Construction and Manufacturing Domain: AMR’s Analysis of the Top 5 Markets Impacting the Sector Positively in Q4 2024

The construction and manufacturing domain is one of the most promising sectors in the global economy. In the post-COVID-19 period, it has successfully recovered from the pandemic-induced economic losses and has witnessed huge growth due to the integration of different emerging technologies and innovations. Moreover, the rising disposable incomes of people across the globe have led to a surge in demand for residential and commercial spaces, thus creating new investment opportunities in the landscape. The transition toward environmental sustainability and green initiatives have played a major role in the rise of the domain. Allied Market Research recently issued a newsletter highlighting the contribution of the top 5 emerging markets in the construction and manufacturing sector in Q4 2024. These industries are covered comprehensively in their reports, thereby aiding companies in focusing on the key investment areas.

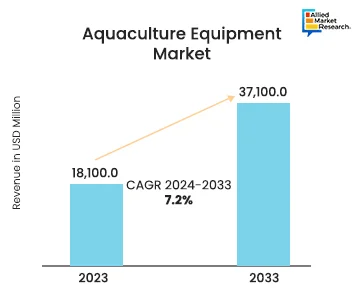

Aquaculture Equipment Market

Aquaculture refers to the controlled breeding, growing, and harvesting of various aquatic animals, including fish, crustaceans, algae, and other aquatic animals. With the growing profitability of this field, many people are shifting to aquafarming as a source of occupation. This has led to a growth in demand for specialized equipment and machines, thereby augmenting the growth rate of the aquaculture equipment market. As per AMR’s report, the industry, which accounted for $18.7 billion in 2023, is anticipated to gather a revenue of $37.1 billion by 2033, rising at a CAGR of 7.2% during 2024-2033. The rising demand for seafood items and the gradual shift toward sustainability has broadened the scope of the landscape even more. Furthermore, the introduction of various advanced technologies has impacted the market positively.

The AMR report classifies the industry into various segments based on type, end users, and distribution channel. By end-user, the grow farms segment held the highest revenue share in 2023 and is predicted to make significant gains in the coming period. Many aquaculture companies have started adopting innovations to improve their productivity and efficiency, thus creating favorable conditions for the growth of the landscape. Additionally, an overall surge in consumption of farmed fish products has contributed to the rise of the market in Q4 2024.

Ultra-High Performance Concrete Market

Recently, Allied Market Research published a report on the ultra-high performance concrete market which states that the industry is estimated to amass a sum of $629 million in 2022. The landscape accounted for $1048.2 million by 2032, rising at a CAGR of 5.3% during 2023-2032. Over the last few years, governments in developed and developing countries have launched affordable housing initiatives for poor and middle-income populations. As a result, the demand for durable and low-maintenance infrastructure has increased in these sovereign states, thus expanding the scope of the market in Q4 2024. Additionally, the advent of new additives and concrete mixing technologies has made UHPC a popular choice among people across the globe. Moreover, the rising focus on sustainable construction projects has created favorable conditions for the growth of the industry.

The report on the ultra-high performance concrete industry throws light on the performance of the landscape in various regions, including North America, LAMEA, Europe, and Asia-Pacific. The leading socioeconomic, demographic, cultural, and administrative factors impacting the market are studied as part of this exercise. As per the regional analysis provided in the report, the rising pace of urbanization and industrialization has increased the revenue share of the landscape in Asia-Pacific countries such as India, Indonesia, China, Singapore, etc. Moreover, many companies in this province have invested heavily in transportation and construction projects, thus accelerating the market’s growth and success.

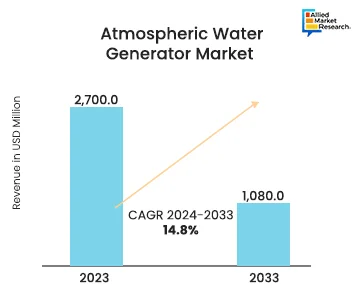

Atmospheric Water Generator Market

An atmospheric water generator is a novel device that extracts moisture from surrounding ambient air and converts it into potable water. This technology has become one of the most innovative techniques in the last few years due to growing concerns related to water shortage in several drought-prone countries in the world. National governments in these countries have launched several schemes to increase the adoption of AWGs in rural and urban areas. For example, the Department of Energy in the US Government recently announced grants to increase the usage of these devices in California. Additionally, the growth of the atmospheric water generator market is attributed to the integration of different technologies and advancements in the field of material sciences.

The AMR report provides a comprehensive segmental analysis wherein the market is classified on the lines of type, capacity, and application. By application, the non-residential segment held the largest revenue share in 2023 and is anticipated to dominate the industry in the near future. In the last few years, several agriculture and healthcare companies have started installing AGWs in their facilities to address the problem of water scarcity. Moreover, the increasing demand for sustainable corporate practices has surged the demand for these machines, thus opening new avenues for growth in the landscape.

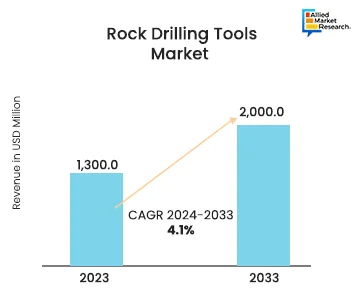

Rock Drilling Tools Market

Rock drilling tools and equipment are specialized machines used in the construction and mining industries to create holes in hard surfaces such as rocks and cement. These industrial machines have become highly important due to the increasing number of infrastructure projects such as highways, tunnels, railways, etc. Along with this, the overall demand for precious metals such as gold, silver, iron, and copper has increased significantly in the last few years. As a result, mining activities across the globe have gathered a huge pace, thus enhancing the demand for these machines. Allied Market Research, in its report on the rock drilling tools market, has highlighted that the industry is anticipated to gather a sum of $2 billion by 2033. The landscape accounted for $1.3 billion in 2023 and is projected to rise at a CAGR of 4.1% from 2024 to 2033.

As per the study, the growing focus on geotechnical investigations and soil stabilization for disaster preparedness has created new opportunities in the landscape. Moreover, the presence of several multinational corporations such as Changsha Heijingang Industrial Co., Ltd (Black Diamond Industrial Ltd., Co.), Sai Deepa Rock Drills Pvt. Ltd., Boart Longyear Group Ltd., SVE Drilling Tools, etc., has expanded the scope of the industry worldwide. Additionally, many of these players have invested heavily in R&D activities and launched innovative products, thus helping the landscape flourish in the fourth quarter of 2024. The market has witnessed substantial growth in almost all regions around the world, including North America, Europe, Asia-Pacific, and LAMEA.

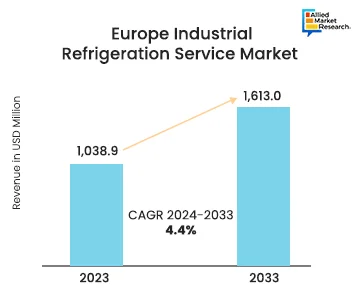

Europe Industrial Refrigeration Service Market

Recently, Allied Market Research published a report on the Europe industrial refrigeration service market which revealed some of the leading growth drivers and factors of the industry. The study states that the landscape, which was valued at $1,038.9 million in 2023, is expected to gather a sum of $1,613.0 million by 2033, citing a CAGR of 4.4% during 2024-2033. The increased demand for industrial refrigeration services from several European food processing and packaging companies has played a huge role in the growth of the industry. Moreover, many countries in this province have enacted laws mandating the use of industrial refrigeration services in healthcare and pharmaceutical companies. These regulations have broadened the scope of the landscape.

To help businesses understand the evolving dynamics of the market, the AMR report divides the market into various segments based on service and end-user. By service, the maintenance and repair segment held a dominant position in 2023 and is anticipated to maximize its revenue share in the coming period. The increased use of advanced technologies such as robotics and automation by major European industrial machinery service providers has impacted the industry positively. Furthermore, the rising awareness regarding energy efficiency has opened new growth avenues in the landscape.

The final word

The main aim of publishing the study on the top 5 emerging markets is to assist businesses in making the right investment decisions in the long run. These markets have significantly contributed to the overall growth of the construction and manufacturing domain in Q4 2024. The increase in governmental initiatives to support infrastructure development companies and the shift toward green manufacturing technologies have further created favorable conditions for the growth of the sector.

Stay in touch with our analysts for more insights into the upcoming trends and developments in the construction and manufacturing domain!