Table Of Contents

Onkar Sumant

Koyel Ghosh

BFSI Sector in Q4 2024: Which Are the Top 5 Emerging Markets in the Domain That Companies Should Invest in?

The increasing focus on the digitalization of financial services has completely transformed the BFSI domain in the last few years. Almost all the major developed and developing countries have launched initiatives to bring the vulnerable and marginalized sections of their population into the formal banking channels. The advent of innovative technologies such as blockchain and AI has further expanded the prospects of the sector. Recently, Allied Market Research has

published a study that analyzes the impact of the top 5 emerging markets on the BFSI domain. Each of these markets is comprehensively covered in their respective reports which focus on the growth drivers and investment opportunities in the landscape.

Prepaid Card Market

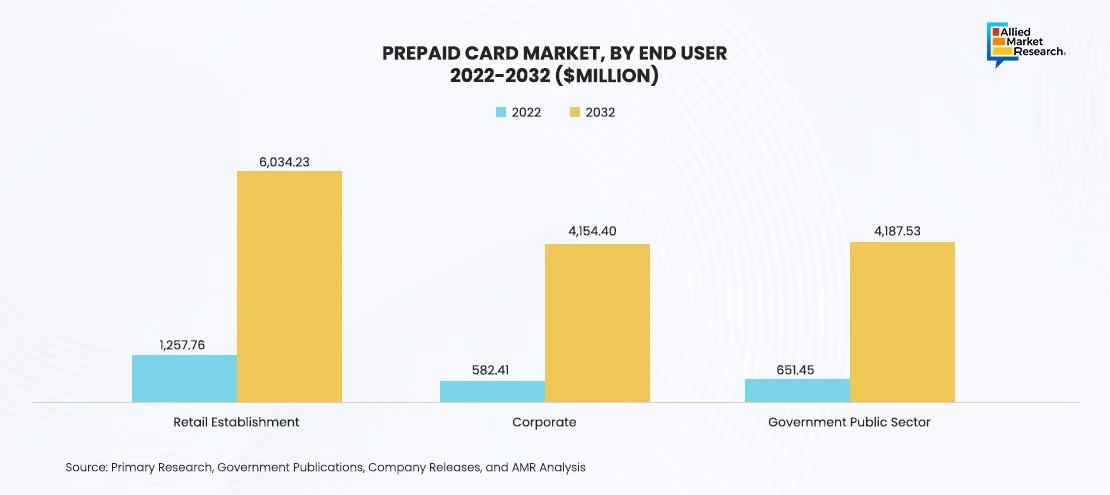

Recently, Allied Market Research issued a report on the prepaid card market, revealing that the industry is predicted to reach $14.4 trillion by 2032. The landscape accounted for $2.5 trillion in 2022 and is projected to surge at a CAGR of 19.5% during 2023-2032. The convenience offered by prepaid cards has made them a popular alternative to cash, cheques, and other payment cards. Moreover, prepaid cards have become a preferred choice for customers who do not have a bank registration as this payment mechanism works smoothly even without linking to a savings or credit account. The growing demand for prepaid cards in remittances in developed and developing countries is expected to help the industry flourish.

The AMR report classifies the market into various segments based on offering, card type, and end user. By card type, the closed-loop prepaid card segment held the highest revenue share in 2022 and is expected to make huge gains in the coming period. The various brand loyalty advantages, incentives, and promotions offered by closed-loop cards have made them the go-to choice for customers looking for tailored experiences. On the other hand, the open-loop prepaid cards segment is anticipated to rise at the fastest growth rate in the near future. The gradual shift toward online transactions and ATM withdrawals has made these cards appealing to customers in the fourth quarter of 2024.

Trade Credit Insurance Market

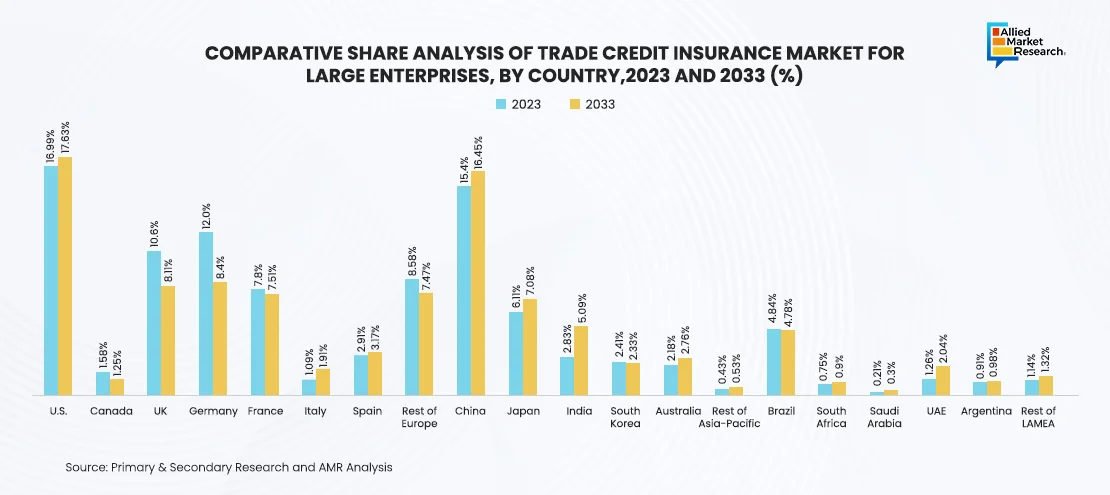

Trade credit insurance is a type of indemnity scheme designed to protect enterprises from different business-related risks and mishaps. These financial protection policies are provided by various private insurance companies and governmental export agencies to provide fiscal security to their clients in case of bankruptcy, protracted default, and insolvency of the company. According to a report by AMR, the trade credit insurance market is expected to amass a revenue of $41.1 billion by 2033. The industry accounted for $14.9 billion in 2023 and is projected to rise at a CAGR of 10.7% during 2024-2033. The growing pace of globalization has increased the volume of global trade drastically, thereby expanding the scope of the landscape in Q4 2024.

The report on the trade credit insurance market by AMR throws light on the performance of the industry in various regions, including Asia-Pacific, LAMEA, Europe, and North America. The major political, socioeconomic, demographic, cultural, and administrative factors influencing the landscape are elaborated as part of this exercise. The study highlights that the North America trade credit insurance market is expected to witness huge growth in the coming period. The strong economic activity and the rising demand for trade credit indemnity policies from multinational corporations and MSMEs have strengthened the position of the industry in Q4 2024.

Business Travel Accident Insurance Market

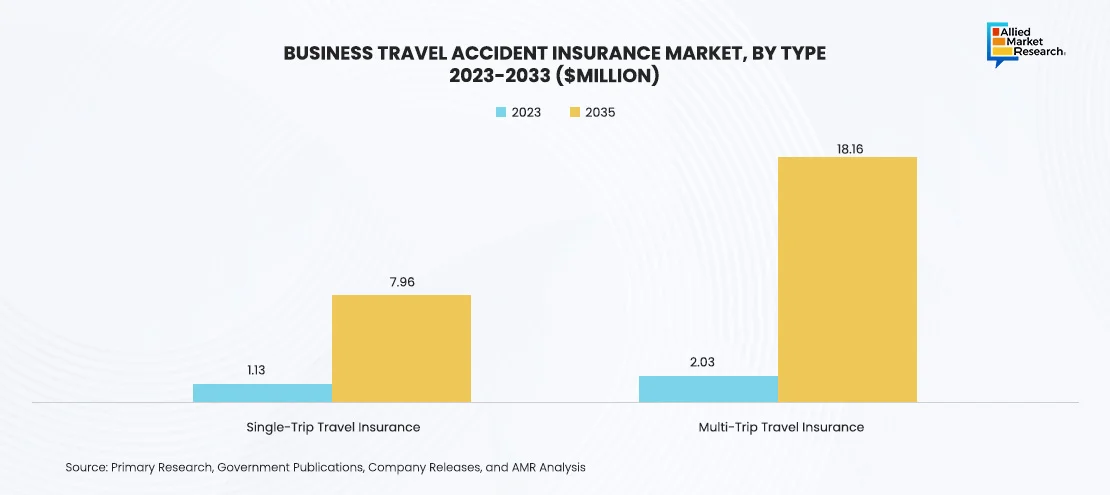

Business travel accident insurance is a type of insurance policy that offers protection to tourists from travel-related accidents. It is a comprehensive fiscal plan that covers expenses related to death or illness of the traveler, trip cancellation, loss of travel documents, and many other such incidents. The overall rise in global business travel is expected to be the primary growth driver of the industry. The AMR report on the business travel accident insurance market states that the landscape, which accounted for $4.1 billion in 2022, is estimated to register a revenue of $30.2 billion by 2032, citing a CAGR of 22.2% during 2023-2032. The increased adoption of data analytics and AI by leading insurance companies has contributed to the growth of the industry in the fourth quarter of 2024.

The AMR report offers a detailed segmental analysis of the landscape based on type, application, and distribution channel. By type, the multi-trip travel insurance segment held the maximum revenue share in 2022 and is anticipated to dominate the industry in the near future. The overall growth in the number of business travelers across the globe has played a huge role in the rise of the segment. Multi-trip insurance policies are generally annual plans devised specifically for frequent travelers. These schemes are opted by companies to cover their entire set of employees holistically.

Bancassurance Market

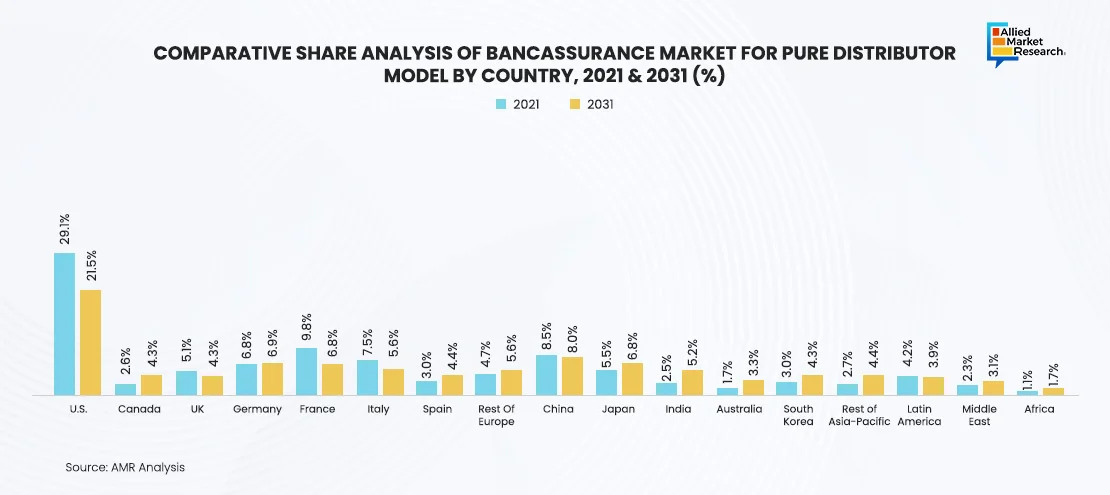

Bancassurance refers to a formal deal between a bank and an insurance company wherein the banking firm allows the insurer to sell its financial products and services to the bank’s customers. It is a win-win situation for both parties as banks earn additional revenue by selling insurance products, while the insurance companies improve their customer base without making any substantial capital investments. As per Allied Market Research, the various advantages offered by this innovative model are expected to help the industry expand its footprint across the globe. The AMR report on the bancassurance market claims that the landscape is expected to gather a revenue of $1.8 billion by 2031, registering a CAGR of 7.4% from 2022-2031.

The AMR report further adds that the bancassurance industry is anticipated to flourish in the Europe region. The increasing penetration of insurance and other financial services in various countries such as Germany, the UK, France, Italy, Spain, etc., has accelerated the industry’s growth and success in Q4 2024. Additionally, several insurers in Europe have opted for different alliances, including mergers & acquisitions, collaborations, partnerships, etc., thus broadening the scope of the landscape in the province. At the same time, the industry in the Asia-Pacific region is also estimated to grow substantially due to the growing demand for retirement insurance plans in various developing countries.

Embedded Finance Market

Recently, Allied Market Research published a report on the embedded finance market which shows that the industry was valued at $82.7 billion in 2023. The landscape is expected to register a sum of $570.9 billion by 2033, rising at a CAGR of 21.3% during 2024-2033. Embedded finance is a new-age fiscal mechanism wherein monetary products and services are provided by non-financial companies with the help of APIs. This business model is primarily adopted by companies to provide their offerings to third-party enterprises and enhance their operational base seamlessly. The transition toward digitalization of various financial services and the growth in the number of fintech companies has created numerous growth opportunities for the industry in the fourth quarter of 2024.

The AMR study on the embedded finance landscape also covers the various segments of the market based on type and industry vertical. By type, the embedded payment segment held the largest revenue share in 2023 and is projected to be the most profitable in the coming period. The gradual shift of customers toward online payments has opened new avenues for growth in the industry. In the last few years, embedded payments have become one of the most trusted transaction modes among consumers and fintech companies due to their secure, reliable, and scalable nature. The increased preference for this innovative financial mechanism has created favorable conditions for the expansion of the landscape.

Summing up

In essence, the expansion of the BFSI sector in the fourth quarter of 2024 is attributed to the increasing integration of digital technologies to provide various financial products. Moreover, as per this study, several new fiscal models such as bancassurance and embedded finance have augmented the growth rate of the BFSI domain in the quarter. The AMR publication on the top 5 emerging markets, thus, focuses on the evolving dynamics of the landscape to aid companies in making the right investment decisions in the coming period.

To stay updated on the latest trends and evolving dynamics in the BFSI sector, contact our experts today!