position Strauss among an exclusive group of manufacturers with such sophisticated capabilities to manufacture premium instant coffee products.

Instant Coffee Market Outlook

Consumers are increasingly busy, and they seek convenient ways to get their caffeine fix. Instant coffee is a quick and easy way to avail a cup of coffee. It is portable and can be consumed while on the go. Instant coffee has come a long way in recent years, and now it tastes much better than it used to earlier. This is owing to the advancements in coffee processing and packaging technologies.

Trends Expected to Propel the Market in Coming Future

- Popularity of premium coffee

- Increase in spending power of Gen Z

- Demand for instant coffee with functional benefits

- Customization and Personalization

With increased globalization, consumers in developing regions are exposed to global trends, including the popularity of premium coffee options. This exposure can create a demand for premium instant coffee as consumers seek to align their choices with international preferences and lifestyle trends. As a result, many companies have started introducing premium and innovative instant coffee products to gain market share and maintain competition in this region. Moreover, there is a growth in popularity of cold brew coffee, which is made by steeping coffee grounds for 12-24 hours. Instant cold brewed coffee is a convenient way to enjoy this popular beverage. Moreover, millennials and Gen Z are more likely to drink instant coffee than older generations and expected to enhance overall revenue worldwide.

The landscape of the instant coffee market looks promising. As coffee culture around the world continues to thrive, the market is poised to see endless growth. Contact AMR for deeper and more comprehensive insights.